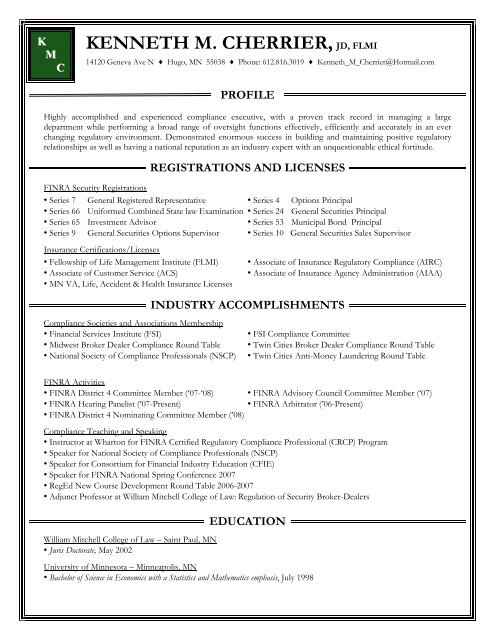

KENNETH M. CHERRIER,JD, FLMI - Financial Services Institute

KENNETH M. CHERRIER,JD, FLMI - Financial Services Institute

KENNETH M. CHERRIER,JD, FLMI - Financial Services Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

How Do We Take Responsibility For Our Industry?Stewardship is the Answer.By:Kenneth M. Cherrier, CCO Fintegra <strong>Financial</strong> SolutionsJoseph Fleming, CCO RBC Dain Rauscher“A man who neglects his duty as a citizen is not entitled to his rights as a citizen.” TiorioWe have all heard the old adage, “You have no right to complain about the president ifyou never voted in the election.” We have seen our industry take heed of this very adagein the recent NASD member vote to consolidate the regulatory arm of the New YorkStock Exchange with the NASD. This vote, which ratified the regulatory merger,generated considerable discussion and a high voting turnout. However, this “old adage” isapplicable to more than just voting.Many of us complain about over-regulation, harsh disciplinary sanctions, and hyperzealousexaminations. Others complain that the industry’s ethical majority is tarred byassociation with our relatively few, high-profile miscreants: the name Gruttadauria willnot soon be forgotten. Yet how many of us have actually taken any steps to improve ourindustry’s state of affairs?Indeed, looking back over the past five to six years, to say that this industry has sufferedconsiderable regulatory burdens and reputational woes would be an obviousunderstatement.To be fair, it must be noted that there are clear indications that regulatory mind sets arechanging for the better. The NASD, under the new leadership of Mary Shapiro, hasdedicated numerous resources to reach out to the industry: she conducted a six month“listening tour” to hear the concerns of hundreds of broker-dealers, she formed severaladditional small broker-dealer committees to ensure small broker-dealer issues weretaken into consideration by the NASD, the NASD Sanction Guidelines were amended inlight of concerns expressed by small broker-dealers, and she created a new positionwithin the NASD formed specifically to listen to the concerns of its members.In addition, several broker-dealer associations, including the Securities Industry and<strong>Financial</strong> Management Association (SIFMA, formerly the SIA and BMA), the <strong>Financial</strong><strong>Services</strong> <strong>Institute</strong> (FSI) and the National Association of Independent Broker-Dealers(NAIBD), have improved information flow with regulators by communicating theirmember’s concerns and issues in a respectful and professional manner.Although some in the industry question the current momentum of the “regulatorypendulum” swinging back, all can agree that the regulatory bar has been raised.Therefore, the question still stands. What steps have we taken to lead our industry to abetter state?

