Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

Form No Description Pages - Max Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

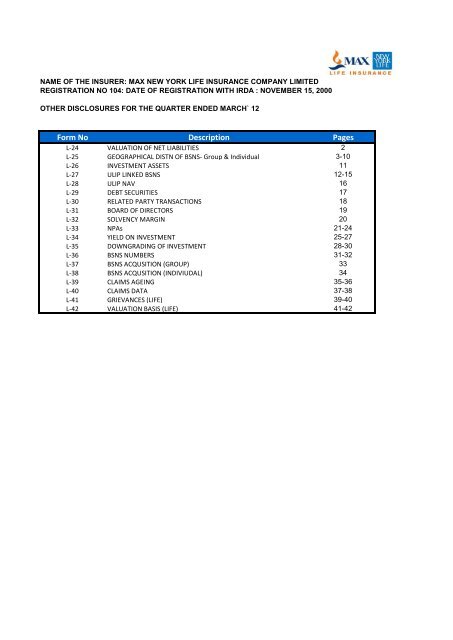

NAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000OTHER DISCLOSURES FOR THE QUARTER ENDED MARCH` 12<strong>Form</strong> <strong>No</strong> <strong>Description</strong> <strong>Pages</strong>L-24 VALUATION OF NET LIABILITIES 2L-25 GEOGRAPHICAL DISTN OF BSNS- Group & Individual 3-10L-26 INVESTMENT ASSETS 11L-27 ULIP LINKED BSNS 12-15L-28 ULIP NAV 16L-29 DEBT SECURITIES 17L-30 RELATED PARTY TRANSACTIONS 18L-31 BOARD OF DIRECTORS 19L-32 SOLVENCY MARGIN 20L-33 NPAs 21-24L-34 YIELD ON INVESTMENT 25-27L-35 DOWNGRADING OF INVESTMENT 28-30L-36 BSNS NUMBERS 31-32L-37 BSNS ACQUSITION (GROUP) 33L-38 BSNS ACQUSITION (INDIVIUDAL) 34L-39 CLAIMS AGEING 35-36L-40 CLAIMS DATA 37-38L-41 GRIEVANCES (LIFE) 39-40L-42 VALUATION BASIS (LIFE) 41-42

PERIODIC DISCLOSURESFORM L-24 VALUATION OF NET LIABILITIESNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000Valuation of net liabilitiesIn ` 000Sl.<strong>No</strong>. Particulars As at 31 Mar 2012 As at 31 March 20111 Linkeda <strong>Life</strong> 89,567,377 81,305,838b General Annuity - -c Pension 9,089,257 7,389,718d Health - -2 <strong>No</strong>n-Linked -a <strong>Life</strong> 47,462,947 33,594,346b General Annuity - -c Pension 461,301 429,567d Health 13,145 11,3952

PERIODIC DISCLOSURESFORM L-25- (I) : GEOGRAPHICAL DISTRIBUTION CHANNEL - INDIVIDUALNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000For the quarter ending 31st March 12Rural Urban Total BusinessSI.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh 5,661 5,506 10 168 6,896 6,843 24 328 12,557 12,349 35 4952 Arunachal Pradesh 20 16 0 2 155 141 1 10 175 157 1 123 Assam 1,159 1,113 3 25 1,527 1,493 5 46 2,686 2,606 8 714 Bihar 2,109 2,047 4 48 2,083 2,063 5 50 4,192 4,110 9 985 Chattisgarh 1,600 1,581 4 43 1,146 1,143 4 35 2,746 2,724 7 786 Goa 136 114 0 4 1,584 1,577 5 67 1,720 1,691 5 717 Gujarat 3,468 3,191 8 118 10,147 10,121 39 452 13,615 13,312 47 5708 Haryana (372) (175) (3) (15) 4,412 4,099 11 121 4,040 3,924 8 1079 Himachal Pradesh 411 404 1 17 123 109 1 4 534 513 2 2110 Jammu & Kashmir 157 149 0 4 827 778 2 27 984 927 3 3111 Jharkhand 990 842 2 24 1,231 1,064 4 41 2,221 1,906 6 6512 Karnataka 2,858 2,803 6 61 5,465 5,304 26 303 8,323 8,107 32 36413 Kerala 464 341 2 26 4,699 4,621 13 124 5,163 4,962 15 15014 Madhya Pradesh 1,446 1,436 3 39 2,813 2,724 9 102 4,259 4,160 12 14115 Maharashtra 5,213 5,036 10 185 19,054 18,014 80 1,056 24,267 23,050 91 1,24216 Manipur 318 317 1 9 191 166 1 7 509 483 2 1517 Meghalaya 51 51 0 1 94 91 1 5 145 142 1 618 Mirzoram - - - - 12 11 0 1 12 11 0 119 Nagaland 25 24 1 3 115 107 3 21 140 131 4 2520 Orissa 3,138 3,109 8 77 1,310 1,286 5 47 4,448 4,395 13 12421 Punjab 582 492 2 31 6,164 5,750 20 194 6,746 6,242 22 22522 Rajasthan 2,908 2,868 6 74 4,419 4,406 14 175 7,327 7,274 20 24923 Sikkim 57 53 0 2 120 119 1 5 177 172 1 724 Tamil Nadu 3,545 3,524 7 105 10,437 9,779 38 514 13,982 13,303 45 61825 Tripura 216 208 1 4 1 1 (0) 1 217 209 1 626 Uttar Pradesh 4,184 4,176 9 119 8,370 7,743 25 305 12,554 11,919 35 42427 UttraKhand 689 672 2 24 1,449 1,395 5 54 2,138 2,067 6 7828 West Bengal 3,562 3,490 13 112 13,358 12,535 41 332 16,920 16,025 54 44529 Andaman & Nicobar Islands 31 27 0 0 104 104 0 2 135 131 0 330 Chandigarh 225 208 1 7 811 772 4 44 1,036 980 4 5131 Dadra & Nagra Haveli 7 6 0 0 30 29 0 1 37 35 0 132 Daman & Diu 19 18 0 0 10 10 0 0 29 28 0 133 Delhi 979 930 2 28 9,994 9,397 44 521 10,973 10,327 46 54934 Lakshadweep - - - - - - - - - - - -35 Puducherry 49 49 0 2 133 132 0 7 182 181 1 8Company Total 45,905 44,626 105 1,349 119,284 113,927 430 5,005 165,189 158,553 536 6,353*Premium amount is New Business premium only.3

PERIODIC DISCLOSURESFORM L-25- (I) : GEOGRAPHICAL DISTRIBUTION CHANNEL - INDIVIDUALNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000Upto the quarter ending 31st March 12RuralSI.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)Total Business<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh 13,728 13,352 23 386 30,533 29,658 89 1,342 44,261 43,010 112 1,7272 Arunachal Pradesh 20 16 0 2 162 146 1 10 182 162 2 123 Assam 2,635 2,565 6 49 5,214 5,101 16 139 7,849 7,666 22 1884 Bihar 6,185 6,077 11 107 7,569 7,472 17 191 13,754 13,549 28 2975 Chattisgarh 3,132 2,890 7 82 5,021 4,928 13 152 8,153 7,818 21 2346 Goa 369 316 1 11 5,498 5,046 16 207 5,867 5,362 17 2187 Gujarat 8,581 7,783 20 263 36,186 34,334 124 1,527 44,767 42,117 143 1,7908 Haryana 6,241 6,122 17 160 31,103 29,229 113 1,186 37,344 35,351 129 1,3469 Himachal Pradesh 1,218 1,108 3 36 1,786 1,716 4 66 3,004 2,824 6 10210 Jammu & Kashmir 340 326 1 8 2,744 2,591 7 86 3,084 2,917 7 9411 Jharkhand 2,027 1,821 5 49 5,437 5,015 14 158 7,464 6,836 19 20712 Karnataka 5,954 5,530 11 109 20,061 19,327 79 912 26,015 24,857 90 1,02113 Kerala 3,796 3,548 8 72 14,261 13,329 37 350 18,057 16,877 45 42114 Madhya Pradesh 3,034 2,901 6 76 10,619 10,314 29 376 13,653 13,215 36 45215 Maharashtra 12,159 11,691 25 392 69,365 65,450 252 3,654 81,524 77,141 276 4,04716 Manipur 1,183 1,052 4 32 1,524 1,490 4 36 2,707 2,542 8 6817 Meghalaya 82 81 0 3 216 202 1 11 298 283 2 1418 Mirzoram 3 2 0 0 76 71 0 4 79 73 0 419 Nagaland 46 44 1 4 405 377 12 69 451 421 13 7420 Orissa 7,138 6,654 16 160 7,306 7,174 22 221 14,444 13,828 38 38021 Punjab 3,627 3,524 11 97 15,220 14,472 49 534 18,847 17,996 60 63122 Rajasthan 7,075 6,744 13 164 18,583 17,837 46 660 25,658 24,581 59 82423 Sikkim 109 101 0 4 426 412 2 17 535 513 3 2124 Tamil Nadu 9,483 9,305 20 244 33,008 31,109 103 1,335 42,491 40,414 123 1,57925 Tripura 692 660 1 10 479 473 1 9 1,171 1,133 3 1926 Uttar Pradesh 9,649 9,356 21 231 32,780 31,031 85 1,123 42,429 40,387 106 1,35427 UttraKhand 1,656 1,584 4 49 6,456 6,205 19 241 8,112 7,789 23 28928 West Bengal 17,443 17,169 38 287 37,367 35,764 114 964 54,810 52,933 152 1,25229 Andaman & Nicobar Islands 105 92 0 1 375 374 1 7 480 466 1 830 Chandigarh 526 505 1 16 3,547 3,364 13 155 4,073 3,869 14 17131 Dadra & Nagrahaveli 18 12 0 1 68 67 0 2 86 79 0 332 Daman & Diu 40 34 0 1 44 44 0 1 84 78 0 233 Delhi 2,652 2,566 5 61 36,422 34,004 142 1,880 39,074 36,570 147 1,94134 Lakshadweep - - - - - - - - - - - -35 Puducherry 109 103 0 5 569 539 2 30 678 642 2 35Company Total 131,055 125,634 282 3,171 440,430 418,665 1,426 17,656 571,485 544,299 1,708 20,827*Premium amount is New Business premium only.Urban4

PERIODIC DISCLOSURESFORM L-25- (I) : GEOGRAPHICAL DISTRIBUTION CHANNEL - INDIVIDUALNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000For the quarter ending 31st March 11Rural Urban Total BusinessSI.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh 5,699 5,658 8 130 10,200 9,785 30 403 15,899 15,443 37 5332 Arunachal Pradesh 10 10 0 0 42 40 0 2 52 50 0 23 Assam 1,532 1,521 2 18 1,592 1,527 5 40 3,124 3,048 7 584 Bihar 4,745 4,711 5 46 2,296 2,203 5 55 7,041 6,914 10 1025 Chattisgarh 774 768 1 18 1,886 1,809 5 53 2,660 2,577 6 716 Goa 167 166 0 5 1,575 1,511 4 46 1,742 1,677 5 517 Gujarat 4,405 4,373 8 113 9,915 9,512 36 354 14,320 13,885 44 4678 Haryana 2,393 2,376 7 64 4,749 4,556 12 143 7,142 6,931 19 2079 Himachal Pradesh 648 643 2 14 391 375 0 10 1,039 1,018 2 2410 Jammu & Kashmir 159 158 0 3 956 917 2 27 1,115 1,075 3 3011 Jharkhand 1,042 1,035 2 19 1,626 1,560 4 41 2,668 2,594 6 6112 Karnataka 1,668 1,656 2 33 5,794 5,558 27 220 7,462 7,214 29 25313 Kerala 2,534 2,516 8 33 2,996 2,874 8 83 5,530 5,390 16 11714 Madhya Pradesh 1,177 1,169 2 34 3,547 3,403 10 123 4,724 4,572 11 15715 Maharashtra 5,499 5,460 11 146 20,814 19,968 73 1,008 26,313 25,428 84 1,15416 Manipur 800 794 1 25 131 126 1 (9) 931 920 2 1617 Meghalaya 36 36 0 1 73 70 0 3 109 106 1 418 Mirzoram - - - - 42 40 0 2 42 40 0 219 Nagaland 36 36 0 1 131 126 1 11 167 161 2 1120 Orissa 4,008 3,979 6 58 1,706 1,637 7 64 5,714 5,616 13 12221 Punjab 1,828 1,815 10 46 4,672 4,482 11 136 6,500 6,297 21 18122 Rajasthan 2,793 2,773 4 66 7,328 7,030 16 209 10,121 9,803 20 27523 Sikkim 30 30 0 1 91 87 1 4 121 117 1 524 Tamil Nadu 3,557 3,531 5 71 12,833 12,311 44 381 16,390 15,843 49 45125 Tripura 510 506 1 6 225 216 0 2 735 723 1 826 Uttar Pradesh 5,888 5,846 9 134 14,630 14,035 30 280 20,518 19,881 39 41427 UttraKhand 854 848 2 24 2,731 2,620 7 69 3,585 3,468 9 9228 West Bengal 14,745 14,639 21 154 6,178 5,926 31 269 20,923 20,566 52 42329 Andaman & Nicobar Islands 50 50 0 1 (5) (5) 0 2 45 45 0 230 Chandigarh 218 216 0 4 1,732 1,661 4 43 1,950 1,878 4 4731 Dadra & Nagra Haveli 2 2 0 0 9 9 0 0 11 11 0 032 Daman & Diu 5 5 0 0 16 15 0 0 21 20 0 133 Delhi 693 688 1 18 13,017 12,488 47 479 13,710 13,176 48 49734 Lakshadweep - - - - - - - - - - - -35 Puducherry 21 21 0 1 258 248 1 12 279 268 1 13Company Total 68,526 68,034 118 1,286 134,176 128,720 424 4,565 202,702 196,754 543 5,851*Premium amount is New Business premium only.5

