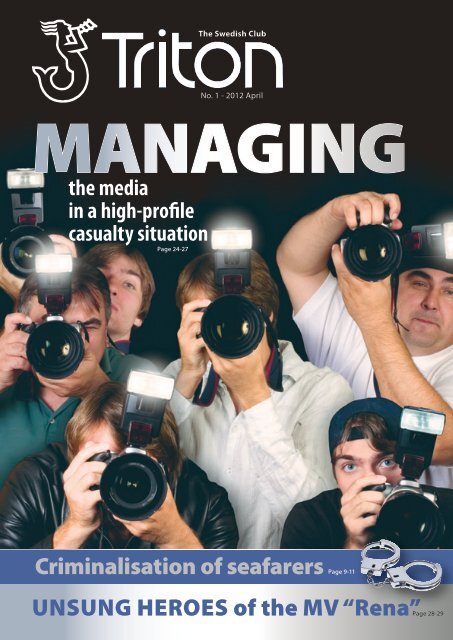

TSC Triton no. 1 2012 - The Swedish Club

TSC Triton no. 1 2012 - The Swedish Club

TSC Triton no. 1 2012 - The Swedish Club

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>Marketing & Business Development | State of the Market“140 years old, full of new-bornenergy and a prosperous future”Henric GardDirector,Marketing & Business DevelopmentHistory is important and most, if <strong>no</strong>t all, companies or organisationsare a product or a reflection of their history. Historyon the other hand does <strong>no</strong>t tell us much about the future. Animportant differentiator is that companies or organisations thatanalyse, learn and act on what history teaches us have a betterchance of influencing or even creating their future.<strong>The</strong> 101 st P&I renewal has just finishedAt the time of writing we have just finished our 101 st P&I renewal.Every renewal has its own characteristics and every renewalis different, as is this one. In the current freight marketenvironment where shipowners are struggling, costs such asinsurance are naturally being focused on more by owners as wellas managers. It is therefore pleasing to be able to report thatthis year’s P&I renewal also ended satisfactorily from the <strong>Club</strong>’sperspective. Not only did we achieve our general increase set bythe board, we also managed to expand our renewal portfolioand received firm commitments of a sizeable tonnage amount toattach during the year. We take this as yet a<strong>no</strong>ther endorsementof the <strong>Club</strong>’s ambition to slowly but steadily build a portfolioof high quality shipowners and managers with an eye for stability,financial resilience and a service concept second to <strong>no</strong>ne.Although, we expect the overall growth rate to slightly slowdown in the short-term, due to factors beyond our control, the<strong>Club</strong> has managed to expand the P&I portfolio by well over30% since 2009 and transformed from a small to a mid-sizedP&I club.Heading towards our first energy renewalsA year has past since starting our most recent business line, Energy,and we are rapidly approaching a series of first renewals.<strong>The</strong> first year of operation has been very satisfactory and I daresay that we have proceeded according to plan, if <strong>no</strong>t ahead ofthem. Our portfolio currently consists of over 30 accounts andcovers well in excess of 200 offshore units. This is indeed a goodstart and ratification that the <strong>Club</strong>’s diversification ambitionsare well founded and make sense from a business perspectiveOur office in Oslo has done a tremendous job and has beenhelped by the good timing of our entry, as well as a need fromowners and brokers for fresh, new, local, long-term capacity.At the moment the vast majority of the business underwrittenemanates from Scandinavian owners and brokers. Over the nextyear we intend to carefully explore business based and producedoutside Scandinavia, provided of course that the quality andpricing is in line with our models.Getting the price right (immediately)is still the key after 140 yearsP&I business is generally long-term and the marine marketcontinues to be a commodity market. Major market claims, likethe Costa Concordia, will of course have an impact on currentrating levels but a major obstacle against a much-needed, firm,upward rate correction is overcapacity. <strong>The</strong> concept of generalincrease has never attracted the marine market and probablynever will. It is therefore paramount to get the price right (immediately)as the market is very liquid and the possibility ofadjusting the pricing over time demands almost magical skills.Nevertheless, the marine side of our business remains very importantto us and our commitment to further diversify withinthe marine portfolio remains strong.Celebrating 30 years of “delivering the firm” in AsiaIn <strong>2012</strong> we also celebrate 30 years of being and operating inAsia. Our Hong Kong office opened in 1982 and offers <strong>The</strong><strong>Swedish</strong> <strong>Club</strong> all-in-one concept to Asian shipowners andcharterers. Over the years the Asian region has become increasinglyimportant to us and today around 30% of the <strong>Club</strong>’s P&Iportfolio is dealt with by our Hong Kong office. Being able tosee the formidable growth and development that the region inthe past, present and future has, is exciting and a strong motivatorfor all of us at the <strong>Club</strong> to continue to “deliver the firm” toAsian owners and brokers.<strong>The</strong> <strong>Swedish</strong> <strong>Club</strong> has a long and proud history from itsfounding in 1872 to the present day. For most people 140 yearsis a very long time, and that’s true. On the other hand it is alsoproof that the <strong>Club</strong> has been able to use its history in order toadapt, adjust, develop and move forward. This important workis continuing at full strength and rest assured – “we are withyou at all times and all the way”.4

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>Risk & Operations | Marine Renewal <strong>2012</strong><strong>The</strong> historic reason why 20 February is the date forrenewing P&I insurance, is because this was the timeof the year when a new trading season could begin.So, a new trading season has begun but admittedly itleaves us with slightly mixed emotions.From the <strong>Club</strong>’s perspective we have met our targetsas far as rates are concerned and we added somenew tonnage.From the owners’ perspective however, the outlookis of course very troublesome and uncertain indeed.From the outset it was clear that this renewal was, to agreater extent than many times before, about managingboth exposure and expectations.In conclusion the <strong>Club</strong> did very well in both respects.In contrast to the past two winters in our region,this one has so far been very mild and accommodating.That can<strong>no</strong>t be said about the state of the shippingmarket where icy winds continue to blow, exposingrelationships to frostbite on the back of the ongoingfinancial turbulence.Happy New Policy Year!Managing our business partners’ expectationswith renewal surrounded by a lot ofuncertainty about the state of the eco<strong>no</strong>myin future, is of even greater importancethan before. For us it has been natural totake a longer view of the rating structureand finding an equitable balance betweenthe timing of rate corrections over time andthe ability of meeting our requirements. Asalways there are levels that you simply can<strong>no</strong>tdeviate from. <strong>The</strong> alternative to unsustainablelevels is of course de-risking. Weare in the process of enhancing the <strong>Club</strong>’salready strong financial position making usan even more solid business partner wherestakeholders can feel comfortable that theyare investing in future certainty. Due to thecurrent financial turmoil, predictabilityis increasingly more important than ever.<strong>The</strong> <strong>Club</strong> has delivered sustainable technicalunderwriting results in recent yearsand even though 2011 was something ofa disappointment in that respect – we areconfident that we will be “back in black”going forward. We are in many respectscontinuing our efforts in taking the <strong>Club</strong> tothe next level.Lars A. MalmDirector,Risk & OperationsDevelopment of IT solutionscontinuesWe are continuing to develop IT solutionson our website and for smart phones to supportour business partners’ day-to-day business.We have already taken the first stepand introduced certain interactive featureson our website enabling our business partnersto make various transactions on-linethrough <strong>The</strong> <strong>Swedish</strong> <strong>Club</strong> On Line platform(SCOL). For more information aboutSCOL, please see page 30.Work on refining our Internal CapitalModel continues to increase, and over thelong-term, this will have a positive impacton our members.P&I RenewalAs far as claims on the P&I side is concerned,2011 was admittedly slightly worsethan expected. We <strong>no</strong>ticed an increase inthe number of larger claims. We can safelysay that the number of smaller claims inthe categories of “Cargo” and “Crew” hasincreased a lot over the past five years. 2011also started rather well in terms of retur<strong>no</strong>n our investments. <strong>The</strong> latter part of 2011,however, performed less satisfactorily inthis respect and left us with less contributionthan expected.In conclusion, the <strong>Club</strong>’s overall financialstanding remains strong and when takingthe overall situation into account we werepleased that this year’s renewal could behandled in a balanced manner. <strong>The</strong> <strong>Club</strong>’sposition has improved year-on-year and itis clear that results, enhanced risk management,service and re-emphasized focus onmarketing are paying off well.During the policy year 2011/12 we addedfurther business to our P&I portfolio. Atpolicy year-end <strong>2012</strong>/13 we are expecting tohave a combined owners/charters book ofapproximately 55 million gross tonnes. Aswe have elaborated before – but it deservesto be said again – size is important only ifsustainable over the long-term. <strong>The</strong> <strong>Club</strong>’sgrowth with this renewal is very pleasingand again reflects the most profound supportand genuine commitment to the <strong>Club</strong>from its business partners.Marine RenewalMarine & Energy renewals have, over theyears, gradually become spread out overthe year, the significance of the 1 Januaryrenewal is today somewhat less than it usedto be. Having said that, some of the <strong>Club</strong>’smost important members still renew onthis date. <strong>The</strong> Marine and Energy insurancesare the owners’ most basic protection9continues on page 65