This article is based on that very question and will take a closer look at the actions eachand every one of us can take to help direct and lead our industry.In the view of Mr. Brian Murphy, CEO of Woodbury <strong>Financial</strong> <strong>Services</strong>, Inc., the answerto that question must include the idea of stewardship. Mr. Murphy states, “Our industryhas been devoted to helping people get ready for the unknown. By planning for thefuture, we help customers to achieve their future goals. Always, a plan requires action. Itis no different with our industry. The people in this industry today have a tremendousresponsibility to take actions that will leave the industry in better condition for the future.Clearly, the regulatory environment has a significant influence on who represents us, howthey structure their practices, and which client segments they serve.”To place a finer point on it, stewardship can be defined in a practical manner. There areactions each and every one of us can take to become stewards of our industry. Eventhough most of us are fully occupied, or even overwhelmed, in just keeping up with ourcurrent day-to-day responsibilities, we all need to search for the time and resources totake the extra steps to improve the state of our industry. We believe that in taking theseextra steps, you will find that you also benefit through personal development and byfortifying your professional network.Listed below are numerous specific actions compliance professionals have taken over theyears to help guide our industry – to become stewards of our industry. We hope bysharing this list, we can provide some insight as to the steps any one of us can take toaddress the issues we all deal with on a daily basis.Become an NASD arbitrator.One of the great responsibilities a compliance professional can accept is to become aNASD arbitrator. Arbitrating industry issues and conflicts is an important and fulfillingundertaking. As stated on the NASD website, “The success of securities arbitrationdepends on the quality of the arbitrators who hear and decide the disputes presented bythe parties. If you qualify, you will join a group of dedicated individuals serving theinvesting public and the securities industry.” 1We agree with the NASD’s assessment in correlating the industry’s integrity with asound and reliable conflict resolution program. The retail industry, particularly, is only assolid as the faith given to it by investors, and that faith is reinforced by a dispute venuethat they can trust. Therefore, the presence and input of experienced and ethical industrypersons in the arbitration process supports and defends the very integrity of the securitiesindustry itself.We all have an opportunity to bring our collective industry knowledge and professionalguidance to ease current industry woes by becoming NASD arbitrators. To learn moreabout becoming a NASD arbitrator, log onto the NASD website and select the Arbitration1 http://www.nasd.com/ArbitrationMediation/ResourcesforArbitratorsandMediators/ArbitratorRecruitment/index.htm

& Mediation tab, or simply contact Vandna Gargh form NASD Dispute Resolution at(212) 858-4327.Become an NASD District Committee Member.This year’s NASD District Committee race was very active. Hundreds of small brokerdealersunder the banner of the <strong>Financial</strong> Industry Association (FIA) spoke up to contestNASD District Committee elections in every one of the eleven NASD districts. Themessage was clear: small broker-dealers wanted the NASD to hear their concerns andgrievances. Although the “heated tone” from the FIA leadership ruffled some in theindustry, their uncompromising communications brought the District Committee venueinto the spotlight and our industry as a whole was educated on the importance of thisplatform through which members can directly communicate with top NASD officials.Although the District Committees hold no official regulatory power, they do play a veryimportant role in advising and consulting with the NASD on industry matters. “Amongother things, District Committee members: Alert [NASD] staff to industry trends thatcould be a potential regulatory concern. Consult with NASD staff on proposed policiesand rule changes brought to a District Committee for its views. Serve on DisciplinaryPanels in accordance with NASD Rules. Promote NASD’s mission and statedpositions.” 2Becoming an NASD District Committee member allows you to assist in the guiding andshaping of our current and future regulation and is a great way for a member to lead andenhance our industry. For more information on how to become a NASD DistrictCommittee member, look for a Special Notice to Members which should be issuedsometime this Summer by the NASD.Become a member of an industry association.Industry associations can be very beneficial in assisting securities professionals ineducating themselves and staying abreast of regulatory changes. In addition, theseassociations also provide an arena in which to vet and gather support for your opinionsand viewpoints.Of course there is the National Society of Compliance Professionals (NSCP), which is thepremier compliance association of our industry, and has grown significantly over the pastseveral years in membership as well as respect and clout with industry regulators.There are numerous other strong and highly respected industry associations from whichto choose: the aforementioned FSI, NAIBD, the Securities Industry and <strong>Financial</strong>Management Association (SIFMA), and the Banking, Insurance and SecuritiesAssociation (BISA) are a just a few of the respected professional associations to whichmany of us currently belong.You should closely review any association to determine which group or groups are rightfor you and your company. Regardless of which association you chose, most groups2 NASD Special Notice to Members 06-24: District Elections, p.1.