PERIODIC DISCLOSURESFORM L-25- (I) : GEOGRAPHICAL DISTRIBUTION CHANNEL - INDIVIDUALNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000Upto the quarter ending 31st March 11Rural Urban Total BusinessSI.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh 19,336 19,036 25 486 45,414 44,330 107 1,667 64,750 63,366 132 2,1532 Arunachal Pradesh 9 9 0 0 94 91 0 4 103 100 1 43 Assam 3,611 3,560 5 56 5,745 5,601 20 165 9,356 9,161 25 2204 Bihar 9,024 8,909 10 121 8,281 8,074 18 204 17,305 16,983 29 3255 Chattisgarh 2,170 2,138 4 52 6,129 5,971 15 159 8,299 8,109 19 2116 Goa 460 453 1 13 6,168 6,017 18 179 6,628 6,470 19 1927 Gujarat 16,587 16,324 26 437 50,379 49,207 146 1,620 66,966 65,531 172 2,0568 Haryana 10,386 10,217 18 281 24,799 24,225 62 831 35,185 34,442 80 1,1129 Himachal Pradesh 2,055 2,024 3 37 3,202 3,133 5 76 5,257 5,156 8 11410 Jammu & Kashmir 622 612 1 16 4,043 3,946 9 121 4,665 4,558 10 13811 Jharkhand 2,692 2,653 5 64 6,289 6,134 15 160 8,981 8,787 19 22412 Karnataka 5,525 5,440 7 101 25,866 25,249 88 892 31,391 30,689 96 99313 Kerala 7,156 7,050 15 116 16,539 16,160 42 394 23,695 23,210 57 50914 Madhya Pradesh 4,101 4,037 6 113 14,064 13,720 32 445 18,165 17,757 38 55915 Maharashtra 18,400 18,115 30 516 94,008 91,771 283 3,801 112,408 109,887 313 4,31616 Manipur 1,046 1,036 2 31 2,848 2,791 6 83 3,894 3,827 8 11417 Meghalaya 76 75 0 2 342 334 1 14 418 409 2 1618 Mirzoram - - - - 76 74 0 4 76 74 0 419 Nagaland 56 55 0 3 385 375 4 32 441 430 5 3420 Orissa 13,718 13,505 19 222 10,535 10,298 27 256 24,253 23,803 46 47821 Punjab 12,962 12,737 30 349 21,841 21,325 58 707 34,803 34,062 88 1,05622 Rajasthan 10,043 9,885 15 274 25,731 25,084 57 832 35,774 34,969 72 1,10523 Sikkim 54 53 0 2 304 296 1 11 358 350 1 1224 Tamil Nadu 11,480 11,304 17 251 48,240 47,046 135 1,453 59,720 58,350 153 1,70425 Tripura 1,078 1,064 2 17 1,353 1,323 3 31 2,431 2,386 5 4826 Uttar Pradesh 16,241 16,002 22 347 53,441 52,108 113 1,377 69,682 68,110 135 1,72327 UttraKhand 3,015 2,968 7 87 10,696 10,434 25 297 13,711 13,401 32 38428 West Bengal 51,034 50,239 60 590 38,197 37,337 109 896 89,231 87,576 170 1,48729 Andaman & Nicobar Islands 76 75 0 1 423 415 1 13 499 490 1 1430 Chandigarh 1,255 1,234 2 30 6,010 5,858 15 171 7,265 7,092 17 20131 Dadra & Nagrahaveli 2 2 0 0 25 24 0 1 27 26 0 132 Daman & Diu 13 13 0 0 43 42 0 1 56 55 0 133 Delhi 4,905 4,820 7 105 54,585 53,266 175 2,114 59,490 58,086 182 2,22034 Lakshadweep - - - - - - - - - - - -35 Puducherry 114 112 0 5 863 841 2 37 977 953 2 42Company Total 229,302 225,755 340 4,724 586,957 572,899 1,596 19,047 816,259 798,654 1,936 23,772*Premium amount is New Business premium only.6

PERIODIC DISCLOSURESFORM L-25- (II) : GEOGRAPHICAL DISTRIBUTION CHANNEL - GROUPNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000For the quarter ending 31st March 2012Rural (Group) Urban (Group) Total Business (Group)S.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh - - - - 26 444,567 5 (1,160) 26 444,567 5 (1,160)2 Arunachal Pradesh - - - - - - - - - - - -3 Assam - - - - - - - - - - - -4 Bihar - - - - - - - - - - - -5 Chattisgarh - - - - - - - - - - - -6 Goa - - - - - - - - - - - -7 Gujarat - - - - 5 2,368 0 68 5 2,368 0 688 Haryana - - - - 32 (1,354) 8 (796) 32 (1,354) 8 (796)9 Himachal Pradesh - - - - - - - - - - - -10 Jammu & Kashmir - - - - - - - - - - - -11 Jharkhand - - - - 1 1,003 0 80 1 1,003 0 8012 Karnataka - - - - 20 4,699 0 434 20 4,699 0 43413 Kerala - - - - 1 156 0 24 1 156 0 2414 Madhya Pradesh - - - - 2 192 0 13 2 192 0 1315 Maharashtra - - - - 63 73,596 47 3,742 63 73,596 47 3,74216 Manipur - - - - - - - - - - - -17 Meghalaya - - - - - - - - - - - -18 Mirzoram - - - - - - - - - - - -19 Nagaland - - - - - - - - - - - -20 Orissa - - - - - - - - - - - -21 Punjab - - - - 1 1,850 0 15 1 1,850 0 1522 Rajasthan - - - - - 1 0 0 - 1 0 023 Sikkim - - - - - - - - - - - -24 Tamil Nadu - - - - 9 3,538 0 77 9 3,538 0 7725 Tripura - - - - - - - - - - - -26 Uttar Pradesh - - - - 2 69 0 35 2 69 0 3527 Uttarakhand - - - - 2 83 0 4 2 83 0 428 West Bengal - - - - 2 (1,441) 0 (19) 2 (1,441) 0 (19)29 Andaman & Nicobar Islands - - - - - - - - - - - -30 Chandigarh - - - - - 10 0 3 - 10 0 331 Dadra & Nagrahaveli - - - - - - - - - - - -32 Daman & Diu - - - - - - - - - - - -33 Delhi - - - - 28 10,320 23 (12) 28 10,320 23 (12)34 Lakshadweep - - - - - - - - - - - -35 Puducherry - - - - - - - - - - - -Company Total - - - - 194 539,657 84 2,509 194 539,657 84 2,509*Premium amount is New Business premium only.7

PERIODIC DISCLOSURESFORM L-25- (II) : GEOGRAPHICAL DISTRIBUTION CHANNEL - GROUPNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000Upto the quarter ending 31st March 2012Rural (Group)S.<strong>No</strong>. State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)Urban (Group)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)Total Business (Group)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh - - - - 101 2,223,400 17 3,630 101 2,223,400 17 3,6302 Arunachal Pradesh - - - - - - - - - - - -3 Assam - - - - - - - - - - - -4 Bihar - - - - - - - - - - - -5 Chattisgarh - - - - - - - - - - - -6 Goa - - - - - - - - - - - -7 Gujarat - - - - 38 22,890 0 361 38 22,890 0 3618 Haryana - - - - 123 75,974 17 4,604 123 75,974 17 4,6049 Himachal Pradesh - - - - - - - - - - - -10 Jammu & Kashmir - - - - - - - - - - - -11 Jharkhand - - - - 1 1,003 0 80 1 1,003 0 8012 Karnataka - - - - 100 34,059 2 2,842 100 34,059 2 2,84213 Kerala - - - - 3 156 0 24 3 156 0 2414 Madhya Pradesh - - - - 3 1,232 0 82 3 1,232 0 8215 Maharashtra - - - - 323 332,025 131 27,396 323 332,025 131 27,39616 Manipur - - - - - - - - - - - -17 Meghalaya - - - - - - - - - - - -18 Mirzoram - - - - - - - - - - - -19 Nagaland - - - - - - - - - - - -20 Orissa - - - - 1 7,288 0 103 1 7,288 0 10321 Punjab - - - - 2 1,892 0 25 2 1,892 0 2522 Rajasthan - - - - 2 243 0 54 2 243 0 5423 Sikkim - - - - - - - - - - - -24 Tamil Nadu - - - - 42 19,657 1 989 42 19,657 1 98925 Tripura - - - - - - - - - - - -26 Uttar Pradesh - - - - 29 9,302 0 751 29 9,302 0 75127 UttraKhand - - - - 4 1,656 0 22 4 1,656 0 2228 West Bengal - - - - 8 2,556 0 25 8 2,556 0 2529 Andaman & Nicobar Islands - - - - - - - - - - - -30 Chandigarh - - - - 1 187 0 56 1 187 0 5631 Dadra & Nagrahaveli - - - - - - - - - - - -32 Daman & Diu - - - - - - - - - - - -33 Delhi - - - - 105 37,021 25 1,794 105 37,021 25 1,79434 Lakshadweep - - - - - - - - - - - -35 Puducherry - - - - - - - - - - - -Company Total - - - - 886 2,770,541 194 42,839 886 2,770,541 194 42,839*Premium amount is New Business premium only.8

PERIODIC DISCLOSURESFORM L-25- (II) : GEOGRAPHICAL DISTRIBUTION CHANNEL - GROUPNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000For the quarter ending 31st March 2011Rural (Group) Urban (Group) Total Business (Group)S.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh - - - - 18 (683,610) 4 3,088 18 (683,610) 4 3,0882 Arunachal Pradesh - - - - - - - - - - - -3 Assam - - - - - - - - - - - -4 Bihar - - - - - - - - - - - -5 Chattisgarh - - - - - - - - - - - -6 Goa - - - - - - - - - - - -7 Gujarat - - - - - (116) 0 4 - (116) 0 48 Haryana - - - - 19 (5,886) 4 (288) 19 (5,886) 4 (288)9 Himachal Pradesh - - - - - - - - - - - -10 Jammu & Kashmir - - - - - - - - - - - -11 Jharkhand - - - - - - - - - - - -12 Karnataka - - - - 12 (109,604) 0 (154) 12 (109,604) 0 (154)13 Kerala - - - - (1) 46,647 0 24 (1) 46,647 0 2414 Madhya Pradesh - - - - - 147 0 10 - 147 0 1015 Maharashtra - - - - 38 15,891 26 1,588 38 15,891 26 1,58816 Manipur - - - - - - - - - - - -17 Meghalaya - - - - - - - - - - - -18 Mirzoram - - - - - - - - - - - -19 Nagaland - - - - - - - - - - - -20 Orissa - - - - - - - - - - - -21 Punjab - - - - 1 - 0 5 1 - 0 522 Rajasthan - - - - - - - - - - - -23 Sikkim - - - - - - - - - - - -24 Tamil Nadu - - - - 6 981 1 2 6 981 1 225 Tripura - - - - - - - - - - - -26 Uttar Pradesh - - - - 4 444 0 44 4 444 0 4427 UttraKhand - - - - - - - - - - - -28 West Bengal - - - - 2 (260) 0 3 2 (260) 0 329 Andaman & Nicobar Islands - - - - - - - - - - - -30 Chandigarh - - - - - - - - - - - -31 Dadra & Nagra Haveli - - - - - - - - - - - -32 Daman & Diu - - - - - - - - - - - -33 Delhi - - - - 23 (16,226) 1 (382) 23 (16,226) 1 (382)34 Lakshadweep - - - - - - - - - - - -35 Puducherry - - - - - - - - - - - -Company Total - - - - 122 (751,592) 37 3,945 122 (751,592) 37 3,945*Premium amount is New Business premium only.9