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>Finance | Result 2011THE CLUB reports a twelve-monthloss of USD 9.3 million (2010: +29.5),which is a fall of USD 20.9 millioncompared to the profit reported for thefirst six months of the year. <strong>The</strong> deteriorationin the second half of the yearis primarily due to three major P&Iclaims, along with a decline in the equityportfolio.Major P&I claims<strong>The</strong> <strong>Club</strong> can expect to have just belowone P&I claim per year in excessof the USD 8 million pool retention.For almost four years, August 2007 –May 2011, there were <strong>no</strong>ne. After that,things changed dramatically and in lessthan four months we had three claimsin excess of that amount.<strong>The</strong> first was the bulk carrier, PioneerPacific. On 20 June 2011 this vessel wasinvolved in a collision at Rio Parma inArgentina, striking and damaging aterminal structure. <strong>The</strong> current reservationfor this casualty is USD 16 million.<strong>The</strong> next incident occurred on 29July, and this time it was the bulk carrierB Oceania, which sunk off the coastof Malaysia after colliding with a<strong>no</strong>thervessel. A wreck removal operation hasbeen initiated and the current claimsreservation is USD 45 million.Disaster struck again on 4 OctoberToughclaimsyearput figuresin deficitwhen the container ship Rena hit groundoff the coast of Tauranga, New Zealand.This casualty also involves wreck removaland in January <strong>2012</strong>, the P&I claims reservationwas increased from USD 125 toUSD 175 million. For this vessel, the <strong>Club</strong>also has claims costs for Hull & Machineryand Increased Value.Underwriting resultDespite the unfavourable trend in claims,the underwriting loss was limited to USD11.8 million (2010: +17.7) and the overallcombined ratio was 110% (2010: 87). Thisclearly indicates that our solid reinsurancestructure – <strong>no</strong>t least the InternationalGroup Pooling Agreement and Excess ofLoss reinsurance cover – works well.Premium volume increased by 9% comparedto last year. <strong>The</strong> new business area,Energy, was responsible for more tha<strong>no</strong>ne-third of the overall premium volumeincrease of USD 14 million. All insurancesclasses, with the exception of Hull &Machinery, reported increased premiumvolumes.<strong>The</strong> total cost for reinsurance relativeto premium volumes is at the same levelcompared to 2010. However, reinsurancespending fell substantially in 2011 for theMarine class, Loss of Hire. This was due tothe phase-out from a quota share reinsuranceto an excess of loss cover, which tookplace over last year.Energy<strong>The</strong> new business area, Energy (launched 1March 2011), performed in line with businessplans and reported a net earned premiumof USD 4.4 million. Furthermore,<strong>no</strong> major claims were reported. This businessarea is primarily managed from ournewly opened office in Oslo.Marine business<strong>The</strong> Marine business area consists of Hull& Machinery, Increased Value, Loss ofHire and War. Overall, a slight loss was reportedand the combined ratio was 104%.Happy New...9continuedagainst unwanted fortuitous incidents in Energy business last year proved to be veryrelation to their property and earnings. successful and should be seen as a<strong>no</strong>therfrom page 5 <strong>The</strong> amount of support you can afford to way for us to safeguard delivery of sustainableresults over time.give members is very much correlated withthe long-term sustainability of the differentclasses of insurance the <strong>Club</strong> engages side, and for the <strong>Club</strong> as a whole, is obvi-Further diversification on the Marinein. <strong>The</strong> margin of support can be increased ously more important when the market isby adding additional sustainable classes of anything but firm. Even though the marketcould be described from our point ofbusiness.Last year we took yet a<strong>no</strong>ther important view as “dull” we still enjoy reaffirmed andstep in diversifying by introducing the loyal support from our members on theEnergy Class of business. <strong>The</strong> <strong>Club</strong> has property side of our business. This can bebeen able to deliver rather good results on achieved by us de-risking and diversification,enabling us to take a more holistic the Marine side in recent years. Adding theap-6

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>However, the situation varies for each insuranceclass. Smaller classes are reportingstable underwriting returns that are evenhigher than in 2010. This compensatesfor the downturn in Hull & Machinery,which had a poor year. <strong>The</strong> majority ofgrowth in this business area comes fromWar, related to the coverage that we provideagainst pirate attacks in the Gulf ofAden. However, even though the Warcoverage that we provide our shipownersmakes a positive contribution to the <strong>Club</strong>’soverall result, we all naturally wish it wasunnecessary.Claims costsIn 2011, 15 claims in excess of USD500,000 were reported, which is the samefrequency as last year. However, the severityof claims was much higher in 2011. During2010, the two most expensive claims(both on the Marine side) amounted toUSD 2.5 and 6.5 million respectively. Thisyear, there were eight claims (compared totwo last year) where the estimated claimscost before reinsurance exceeded USD 2million, and some of them, as mentionedearlier, have reservations far above theamounts reserved in 2010.Financial result<strong>The</strong> financial result for 2011 was USD 2.5million (2010: +11.6) and the value of the2011June20Monday2011July29Fridayinvestment portfolio at year-end was USD315 million (2010: +297). During the autumn,when volatility in the equity marketwas extreme, the <strong>Club</strong> took a cautious approach.At the end of August, we sold halfof the equity holdings in exchange for UStreasuries. In January <strong>2012</strong>, we re-enteredthe market and obtained the same exposurethat we had back in August 2011.<strong>The</strong>se risk management measures did <strong>no</strong>thave any <strong>no</strong>ticeable impact on the result,since we basically re-entered the marketat the same level. But, the low exposure toequities during this turbulent period didmake life a bit more pleasant for us!An underwriting deficit of almost USD12 million and a financial result of justUSD 2.5 million was <strong>no</strong>t what we aimedfor. However, given what has happenedon both the claims side and in financialmarkets, we are nevertheless satisfied. Let’shope that <strong>2012</strong> will be more in line withour expectations. Or why <strong>no</strong>t – even a littlebetter!2011OCTOBER4TuesdayJan RydenfeltDirector,Finance & Reinsurance, ITproach to our members’ overall insurancecommitments with the <strong>Club</strong>.Last year we reported a slightly betteroutcome than expected in terms of largeclaims. For 2011 it is correct to say thatthe number of large claims increased. For<strong>2012</strong> we can<strong>no</strong>t see, despite the problematicshipping markets, that shipping activitieswill drop significantly. To this end,we expect large claims will remain fairlystable and at a high level. Ack<strong>no</strong>wledgingthis of course means that we will have tomake sure that rates are set accordingly.As far as volume is concerned the <strong>Club</strong> hasincreased its H&M book slightly and thisis mainly through organic growth. Due tothe de-risking strategy we see that our averageshare written fell during 2011 and isexpected to continue to drop during <strong>2012</strong>.Overall, this is in line with our currentcycle management.Energy Renewal<strong>The</strong> Energy business that we started on 1March 2011, has developed better thanexpected. We are currently involved inmore than 30 accounts and we expect toincrease that volume slightly throughout<strong>2012</strong>. Our average share on Energy is 3.5%and we will maintain this level of commitmentin <strong>2012</strong>. As mentioned in connectionwith P&I above, but even more relevant toMarine & Energy: “Size is important onlyif sustainable over the long-term”. Thisstatement is more relevant to the propertyside of the business, because for obviousreasons it is far more commoditized thanthe liability side.7