share common benefits: a venue to discuss and debate issues and platforms, access to toplevelregulators through conferences and seminars, and the availability to strengthen yourvoice by joining with others who share your opinions. These benefits make industryassociations great platforms to support your stewardship activities.For your reference, the websites of some of the industry associations mentioned are listedbelow. It should be noted, the NSCP does not certify, endorse, formally sanction orrecommend any of these associations. FSI: www.financialservices.org, BISA:www.bisanet.org, NAIBD: www.naibd.com, SIFMA: www.sifma.org.Respond to proposed SRO and SEC rules.Industry rules do not just materialize out of thin air, although to some, it may haveappeared that way several years ago. There are in fact, due process rules which requirethe NASD and the SEC to publicly post all proposed rules and amendments and invitecomments from the public. The public’s comments must be considered prior to approvalof the proposed rule. Therefore, becoming involved in the due process of a proposed ruleis an excellent opportunity for all of us to review, question, opine and comment on everyrule and amendment that is proposed to our industry.As stated, due process requirements exist for every regulatory level of our industry,including NASD rules. The NASD has improved its member communication in this areaby creating a “rule filing” page under the Rules & Regulations tab of the NASD websitein which members can track the status of all NASD proposed rules and amendments. 3In addition, much work is done internally by the NASD in the creation of a new rule orrule amendment before the membership is notified of the proposal. Normally a proposedrule is first presented to the District Committees and other internal committees forconsideration. The rule or amendment is always submitted to the Small Firm AdvisoryBoard (SFAB) to ensure the rule or amendment has no undue negative effect on smallerbroker-dealers. After this internal vetting takes place, the NASD submits the resultingproposal to the entire membership via a Notice to Members.It is at this point that all of us have an opportunity to review and respond to the NASD onthe proposal. After the NASD has had the opportunity to assess member comment, theNASD can take several steps. The proposal can be amended pursuant to the collectedcomments and be resubmitted to the members for additional comment, or the NASD cansubmit the proposal as it stands, or amended, to the SEC for approval.However, our ability to comment on the proposal does not stop there. The SEC is alsorequired to publish the proposed rule or amendment and solicit comment. Thissubmission for comment is normally done through the United States Federal Register.We as members of the industry, can once again comment on the proposed rule oramendment and submit our opinions to the SEC for consideration. The SEC can require3 www.nasd.com/RulesRegulation/RuleFilings/index.htm

the NASD to amend the proposal pursuant to the received comments or approve theproposal.Unfortunately, very few broker-dealers utilize this very important right to help guide ourown regulation. It is one of the most fundamental actions an industry professional cantake to help guide our industry. Therefore, time should be allocated accordingly for it. Inaddition to thoroughly reviewing all released NASD Notice to Members, we recommendsubscribing to an industry periodical to assist you in staying abreast of all proposed rulesand amendments.Attend a compliance certification program.As we are all aware, SEC regulation now requires registered investment advisors andinvestment companies to employee Chief Compliance Officers. Although these rules areseveral years old, there is still considerable discussion on what credentials a CCO shouldhave. In addition to these requirements, the fast paced regulatory pressures have placededucational demands on broker-dealer CCO’s as well. To address this de facto educationrequirement that has developed in the industry, several associations have stepped in to fillthe void, including the NASD, NSCP and National Regulatory Service.These programs provide for a fundamental education that all CCO’s should have. Thesecertification programs allow for a CCO to meet the demands of their job as well aseducate the CCO so as to prepare them to protect and watch over the industry. There areseveral noteworthy programs currently or soon to be offered.The NASD offers a compliance certificate through Wharton, one of the country’s premierbusiness schools. The certification, Certified Regulatory Compliance Professional(CRCP) is offered in three phases.Phase I Foundation: Develops a solid foundation of regulatory and complianceknowledge by focusing on securities law, regulatory structures and complianceframeworks. Participants take part in an intensive, weeklong session at the WhartonSchool’s state-of-the-art executive facilities in either Philadelphia or San Francisco.Phase II Core: Delves into the core compliance topics critical to any complianceoperation. CRCP candidates attend a series of half-day, full-day, and two-day coursesoffered at various locations across the country.Phase III Capstone: Builds on previous coursework by delving deeper into the nuances ofsecurities law and by exploring intricate new case studies and topics. In this weeklongprogram at Wharton, participants explore a range of specialized topics to expand theirknowledge of compliance and regulatory issues to more sophisticated levels. 4A second program is offered by the Investment Adviser Association (IAA) ofWashington and the National Regulatory <strong>Services</strong> (NRS). The IAA and NRS recently4 www.nasd.com/EducationPrograms/NASD<strong>Institute</strong>/index.htm