PERIODIC DISCLOSURESFORM L-25- (II) : GEOGRAPHICAL DISTRIBUTION CHANNEL - GROUPNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000Upto the quarter ending 31st March 2011Rural (Group) Urban (Group) Total Business (Group)S.<strong>No</strong>.State / Union Territory<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)<strong>No</strong>. of Policies <strong>No</strong>. of Lives Premium (`Crs)Sum Assured(`Crs)1 Andhra Pradesh - - - - 73 7,824,039 54 10,576 73 7,824,039 54 10,5762 Arunachal Pradesh - - - - - - - - - - - -3 Assam - - - - - - - - - - - -4 Bihar - - - - - - - - - - - -5 Chattisgarh - - - - - - - - - - - -6 Goa - - - - - - - - - - - -7 Gujarat - - - - 37 20,782 0 261 37 20,782 0 2618 Haryana - - - - 103 102,569 17 6,935 103 102,569 17 6,9359 Himachal Pradesh - - - - - - - - - - - -10 Jammu & Kashmir - - - - - - - - - - - -11 Jharkhand - - - - 1 844 - 36 1 844 - 3612 Karnataka - - - - 82 40,717 2 2,540 82 40,717 2 2,54013 Kerala - - - - 2 62,870 0 63 2 62,870 0 6314 Madhya Pradesh - - - - 2 1,160 0 75 2 1,160 0 7515 Maharashtra - - - - 267 422,809 48 16,772 267 422,809 48 16,77216 Manipur - - - - - - - - - - - -17 Meghalaya - - - - - - - - - - - -18 Mirzoram - - - - - - - - - - - -19 Nagaland - - - - - - - - - - - -20 Orissa - - - - - - - - - - - -21 Punjab - - - - 2 42 0 10 2 42 0 1022 Rajasthan - - - - - - - - - - - -23 Sikkim - - - - - - - - - - - -24 Tamil Nadu - - - - 24 10,060 1 447 24 10,060 1 44725 Tripura - - - - - - - - - - - -26 Uttar Pradesh - - - - 31 10,528 0 473 31 10,528 0 47327 UttraKhand - - - - - - - - - - - -28 West Bengal - - - - 6 2,195 0 27 6 2,195 0 2729 Andaman & Nicobar Islands - - - - - - - - - - - -30 Chandigarh - - - - 1 182 - 4 1 182 - 431 Dadra & Nagrahaveli - - - - - - - - - - - -32 Daman & Diu - - - - - - - - - - - -33 Delhi - - - - 81 90,029 3 2,702 81 90,029 3 2,70234 Lakshadweep - - - - - - - - - - - -35 Puducherry - - - - - - - - - - - -Company Total - - - - 712 8,588,826 126 40,922 712 8,588,826 126 40,922*Premium amount is New Business premium only.10

PERIODIC DISCLOSURESL-26-INVESTMENT ASSETS - 3A PART ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012In ` Lacs Reconciliation of Investment Assets In ` LacsParticularsAmountParticularsAmountTotal Application as per Balance Sheet (A) 1,728,998 Total Investment Assets as per Balance Sheet 1,721,506Add : (B) Balance Sheet Value of : 1,721,506Provisions 599 A. <strong>Life</strong> Fund 723,013Current Liabilities 132,407 B. Pension & General Annuity Fund 11,926Less: (C) C. Unit Linked Funds 986,566Debit Balance in P & L A/c 36,978Loans 1,587Adv & Other Assets 56,867Cash & Bank Balance 26,040Fixed Assets 11,994Misc Exp <strong>No</strong>t Written Off 7,033Funds available for Investments 1,721,506NON LINKED BUSINESSA. LIFE FUND % as per RegSH PH Book ValueBalance FRSM + UL-<strong>No</strong>n Unit Res PAR NON PAR (SH+PH)(a) (b) (c) (d) (e) F= (b+c+d+e)1 G. Sec<strong>No</strong>t less than25% - 72,516 13,977 229,215 21,102 336,810 47% - 336,810 319,5472 G. Sec or Other Approved Securities (incl 1 Above)<strong>No</strong>t less than50% - 93,022 17,752 276,815 25,733 413,323 57% - 413,323 393,6023 Investment Subject to Excposure <strong>No</strong>rmsa. Housing & Infrastructure<strong>No</strong>t less than15% - 61,484 5,133 102,823 8,506 177,946 25% 58 177,946 174,221b. i) Approved Investments <strong>No</strong>t- 63,052 5,621 58,155 1,959 128,786 18% 303 128,786 127,533ii) "Other Investments" not to exceed 15% exceeding- 1,264 - 1,690 5 2,959 0% (22) 2,959 2,959TOTAL LIFE FUND 100% - 218,821 28,506 439,482 36,203 723,013 100% 339 723,013 698,315Actual %FVCAmountTotal FundIn ` LacsMarket ValueB. PENSION AND GENERAL ANNUITY FUND % as per RegPHFVCBook Value Actual %PAR NON PARAmountTotal Fund Market Value1 G. Sec <strong>No</strong>t less than 20%5,094 2,961 8,055 68% - 8,055 7,6352 G. Sec or Other Approved Securities (incl 1 Above) <strong>No</strong>t less than 40%5,694 2,976 8,671 73% - 8,671 8,2433 Investment Subject to Excposure <strong>No</strong>rms <strong>No</strong>t exceeding 60%1,199 2,056 3,255 27% - 3,255 3,214TOTAL PENSION , GENERAL ANNUITY FUND 100%6,894 5,032 11,926 100% - 11,926 11,458LINKED BUSINESSC. LINKED FUNDS % as per RegPHPAR NON PARTotal Fund Actual %1 Approved Investment <strong>No</strong>t less than 75%- 916,528 916,528 93%2 Other Investments <strong>No</strong>t exceeding 25%- 70,038 70,038 7%100%- 986,566 986,566 100%CERTIFICATIONCertified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed.DATE: Signature: sd/-Full Name: Rajesh Sud / Prashant Sharma<strong>No</strong>te: (+) FRMS refers to 'Funds representing Solvency Margins'.Designation: Chief Executive Officer/ Chief Investment OfficerPattern of Investment will apply only to Shareholders (SH) funds representing FRSM ("F")Funds beyond Solvency Margin shall have a separate Custody AccountOther Investments are as permitted under Section 27A(2) and 27B(3) of <strong>Insurance</strong> Act, 1938.11

PERIODIC DISCLOSURESFORM L-27- UNIT LINKED - 3A PART BNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012ParticularsPension Balanced Fund Pension Growth Fund Pension Conservative Fund Pension Secured Fund Pension Growth Super FundULIF00625/11/05PENSBALANC104ULIF00525/11/05PENSGROWTH104ULIF00725/11/05PENSCONSER104ULIF00825/11/05PENSSECURE104ULIF01213/08/07PENSGRWSUP104Opening Balance (Market Value) 9,675 33,875 1,008 4,551 23,953 73,062Add: Inflow During the Quarter 505 1,960 88 1,089 1,027 4,670Increase / (Decrease) Value of Inv. (Net) 547 3,099 27 (726) 3,417 6,364Less: Outflow during the Quarter 127 656 12 105 147 1,046TOTAL INVESTIBLE FUNDS (MKT VALUE) 10,601 38,279 1,110 4,809 28,251 83,049Total PensionIn ` LacsInvestment Of Unit FundPension Balanced FundPension Growth Fund Pension Conservative Fund Pension Secured FundPension Growth Super FundFundActual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % ActualApproved Investments (>=75%)Government Bonds 2,356 22% 985 3% 577 52% 2,512 52% - 0% 6,431 8%Corporate Bonds 1,344 13% 2,202 6% 38 3% 608 13% 81 0% 4,273 5%Infrastructure Bonds 2,006 19% 6,870 18% 238 21% 946 20% 325 1% 10,385 13%Approved Equity 2,514 24% 18,095 47% 114 10% - 0% 21,743 77% 42,466 51%Money Market 1,314 12% 5,649 15% 9 1% 176 4% 3,941 14% 11,090 13%Mutual funds - 0% 657 2% - 0% - 0% - 0% 657 1%Deposit with Banks 559 5% 1,648 4% 99 9% 538 11% - 0% 2,844 3%Sub Total (A) 10,093 95% 36,105 94% 1,076 97% 4,781 99% 26,090 92% 78,145 94%Current Assets:Accrued Interest 239 2% 525 1% 33 3% 189 4% 20 0% 1,007 1%Bank Balance 33 0% 106 0% 3 0% 35 1% 21 0% 198 0%Dividend Receivable 0 0% 4 0% - 0% - 0% 7 0% 11 0%Receivable for Sale of Investments 317 3% 71 0% 100 9% 502 10% 238 1% 1,229 1%Other Current Assets (for Investments) 97 1% 79 0% 23 2% 9 0% 118 0% 327 0%Appropriation (Expropriation) Asset - 0% - 0% - 0% - 0% - 0% - 0%Less: Current LiabilitiesPayable for Investments 459 4% 51 0% 126 11% 691 14% 51 0% 1,377 2%Other current liabilites (for Investments) - 0% 7 0% 0 0% 17 0% - 0% 24 0%Fund Mgmt Charges Payable - 0% - 0% - 0% - 0% - 0% - 0%Sub Total (B) 228 2% 727 2% 33 3% 28 1% 354 1% 1,371 2%Other Investments (

PERIODIC DISCLOSURESFORM L-27- UNIT LINKED - 3A PART BNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Opening Balance (Market Value)Add: Inflow During the QuarterIncrease / (Decrease) Value of Inv. (Net)Less: Outflow during the QuarterTOTAL INVESTIBLE FUNDS (MKT VALUE)ParticularsGroup Gratuity Balanced fundULGF00217/04/06GRATBALANC104Group Gratuity Growth fundULGF00117/04/06GRATGROWTH104Group Gratuity ConservativeFundULGF00317/04/06GRATCONSER104Group SuperannuationBalanced FundULGF00523/01/07SANNBALANC104Group SuperannuationGrowth FundGroup SuperannuationConservative FundULGF00423/01/07SANNGROW ULGF00623/01/07SANNCONSETH104R1041,568 1,285 3,541 1 4 382 6,781225 14 573 0 97 232 1,14177 101 83 (0) (97) 32 19635 28 64 0 0 147 2741,835 1,371 4,134 1 5 498 7,843Total Group FundIn ` LacsApproved Investments (>=75%)Government BondsCorporate BondsInfrastructure BondsApproved EquityMoney MarketMutual fundsDeposit with BanksCurrent Assets:Accrued InterestBank BalanceDividend ReceivableReceivable for Sale of InvestmentsOther Current Assets (for Investments)Appropriation (Expropriation) AssetLess: Current LiabilitiesPayable for InvestmentsOther current liabilites (for Investments)Fund Mgmt Charges PayableInvestment Of Unit FundSub Total(A)Group Gratuity Balanced fundGroup Gratuity Growth fundGroup Gratuity ConservativeFundGroup SuperannuationBalanced FundGroup SuperannuationGrowth FundGroup SuperannuationConservative FundTotal Group FundActual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual423 23% 13 1% 2,171 53% 0 45% 1 26% 254 51% 2,861 36%65 4% 84 6% 352 9% 0 21% 1 14% 42 9% 544 7%469 26% 279 20% 908 22% - 0% - 0% 100 20% 1,756 22%460 25% 663 48% - 0% 0 29% 2 53% - 0% 1,126 14%105 6% 97 7% 78 2% - 0% - 0% 18 4% 298 4%- 0% - 0% - 0% - 0% - 0% - 0% - 0%140 8% 74 5% 458 11% 0 9% - 0% 42 8% 714 9%1,661 91% 1,210 88% 3,967 96% 1 105% 4 93% 456 91% 7,299 93%52 3% 23 2% 148 4% 0 1% 0 1% 15 3% 239 3%21 1% 2 0% 4 0% 0 0% 0 0% 0 0% 26 0%0 0% 0 0% - 0% - 0% - 0% - 0% 0 0%100 5% - 0% 502 12% - 0% 0 4% 85 17% 688 9%- 0% - 0% 0 0% - 0% 0 0% 25 5% 25 0%- 0% - 0% - 0% - 0% - 0% - 0% - 0%93 5% - 0% 488 12% 0 8% - 0% 82 16% 663 8%0 0% 0 0% - 0% - 0% - 0% - 0% 0 0%- 0% - 0% - 0% - 0% - 0% - 0% - 0%Other Investments (