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>FD&D | Legal updateFreight Demurrage & Defence insuranceStateof AffairsAnders LeissnerDirector,Corporate Legal & FD&DFreight Demurrage & Defence insurance is alegal cost insurance. <strong>The</strong> insured has access tothe expertise of the <strong>Club</strong>’s Freight Demurrage &Defence lawyers and has also cover for legal costsup to USD 5 million regarding a wide range ofdisputes pertaining to the operation of the vesselthat are <strong>no</strong>t covered by any other class of insurance.<strong>The</strong> <strong>Club</strong>’s FD&D portfolio continued to develop positively in 2011. Asof 1 February <strong>2012</strong>, 738 vessels (29.2 million GT) were insured for FD&Drisks compared to 693 vessels in 2010 and 580 vessels in 2009. Our ambitionis, obviously, to continue this growth and develop the portfolio further in allmarkets. FD&D insurance is an important supplement to the other classesof insurance, in particular in these turbulent times with a high demand forlegal services.Looking at the FD&D statistics, it is obvious that the <strong>Club</strong>’s membershave had, and continue to have, difficulties. <strong>The</strong> market turbulence in 2007and 2008 led to 312 FD&D claims being registered in 2008, a record number.This represented 0.44 claims per entered vessel. In 2009, the number ofclaims was down to 0.37 followed by 0.29 in 2010 and the figure for 2011 is0.35. One reasonable assumption is that if the markets will stabilize then frequencywill continue to go down. Having said this, market turbulence, and<strong>no</strong>t least long periods of depressed markets, vastly increases the risk for largelegal disputes when parties can <strong>no</strong> longer meet their contractual obligations.In 2011, the <strong>Club</strong> assisted several owner-members in disputes concerningvalues in the region of USD 50–100 million as a result of early terminatio<strong>no</strong>f long-term time charterparties. Our assessment is that, regretfully, we have<strong>no</strong>t seen the end of this trend as numerous companies that grew too rapidlyin 2007-2009 still constitute a high default risk. Consequently, even ifclaims frequencies are falling the risk for large claims in <strong>2012</strong> remains high.One way of measuring the results of insurance business is calculating thecombined ratio, which is claims costs in relation to premiums and operationalcosts. Despite a five-year period that has been exceptionally challenging forthe FD&D class (and its members) the average combined ratio for these yearsis 107%. Compared to the target of 100% the achieved result is quite acceptablealthough over the long-term it may be a sign that, structurally, premiumlevels are too low. After all, FD&D premium levels have been relatively stablefor the past ten years. On the other hand, the level of legal costs has <strong>no</strong>t beenstable – our assessment is that the average hourly rate for a London lawyerhas risen by at least 25% over the same period.In 2011 there was also frequent usage of the <strong>Club</strong>’s FD&D services in respectof topical issues such as sanctions and piracy. Loading of iron ore andnickel ore fines in India and Brazil also generated complex charterparty disputeswith which the <strong>Club</strong>’s lawyers have assisted. However, again, the farmost common type of intervention concerned various types of debt collecting.One particularly problematic situation was unpaid bunker invoices. Irrespectiveif an unpaid bunker invoice gives rise to a maritime lien in the vessel(that varies between countries) the owner and the <strong>Club</strong> will have an oneroustask fighting off arrest attempts by the supplier in one port after a<strong>no</strong>ther andeventually the owner may be left with <strong>no</strong> other option but to pay the invoicethemselves.Finally, a word of caution. In times like these guarantee letters have greaterimportance. Indeed, it may be desirable for the owner to k<strong>no</strong>w that theperformance by the charterer for a time charterparty (e.g. hire payment) isguaranteed by a larger and better-k<strong>no</strong>wn entity. However, variations in theunderlying contract without consent by the guarantor may discharge theguarantor under the guarantee letter. <strong>The</strong>re is a very simple remedy to avoidsuch a fatal situation – do <strong>no</strong>t forget to seek consent from the guarantorwhen amending the charterparty!8

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | Criminalisation of SeafarersCriminalisatio<strong>no</strong>f SeafarersPhoto: iStockphotoLearningfrom the pastto improve the futureIn the aftermath of a casualty, particularlyin high profile incidentswhere pollution is involved, historyhas an unfortunate tendency to repeatitself as far as unfair treatmentof seafarers is concerned. Local authoritiesand prosecutors will inevitablyface immense pressure fromthe public to deal effectively withthose assumed to be responsible forthe incident – and it is often the crewwho suffer the consequences. Situationssuch as that faced by CaptainMangouras, the master of the Prestige,suggest that there is a need forlaws which more effectively underpinthe human rights of the accusedin highly-charged cases of this sort.Protecting the Seafarer– International Law<strong>The</strong>re is valid concern within the industrythat the trend towards an assumptio<strong>no</strong>f criminality on the part of the seafarerand owner is likely to deter good qualityindividuals from a seafaring career. In a climateof criminalisation, a<strong>no</strong>ther legitimateconcern is that enquiries may never revealthe true cause of an incident for crew mayfear self-incrimination. None of this can begood for the shipping industry, <strong>no</strong>r for theordinary citizen who relies upon qualityseafarers safely steering those crucial goodsand energy carriers to deliver his everydayneeds in a safe and timely manner.<strong>The</strong> issues surrounding the alleged unfairtreatment of seafarers have arisen despitethe fact that mandatory safeguards for theprotection of individuals, and seafarers inparticular, already exist under internationallaw.Universal Declaration of HumanRights (UDHR)<strong>The</strong> UDHR provides that everyone has theright to leave any country and return to hisown. It is therefore <strong>no</strong>rmally difficult tojustify withholding of a passport, let alonehotel arrest or detention in custody, on themere ground that the individual has beencharged with an offence, unless there is atleast a reasonable possibility that he could,if convicted, be punished by a term of imprisonment.UNCLOS 1982 (UNCLOS)<strong>The</strong>re are also safeguards set out in UNC-LOS, specifically under Article 230, whichconstitute an internationally agreed balancebetween public concerns about pollutio<strong>no</strong>n the one hand and the recognised rightsof the accused including the liberty of9continuesCapt Faz PeermohamedPartner, Ince & Co LLPLondonFaz Peermohamed is aPartner at the London officesof Ince & Co LLP and headsInce’s Global AdmiraltyGroup. He is re<strong>no</strong>wned for hisability to handle all aspectsof Admiralty work, fromcollisions, salvage, total losses,groundings and shipboardfires to general shippingdisputes. He is particularlyk<strong>no</strong>wn for his expert advicein the highly chargedatmosphere following amaritime casualty.Olivia MurraySenior Associate, Ince & Co LLPLondonOlivia Murray is a SeniorAssociate at Ince & Co LLP.Olivia has particular experiencein work relating to seafarerrights; she is an active memberof the CMI InternationalWorking Group on the FairTreatment of Seafarers and hasrecently been appointed Chairof the Group.on page 109

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | Criminalisation of Seafarers9continuedfrom page 9foreign seafarers, on the other. Article 230 effectively bars coastalstates from imprisoning foreign seafarers for any pollution offencebeyond their territorial waters, or for one within those waters, unlessinvolving a wilful and serious act of pollution. However, therehave been concerns expressed within the international maritimecommunity that these restrictions have <strong>no</strong>t always assisted the defendant.MARPOL 1973/1978 (MARPOL)<strong>The</strong> principal international regulations to prevent pollution fromships are those set out in MARPOL. Importantly, MARPOLrecognises the importance of the distinction between operational(i.e. intentional) and accidental spills. Accordingly, intentional dischargesare prohibited except where certain stringent conditions aremet and MARPOL provides an exemption from liability in certaincircumstances. In the case of accidental spills this exemption mayavail a master or shipowner where the discharge resulted from damageto the ship or its equipment provided he did <strong>no</strong>t act with intentor recklessness.Industry concern regarding the protection of Seafarers<strong>The</strong>re has been concern expressed - <strong>no</strong>t only by shipping and seafaringbodies but also by human rights organisations, internationallegal bodies and governments - that the recognised rights of seafarerswere <strong>no</strong>t being respected for domestic political reasons. Recentyears have seen measures introduced, therefore, with a view to addressingthe issues that repeatedly seem to arise.IMO Guidelines on the Fair Treatment of Seafarers in the Eventof the Maritime Accident (the Guidelines)<strong>The</strong> Guidelines were adopted by the IMO and ILO in 2006 and,whilst <strong>no</strong>t legally binding, they are intended to establish international<strong>no</strong>rms for governments and courts to take into account. Inthe context of pollution cases, the particular vulnerability of seafarersto extended detention has been recognised in the Guidelineswhich provide, inter alia, that a port or coastal state should ‘use allavailable means to preserve evidence to minimize the continuing needfor the physical presence of any seafarer’ and recognise that seafarersrequire special protection, especially in relation to contact withpublicauthorities.<strong>The</strong> statedobjective of theGuidelines is to ensurethat seafarers are treated fairlyfollowing a maritime accident and during any investigationand detention by public authorities and that detentionis for <strong>no</strong> longer than necessary. <strong>The</strong> human rights and other legitimateinterests of seafarers involved should be respected at all times.In November 2011 the IMO Assembly adopted a resolution entitled‘Promotion as widely as possible of the application of the 2006Guidelines on Fair Treatment of Seafarers in the Event of a MaritimeAccident’ (the Resolution). <strong>The</strong> Resolution calls upon governmentsto give effect to the Guidelines, and invites interested partiesto assist in raising awareness of the Guidelines.<strong>The</strong> IMO Code of the International Standards and RecommendedPractices for a Safety Investigation into a Marine Casualtyor Marine Incident (the Code)<strong>The</strong> Code was adopted in 2008 and entered into force in January2010. It is designed to facilitate objective marine safety investigationsfor the benefit of flag States, coastal States, the Organizationand the shipping industry in general. Its stated objective is the provisio<strong>no</strong>f a common approach for States to adopt in the conductof marine safety investigations into marine casualties and marineincidents. <strong>The</strong> Code recognises and addresses the vulnerability ofseafarers in the aftermath of a casualty and Chapter 12 of the Codeprovides mandatory standards in relation to obtaining evidencefrom seafarers. <strong>The</strong> Preamble to the Code expressly refers to theIMO Guidelines mentioned above and indeed the Legal Committeeof the IMO has expressly ack<strong>no</strong>wledged that these should beimplemented in tandem with the Code.Key issues for Shipowners/Managers and CrewIf a casualty is <strong>no</strong>t managed properly to protect both crew andcompany, the consequences could be dire and include the risk ofsevere penalties (custodial as well as monetary) for all concernedand a real danger of reputational damage. <strong>The</strong>re can be little doubt3 Scapegoats<strong>The</strong> Prestige<strong>The</strong> Prestige, carrying 77,000tons of fuel oil, is a well-k<strong>no</strong>wnexample of a situation where, it hasbeen suggested, the public authorities havebeen keen to deflect blame from themselvesand find a scapegoat. Nearly ten years afterthe ship broke up, Captain Mangouras is stillwaiting for his criminal trial to take place.Cases prior and subsequent to the Prestige,however, have demonstrated that, far from beinga one off, such instances of potential unfairtreatment of seafarers continue to occur.10