announced that they will co-sponsor a compliance certification program for investmentadvisor CCO’s titled the Investment Adviser Compliance Certificate Program.This certificate program requires 60 hours of course work, two years of work experience,completion of a certifying exam, adherence to industry ethics and participation incontinuing education courses. The certificate program will be offered through the NRSCenter for Compliance Professionals. 5Finally, the NSCP has developed a compliance program that will be rolled out later thisyear. This highly anticipated certification program offering the Certified SecuritiesCompliance Professional (CSCP) designation, “distinguishes individuals withintermediate to advanced proficiency and a commitment to advancing securitiescompliance practices, lifelong learning, and professional development.” 6Compliance professionals holding the CSCP credential will demonstrate expertise inareas such as: (i) developing compliance programs to ensure adherence to internalcompany policies, procedures, processes and external laws, rules, and regulations; (ii)confirming that activity in client portfolios is consistent with client investment guidelinesand client- directed trade allocations; (iii) monitoring personal trading activities forevidence of market timing, insider trading or appearance of conflict; (iv) educatingdepartments across the company to assist them in their understanding of regulatory andlegal obligations; (v) preparing and filing required regulatory reports outlining actionstaken in resolution of customer complaints; (vi) monitoring firm’s maintenance of clientrecords to ensure they are secure from unauthorized alteration or use; and (vii)developing and maintaining the firm’s policies and procedures, including Anti-MoneyLaundering procedures. 7We strongly believe that individual participation in these programs great improves andstrengthens our industry as a whole.TeachFor those of us with a bit more experience, teaching the courses offered by theseprograms, or speaking at industry conferences, are great ways to pass along the skill andknow-how we have obtained over the years. Offering to be a guest speaker to a financeor business class at a local college or university is another opportunity that can be hadwith a little leg work. Our experience is that many college and university professorsjump at the chance to bring speakers with real-life experiences to their classrooms.Teaching a law school class is another stewardship opportunity. Though requiring asignificant time commitment, it affords a chance to make a significant impact. As aresult of the litigious nature our industry has taken over the past decade, manycompliance officers have obtained a legal degree, (a Juris Doctorate or <strong>JD</strong> for short), orare in the process of obtaining one. Although a <strong>JD</strong> can be very beneficial in navigatingthe increasingly difficult regulatory landscape, many can attest to the lack of specific5 www.investmentnews.com/apps/pbcs.dll/article?AID=/20070130/REG/70130013/-1/INDaily016 www.nscpcertification.org/7 www.nscpcertification.org/cscp.html

securities law courses offered in law schools. For those of us with a <strong>JD</strong>, the experience oflaw school is most likely the same: aside from Securities Law, there is a complete lack ofoffered courses in the areas of broker-dealer, mutual fund and investment advisorregulation. For those looking to hire a junior lawyer, the general lack of an evenrudimentary understanding of broker-dealer and investment adviser regulation bears thispoint out as well.Although an exhaustive undertaking, those of us with legal degrees have a great andhonorable opportunity to help educate, train and groom legal minds that may watch overour industry in the future by creating and teaching a Broker-Dealer Regulation course at alaw school. (If becoming an adjunct law school professor is something you would beinterested in, we would be more than willing to assist you in how to make that happen.You may contact either of us at the emails provided at the end of this article.)Attend or create a local compliance roundtable.The NSCP has done a great job of setting up the networking framework and support tobuild a compliance round table in your community. Per the NSCP’s website on thismatter, “a local compliance roundtable is a group of your peers with whom you meetlocally to discuss compliance issues. For example, have you ever wished that you knewsomeone to call for tips regarding a new business line your firm is considering? Orperhaps you would like the opportunity to get to know your local regulators better or heartheir thoughts on current topics. Forming a local compliance roundtable would provideyou with the convenient venue needed for this.” 8For more information on how to start or join a compliance round table, log onto theNSCP website and select the Roundtables tab.We hope these examples can be useful in assisting you in becoming more involved in ourindustry. Taking responsibility for our own future and becoming a steward of ourindustry is imperative. We need to shed the thought that just doing our jobs is enough.We are all busy and many of us are at the limit of available resources just trying to keepour firms compliant with the myriad of new and amended rules and regulations.However, if we do not address the issues and problems our industry continues to face; ifwe do not take the steps to make time and resources available to take action; if we onlyfocus on our jobs and companies and ignore our responsibilities to our industry, then wefail in our duties as compliance professionals.In the words of our third President, Thomas Jefferson, “Only aim to do your duty, andmankind will give you credit where you fail.”-Kenneth M. Cherrier can be reached at kenc@fintegra.com.-Joseph Fleming can be reached at joe.fleming@rbcdain.com.8 www.nscp.org/roundtables.html