PERIODIC DISCLOSURESFORM L-27- UNIT LINKED - 3A PART BNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Opening Balance (Market Value)Add: Inflow During the QuarterIncrease / (Decrease) Value of Inv. (Net)Less: Outflow during the QuarterTOTAL INVESTIBLE FUNDS (MKT VALUE)ParticularsBalanced FundULIF00225/06/04LIFEBALANC104Growth Fund Conservative Fund Secured Fund Guaranteed Fund-IncomeULIF00125/06/04LIFEGROWTH104ULIF00325/06/04LIFECONSER104ULIF00425/06/04LIFESECURE104ULIF00904/10/06AMSRGUAINC104Guaranteed Fund-DynamicULIF01004/10/06AMSRGUADYN10450,529 468,433 4,836 14,108 63 341 214,4082,114 7,413 264 823 118 419 6,2823,003 41,883 190 319 (104) (386) 30,856290 4,623 166 402 2 7 1,21155,357 513,107 5,124 14,849 74 367 250,335In ` LacsGrowth Super FundULIF01108/02/07LIFEGRWSUP104Investment Of Unit FundBalanced FundGrowth Fund Conservative Fund Secured Fund Guaranteed Fund-Income Guaranteed Fund-Dynamic Growth Super FundApproved Investments (>=75%)Government BondsCorporate BondsInfrastructure BondsApproved EquityMoney MarketMutual fundsDeposit with BanksCurrent Assets:Accrued InterestBank BalanceDividend ReceivableReceivable for Sale of InvestmentsOther Current Assets (for Investments)Appropriation (Expropriation) AssetLess: Current LiabilitiesPayable for InvestmentsOther current liabilites (for Investments)Fund Mgmt Charges PayableSub Total(A)Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual12,290 22% 17,885 3% 2,626 51% 7,689 52% 42 57% 195 53% - 0%3,356 6% 31,142 6% 564 11% 1,734 12% 10 13% 19 5% 664 0%13,728 25% 88,433 17% 977 19% 3,010 20% - 0% 48 13% 960 0%13,852 25% 269,752 53% 574 11% - 0% 4 6% 55 15% 210,424 84%4,701 8% 28,721 6% 57 1% 630 4% 9 12% 17 5% 7,731 3%233 0% 1,801 0% - 0% - 0% - 0% - 0% 0 0%3,230 6% 25,708 5% 175 3% 1,728 12% 5 7% 28 8% 2,000 1%51,391 93% 463,443 90% 4,971 97% 14,791 100% 71 95% 364 99% 221,780 89%1,209 2% 7,559 1% 145 3% 567 4% 2 2% 9 2% 110 0%60 0% 108 0% (3) 0% (6) 0% 0 0% 3 1% 76 0%4 0% 74 0% 0 0% - 0% - 0% - 0% 60 0%1,332 2% 11,529 2% 511 10% 1,404 9% 31 42% 87 24% 5,834 2%400 1% 1,574 0% 107 2% 22 0% 2 2% 2 1% 940 0%- 0% - 0% - 0% - 0% - 0% - 0% - 0%1,099 2% 6,795 1% 670 13% 1,904 13% 31 42% 100 27% 3,820 2%- 0% - 0% - 0% 26 0% - 0% 1 0% - 0%- 0% - 0% - 0% - 0% - 0% - 0% - 0%Other Investments (

PERIODIC DISCLOSURESFORM L-27- UNIT LINKED - 3A PART BNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Opening Balance (Market Value)Add: Inflow During the QuarterIncrease / (Decrease) Value of Inv. (Net)Less: Outflow during the QuarterTOTAL INVESTIBLE FUNDS (MKT VALUE)ParticularsHigh Growth Fund Dynamic Opportunity Fund Money Market Fund Secure Plus FundTotal Individual FundGrand TotalULIF01311/02/08LIFEHIGHGR104ULIF01425/03/08LIFEDYNOPP104ULIF01528/04/09LIFEMONEYM104ULIF01628/04/09LIFESECPLS1043,178 38,819 2,591 2,451 799,759 879,602140 4,252 1,172 343 23,339 29,150514 4,390 (883) 66 79,848 86,40885 269 31 186 7,273 8,5933,746 47,192 2,849 2,675 895,674 986,566In ` LacsInvestment Of Unit FundHigh Growth Fund Dynamic Opportunity Fund Money Market Fund Secure Plus FundTotal Individual FundGrand TotalApproved Investments (>=75%)Government BondsCorporate BondsInfrastructure BondsApproved EquityMoney MarketMutual fundsDeposit with BanksCurrent Assets:Accrued InterestBank BalanceDividend ReceivableReceivable for Sale of InvestmentsOther Current Assets (for Investments)Appropriation (Expropriation) AssetLess: Current LiabilitiesPayable for InvestmentsOther current liabilites (for Investments)Fund Mgmt Charges PayableSub Total(A)Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual Actual Inv. % Actual- 0% 1,088 2% 2,829 99% 1,674 63% 46,320 5% 55,612 6%71 2% 2,646 6% - 0% 171 6% 40,376 5% 45,192 5%60 2% 8,129 17% - 0% 497 19% 115,843 13% 127,985 13%3,074 82% 25,138 53% - 0% - 0% 522,875 58% 566,466 57%7 0% 3,468 7% - 0% 61 2% 45,403 5% 56,790 6%- 0% 544 1% - 0% - 0% 2,578 0% 3,235 0%130 3% 1,797 4% - 0% 250 9% 35,051 4% 38,608 4%3,343 89% 42,811 91% 2,829 99% 2,652 99% 808,445 90% 893,889 91%14 0% 651 1% - 0% 94 4% 10,360 1% 11,606 1%9 0% 215 0% 11 0% 17 1% 489 0% 713 0%1 0% 3 0% - 0% - 0% 142 0% 153 0%19 1% - 0% - 0% 502 19% 21,250 2% 23,166 2%14 0% 823 2% 11 0% 21 1% 3,917 0% 4,269 0%- 0% - 0% - 0% - 0% - 0% - 0%4 0% 141 0% - 0% 605 23% 15,168 2% 17,208 2%- 0% - 0% 2 0% 7 0% 36 0% 60 0%- 0% - 0% - 0% - 0% - 0% - 0%Other Investments (

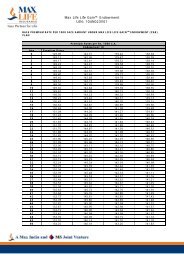

PERIODIC DISCLOSURESFORM L-28-ULIP NAV Linked to <strong>Form</strong> 3A ( Part B)NAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Part - CS.<strong>No</strong>Name of the SchemeSFIN <strong>No</strong>.As on the Above DateAssets HeldNAV (Rs) AsNAV (Rs)(Rs Lacs)per LB21 Group Gratuity Balanced Fund ULGF00217/04/06GRATBALANC104 1,835 16.46 16.46 15.71 15.76 15.97 4.39% 11.24%2 Group Superannuation Balanced Fund ULGF00523/01/07SANNBALANC104 1 14.23 14.23 13.35 13.59 14.22 1.56% 6.51%3 Group Gratuity Conservative Fund ULGF00317/04/06GRATCONSER104 4,134 15.13 15.13 14.79 14.48 14.19 8.01% 6.97%4 Group Superannuation Conservative Fund ULGF00623/01/07SANNCONSER104 498 12.06 12.06 11.81 11.53 11.33 7.50% 6.45%5 Group Gratuity Growth Fund ULGF00117/04/06GRATGROWTH104 1,371 15.24 15.24 14.12 14.60 15.17 1.28% 12.90%6 Group Superannuation Growth Fund ULGF00423/01/07SANNGROWTH104 5 13.13 13.13 12.13 12.63 13.35 -1.02% 9.51%7 Balanced Fund ULIF00225/06/04LIFEBALANC104 55,357 23.06 23.06 21.92 22.04 22.43 3.46% 12.18%8 Conservative Fund ULIF00325/06/04LIFECONSER104 5,124 20.04 20.04 19.42 19.14 19.03 6.10% 10.50%9 Secured Fund ULIF00425/06/04LIFESECURE104 14,849 16.82 16.82 16.46 16.04 15.73 7.96% 6.89%10 Dynamic Opportunity Fund ULIF01425/03/08LIFEDYNOPP104 47,192 13.57 13.57 12.40 12.96 13.80 -1.56% 14.90%11 Guaranteed Fund-Dynamic ULIF01004/10/06AMSRGUADYN104 367 13.80 13.80 13.28 13.25 13.41 2.90% 6.34%12 Guaranteed Fund-Income ULIF00904/10/06AMSRGUAINC104 74 13.35 13.35 12.98 12.80 12.75 5.11% 6.32%13 Growth Fund ULIF00125/06/04LIFEGROWTH104 513,107 30.24 30.24 27.77 28.80 30.61 -1.29% 15.89%14 High Growth Fund ULIF01311/02/08LIFEHIGHGR104 3,746 12.43 12.43 10.75 11.69 12.79 -2.54% 22.81%15 Money Market Fund ULIF01528/04/09LIFEMONEYM104 2,849 11.36 11.36 11.16 10.97 10.79 6.78% 4.52%16 Growth Super Fund ULIF01108/02/07LIFEGRWSUP104 250,335 15.91 15.91 13.97 15.06 16.88 -6.97% 23.47%17 Secure Plus Fund ULIF01628/04/09LIFESECPLS104 2,675 11.80 11.80 11.55 11.29 11.06 8.03% 5.89%18 Pension Balanced Fund ULIF00625/11/05PENSBALANC104 10,601 15.98 15.98 15.27 15.32 15.53 3.56% 9.46%19 Pension Conservative Fund ULIF00725/11/05PENSCONSER104 1,110 15.46 15.46 15.03 14.85 14.77 5.34% 7.61%20 Pension Secured Fund ULIF00825/11/05PENSSECURE104 4,809 14.89 14.89 14.56 14.19 13.91 8.22% 6.85%21 Pension Growth Fund ULIF00525/11/05PENSGROWTH104 38,279 17.67 17.67 16.23 16.85 17.91 -1.36% 15.14%22 Pension Growth Super Fund ULIF01213/08/07PENSGRWSUP104 28,251 9.68 9.68 8.52 9.18 10.28 -6.60% 20.47%TOTAL 986,566Previous Qtr.NAV (Rs)2nd Previous Qtr.NAV (Rs)3rd Previous Qtr.NAV (Rs)AnnualisedReturn/Yield3 YearRolling CAGR<strong>No</strong>te :1 NAV figures as per LB2 are as on 31st March 20122 Launch Dates for fund not in existence for 3 yearsFund DetailsMoney Market FundSecure Plus FundLaunch Date13-May-0913-May-09CertificationCertified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed.DATE: Signature: sd/-Full Name: Rajesh Sud / Prashant SharmaDesignation: Chief Executive Officer/ Chief Investment Officer16