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>that the approach takenby the media affects bothpublic opinion and, potentially,the actions taken by theauthorities. By keeping theseissues in mind it may be possibleto minimise the damaging impact of acasualty. Effective casualty management isessential following a high profile incident andan awareness of the potential for unfair treatment of thecrew should be at the heart of the incident response.Awareness of International Safeguards relating to the FairTreatment of SeafarersFor a shipowner and his crew to have a fighting chance of protectingthe crew in the aftermath of a casualty it will be crucial thatthey, and their advisors, have an awareness of the safeguards availableto seafarers under international law, both mandatory and <strong>no</strong>nbinding. It is also important to ensure that local authorities andprosecutors are aware of those safeguards, preferably before chargesare brought and the decision to prosecute is taken. <strong>The</strong>y should alsobe aware of the potential for cross-border measures to be takenagainst them in particular circumstances. A shipowner’s representative,for example, should be aware that he could potentially be vulnerableto a European Arrest Warrant being issued in the aftermathof a casualty abroad.Information management – External and InternalMany parties with conflicting interests will pressure owners for theurgent provision of information. It will be crucial to put in placededicated channels of communication to ensure that informationis gathered and analysed as soon as possible so that a consistentapproach can be adopted. Internal communications should alsobe carefully considered and managed, in particular in relation tothe creation of post-incident documents. Particular care should betaken regarding the release of information and documents relatingto causation. Such information should be carefully considered withyour lawyers in the first instance.Media StrategyA common media strategy should be agreed upon with your lawyersand any external communication should be carefully consideredin order to protect the crew and company’s reputation, to mitigatethe risk of litigation or criminal prosecution and to manage publicperception. In applicable cases, reassuring the public as to the existenceof an international regime for the provision of compensatio<strong>no</strong>r crew release may assist in assuaging anxiety which will inevitablyexist where significant pollution damage has occurred. Past caseshave demonstrated that managing public perception regarding theavailability of international regimes and possible compensation canassist in reducing the level of claims.ConclusionClearly the ideal situation is to prevent casualties from occurring inthe first place. A momentary lapse of concentration on the bridgecan result in a life changing crisis for both crew and owners. If theworst does occur, however, every decision taken in those first fewhours and days after a casualty will have a long term impact onevery aspect of the case – from the potential criminal liability ofcrew and shipowner’s shore representatives to a shipowner’s reputationand the eventual cost of the incident. In time, a company’sreputation will be measured less by reference to the original causeof the casualty but more in terms of how it was perceived to haveresponded. When it comes to the fair treatment of seafarers, to theextent it is possible, ‘prevention’ is always better than ‘cure.’ Oncean entrenched position against the crew has been taken by localauthorities and prosecutors, it may well be hard for them to ‘backdown’ and crew and owners may well find themselves facing criminalproceedings for years to come.Whilst measures such as the Guidelines and the recent IMO AssemblyResolution on the subject are encouraging, it is clear thatthere is still much to be done and it remains to be seen whether allparties involved can work together to ensure that seafarers are treatedfairly and consistently in the aftermath of a casualty.<strong>The</strong> Tasman SpiritIn 2003, for example, the treatment of the crew and the salvagemaster in the Tasman Spirit incident prompted widespreadcondemnation. This tanker, laden with Iranian crude oil,grounded at the entrance to Karachi Port, eventually breaking up and leadingto a spill of some 34,000 tonnes of oil. <strong>The</strong> case is illustrative of a situationwhere focus upon the alleged failings of the crew served to deflectattention from suggestions that local authorities may be at fault. All theGreek crew on duty were detained as well as the salvage master (who onlyattended after the vessel broke up). <strong>The</strong> ‘Karachi 8’, as the detained groupbecame k<strong>no</strong>wn, were held for almost nine months and were released onlyafter intense political pressure and continued lobbying by many internationalorganisations as well as the Greek Government and European Union.<strong>The</strong> Hebei Spirit<strong>The</strong> Hebei Spirit collision in 2007resulted in some 11,000 tonnes ofcrude oil leaking into the Yellow Sea andwas the largest oil spill in South Korean history.<strong>The</strong> detention and treatment of the tanker’smaster and chief officer was the subject of significantprotest and condemnation across themaritime industry and the case highlights thedifficulties foreign seafarers may face in thepolitically charged context of a major oil spill.11