ATTACHMENT III“20 Rising Stars of Compliance”in 2008

ATTACHMENT IV2004 Representative SurveySatisfaction with FintegraCompliance DepartmentUnder My GuidanceAndManagement

2004 Internal Survey ResultsHow would you rate your overall level ofsupport from the following Fintegradepartments:ExceedsExpectationsMeetsExpectationsNot MeetingExpectationsFixed Income 54% 46% 0%DeskCompliance 41% 54% 5%Operationsand TradingITDepartmentAccountMgmnt &MarketingProductTraining andSupport26% 50% 24%23% 60% 17%14% 66% 20%8% 62% 31%

ATTACHMENT V2006 Broker-DealerSurvey of 14 Broker-Dealers

2006Study ofBank Brokerage &Retail Investment <strong>Services</strong>By American BrokerageCONSULTANTSExecutive SummaryThe first annual Study of Bank & Retail Investment <strong>Services</strong> has been completedvia a partnership arrangement between American Banker, a SourceMediapublication based in New York City, and American Brokerage Consultants(“ABC”) of St. Petersburg, Florida.ABC received, reviewed, tabulated, and analyzed far-ranging operational dataprovided by over 8% of U.S. banks that offer retail investment services to theircustomers. This information was obtained via mail survey responses receivedfrom 169 banks which offer investment services. American Banker has publishedABC’s analysis of the data in a report titled 2006 Study of Bank Brokerage &Retail Investment <strong>Services</strong>.The companies evaluated in the survey were as follows:● Investment Professionals● Essex National Securities● Uvest <strong>Financial</strong> <strong>Services</strong>● PrimeVest <strong>Financial</strong> <strong>Services</strong>● Fintegra <strong>Financial</strong> <strong>Services</strong>● PFIC Corporation● Duerr <strong>Financial</strong> Corporation● Raymond James <strong>Financial</strong> <strong>Services</strong>● Invest <strong>Financial</strong> Corporation● Independent <strong>Financial</strong> Marketing Group● Infinex <strong>Financial</strong> Group● <strong>Financial</strong> Network Investment Corp.● LPL <strong>Financial</strong> <strong>Services</strong>● Commonwealth <strong>Financial</strong> NetworkFintegra ranked 1 st in the area of Compliance Expertise with a grade of A+Fintegra ranked 4 th in the area of Compliance Procedures with a grade of AFintegra ranked 1 st overall in Compliance

ATTACHMENT VIPublished in the National Society ofCompliance ProfessionalsCURRENTS