PERIODIC DISCLOSURESFORM L - 29 - DEBT SECURITIES - 7ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012In ` LacsDetail Regarding Debt SecuritiesMarket ValueBook ValueAs at 31st March 2012 As at 31st March 2011 As at 31st March 2012 As at 31st March 2011ULIP <strong>No</strong>n-ULIP Totalas % of total foras % of total foras % of total foras % of total forULIP <strong>No</strong>n-ULIP TotalULIP <strong>No</strong>n-ULIP TotalULIP <strong>No</strong>n-ULIP Totalthis classthis classthis classthis classBreak down by creditratingAAA rated 204,839 250,522 455,361 45.21% 247,402 158,570 405,971 52.29% 204,839 255,052 459,891 44.54% 247,402 160,851 408,253 51.79%AA or better 18,093 10,268 28,361 2.82% 14,606 5,661 20,268 2.61% 18,093 10,848 28,941 2.80% 14,606 6,023 20,629 2.62%Rated below AA butabove A0 0 0 0.00% 0 0 0 0.00% 0 0 0 0.00% 0 0 - 0.00%Rated below A but aboveB0 0 0 0.00% 0 0 0 0.00% 0 0 0 0.00% 0 0 - 0.00%Any other 101,256 422,298 523,553 51.98% 45,527 304,617 350,143 45.10% 101,256 442,354 543,610 52.65% 45,527 313,819 359,345 45.59%324,188 683,087 1,007,275 100% 307,534 468,848 776,382 100% 324,188 708,254 1,032,442 100% 307,534 480,692 788,226 100%BREAKDOWN BYRESIDUALMATURITYUp to 1 year 125,580 53,030 178,610 17.73% 174,773 12,015 186,788 24.06% 125,580 53,052 178,632 17.30% 174,773 12,026 186,799 23.70%More than 1 yearandupto 3years85,130 48,135 133,265 13.23% 68,119 24,043 92,162 11.87% 85,130 48,581 133,711 12.95% 68,119 24,307 92,426 11.73%More than 3years and upto 7years67,150 119,272 186,422 18.51% 40,143 72,270 112,413 14.48% 67,150 121,839 188,989 18.31% 40,143 73,089 113,232 14.37%More than 7 years andup to 10 years44,937 121,746 166,684 16.55% 23,337 82,364 105,701 13.61% 44,937 125,124 170,062 16.47% 23,337 83,873 107,210 13.60%More than 10 years andup to 15 years329 116,470 116,799 11.60% 109 83,295 83,403 10.74% 329 121,899 122,228 11.84% 109 84,965 85,074 10.79%More than 15 years andup to 20 years58 104,833 104,891 10.41% 1,053 73,094 74,147 9.55% 58 108,459 108,517 10.51% 1,053 74,629 75,682 9.60%Above 20 years 1,004 119,600 120,604 11.97% 0 121,768 121,768 15.68% 1,004 129,299 130,303 12.62% 0 127,803 127,803 16.21%324,188 683,087 1,007,275 100% 307,534 468,848 776,382 100% 324,188 708,254 1,032,442 100% 307,534 480,692 788,226 100%Breakdown by type ofthe issuera. Central Government 36,563 378,824 415,386 41.24% 30,703 298,322 329,025 42.38% 36,563 398,385 434,948 42.13% 30,703 307,530 338,234 42.91%b. State Government 19,050 21,607 40,656 4.04% 1,742 1,421 3,162 0.41% 19,050 22,101 41,151 3.99% 1,742 1,414 3,156 0.40%c.Corporate Securities 268,576 282,657 551,233 54.73% 275,089 169,105 444,195 57.21% 268,576 287,768 556,344 53.89% 275,089 171,748 446,837 56.69%324,188 683,087 1,007,275 100% 307,534 468,848 776,382 100% 324,188 708,254 1,032,442 100% 307,534 480,692 788,226 100%<strong>No</strong>te1. In case of a debt instrument is rated by more than one agency, then the lowest rating will be taken for the purpose of classification.2. The detail of ULIP and <strong>No</strong>n-ULIP will be given separately.3. Market value of the securities will be in accordance with the valuation method specified by the Authority under Accounting/ Investment regulations.* Includes Government Securities, Treasury Bills, Reverse Repo and Fixed Deposits17

PERIODIC DISCLOSURESFORM L-30 : RELATED PARTY TRANSACTIONSNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000In ` CrsSI <strong>No</strong>.For the Quarterending 31st March2012Upto the Quarterending 31st March2012For the Quarterending 31st March2011Upto the Quarterending 31st March2011Name of the Related PartyNature of Relationship with Company <strong>Description</strong> of Transaction / CategoriesReceiving of services. 0.27 0.27 0.08 0.251 <strong>Max</strong> India Ltd. Holding CompanyRendering of Services 2.29 2.63 1.35 0.79Equity Share Capital - - - -Recovery of Expenses - 0.05 0.00 0.00Equity Share Capital 0.15 73.68 - 1.582 New York <strong>Life</strong> International LlcShareholders with Significant InfluenceReceiving of services. - 1.56 0.01 1.43Recovery of Expenses 0.22 0.45 - 1.80Reimbursement of expenses. 0.01 0.12 1.87 0.553 New York <strong>Life</strong> <strong>Insurance</strong> Co. Shareholders with Significant Influence Receiving of services. 47.68 59.70 13.73 55.78Reimbursement of expenses. 0.00 0.01 0.14 0.054 <strong>Max</strong> Healthcare Institute Ltd. Fellow SubsidiariesRecovery of Expenses - 0.05 - -Rendering of Services 0.30 0.34 - 0.255 Pharmax Corporation Ltd. andFellow SubsidiariesReceiving of services. - - 0.04 0.36Reimbursement of expenses. 0.68 2.01 0.24 1.50Reimbursement of expenses. - - - 0.00Recovery of Expenses - 0.05 - -6 <strong>Max</strong> Bupa Health <strong>Insurance</strong> Limited Fellow SubsidiariesSale of Assets - - - 0.01Rendering of Services 0.16 0.64 - 0.53Receiving of services. 0.19 4.26 - -7 MAX UK LTD, UK Fellow Subsidiaries Reimbursement of expenses. - - - 0.018 Alps Hospital Pvt. Ltd. Fellow Subsidiaries Rendering of Services - 0.00 - 0.119 <strong>Max</strong> Neeman Medical International Ltd. Fellow Subsidiaries Rendering of Services - 0.01 - 0.0010 <strong>Max</strong> Foundation11 New Delhi House Services LimitedEnterprises over which Key managementPersonnel have significant InfluenceEnterprises over which Key managementPersonnel have significant InfluenceVoluntry Contribution - 2.00 - 1.50Recovery of Expenses 0.00 - - -Rendering of Services 0.00 0.00 0.00 0.38Reimbursement of expenses. 0.05 0.42 0.05 0.0118

PERIODIC DISCLOSURESFORM L-31 BOARD OF DIRECTORS & KEY PERSONSNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000As at 31st March 2012Sl. <strong>No</strong>. Name of person Role/designation Remarks1 Analjit Singh Chairman2 Anuroop (Tony) Singh Vice Chairman3 Rajesh Sud CEO & Managing Director4 Rajit Mehta Executive Director & COO5 Gary Bennett Director6 Leo Puri Independent Director Appointed wef 1st Feb 20127 Richard Mucci Director8 Dr. Omkar Goswami Independent Director9 Marielle Theron Director Appointed wef 1st Feb 201210 Rahul Khosla Additional Director Appointed wef 1st Feb 2012Key Persons as defined in IRDA Registration of Companies Regulations, 2000SI. <strong>No</strong>. Name of Person Role/designation Remarks1 Rajesh Sud Chief Executive Officer2 Sanchit Maini Appointed Actuary3 Prashant Sharma Chief Investment Officer4 Prashant Tripathy Chief Financial Officer Acting as a CFO, Appinted as CFO wef 1st April 125 Anisha Motwani Chief Marketing Officer6 Ashish Vohra Chief Distribution Officer7 Rajiv Mathur Chief Compliance Officer19

PERIODIC DISCLOSURESFORM L-32-SOLVENCY MARGIN - KT331st Mar 2012Name of Insurer:MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDClassification:Registration Number: 104(See Regulation 4)<strong>Insurance</strong> Regulatory and Development Authority (Actuarial Report and Abstract) Regulations, 2000.AVAILABLE SOLVENCY MARGIN AND SOLVENCY RATIO.<strong>Form</strong> Code:Classification Code:Item<strong>Description</strong>Adjusted Value(Amount (In ` '000)01 Available Assets in Policyholders' Fund: 150,253,994Deduct:02 Mathematical Reserves 146,594,02703 Other Liabilities04 Excess in Policyholders' funds 3,659,96705 Available Assets in Shareholders Fund: 30,649,702Deduct:06 Other Liabilities of shareholders’ fund 13,355,44507 Excess in Shareholders' funds 17,294,25608 Total ASM (04)+(07) 20,954,22409 Total RSM 3,924,22610 Solvency Ratio (ASM/RSM) 5.34I, the Appointed Actuary, certify that the above statements have been prepared in accordance with the section 64VA of the <strong>Insurance</strong> Act, 1938, and the amountsmentioned therein are true and fair to the best of my knowledge.Place: Gurgaon sd/-Date:Name and Signature of Appointed Actuary<strong>No</strong>tesSanchit Maini1. Item <strong>No</strong>. 01 shall be the amount of the Adjusted Value of Assets as mentioned in <strong>Form</strong> IRDA-Assets- AA as specified under Schedule I of <strong>Insurance</strong> Regulatoryand Development Authority (Assets, Liabilities, and Solvency Margin of Insurers) Regulations, 2000;2. Item <strong>No</strong>. 02 shall be the amount of Mathematical Reserves as mentioned in <strong>Form</strong> H;3. Item <strong>No</strong>s. 03 and 06 shall be the amount of other liabilities as mentioned in the Balance Sheet;4. Items <strong>No</strong>. 05 shall be the amount of the Total Assets as mentioned in <strong>Form</strong> IRDA-Assets- AA as specified under Schedule I of <strong>Insurance</strong> Regulatory andDevelopment Authority (Assets, Liabilities, and Solvency Margin of Insurers) Regulations, 2000.20

PERIODIC DISCLOSURESFORM L - 33 - NPAs - 7ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012NO. DESCRIPTION CONFIRMATION (YES / NO )Details of Approved Investments / Other Investments which have matured for payment and maturityamount is outstanding along with particulars of defaulted amount and period for which said default has<strong>No</strong>1 continued2 Any Investment as at (1), which subsequent to maturity have been rolled over <strong>No</strong>In respect of Investments where periodic income have fallen due, details of interest payment in default,3 along with period for which such default have persisted<strong>No</strong>Details of steps taken to recover the defaulted amounts, and the provisioning done / proposed in the4 accounts against such defaultsN.A.CertificationCertified that the information given herein are correct and complete to the best of my knowledge Signature: sd/-and belief and nothing has been concealed or suppressedFull Name: Rajesh Sud / Prashant SharmaDesignation: Chief Executive Officer/ Chief Investment OfficerDate:<strong>No</strong>te: If any of the confirmations is in the affirmative, details be provided21

PERIODIC DISCLOSURESFORM L - 33 - NPAs - 7ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012COICompanyNameInstrumenttypeInterest Rate%age Has there been arevisionTotal O/s (Book Value)Default Principal (Book Value)Default Interest (Book Value)PrincipalDue fromInterestDue fromDefferedInterestName of the Fund: <strong>Life</strong> FundRolled OverHas there been any principalwaiverAmount Board Approvalref.Classification Provision %` in LacsProvisionRs.NILCertification :Certified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressedDATE:Signature: sd/-<strong>No</strong>te :Full Name: Rajesh Sud / Prashant SharmaA. Category of Investment ( COI) shall be as per INV/GLN001/2003-04 Designation: Chief Executive Officer/ Chief Investment OfficerB. <strong>Form</strong> 7A shall be submitted in respect of each fundC. Classification shall be as per F&A circular 169 Jan 07 dt.24-01-0722

PERIODIC DISCLOSURESFORM L - 33 - NPAs - 7ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012COICompanyNameInstrumenttypeInterest Rate%age Has there been arevisionTotal O/s ( BookValue)Default Principal (Book Value)Default Interest (Book Value)PrincipalDue fromInterestDue fromDeferredInterestName of the Fund: Annuity FundRolled OverHas there been any principal Classification Provision %waiverAmount BoardApproval ref.` in LacsProvisionRs.NILCertification :Certified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressedDATE:Signature: sd/-<strong>No</strong>te :Full Name: Rajesh Sud / Prashant SharmaA. Category of Investment ( COI) shall be as per INV/GLN001/2003-04 Designation: Chief Executive Officer/ Chief Investment OfficerB. <strong>Form</strong> 7A shall be submitted in respect of each fundC. Classification shall be as per F&A circular 169 Jan 07 dt.24-01-0723