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | Scindia dutiesScindia Duties and LongshActivities in the United StaKeith B. LetourneauShareholderBell, Ryniker & LetourneauHoustonKeith Letourneau received aBachelor of Science degree withho<strong>no</strong>rs from the United StatesCoast Guard Academy in 1980.His military service included experienceas a deck watch officeraboard a medium endurancecutter in Florida and as commandingofficer of a Coast Guardpatrol boat stationed alongthe southeast Texas coast. Heholds the rank of Commander,U.S. Coast Guard, Retired. Hegraduated in 1989 from theMarshall-Wythe School of Law,College of William and Mary, asa member of the Order of theCoif. Mr. Letourneau served as atrial attorney for both the CoastGuard’s Procurement Law Divisionand the Admiralty Section ofthe U.S. Department of Justice’sCivil Division. He is a foundingshareholder in the law firm Bell,Ryniker & Letourneau, P.C., basedin Houston, Texas. He is licensedto practice in Texas and Virginia,and admitted before numerousfederal district and appellatecourts, including the Third,Fourth, Fifth and Seventh CircuitCourts of Appeals.Longshore work in the United Statescan easily create personal injury liabilityexposure for an unwary shipowner.This article addresses the duties owedby a shipowner to longshoremen in theStates, and provides recommendationsto minimize such exposure.<strong>The</strong> leading United States Supreme Court casesetting forth the obligations of a vessel owneris Scindia Steam Navigation Co. v. De LosSantos, 451 U.S. 156 (1981). Scindia stands fortwo important propositions.Firstly, as a general matter, the shipownermay rely upon the stevedore to avoid exposinglongshoremen to unreasonable hazards.However, under U.S. maritime law and theU.S. Longshore and Harbor Workers CompensationAct (“LHWCA”), a vessel ownercan<strong>no</strong>t recover against a stevedore employerfor any injuries that occur to a longshoreman.Moreover, in the event that the vessel ownerbreaches one of its duties to the longshoreman(discussed below) resulting in injury, the longshoremancan sue the vessel owner for negligence.Under joint and several liability principlesthat apply pursuant to U.S. maritime law,if we hypothesize that the vessel owner is 10%at fault, the longshoreman 20%, and the stevedoreemployer 70%, the vessel owner <strong>no</strong>nethelesswould be responsible for 80% of the damagesawarded.This result follows because joint and severalliability principles under U.S. maritimelaw shift the risk of uncollectibility from anin<strong>no</strong>cent plaintiff to a culpable tortfeasor.<strong>The</strong> LHWCA’s compensation bar essentiallytransforms the stevedore into a judgmentproofdefendant. Additionally, the stevedore’sworker’s compensation carrier generally intervenesin any suit against owners or charterersto recover medical care costs expended on thelongshoreman’s behalf. Consequently, the vesselowner, rather than the longshoreman, bearsthe brunt of fault attributable to the stevedore,despite Scindia’s first proposition.Secondly, Scindia holds that the vessel owesthe stevedore and his longshore employees theduty of exercising due care under the circumstances.Thus, while the primary responsibilityfor the longshoremen’s safety ostensibly restswith the stevedore, the vessel owner also owesa standard of care to the longshoremen. Thatstandard encompasses three duties to longshoremenservicing the vessel: (1) the “Tur<strong>no</strong>verDuty,” (2) the “Active Control Duty,” and(3) the “Duty to Intervene.”1. <strong>The</strong> “Tur<strong>no</strong>ver Duty”<strong>The</strong> “Tur<strong>no</strong>ver Duty” requires the vesselowner to furnish a reasonably safe ship, and towarn the longshoremen of hazards from gear,equipment, tools and the workspace to be usedduring cargo operations “that are k<strong>no</strong>wn tothe ship or should be k<strong>no</strong>wn to it in the exerciseof reasonable care.” However, the vesselowner is <strong>no</strong>t obligated to warn the stevedoresabout hazards that are open and obvious, ordangers that “a reasonably competent stevedoreshould anticipate encountering.” Forexample, in a recent case, the Fifth CircuitCourt of Appeals (which governs federal proceedingsin Texas, Louisiana and Mississippi)found that a longshoreman, who was injuredbecause of an open and obvious defect in astow of steel coils in the cargo hold, could <strong>no</strong>trecover against the vessel owner, operator orcharterer. In that case, one of the steel coilsfell from atop the stow onto the longshoremanresulting in the loss of a leg. <strong>The</strong> courtfound that a “vessel owner has <strong>no</strong> legal duty toprevent or alleviate an unsafe condition in thecargo hold resulting from an improper stowwhen the condition is open and obvious to thelongshore workers.”Vessel owners may wish to consider somepreventative measures before arriving in a U.S.port. To ward off potential liability exposurein the event a longshoreman claims injury,owners may be able to satisfy their Tur<strong>no</strong>verDuty obligations through the use of a checklistidentifying potentially hazardous conditions,perhaps coupled with a simple vessel diagramshowing the main deck, cargo holds and129continueson page 14

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | Scindia duties9continuedfrom page 12other areas where the longshoremen are scheduled to work.Prior to the vessel’s arrival in port, one of vessel’s officersshould carefully inspect each of these areas, and <strong>no</strong>te on thechecklist any potentially hazardous conditions, for example,with respect to hatchways, latches, ladders, lighting, twistlocks, wires, cables, equipment lying about, rusty conditionsof deck and handhold surfaces, etc. <strong>The</strong> checklist could <strong>no</strong>tewhere any repairs are being conducted, and the scope of theproject (to place the stevedore on <strong>no</strong>tice of <strong>no</strong>t only where repairwork is ongoing, but where repairwork is being considered).Provided vessel workspaces are ingood condition, it may make sense totake a series of digital photographs ofthe spaces where the longshoremenwill work, including access ladders,to document the condition duringthe pre-arrival walk through. Tocomplete the tur<strong>no</strong>ver process, uponarrival in port, the chief mate couldpresent the checklist to the stevedore,and the two could walk thevessel where the longshoremen willwork <strong>no</strong>ting any areas of concern.If the vessel provides any equipmentemployed during longshorework, for example, twist locks, lashingchains, hooks, etc., such equipmentshould be regularly inspected,serviced, and replaced as necessary,with documentation provided (orperhaps at least made available) tothe stevedores evidencing the conditio<strong>no</strong>f such equipment at the start oflongshore operations.2. <strong>The</strong> “Active Control Duty”<strong>The</strong> “Active Control Duty” is breached if the vessel owner “activelyinvolves itself in the cargo operations and negligentlyinjures a longshoreman” or “if it fails to exercise due care toavoid exposing longshoremen to harm from hazards they mayencounter in areas, or from equipment, under the active controlof the vessel during the stevedoring operation.” Beforelongshore activities commence, the master or chief mate maywish to instruct vessel personnel to stay completely clear ofloading or unloading operations, leaving such work to thelongshore gangs. By doing so, owners may avoid the “ActiveControl Duty” in its entirety.3. <strong>The</strong> “Duty to Intervene”Lastly, under the “Duty to Intervene”, a vessel owner owesa duty to intervene if “contract provision, positive law, orcustom” dictates “by way of supervision or inspection [thatthe vessel owner] exercise reasonable care to discover dangerousconditions that develop within the confines of the cargooperations that are assigned to the stevedore.” <strong>The</strong> “Duty toInspect vessel equipmentand spacesIntervene” may be implicated if the master or chief officer iscontractually obligated to supervise cargo operations, or if vesselequipment used during such operations is <strong>no</strong>t operatingproperly, for example, ship’s winches or cranes.Numerous accidents have occurred over the years involvingvessel cranes while operated by longshoremen. Generally,such cases have involved the failure to properly maintain cranecomponents and equipment in good operating order. Ownersshould consider tasking their technical superintendents toensure that ship’s cranes are regularlyinspected and serviced, and currenton all class certifications.Often times, the charter agreementallocates responsibilities for cargostowage to the charterer “under themaster’s supervision,” and sometimesthe vessel owner and charterer haveentered into an Inter-<strong>Club</strong> Agreement,or incorporated it by referenceinto the charter. <strong>The</strong>se arrangementsmay affect how a case brought by thelongshoreman against both the vesselowner and charterer will be defended,but do <strong>no</strong>t necessarily alterwhether the longshoreman may bringsuit against both parties in the firstinstance. To avoid assisting the longshoremanby pointing fingers at eachother, it is important at the inceptio<strong>no</strong>f such a suit to work out the defensearrangements between vessel ownerand charterer if at all possible.<strong>The</strong> vessel owner’s duty to intervenedoes <strong>no</strong>t extend to open and obvioustransitory conditions (1) createdentirely by the stevedore, (2) under its control, or (3) relatingwholly to the stevedore’s own gear and operations.Document any potentiallyhazardous conditionsConvey this informationto the stevedore prior tocommencing cargo operationsStay out of active cargooperationsService and inspect theship’s cranes regularlySummaryIn summary, whiles stevedores are purportedly the party primarilyresponsible for the safety of longshoremen in the States,in the event of an accident resulting in personal injury ordeath, owners face considerable liability exposure should thevessel breach one of the three Scindia duties (Tur<strong>no</strong>ver, ActiveControl, or Duty to Intervene), especially because any liabilityof the stevedore is attributable to the culpable defendant(s)under U.S. maritime law. <strong>The</strong> best method to obviate suchliability is to institute regular procedures to satisfy or avoidbreaching these duties: inspect vessel equipment and spaces;document any potentially hazardous conditions; convey thisinformation to the stevedore prior to commencing cargo operations;stay out of active cargo operations; and service andinspect the ship’s cranes regularly. <strong>The</strong>se suggestions shouldhelp to minimize owner’s liability exposure in the event of alongshoreman’s accident.14