Charles Ponzi – The Creator of the Ponzi Scheme? PART IBy:Kenneth M. Cherrier, 1 st BridgeHouse Consulting, LLCIt seems we cannot open up a paper without reading of yet another Ponzi schemeuncovered by industry regulators. It is an unfortunate sign of the times. But what exactlyis a Ponzi scheme and who was the man it was named after? The purpose of this article isnot just to answer those questions, but is written in manner which allows the informationto be pulled and redistributed to your investment advisors and/or registeredrepresentatives via a compliance bulletin, company notice or any other medium for thepurpose of educating your sales force so they can answer the questions we know theirclients are asking them: “What is a Ponzi scheme?”. In answering that question, thearticle will take a very close look at the life of Charles Ponzi and what he did that foreveretched his name in history. 9 Part I of the two part series will look at the rise of CharlesPonzi and his infamous scheme while Part II will take a close look at how one of thegreatest Ponzi schemes in America came crashing down.What is a Ponzi Scheme?A common error committed by many who write about our industry is to apply the term“Ponzi scheme” to any fraud committed by an investment banker, representative orfinancial professional. However, a true Ponzi scheme is a very specific fraud, one inwhich investors’ money is taken in by the fraudster with a promise of high rates of returnbased on an underlying investment which is usually fraudulent or nonexistent. A “wellrun” Ponzi scheme is perpetuated by initial investors being paid promised returns via thefunds received by later investors. In short, a Ponzi scheme is truly a robbing Peter to payPaul scheme. Although the origins of the term “Robbing Peter to Pay Paul” is in debate,some believe it originated in England in the 1500's when the lands of Saint Peter's Churchat Westminster were sold to pay for repairs of Saint Paul's Cathedral in London. Onething is for certain, the scheme of paying initial investors with principal received fromlater investors has been around for centuries.In fact, prior to Ponzi’s name being dubiously anointed to the scheme during the early1900’s, the reigning American king of the Peter/Paul scheme was William FranklinMiller. Working as a brokerage-house-clerk in 1899 for a meager $5 a week, Milleropened a business in New York promising a whopping 10% rate of return on allinvestments – weekly. He was given the name “520 Percent Miller” based on whatinvestors would get over a year. When pressed on how he could pay such unheard ofinterest, Miller spoke of utilizing the tricks of the trade closely guarded by the Wall Streetsharks and utilizing inside tips that the common man did not have access to.Unfortunately, there were no ticks. Unbeknownst to investors, Miller was simply payinginitial investors with new investors’ money. So, when word got around that Miller wasactually paying out the promised interest every week, new investors flooded in. Manyinvestors started to let their initial investments roll over, thus perpetuating the scam. It9 Much of the material in this article including all biographical material on Charles Ponzi is taken from avery well written autobiography appropriately titled, Ponzi’s Scheme, written by Mitchell Zuckoff andpublished by Randon House. I highly recommend the book.

was so well run that Miller took in more than a million dollars before the scam wasuncovered by the New York Herald. 10Who was Charles Ponzi?So if the scam was around prior to Ponzi, why is it named after him? To answer thatquestion, we need to look at the life of Charles Ponzi to understand how his Peter/Paulscam made such a significant impact on American culture that we renamed the scam inhis name.Born in Lugo, Italy on March 3, 1882, Carlo Pietro Giovanni Tebaldo Ponzi was the sonof a middle class postman and mother hailing from a family of Italian aristocrats. 11Charles’ mother, Imelda Ponzi, had lost her status of Italian royalty as a result of“marrying down” to a commoner. Nineteenth century Italy was extremely class consciousand as a result of her marriage, Imelda had placed all her hopes in her only son Charles torestore the family’s good name. It was the pressure from his mother that would set thestage for Charles’ desire for wealth early on in life.His family sent Charles at a young age to a prestigious private boarding school run byNapoleon Bonaparte’s second wife, Princess Marie-Louise. While away at school,Charles’ father past away. And although greatly saddened, Charles worked hard, receivedgood grades and eventually gained admittance to the University of Rome.Inheritance from his father's death and some money from an aunt would have beenenough to get Charles through school if he was thrifty. But it seems the dangers of goingoff to college in the late 1800’s were very similar to the perils faced by today’s unfocusedyouth: young Ponzi began to party. He befriended the wealthy students, adopting theirmanners, speech, social habits as well as their reputable talent for spending. He dressed inthe latest fashions, picked up restaurant tabs, refined his taste for opera and gambled inthe underground casinos of Rome. Finally his limited funds ran out and at 21, Charleswas forced to leave the University penniless.Returning home ashamed he had failed his widowed mother, Charles soon was provideda second opportunity to restore the family’s name. Charles’ uncle had suggested he makehis fortune in America where the streets were paved with gold. All one had to do wasreach down and scoop it up. It seemed like the perfect chance for someone like Charles,well spoken and well schooled in the mannerisms of the wealthy, to redeem his family’ssocial status and satisfy his desire for fortune and fame.On November 3, 1903, he left for Boston on the S.S. Vancouver with the last of hismother's money: about $200. Although the trip lasted only a week, unfortunately it was aweek too long for the young Ponzi who had grown accustom to the finer things in life.While on the ship, he gambled, drank and tipped big. By the time the ship docked inBoston, Charles had just $2 in his pockets. Even at the early age of 21, a trend that wouldbe the end of Charles Ponzi was emerging: his need for wealth and spending it.10 A million dollars in 1899 would be roughly $22 million measured in today’s dollars.11 Upon arriving in America and not speaking any English, Ponzi’s first name was changed from Carlo toCharles. The middle names were all dropped.