PERIODIC DISCLOSURESFORM L - 33 - NPAs - 7ANAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012COICompanyNameInstrumenttype%ageInterest RateHas there been arevisionTotal O/s ( BookValue)Default Principal (Book Value)Default Interest( Book Value)PrincipalDue fromInterestDue fromDeferredInterestName of the Fund: Linked FundRolled OverHas there been any principalwaiverAmount Board Approvalref.Classification` in LacsProvision % Provision Rs.NILCertification :Certified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressedDATE:Signature: sd/-<strong>No</strong>te :Full Name: Rajesh Sud / Prashant SharmaA. Category of Investment ( COI) shall be as per INV/GLN001/2003-04 Designation: Chief Executive Officer/ Chief Investment OfficerB. <strong>Form</strong> 7A shall be submitted in respect of each fundC. Classification shall be as per F&A circular 169 Jan 07 dt.24-01-0724

PERIODIC DISCLOSURESFORM L - 34 YEILD ON INVESTMENTNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012<strong>No</strong>.Investment ParticularsCat CodeInvestment (Rs.)Name of the Fund: <strong>Life</strong> Fund` in LacsCurrent Quarter Year To Date Previous YearIncome On InvestmentIncome OnIncome On(Rs.) Gross Yield (%) Net Yield (%) Investment (Rs.) Investment (Rs.) Gross Yield (%) Net Yield (%) Investment (Rs.) Investment (Rs.) Gross Yield (%) Net Yield (%)A GOVERNMENT SECURITIESA01 Central Government Bonds CGSB 335,490 6,363 7.97% 7.97% 335,490 22,894 7.97% 7.97% 250,677 15,588 7.65% 7.65%A03 Deposit under Section 7 of <strong>Insurance</strong> Act, 1938 CDSS 1,061 25 9.41% 9.41% 1,061 99 9.40% 9.40% 1,049 99 9.40% 9.40%A04 Treasury Bills CTRB 260 4 8.20% 8.20% 260 7 8.13% 8.13% - 4 0.00% 0.00%BGOVERNMENT SECURITIES / OTHER APPROVEDSECURITIESB02 State Government Bonds SGGB 21,982 369 8.60% 8.60% 21,982 612 8.57% 8.57% 1,412 42 7.64% 7.64%Other Approved Securities (excluding InfrastructureB04 Investments) SGOA 54,531 1,115 8.25% 8.25% 54,531 4,353 8.28% 8.28% 50,690 3,995 8.23% 8.23%C HOUSING SECTOR INVESTMENTSC04Commercial Papers - NHB/Institutions accredited byNHB HTLN - 3 9.73% 9.73% - 13 9.77% 9.77% - - 0.00% 0.00%C10 Bonds/Debuntures issued by HUDCO HFHD 2,478 10 7.80% 7.80% 2,478 10 7.80% 7.80% - - 0.00% 0.00%D INFRASTRUCTURE INVESTMENTSTAXABLE BONDSD02 Infrastructure - PSU - Equity shares - Quoted ITPE 1,911 90 38.97% 38.97% 1,911 97 26.72% 26.72% 13 0 2.02% 2.02%D03Infrastructure - Corporate Securities - Equity shares-Quoted ITCE 1,756 36 29.74% 29.74% 1,756 67 25.75% 25.75% 51 0 0.67% 0.67%D07 Infrastructure - PSU - Debentures / Bonds IPTD 142,927 3,024 9.03% 9.03% 142,927 10,414 8.99% 8.99% 96,077 6,856 8.73% 8.73%D09Infrastructure - Other Corporate Securities -Debentures/ Bonds ICTD 27,826 557 8.57% 8.57% 27,826 2,086 8.90% 8.90% 16,981 1,227 8.64% 8.64%D12 Infrastructure - PSU - Debentures / Bonds IPFD 1,047 14 11.32% 11.32% 1,047 14 11.32% 11.32% - - 0.00% 0.00%APPROVED INVESTMENT SUBJECT TO EXPOSUREE NORMSE01 PSU - Equity shares - Quoted EAEQ 3,087 151 39.09% 39.09% 3,087 184 21.80% 21.80% 246 4 1.67% 1.67%E02Corporate Securities - Equity shares (Ordinary)-Quoted EACE 10,718 413 29.38% 29.38% 10,718 710 21.41% 21.41% 961 19 2.19% 2.19%E05 Corporate Securities - Bonds - (Taxable) EPBT 56,321 1,232 8.93% 8.93% 56,321 4,353 8.80% 8.80% 38,472 3,040 8.92% 8.92%E16Deposits - Deposit with Scheduled Banks, FIs (incl.Bank Balance awaiting Investment), CCIL, RBI ECDB 13,922 324 10.04% 10.04% 13,922 846 10.21% 10.21% 4,874 197 4.16% 4.16%E17 Deposits - CDs with Scheduled Banks EDCD 25,035 434 9.43% 9.43% 25,035 731 9.55% 9.55% 6,293 441 6.39% 6.39%E18 Deposits - Repo / Reverse Repo ECMR 7,748 49 8.12% 8.12% 7,748 92 8.17% 8.17% - 56 11.80% 11.80%E21 Commercial Papers ECCP - 14 9.35% 9.35% - 45 9.42% 9.42% - - 0.00% 0.00%E23Perpetual Debt Instruments of Tier I & II Capitalissued by PSU Banks EUPD 4,200 95 9.00% 9.00% 4,200 381 9.06% 9.06% 4,200 380 9.05% 9.05%E24Perpetual Debt Instruments of Tier I & II Capitalissued by <strong>No</strong>n-PSU Banks EPPD 1,500 37 9.96% 9.96% 1,500 150 10.02% 10.02% 1,500 150 10.00% 10.00%E28 Mutual Funds - Gilt / G Sec / Liquid Schemes EGMF 6,255 646 10.06% 10.06% 6,255 1,893 9.16% 9.16% 14,390 813 7.58% 7.58%F OTHER INVESTMENTSF03 Equity Shares (incl Co-op Societies) OESH 2,742 57 19.75% 19.75% 2,742 102 18.99% 18.99% 102 0 0.23% 0.23%F04 Equity Shares (PSUs & Unlisted) OEPU 217 1 2.74% 2.74% 217 (7) -12.03% -12.03% 31 0 1.64% 1.64%F09 Preference Shares OPSH - - 0.00% 0.00% - - 0.00% 0.00% - (2) -69.11% -69.11%Mutual Funds - Debt / Income / Serial Plans / LiquidF13 Secemes OMGS - 3 9.43% 9.43% - 7 9.14% 9.14% - - 0.00% 0.00%Total 723,013 15,064 8.85% 8.85% 723,013 50,153 8.57% 8.57% 488,019 32,911 8.01% 8.01%1 All yields are on annualised basis2 Previous year figures are for period ending 31st March 2011CERTIFICATIONCertified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed.<strong>No</strong>te: Category of Investments shall be as per Guidelines Signature: sd/-1 To be calculated based on Monthly or lesser frequency 'Weighted Average" of Investments. Full Name: Rajesh Sud / Prashant Sharma2 Yield netted for Tax. Designation: Chief Executive Officer/ Chief Investment Officer3 FORM-1 shall be prepared in respect of each fund.25

PERIODIC DISCLOSURESFORM L - 34 YEILD ON INVESTMENTNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012<strong>No</strong>.Investment ParticularsCat CodeInvestment(Rs.)Income OnInvestment (Rs.) Gross Yield (%) Net Yield (%)Investment(Rs.)Name of the Fund: Annuity FundCurrent Quarter Year To Date Previous YearIncome OnInvestment (Rs.) Gross Yield (%) Net Yield (%)Investment(Rs.)Income OnInvestment (Rs.) Gross Yield (%) Net Yield (%)A GOVERNMENT SECURITIESA1 Central Government Bonds CGSB 8,055 130 7.79% 7.79% 8,055 508 7.84% 7.84% 6,122 395 7.61% 7.61%A3Deposit under Sec 7 of <strong>Insurance</strong> Act,1938 CDSS - - 0.00% 0.00% - 1 9.39% 9.39% 14 1 9.40% 9.40%` in LacsBB2B4DD07D09EGOVERNMENT SECURITIES / OTHERAPPROVED SECURITIESState Government Bonds/Development Loans SGGB 119 2 8.69% 8.69% 119 6 8.60% 8.60% 2 0 7.94% 7.94%Other Approved Securities (excludingInfrastructure Investments) SGOA 497 10 8.48% 8.48% 497 42 8.55% 8.55% 487 42 8.55% 8.55%INFRASTRUCTURE INVESTMENTSTAXABLE BONDSInfrastructure - PSU - Debentures /Bonds IPTD 1,124 17 9.34% 9.34% 1,124 61 9.32% 9.32% 480 44 9.18% 9.18%Infrastructure - Other CorporateSecurities - Debentures/ Bonds ICTD 463 11 9.18% 9.18% 463 42 9.10% 9.10% 428 34 8.93% 8.93%APPROVED INVESTMENT SUBJECT TOEXPOSURE NORMSE05 Corporate Securities - Bonds - (Taxable) EPBT 945 20 8.42% 8.42% 945 79 8.34% 8.34% 935 69 8.04% 8.04%E17 Deposits - CDs with Scheduled Banks EDCD 527 0 9.83% 9.83% 527 0 8.80% 8.80% - - 0.00% 0.00%E18 Deposits - Repo / Reverse Repo ECMR 197 1 8.19% 8.19% 197 2 8.06% 8.06% - - 0.00% 0.00%Mutual Funds - Gilt / G Sec / LiquidE28 Schemes EGMF - - 0.00% 0.00% - - 0.00% 0.00% 200 - 0.00% 0.00%FOTHER INVESTMENTSTotal 11,926 192 8.15% 8.15% 11,926 742 8.13% 8.13% 8,667 586 7.69% 7.69%<strong>No</strong>te :1 All yields are on annualised basis2 Previous year figures are for period ending 31st March 2011CERTIFICATIONCertified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed.DATE: Signature: sd/-Full Name: Rajesh Sud / Prashant Sharma<strong>No</strong>te: Category of Investments shall be as per Guidelines Designation: Chief Executive Officer/ Chief Investment Officer1 To be calculated based on Monthly or lesser frequency 'Weighted Average" of Investments.2 Yield netted for Tax.3 FORM-1 shall be prepared in respect of each fund.26