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | Cleanliness of holds<strong>The</strong> High Cost of failing“Grain Clean” in AustraliaJames NeillSolicitorAus ShipSydney, AustraliaRecently a ship arrived in Adelaide,Australia. <strong>The</strong> owners of that shipwere experienced and careful. <strong>The</strong>yknew Australia was tough on ‘grainclean’ – they had instructed themaster to clean the hold and hadreceived the master’s assurance thateverything was “OK”. Three weekslater they were writing a cheque forover A$200,000 for cleaning. Howdid this happen and what are thelessons for the rest of us?<strong>The</strong> Export Control Act (1982) requiresboth the Australian Quarantine andInspection Service (AQIS) and an independentmarine underwriter’s surveyor toinspect the vessel’s holds before loadinggrain. (For ease of reference in this paperI will call these two people “<strong>The</strong> Inspectors”.)<strong>The</strong> vessel must pass both inspectionsbefore it can load.<strong>The</strong> independent inspector<strong>The</strong> underwriters ‘independent’ inspectoris ‘independent’ in the sense he worksfor an independent company but he is appointedby the cargo underwriters and obviouslythat is his focus.When ships fail, many owners ask us, “Isthat guy helping out the shipper becausethey are <strong>no</strong>t ready to load?” <strong>The</strong> answer is“No’.He is <strong>no</strong>t appointed by the shippers andin our experience he is <strong>no</strong>t influenced at allby the shippers’ or charterers’ commercialinterests. His focus is entirely on certifyingthe ship as fit to load with respect to thepumping system, moisture, the hatches,odours, rust scale, grease or oil stains andmost importantly, previous cargo residues.AQIS inspectionAQIS does a very similar inspection to the‘independent’ surveyor’ but their objectivesare slightly different. AQIS is focused onthe ‘quality’ of Australia’s exports. <strong>The</strong>ylook at the holds because ‘dirty’ holds resultin ‘dirty’ cargo.At the risk of stating the obvious, it isimportant to remember grain is food andmust be fit for human consumption. It istherefore perhaps <strong>no</strong>t surprising these inspectorsare careful.<strong>The</strong> initial inspection by the underwriter’ssurveyor tends to take place at theanchorage and the inspection by AQIS<strong>no</strong>rmally takes place at the berth.How the inspections are conductedWhen a ship fails, it is wrong to assume themaster and owners lacked diligence. Thatis almost never the case. Usually the masterand owners k<strong>no</strong>w they are going to beinspected and they usually make a seriouseffort to pass. <strong>The</strong> surveyors however lookin areas the crew can<strong>no</strong>t easily get to - highareas, behind ladders, behind manhole covers,on top of underdeck beams, behindbulkheads and into void spaces and thoseare the areas that usually cause failure.Usually inspections are initially conductedwithout using cherry pickers andusually <strong>no</strong>t only about “what the Inspectorsees” but also “about the general impressionthe Inspector forms.” Many ships passthese first inspections BUT if either surveyorhas doubts about the cleanliness ofareas they can<strong>no</strong>t properly see, they ask forcherry pickers to be provided. Usually, thatis when the trouble starts - because inspectionby cherry picker is tough to pass. Evenships that have just come from dry dockhave failed when inspected using cherrypickers. <strong>The</strong> reason is the inspector looks atareas of the ship ‘up close’ which the crewcan<strong>no</strong>t <strong>no</strong>rmally even see - let alone reachto clean.So the first lesson to learn is:“Make sure the ship is clean and gives agood impression of cleanliness so that itdecisively passes the first inspection donewithout a cherry picker – so the inspectorhas <strong>no</strong> cause to call for a cherry picker.”Why do vessels usually fail?<strong>The</strong>re are three main reasons:1. <strong>The</strong> holds were simply <strong>no</strong>t close to cleane<strong>no</strong>ugh to pass when inspected.2. <strong>The</strong> ship was nearly good e<strong>no</strong>ugh topass and with the right advice and supervisionit might have passed.3. That particular surveyor applied a higherstandard than others would have.Case Study 1A 1997 built Panamax bulk carrier arrivedat the anchorage in early October 2011with an ETB of ten days later. <strong>The</strong> underwriter’sinspector attended on board, at theanchorage (via a launch) a few days beforethe ETB, and failed the ship. <strong>The</strong> inspectorreported he had found a large number ofdeficiencies including infestation with insectsin a void space behind a panel withina hold and substantial quantities of residuefrom previous cargos in high areas of theship. <strong>The</strong> ship was delayed two weeks andcleaned and fumigated with the ship’s crewand shore labour using cherry pickers andhigh-pressure washing. <strong>The</strong> cleaning costwas more than A$200,000. This is an exampleof point ‘1’ above – i.e. a ship thatwas perhaps <strong>no</strong>t close to passing.Case Study 2A 2011 built ship arrived at an Australianport in 2011. <strong>The</strong> ship was less than sixmonths old and had only made a few voyages.<strong>The</strong> ship passed inspection at anchorageby the underwriter’s inspector16

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>Photo: <strong>TSC</strong>Some crews have successfully usedladders and platforms to cleanhigh areas prior to inspection.but then failed AQIS’ survey when at theberth. <strong>The</strong> ship was subsequently cleanedusing the ship’s crew and shore labour usingcherry pickers and high-pressure washing.<strong>The</strong> ship was delayed ten days and thecleaning cost was over A$200,000. Thisis an example of two inspecting surveyorshaving different opinions and the differentstandards two surveyors can have whenconducting the same inspection. It is alsoan example of a ship that perhaps ‘could’have passed had the owners obtained goodadvice and supervision.What lessons can we learn?Firstly, owners should <strong>no</strong>te this is a commonand expensive problem. We do <strong>no</strong>tk<strong>no</strong>w the statistics but believe over the lastthree years at least ten ships per year havefailed these surveys and incurred cleaningcosts of about A$200,000 per ship.Secondly, owners can do something tominimise the risk. If the ship is fixed toload grain in Australia the crew shouldclean the holds thoroughly:• If the next cargo is grain from Australiaand it is safe to do so, get the crew upon top of the previous cargo before dischargeand clean the high areas whileyou can.• Some crews have successfully used laddersand platforms to clean high areasprior to inspection.• Very careful cleaning the low reachableareas creates a good impression with theinspectors.Thirdly, owners should consider gettingtheir own surveyor to attend BEFOREthe underwriters and AQIS attend so asto ‘pre-inspect’ and then have the surveyorsupervise additional cleaning prior to theactual inspections, so as to increase thechances of passing first time. On numerousoccasions this has worked successfully.Fourthly, owners should consider gettingtheir own surveyor to attend during the inspections.<strong>The</strong>se inspections are very mucha matter of ‘opinion’ and ‘degree’ andtherefore owners can sometimes positivelyinfluence that ‘opinion’ by using a seniorsurveyor who is ‘a local’ and ‘respected’.One never k<strong>no</strong>ws for sure but we think wehave seen surveyors achieve good results inthis respect.Finally, it is usually a false eco<strong>no</strong>my forowners <strong>no</strong>t to send their own surveyor. O<strong>no</strong>ne spectacular occasion an owner was preparedto send a surveyor but decided thecost of a helicopter to that anchorage wasjust too high and so did <strong>no</strong>t send him –the owners subsequently spent more thanA$200,000 cleaning that ship.Recommendations1. Read and understand the “lessons” outlinedin this article.2. Arrive with a very clean ship!!(Not so easy in the real world.)3. Appoint your own surveyor to inspectyour ship before the official inspectionstake place. <strong>The</strong> cost is usually wellworth it compared to failing inspectionand having to clean.4. Appoint your own surveyor to accompanythe inspectors. This can make thedifference sometimes.5. If you did <strong>no</strong>t follow the recommendationsabove and your vessel fails, immediatelycontact the owners P&I surveyorto provide advice.6. If cleaning is required, seek advice fromthe P&I surveyor and accept that advice.Much money and time has beenwasted pursuing alternatives against therecommendations of the P&I surveyors.7. When contracting with cleaning companies,get several quotes and try tocontract for a lump-sum amount if possible.Also take heed of local experienceand the advice of your agent. Lowerdaily rates are <strong>no</strong>t a bargain if the tasktakes more days.17

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | OPAUnited States Coast Guardto limit OPA 90 liability forHerbert H. Ray Jr.Managing ShareholderKeesal, Young & LoganAnchorage, Alaska, USABert Ray received his B.S. degreefrom the College of William andMary in 1982, an M.S. degreefrom George Mason Universityin 1986, and a J.D. degree fromthe University of Oregon in 1988.He is a member of the Alaska BarAssociation, the Washington BarAssociation, the Maritime LawAssociation of the United States,and Litigation Counsel of America.He has a diverse, generallitigation practice that includesenvironmental, maritime, commercial,securities, malpracticeand white collar criminal matters.He practices extensively instate and federal courts, as wellas in commercial arbitrations,and before administrative agencies.He regularly representsclients in casualty responses inAlaska and along the US WestCoast, serving as lead counselduring response operations andin resulting litigation. He also hassignificant experience representingclients in natural resourcedamage assessments conductedby state and federal agencies.On 27 January <strong>2012</strong> the UnitedStates Coast Guard National PollutionFunds Center (the “NPFC”) issued a decisionupholding the right of the owner andoperator of the Selendang Ayu to limittheir liabilities under the U.S. Oil PollutionAct of 1990 (“OPA”) arising from theSelendang Ayu oil spill. <strong>The</strong> NPFC’s decisionallows the ship’s owner and operator(the “RP”) to limit their OPA liabilities toUSD 23,853,000.00, based on the ship’sgross tonnage and the applicable OPA limitat the time of the casualty. <strong>The</strong> OPA relatedliabilities resulting from the incidenthave exceeded USD 130,000,000, andthe NPFC’s decision entitles <strong>The</strong> <strong>Swedish</strong><strong>Club</strong>, the International Group, andthe Group’s reinsurers to be reimbursedfor their OPA expenditures in excess ofthe OPA limit from the Oil Spill LiabilityTrust Fund (“the Fund”).<strong>The</strong> casualty<strong>The</strong> fully-laden Panamax bulk carrier wason a voyage between Seattle, Washingtonand Xiamen, China in December 2004when the casualty occurred. On 6 December2004, while transiting the Bering Sea<strong>no</strong>rth of the Aleutian Islands, the crewshut down the main engine, after discoveringa crack in one of the cylinder liners.With a storm approaching, the crew isolatedthe cracked cylinder liner, with theintention of restarting the engine and sailingto a port of refuge. However, after theysuccessfully isolated the damaged cylinder,they could <strong>no</strong>t restart the main engine.<strong>The</strong> storm reached the ship before localtugs could take her under tow, and drovethe ship towards shore. When the tugsand a U.S. Coast Guard Cutter arrived onscene, they were unable to halt the ship’sdrift in the stormy seas and winds. Duringthis time, the ship’s crew struggled underextremely trying conditions to repair andrestart the main engine.On the after<strong>no</strong>on of 8 December, afterdrifting for more than 50 hours, the SelendangAyu grounded on the exposed, rockycoastline of <strong>no</strong>rthwest Unalaska Island.<strong>The</strong> ship broke in half shortly after thegrounding, resulting in the total loss of theship and its cargo of soy beans, and the dischargeof approximately 350,000 gallonsof bunker fuel and diesel from the ship’sdouble bottom fuel tanks, which rupturedon impact. Tragically, six of the ship’s crewperished when a U.S. Coast Guard helicoptercrashed while lifting them from thestricken ship.<strong>The</strong> response<strong>The</strong> Coast Guard and the State of Alaskaestablished a command center at DutchHarbor, Unalaska Island, a commercialfishing port located approximately 40miles by air from the site of the grounding.Personnel from <strong>The</strong> <strong>Swedish</strong> <strong>Club</strong>, the RP,the <strong>Club</strong>’s local correspondent, and numerousoil response contractors travelledto Dutch Harbor to coordinate and handlethe response, settle claims, and representthe ship’s owners and operators in the officialgovernment investigations which ensued.Despite the fierce winter conditions,the <strong>Club</strong>’s contractors were successful inremoving more than 100,000 gallons offuel from the ship’s wing tanks and engineroom tanks, by pumping the fuel into portabletanks and flying them to shore by helicopter.Shoreline cleanup operations beganin December 2004 and were completed inthe summer of 2006.Despite the fact that the Bering Sea is thelargest and most productive commercialfishery area in the United States, the <strong>Club</strong>and its consultants were able to avoid theclosure of several large commercial fisheries,and to settle all claims asserted by commercialfishermen without litigation, with theexception of one frivolous lawsuit that wasdismissed by the Court. <strong>The</strong> <strong>Club</strong> settledthe claims of local landowners whose landswere impacted by the spill, and conducteda cooperative natural resource damages assessmentwith state and federal officials.18

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>grants petitionSelendang Ayu Oil SpillPhoto: Unified Command<strong>The</strong> ship broke in half shortly after the grounding.Shortly after the grounding, the State ofAlaska demanded that the owner removethe wreck of the Selendang Ayu. Given thesize of the vessel, and the remote, exposedlocation of the wreck, removal of the wreckwould have been very expensive. <strong>The</strong> <strong>Club</strong>,its local correspondent and consultantsarranged for the removal of all remainingpollutants from the wreck. <strong>The</strong>y then metwith State of Alaska officials and demonstratedthat while the wreck itself posed<strong>no</strong> risk of harm to the environment, alarge-scale wreck removal operation at theexposed, remote location of the wreck, andthe resulting environmental disruption,posed significant environmental risks. Asa result of these efforts, the State of Alaskaultimately agreed that the wreck couldbe left in place, so long as the superstructureremaining above the waterline wasremoved. A local contractor was able toremove the remaining superstructure for asmall fraction of the cost of removing theentire wreck.Limitation of liabilityUnder OPA, an RP is strictly liable forresponse costs and damages arising froman incident. However, the RP may limit9continues on page 2019

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>P&I | OPAPhoto: Unified Command9continuedfrom page 19its OPA liability if it demonstrates that theIncident was <strong>no</strong>t caused by gross negligence,willful misconduct, or the violation of aU.S. statute or regulation governing shipoperations. In addition, the RP must demonstratethat it timely <strong>no</strong>tified the UnitedStates of the incident, and that it providedreasonable cooperation and assistance inresponse to the spill. <strong>The</strong> burden of proofis on the RP to prove by a preponderanceof the evidence that it is entitled to limit itsOPA liability.Because it may take several years before anRP is in a position to prove that it is entitledto limit its OPA liability, and it takes severalyears for the NPFC to adjudicate sucha claim, the RP may incur OPA responsecosts and damages that exceed the limitationamount, before the NPFC determineswhether the RP is entitled to limit its liability.One purpose of the Fund is to reimburseRPs who establish they are entitled to limittheir OPA liability, and who have incurredOPA costs that exceed the liability limit.In the case of the Selendang Ayu, theproximate causes of the grounding were theOn 8 December 2004, the Selendang Ayu grounded on the exposed coastline of Unalaska Island.crack in a main engine cylinder liner, andthe crew’s inability to restart the engineafter isolating the cracked cylinder. <strong>The</strong> RPwas required to prove that these events were<strong>no</strong>t the result of gross negligence or willfulmisconduct on its part. Because the engineroom was flooded when the ship grounded,and the ship’s chief engineer and secondengineer died in the helicopter crash, muchof the evidence regarding the cause of thecracked liner, and the inability to restart theengine, was lost when the ship groundedand the helicopter crashed.<strong>The</strong> <strong>Club</strong>, its correspondent, and engineeringexperts interviewed the survivingmembers of the ship’s crew and other engineersand technical superintendents employedby the RP, examined the ship’s maintenancerecords, and reviewed photographsof the engine taken by the crew while theystruggled to restart it. As a result of theevidence obtained during this forensicinvestigation, they were able to persuadethe NPFC that the cracked cylinder linerand the inability to restart the engine were<strong>no</strong>t caused by gross negligence or willfulmisconduct, or the violation of any UnitedStates laws.<strong>The</strong> RP also had to address claims thatthe crew waited too long to <strong>no</strong>tify theCoast Guard and local officials about theengine casualty, and delayed in searchingfor salvage tugs to respond. More than 12hours elapsed from the time the engine linercrack was discovered until local officialswere <strong>no</strong>tified that the ship was drifting towardsshore. <strong>The</strong> <strong>Club</strong> and its correspondentwere able to demonstrate that therewere <strong>no</strong> tugs available to respond to thecasualty when it occurred, and that the tugsthat eventually responded would <strong>no</strong>t havearrived any sooner.<strong>The</strong> decision to grant limitation of liabilityis the first step in what will be a substantialrecovery for the IG and their reinsurersfrom the NPFC. Ultimately, this recoverywill improve the Group’s loss record withthe reinsurance market, benefitting reinsurersas well as all of the <strong>Club</strong>s and theirmembers.20