PERIODIC DISCLOSURESFORM L - 34 YEILD ON INVESTMENTNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012Name of the Fund: Linked FundCurrent Quarter Year To Date Previous Year` in Lacs<strong>No</strong>.Investment ParticularsCat CodeInvestment (Rs.)Income OnInvestment (Rs.)Gross Yield (%)* Net Yield (%) Investment (Rs.)Income OnInvestment (Rs.)Gross Yield(%) Net Yield (%)Investment(Rs.)Income OnInvestment (Rs.)Gross Yield(%) Net Yield (%)A GOVERNMENT SECURITIESA01 Central Government Bonds CGSB 33,381 874 9.63% 9.63% 33,381 2,485 7.39% 7.39% 28,721 2,404 5.34% 5.34%A04 Treasury Bills CTRB 3,180 65 8.27% 8.27% 3,180 209 7.94% 7.94% 1,982 104 5.94% 5.94%GOVERNMENT SECURITIES / OTHERB APPROVED SECURITIESB02 State Government Bonds SGGB 19,050 8 0.16% 0.16% 19,050 480 5.34% 5.34% 1,742 102 6.46% 6.46%B04Other Approved Securities (excludingInfrastructure Investments) SGOA 1 0 8.16% 8.16% 1 10 10.01% 10.01% - 96 7.72% 7.72%C HOUSING SECTOR INVESTMENTSC04Commercial Papers - NHB/Institutionsaccredited by NHB HTLN - 1 9.67% 9.67% - 3 9.77% 9.77% - - 0.00% 0.00%C06Bonds / Debentures issued by NHB /Institutions accredited by NHB HTDN 3,933 88 8.88% 8.88% 3,933 467 9.32% 9.32% 5,352 272 4.24% 4.24%C10 Bonds/Debuntures issued by HUDCO HFHD - 18 102.60% 102.60% - 18 102.60% 102.60% - - 0.00% 0.00%D INFRASTRUCTURE INVESTMENTSTAXABLE BONDSD02Infrastructure - PSU - Equity shares -Quoted ITPE 25,844 2,674 53.70% 53.70% 25,844 (1,023) -6.67% -6.67% 6,573 (665) -10.56% -10.56%D03Infrastructure - Corporate Securities -Equity shares-Quoted ITCE 30,523 6,988 109.21% 109.21% 30,523 (2,333) -8.40% -8.40% 39,500 4,483 12.35% 12.35%D07Infrastructure - PSU - Debentures /Bonds IPTD 88,278 2,259 8.77% 8.77% 88,278 7,051 9.22% 9.22% 45,561 2,642 5.07% 5.07%D08 Infrastructure - PSU - CPs IPCP - - 0.00% 0.00% - - 0.00% 0.00% - 59 5.83% 5.83%D09Infrastructure - Other CorporateSecurities - Debentures/ Bonds ICTD 35,774 823 8.23% 8.23% 35,774 3,240 8.76% 8.76% 29,313 1,580 6.43% 6.43%APPROVED INVESTMENT SUBJECT TOE EXPOSURE NORMSE01 PSU - Equity shares - Quoted EAEQ 86,580 12,406 66.16% 66.16% 86,580 (12,151) -17.96% -17.96% 73,935 6,506 10.28% 10.28%E02Corporate Securities - Equity shares(Ordinary)- Quoted EACE 423,520 56,191 57.53% 57.53% 423,520 (18,536) -4.97% -4.97% 382,910 39,263 12.63% 12.63%E05 Corporate Securities - Bonds - (Taxable) EPBT 44,280 1,058 9.17% 9.17% 44,280 4,075 9.25% 9.25% 43,730 2,287 5.67% 5.67%E16Deposits - Deposit with ScheduledBanks, FIs (incl. Bank Balance awaitingInvestment), CCIL, RBI ECDB 38,608 1,056 10.32% 10.32% 38,608 2,938 10.16% 10.16% 13,081 691 6.16% 6.16%E17 Deposits - CDs with Scheduled Banks EDCD 47,257 1,226 8.07% 8.07% 47,257 8,282 9.04% 9.04% 134,739 5,368 6.56% 6.56%E18 Deposits - Repo / Reverse Repo ECMR 7,035 64 8.20% 8.20% 7,035 198 8.00% 8.00% - 223 6.40% 6.40%E21 Commercial Papers ECCP 2,498 150 9.35% 9.35% 2,498 615 9.53% 9.53% 2,467 362 6.78% 6.78%E23Perpetual Debt Instruments of Tier I & IICapital issued by PSU Banks EUPD 912 20 8.57% 8.57% 912 64 7.50% 7.50% 846 72 6.50% 6.50%E28Mutual Funds - Gilt / G Sec / LiquidSchemes EGMF 3,235 424 9.52% 9.52% 3,235 2,189 8.86% 8.86% 12,620 1,079 7.23% 7.23%E30Net Current Assets (Only in respect ofULIP Business) ENCA 22,639 - 0.00% 0.00% 22,639 - 0.00% 0.00% 19,844 - 0.00% 0.00%F OTHER INVESTMENTSF03 Equity Shares (incl Co-op Societies) OESH 64,877 2,730 18.88% 18.88% 64,877 (1,775) -3.82% -3.82% 38,294 6,606 11.78% 11.78%F04 Equity Shares (PSUs & Unlisted) OEPU 5,161 565 60.36% 60.36% 5,161 (516) -10.55% -10.55% 5,744 171 2.90% 2.90%F09 Preference Shares OPSH - - 0.00% 0.00% - - 0.00% 0.00% - 3 7.68% 7.68%F13Mutual Funds - Debt / Income / SerialPlans / Liquid Secemes OMGS - 7 9.35% 9.35% - 39 8.61% 8.61% - - 0.00% 0.00%Total 986,566 89,693 37.70% 37.70% 986,566 (3,970) -0.44% -0.44% 886,956 73,707 9.41% 9.41%<strong>No</strong>te :1 All yields are on annualised basis Signature:2 Previous year figures are for period ending 31st March 2011 Full Name: Rajesh Sud / Prashant SharmaCertified that the information given herein are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed.Designation: Chief Executive Officer/ Chief Investment OfficerDATE:sd/-<strong>No</strong>te: Category of Investments shall be as per Guidelines1 To be calculated based on Monthly or lesser frequency 'Weighted Average" of Investments.2 Yield netted for Tax.3 FORM-1 shall be prepared in respect of each fund.27

PERIODIC DISCLOSURESFORM L - 35 DOWNGRADING OF INVESTMENTNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012<strong>No</strong>. Particulars of Investment Cat Code AmountA DURING THE QUARTERNILDate ofPurchaseName Of The Fund: <strong>Life</strong> FundRatingAgencyOriginalGradeCurrentGradeDate ofDowngrade` in LacsRemarksBDAS ON DATEINFRASTRUCTURE INVESTMENTSTAXABLE BONDSD07 7.70% NHPC 31 MARCH 2014 IPTD 494 31-Mar-06 CRISIL AAA AA+ 25-May-07D09 6.7% RELINFRA 19 AUGUST 2018 ICTDD09D095.60% RELIANCE INFRA 28 JULY20136% TATA POWER 18 OCTOBER2015ICTDICTD198 9-Sep-03 CRISIL AAA AA+ 7-May-09973 28-Oct-05 CRISIL AAA AA+ 7-May-091,162 4-Feb-05 CRISIL AAA AA 9-Jul-07CERTIFICATIONCertified that the information herein are correct and complete to the best of my knowledge and beliefand nothing has been concealed or suppressedSignature: sd/-Full Name: Rajesh Sud / Prashant SharmaDATE:Designation: Chief Executive Officer/ Chief Investment OfficerNOTE:1. Provide details of Down Graded Investments during the Quarter.2. Investments currently upgraded, which were listed as Down Graded during earlier Quarter shall be deleted from the Cumulative listing.3. FORM-2 shall be prepared in respect of each fund.4. Category of Investment ( COI) shall be as per INV/GLN/001/2003-0428

PERIODIC DISCLOSURESFORM L - 35 DOWNGRADING OF INVESTMENTNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012<strong>No</strong>. Particulars of Investment Cat Code AmountA DURING THE QUARTERNILDate ofPurchaseRating AgencyOriginalGradeName Of The Fund: Annuity FundCurrent GradeDate ofDowngrade` in LacsRemarksB AS ON DATED INFRASTRUCTURE INVESTMENTSTAXABLE BONDSD09 6.7% RELINFRA 19 AUGUST 2018 ICTD 2 9-Sep-03 CRISIL AAA AA+ 7-May-09CERTIFICATIONCertified that the information herein are correct and complete to the best of my knowledge and beliefand nothing has been concealed or suppressedSignature:sd/-Full Name: Rajesh Sud / Prashant SharmaDATE:Designation: Chief Executive Officer/ Chief Investment OfficerNOTE:1. Provide details of Down Graded Investments during the Quarter.2. Investments currently upgraded, which were listed as Down Graded during earlier Quarter shall be deleted from the Cumulative listing.3. FORM-2 shall be prepared in respect of each fund.4. Category of Investment ( COI) shall be as per INV/GLN/001/2003-0429

PERIODIC DISCLOSURESFORM L - 35 DOWNGRADING OF INVESTMENTNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT AS ON: March 31, 2012<strong>No</strong>. Particulars of Investment Cat Code Amount Date of Purchase Rating Agency Original Grade Current GradeA DURING THE QUARTERNILName Of The Fund: Unit Linked FundDate ofDowngrade` in LacsRemarksBEE05AS ON DATEAPPROVED INVESTMENT SUBJECT TOEXPOSURE NORMS11.90% PIDILITE INDUSTRIES 5DECEMBER 2013EPBT515 5-Dec-08 CRISIL AAA AA+ 31-Dec-08CERTIFICATIONCertified that the information herein are correct and complete to the best of my knowledge and beliefand nothing has been concealed or suppressedDATE:Signature:sd/-Full Name: Rajesh Sud / Prashant SharmaDesignation: Chief Executive Officer/ Chief Investment OfficerNOTE:1. Provide details of Down Graded Investments during the Quarter.2. Investments currently upgraded, which were listed as Down Graded during earlier Quarter shall be deleted from the Cumulative listing.3. FORM-2 shall be prepared in respect of each fund.4. Category of Investment ( COI) shall be as per INV/GLN/001/2003-0430

PERIODIC DISCLOSURESFORM L-36 :PREMIUM AND NUMBER OF LIVES COVERED BY POLICY TYPENAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000For the Quarter 31st March 2012S. <strong>No</strong>.1.00 First year PremiumiParticularsIndividual Single Premium- (ISP)Premium( `Crs)<strong>No</strong>. ofPolicies<strong>No</strong>. of LivesSumInsured,Whereverapplicable(` Crs)Premium( `Crs)For the Quarter 31st March 2011 Upto the Quarter 31st March 2012<strong>No</strong>. ofPolicies<strong>No</strong>. of LivesSumInsured,Whereverapplicable(` Crs)From 0-10000 17 2 2 0 20 1 1 1 59 (2) (2) 13 76 457 432 27From 10,001-25,000 20 - - 1 21 - - 1 71 32 23 13 30 - - 5From 25001-50,000 8 (70) (70) 3 11 3 3 1 31 (115) (110) 6 17 10 10 3From 50,001- 75,000 2 (2) (2) 0 6 1 1 0 9 (4) (4) 1 9 3 3 2From 75,000-100,000 3 96 96 1 3 - - 0 15 586 546 3 6 5 5 1From 1,00,001 -1,25,000 1 1 1 0 2 - - 0 4 21 20 1 2 - - 0Above Rs. 1,25,000 10 32 32 3 10 1 1 0 41 169 166 9 62 251 251 23Premium( `Crs)<strong>No</strong>. ofPolicies<strong>No</strong>. of LivesSumInsured,Whereverapplicable(` Crs)Premium( `Crs)Upto the Quarter 31st March 2011<strong>No</strong>. ofPolicies<strong>No</strong>. of Lives- - - - - - - - - - - -ii Individual Single Premium (ISPA)- Annuity - - - - - - - - - - - -From 0-50000 - - - (0) 0 - - (0) - - - 0 0 2 2 1From 50,001-100,000 - - - - 0 1 1 (0) - - - 0 13 413 398 145From 1,00,001-150,000 - - - - - - - - - - - 0 3 70 67 36From 150,001- 2,00,000 - - - - 1 1 1 (0) 0 1 1 0 2 30 28 20From 2,00,,001-250,000 - - - - - - - - - - - 0 1 7 7 6From 2,50,001 -3,00,000 - - - - - - - - 0 2 2 0 0 5 5 5Above Rs. 3,00,000 - - - - - - - - 0 3 2 0 11 29 29 81- - - - - - - - - - - -iii Group Single Premium (GSP) - - - - - - - - - - - -From 0-10000 - - - - - - - - - - - -From 10,000-25,000 - - - - - - - - - - - -From 25001-50,000 - - - - - - - - - - - -From 50,001- 75,000 - - - - - - - - - - - -From 75,000-100,000 - - - - - - - - - - - -From 1,00,001 -1,25,000 - - - - - - - - - - - -Above Rs. 1,25,000 - - - - - - - - - - - -iv Group Single Premium- Annuity- GSPA - - - - - - - - - - - -From 0-50000 - - - - - - - - - - - -From 50,001-100,000 - - - - - - - - - - - -From 1,00,001-150,000 - - - - - - - - - - - -From 150,001- 2,00,000 - - - - - - - - - - - -From 2,00,,001-250,000 - - - - - - - - - - - -From 2,50,001 -3,00,000 - - - - - - - - - - - -Above Rs. 3,00,000 - - - - - - - - - - - -- - - - - - - - - - - -- - - - - - - - - - - -v Individual non Single Premium- INSP - - - - - - - - - - - -From 0-10000 27 33,357 31,850 710 62 77,368 74,810 808 130 159,318 149,015 3,656 200 272,518 262,780 3,134From 10,000-25,000 149 84,575 81,219 2,160 160 86,185 83,540 2,075 476 274,442 261,942 6,986 640 352,294 348,256 9,704From 25001-50,000 124 32,033 30,744 1,461 111 28,676 28,072 1,436 371 94,409 91,263 4,523 354 90,928 88,615 5,350From 50,001- 75,000 30 5,154 5,005 432 21 3,400 3,394 276 83 13,883 13,633 1,148 60 8,944 8,906 904From 75,000-100,000 62 6,448 6,229 616 48 5,160 5,041 628 187 19,329 18,683 1,881 135 14,234 13,930 2,034From 1,00,001 -1,25,000 14 1,215 1,183 191 5 364 364 62 32 2,917 2,882 448 15 1,091 1,091 230Above Rs. 1,25,000 69 2,401 2,317 776 43 1,495 1,479 561 185 6,611 6,353 2,140 124 4,103 4,050 1,877- - - - - - - - - - - -- - - - - - - - - - - -vi Individual non Single Premium- Annuity- INSPA - - - - - - - - - - - -From 0-50000 1 (50) (50) (0) 15 43 43 (0) 9 (87) (86) 0 127 67,255 66,234 132From 50,001-100,000 0 (1) (1) (0) 2 2 2 (0) 1 (10) (10) (0) 24 2,813 2,770 26From 1,00,001-150,000 0 - - - 0 - - (0) 0 (3) (3) (0) 3 241 241 3From 150,001- 2,00,000 0 - - - 0 - - (0) (0) (9) (9) (0) 5 249 242 7From 2,00,,001-250,000 - - - - 0 - - (0) 0 (1) (1) (0) 2 62 60 2From 2,50,001 -3,00,000 (0) (1) (1) (0) 0 - - (0) 0 (2) (2) (0) 2 84 81 3Above Rs. 3,00,000 (0) (1) (1) (0) 1 1 1 (0) 0 (5) (5) (1) 11 161 161 12In ` CrsSumInsured,Whereverapplicable(` Crs)31