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>Safety | SOLASTitanic and SOLAS (Safety Of Lifes At Sea)1912 - <strong>2012</strong>Photo: Ralph White/CORBISHans FilipssonDeputy Area ManagerTeam Gothenburg<strong>The</strong> Titanic sails away from the dockfor her maiden voyage in 1912.Sailing on the Seven Seas is oftendescribed in a romantic way but somany losses throughout history tella<strong>no</strong>ther story. While shipping is perhapsthe most international of allindustries, it is also one of the mostdangerous. Despite the fact thatships have never been so technicallyadvanced as they are today, accidentsstill happen.Today’s shipping industry is a lot biggerthan it was a hundred years ago and we canat least say that the relative number of disasters,and the loss of life, has been reduced.However, there is still a great need forsafety improvements and training for bothofficers and ratings.<strong>The</strong> Merchant Shipping ActAbout thirty-five years before the Titanicdisaster, the British Government presenteda proposal for increased safety at sea, the“Merchant Shipping Act”. It was a result ofhard work from Mr Samuel Plimsoll whowas a colourful pioneer in the field of improvedsafety at sea.Mr Plimsoll was elected to the Parliamentin 1868, at the age of 44. He started acampaign against unseaworthy vessels and,at the start of his campaign, became veryunpopular among established politiciansand those with financial interests in thecoal trade.He continued his mission and we canstill see the “Plimsoll Line” (Load Line)painted on both sides of all vessels. <strong>The</strong>“Load Line” shows the minimum freeboard(or maximum cargo intake). Overloadingwill lead to a reduced freeboard and lessstability as a result.Titanic – the biggest disaster everOn 10 April 1912, the S/S Titanic beganher maiden voyage, bound for New YorkCity, with Captain Edward J. Smith incommand.Just before midnight, on 14 April 1912,the luxury, British, passenger liner sankafter colliding with a huge iceberg. <strong>The</strong>Titanic was said to be one of the mostmodern and unsinkable ships of the timeand therefore only carried 20 lifeboatson her fateful maiden voyage, four morethan required by the British authorities.Unfortunately, that was less than half thenumber needed to accommodate everyoneon board.About 1500 passengers including shippersonnel lost their lives. Men and membersof the 2 nd and 3 rd class were less likelyto survive. 97 per cent of the women infirst class survived. Overall, only 20 percent of the men survived, compared withalmost 75 per cent of the women.<strong>The</strong> Titanic was the biggest disaster byfar and publicity was e<strong>no</strong>rmous. A largenumber of the passengers were among themost prominent people of the day. It wasdecided that something had to be done toavoid such disasters in the future.<strong>The</strong> SOLAS Convention<strong>The</strong> first version of SOLAS was adoptedin 1914, in response to the Titanic disaster.<strong>The</strong> SOLAS Convention in its successiveforms is generally regarded as themost important of all international treatiesconcerning the safety of merchantships.<strong>The</strong> main objective of the SOLAS Conventionis to specify minimum standardsfor the construction, equipment and operatio<strong>no</strong>f ships, compatible with theirsafety. Flag States are responsible for ensuringthat ships under their flag complywith its requirements, and a number ofcertificates are prescribed in the Conventionas proof that this has been done.100 years have passed<strong>The</strong> Titanic disaster occurred almost 100years ago to the day before this issue of<strong>Triton</strong> is distributed among members andother business partners.<strong>The</strong> time from when Mr Samuel Plimsollwas elected in 1868, also very muchreflects the time when <strong>The</strong> <strong>Swedish</strong> <strong>Club</strong>has been one of the players in marineinsurance. <strong>The</strong> <strong>Swedish</strong> <strong>Club</strong> was establishedin 1872 and we will <strong>no</strong>t onlycontinue to provide shipowners with insurancecover, but also continue contributingto the important work for improvedsafety at sea.21

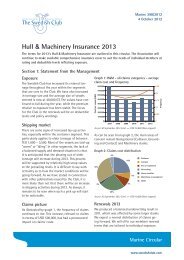

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>Loss Prevention | P&IP&I Claims AnalysisThis is a brief article from a comprehensive study aboutP&I claims over the past ten years that will soon be published.This study will look specifically at cargo, illness and injuryclaims, which have occurred on bulker, container and tankervessels and address the specific issues to why these claims occur.<strong>The</strong>re is a worrying increase in claim frequency since 2009but also an increase in the average claim cost. This is the samefor all the three claim categories and vessel types. One of thereasons for this increase could be the financial crisis and eco<strong>no</strong>micuncertainty in the world since 2008. This uncertaintydoes <strong>no</strong>t only affect companies but is likely to create stress toemployees as well.Cargo<strong>The</strong> average cost of a cargo claim is stable. However, with alarge increase in frequency the total cost would be substantial.Between 2010 and 2011 the total cost increased by around20%.<strong>The</strong> most expensive cargo claim category is contamination,which is mainly an issue for tankers and bulkers. Wet damageis the most expensive claim category for container vessels.In order to prevent contamination, it is imperative to takecargo samples. <strong>The</strong>re are unfortunately numerous cases wherethe vessel has loaded an entire consignment and discovered afterwardsthat it was contaminated.Illness<strong>The</strong> two most common illnesses are cardiovascular disease andproblems with the digestive system. Cardiovascular disease isalmost three times as common as problems with the digestivesystem.This is a huge concern, as cardiovascular disease remains oneof the biggest causes of death worldwide.To prevent these issues and ensure that crew members arehealthy and fit for duty, the <strong>no</strong>rmal medical examination seemsto be insufficient. It will take years of unhealthy living for aserious illness to develop. To be able to discover if a person isJoakim EnströmLoss Pevention Officersuffering from an illness the <strong>Club</strong> has developed a Pre EngagementMedical Examination (PEME), which is a more comprehensiveexamination. If the PEME is completed correctly it islikely that a serious illness will be discovered.InjuryInjuries mostly occur during <strong>no</strong>rmal maintenance work. Approvedprocedures are disregarded and unfortunately it is commonthat neither a work permit or risk assessment has beenissued.An ISM requirement has been in place since 1 July 2010 forcompanies to have shipboard operational procedures that arebased on risk assessments. <strong>The</strong> purpose of a risk assessment isto carry out a careful examination of shipboard operations toverify that there are adequate controls in place making risk levelsacceptable.If the risk assessment has been completed correctly it is likelythat most risks will be addressed. If a work permit has alsobeen issued for the specific job it should be obvious to crewmembers how to complete the job safely.Immediate causesSo why do accidents happen? Has the crew <strong>no</strong>t received e<strong>no</strong>ughtraining, lacking experience, suffering from fatigue? Are theydisregarding procedures? Is the company <strong>no</strong>t explaining whatis expected of their employees?<strong>The</strong>re are usually many reasons why an accident happens butthe immediate cause is usually obvious. Most people are awarewhen something is dangerous but for some reason believe that22

THE SWEDISH CLUB TRITON 1-<strong>2012</strong>450000.7400000.35Cost per vessel400003500030000250002000015000100000.60.50.40.30.2Frequency3500030000250002000015000100000.30.250.20.150.150000.150000.050000Cargo, Injury, Illness: Bulker, Container, Tanker – Claims >= 5000 USD60000.25100000.16Cost per vessel500040003000200010000.20.150.10.05Frequency9000800070006000500040003000200010000.140.120.10.080.060.040.0200002002200320042005200620072008200920102011200220032004200520062007200820092010201120022003200420052006200720082009201020112002200320042005200620072008200920102011Cost per vesselFrequencyCargo: Bulker, Container, Tanker - Claims cost >= USD 5000Cost per vesselFrequencyIllness: Bulker, Container, Tanker - Claims cost >= USD 5000Injury: Bulker, Container, Tanker - Claims cost >= USD 5000the risk is acceptable. We hear about these miscalculationsevery-day in the news. <strong>The</strong> problem with a vessel is that the consequencescan be e<strong>no</strong>rmous and even fatal.<strong>The</strong>re are some recurring immediate causes:• Lack of planning• Lack of experience• No clear guidelines• Not following company procedures• Procedures are unclear or <strong>no</strong>t extensive e<strong>no</strong>ugh• Not being assertive• Not recognising dangerous situations• Disregarding own safety and well-being• Poor communicationLack of safety culture<strong>The</strong> immediate causes mentioned above would indicate a possiblelack of safety culture. One of the difficulties in implementinga good safety culture is that safety for one person can bedifferent to a<strong>no</strong>ther. To change these habits it is imperative thateveryone onboard k<strong>no</strong>ws what is expected of them. Shoresideactivities need to be clear about policy and company culture.All employees need to receive proper training and follow-upsand the root causes need to be identified and rectified.In a well functioning safety culture most people realise theimportance of procedures and are aware of the consequences of<strong>no</strong>t following them. <strong>The</strong> procedures can be seen as somethingpositive that will benefit their own safety and that it is worththe trouble of e.g. using a safety harness, filling out the workpermit correctly and following the actual requirements.This is what MRM is all about<strong>The</strong> above issues are similar to the immediate causes in the Collisionsand Groundings study (see article in <strong>Triton</strong> 2-2011). Thisis expected, as the failure will most likely be from human error.This once again emphasizes the importance of a good safety cultureand improving the k<strong>no</strong>wledge about human errors, whichMRM (Maritime Resource Management) is all about.ConclusionTo prevent these claims it’s essential for a proper safety cultureto be established at the company. For the company to successfullyimplement a safety culture it is essential that all involvedreceive training, are informed about the importance of the safetysystem, that all concerned are aware that they are expected tofollow procedures and that it is unacceptable to disregard safety.23