PERIODIC DISCLOSURESFORM L-36 :PREMIUM AND NUMBER OF LIVES COVERED BY POLICY TYPENAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO 104: DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000For the Quarter 31st March 2012S. <strong>No</strong>.ParticularsPremium( `Crs)<strong>No</strong>. ofPolicies<strong>No</strong>. of LivesSumInsured,Whereverapplicable(` Crs)Premium( `Crs)For the Quarter 31st March 2011 Upto the Quarter 31st March 2012<strong>No</strong>. ofPolicies<strong>No</strong>. of LivesSumInsured,Whereverapplicable(` Crs)Premium( `Crs)<strong>No</strong>. ofPolicies<strong>No</strong>. of LivesSumInsured,Whereverapplicable(` Crs)Premium( `Crs)Upto the Quarter 31st March 2011<strong>No</strong>. ofPolicies<strong>No</strong>. of Lives- - - - - - - - - - - -vii Group <strong>No</strong>n Single Premium (GNSP) - - - - - - - - - - - -From 0-10000 - - - - - - - - - - - -From 10,000-25,000 - - - - - - - - - - - -From 25001-50,000 - - - - - - - - - - - -From 50,001- 75,000 - - - - - - - - - - - -From 75,000-100,000 - - - - - - - - - - - -From 1,00,001 -1,25,000 - - - - - - - - - - - -Above Rs. 1,25,000 - - - - - - - - - - - -- - - - - - - - - - - -viii Group <strong>No</strong>n Single Premium- Annuity- GNSPA - - - - - - - - - - - -From 0-10000 - - - - - - - - - - - -From 10,000-25,000 - - - - - - - - - - - -From 25001-50,000 - - - - - - - - - - - -From 50,001- 75,000 - - - - - - - - - - - -From 75,000-100,000 - - - - - - - - - - - -From 1,00,001 -1,25,000 - - - - - - - - - - - -Above Rs. 1,25,000 - - - - - - - - - - - -- - - - - - - - - - - -- - - - - - - - - - - -- - - - - - - - - - - -2.00 Renewal year Premium - - - - - - - - - - - -i Individual - - - - - - - - - - - -In ` CrsSumInsured,Whereverapplicable(` Crs)From 0-10000 181 - 305,980 6,945 168 - 277,309 6,746 633 - 869,095 20,214 638 - 1,021,879 24,558From 10,000-25,000 563 - 453,144 15,934 511 - 426,728 15,482 1,948 - 1,019,636 36,075 1,685 - 1,456,625 53,285From 25001-50,000 264 - 94,466 6,075 210 - 78,320 5,306 862 - 205,414 13,468 707 - 269,817 18,386From 50,001- 75,000 51 - 15,876 1,612 39 - 14,756 1,506 169 - 28,354 2,964 143 - 54,773 5,597From 75,000-100,000 78 - 10,593 1,233 48 - 7,384 950 245 - 24,858 2,971 167 - 25,683 3,346From 1,00,001 -1,25,000 11 - 1,895 386 9 - 1,697 356 41 - 3,612 777 34 - 6,298 1,325Above Rs. 1,25,000 81 - 3,912 1,778 57 - 2,830 1,507 260 - 8,602 4,060 201 - 10,236 5,595- - - - - - - - - - - - - - - -ii Individual- Annuity - - - - - - - - - - - - - - - -From 0-10000 13 - 18,424 79 17 - 23,213 89 44 - 41,247 129 54 - 80,528 188From 10,000-25,000 27 - 38,498 157 19 - 23,604 62 114 - 70,984 304 55 - 76,254 152From 25001-50,000 13 - 6,108 43 9 - 3,457 22 60 - 14,003 104 22 - 8,642 47From 50,001- 75,000 3 - 1,327 13 2 - 732 6 11 - 1,944 20 4 - 1,976 15From 75,000-100,000 5 - 732 10 4 - 519 7 23 - 2,170 29 10 - 1,290 16From 1,00,001 -1,25,000 1 - 212 3 1 - 134 2 3 - 297 4 2 - 396 6Above Rs. 1,25,000 7 - 338 14 7 - 285 12 32 - 948 40 19 - 705 30- - - - - - - - - - - -iii Group - - - - - - - - - - - -From 0-10000 - - - - - - - - - - - -From 10,000-25,000 - - - - - - - - - - - -From 25001-50,000 - - - - - - - - - - - -From 50,001- 75,000 - - - - - - - - - - - -From 75,000-100,000 - - - - - - - - - - - -From 1,00,001 -1,25,000 - - - - - - - - - - - -Above Rs. 1,25,000 - - - - - - - - - - - -iv Group- Annuity - - - - - - - - - - - -From 0-10000 - - - - - - - - - - - -From 10,000-25,000 - - - - - - - - - - - -From 25001-50,000 - - - - - - - - - - - -From 50,001- 75,000 - - - - - - - - - - - -From 75,000-100,000 - - - - - - - - - - - -From 1,00,001 -1,25,000 - - - - - - - - - - - -Above Rs. 1,25,000 - - - - - - - - - - - -32

PERIODIC DISCLOSURESFORM L-37-BUSINESS ACQUISITION THROUGH DFFERENT CHANNELS (GROUP)NAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000S.<strong>No</strong>.ChannelsIn ` CrsFor The Qtr Ending 31st March 12 For The Qtr Ending 31st March 11 Upto The Qtr Ending 31st March 12Upto The Qtr Ending 31st March 11<strong>No</strong>. of Policies/<strong>No</strong>. of Schemes<strong>No</strong>. of LivesCoveredPremium( `Crs)<strong>No</strong>. of Policies/<strong>No</strong>. of Schemes<strong>No</strong>. of LivesCoveredPremium( `Crs)<strong>No</strong>. of Policies/<strong>No</strong>. of Schemes<strong>No</strong>. of LivesCoveredPremium( `Crs)<strong>No</strong>. of Policies/<strong>No</strong>. of Schemes<strong>No</strong>. of LivesCoveredPremium( `Crs)1 Individual agents 19 33,590 0 - - - 64 56,425 2 - - -2 Corporate Agents-Banks - - - - - - - - - - - -3 Corporate Agents -Others - - - - - - - - - - - -4 Brokers 55 (335,593) 2 63 22,765 3 391 199,749 8 369 181,075 75 Micro Agents - - - - - - - - - - - -6 Direct Business 120 841,660 82 59 (774,357) 34 431 2,514,367 184 343 8,407,751 118Total(A) 194 539,657 84 122 (751,592) 37 886 2,770,541 194 712 8,588,826 1261 Referral (B) - - - - - - - - - - - -Grand Total (A+B) 194 539,657 84 122 (751,592) 37 886 2,770,541 194 712 8,588,826 126<strong>No</strong>te:1. Premium means amount of premium received from business acquired by the source.2. <strong>No</strong> of Policies stand for no. of policies sold.33

PERIODIC DISCLOSURESFORM L - 38 BUSINESS ACQUISITION THROUGH DIFFERENT CHANNELS (INDIVIDUALS)NAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000S. <strong>No</strong>. ChannelsFor The Qtr Ending 31st March 12 For The Qtr Ending 31st March 11<strong>No</strong>. of PoliciesPremium( `Crs)<strong>No</strong>. of PoliciesPremium( `Crs)Upto The Qtr Ending 31st March 12 Upto The Qtr Ending 31st March 11<strong>No</strong>. of PoliciesPremium( `Crs)<strong>No</strong>. of Policies1 Individual agents 56,015 152.23 80,035 226.43 243,849 639.51 432,043 1,040.762 Corporate Agents-Banks 61,316 259.56 47,983 185.71 162,494 687.42 111,383 423.713 Corporate Agents -Others 36,777 74.06 59,226 103.74 126,528 226.13 225,341 379.604 Brokers 2,452 4.28 13,439 18.86 17,732 25.54 31,033 43.995 Micro Agents - - - - - - - -6 Direct Business 8,284 45.23 1,881 6.90 18,965 126.59 11,046 38.40Total (A) 164,844 535.36 202,564 541.64 569,568 1,705.19 810,846 1,926.451 Referral (B) 345 0.45 138 0.93 1,917 2.44 5,413 9.40Grand Total (A+B) 165,189 535.81 202,702 542.58 571,485 1,707.64 816,259 1,935.85<strong>No</strong>te:1. Premium means amount of premium received from business acquired by the source.2. <strong>No</strong> of Policies stand for no. of policies sold.Premium( `Crs)34

PERIODIC DISCLOSURESFORM L-39-DATA ON SETTLEMENT OF CLAIMSNAME OF THE INSURER: MAX NEW YORK LIFE INSURANCE COMPANY LIMITEDREGISTRATION NO: 104; DATE OF REGISTRATION WITH IRDA : NOVEMBER 15, 2000STATEMENT for the Quarter Ending 31st March 2012Ageing of Claims* - Individual<strong>No</strong>. of claims paidS.<strong>No</strong>. Types of Claims On or before6 months - 11 month 1 - 3 months 3 - 6 monthsmaturityyear1 Maturity Claims 1,514 - - - - - 1,514 202 Survival Benefit 12,793 74 5 - - - 12,872 243 Annuities / Pension - - - - - - - -4 Death Claims - 1,869 491 23 2 38 2,423 565 For Surrender - 113,749 - - - - 113,749 4056 Other benefits - 54 7 4 2 - 67 2Ageing of Claims* - Group<strong>No</strong>. of claims paidS.<strong>No</strong>. Types of Claims On or before6 months - 11 month 1 - 3 months 3 - 6 monthsmaturityyear> 1 year1 Maturity Claims - - - - - - - -2 Survival Benefit - 1 1 - - - 2 03 Annuities / Pension - - - - - - - -4 Death Claims - 5,391 25 44 61 27 5,548 135 For Surrender 2 - - - - - 2 06 Other benefits - - - - - - - -The figures for individual and group insurance business need to be shown separately.*the ageing of claims, in case of the death of the claims will be computed from the date of completion of all the documentation.> 1 yearTotal <strong>No</strong>. of claimspaidTotal <strong>No</strong>. of claimspaidTotal amount ofclaims paid (` Crs)Total amount ofclaims paid (` Crs)35