For the next three and a half years, Charles Ponzi wondered across America doing oddend jobs until finally in July of 1907 he boarded a train bound for Montreal seeking achange of luck. It was there that Charles learned first hand of the intricacies of a well runrobbing Peter to pay Paul scheme. Utilizing his Italian schooling and charm, he gainedemployment as a clerk at Banco Zarossi, a bank owned by an Italian. Charles watchedand learned as the bank owner, Luigi Zarossi, promised a 6% rate of return to bankclients on all investments: 3% higher than other banks were offing at the time. To providea legitimate cover as to how he could offer such high interest, Zarossi used the very sameclaims as 520 Percent Miller. He claimed that the other gluttonous bankers could provide6% to the common man if they wanted to but were too greedy to do so. But all Zarossiwas doing was paying initial bank depositors with new depositors’ money, and Charleshad a back stage seat to it all. Although he claimed he was never involved in effectuatingthe scam in any way, Charles did learn gain valuable insight on exactly how to swindlehis fellow man playing on human greed, fear and dreams. Eventually the scam failed, thebank was closed and Charles was left to ponder his next move. Unfortunately, it was nota good one.In August of 1908, in an attempt to pull together funds to return to America, Charles wasarrested for check forgery, a crime he did indeed commit. But even sitting in a filthy jailcell in Montreal Canada awaiting trial, Charles’ true colors began to show. He schemedhis way to better accommodations by pretending to be slightly crazy, curling up in thecorner of his cell, chewing a towel to shreds, screaming and jumping around like ananimal. His act paid off as he was moved to the relatively luxurious infirmary to awaittrial. At trial, Charles pled guilty thinking the judge would be lenient. He was wrong.Charles was sentenced to three years in a Montreal prison. His sentenced was reduced totwo years for good behavior and he was released in July of 1910. Unfortunately, Charles’bad luck continued.Upon being released, he immediately tried to return to America where his fortunes hadbeen more positive. Charles boarded a train bound for New York. While on the train, hebefriended five Italians who did not have proper papers and did not speak English. A USimmigration inspector was suspicious and took all six men into custody. As a result,Charles was charged with smuggling aliens into the United States. He pled guilty fearingan innocent plea and guilty verdict would result in hard time. Charles guessed wrongagain. He was sentenced to two years in federal prison in the Atlanta FederalPenitentiary.Charles served his time and was released without issue. After prison, Charles wanderedthe United States for another four years, again working odd jobs from town to town.From 1910 to 1914, Charles actually led a somewhat dull life. However, there is oneinteresting point to note during this period. While in Blocton Alabama, a coal miningtown, Charles supposedly donated skin from his thighs and back – a total of 122 squareinches – for several painful medical transplant procedures to help a burn victim namedPearl Gossett. As a result he spent three agonizing months in the hospital fighting offinfections while recovering. Charles would carry the scars for the rest of his life. It wasactions … or claims … such as this that fueled the Ponzi legend.

It was a short time later after the skin transplant operation, Charles learned of Italy’sproclamation to all Italian emigrants in the US to return home to defend the motherlandin the Great War. Prepared to fight for his country, he traveled to New York and boardeda ship for Italy. However, upon boarding the ship, he learned that the Italian governmentwould not pay for the return trip once the war was over. Outraged, he left the ship justprior to its departure. Finding himself back on the East coast, he found a job in Boston,13 years later from his first arrival to the US. He took employment as a clerk with animport-export business named J.R. Poole Company.Charles settled into the position at the J.R. Poole Company from 1916 to 1919. He waseven awarded several raises and promotions. In that time he met and married his wife,Rose Gnecco, the pride and love of his life. But Charles’ dreams of wealth could not betamed by married life and a few meaningless raises. His thirst for fame and fortune wasfed by conversations with his banker, Roberto de Masellis, a manager at Fidelity TrustCompany were Charles kept a meager account. It was Mr. Masellis who explained to himthe finer points of arbitraging national currencies. The concept of arbitrage would be thesecond of three major pieces of information Charles would utilize to support the schemeto come.Charles thirst for wealth grew and he knew it would not come while working atJ.R.Poole. It was in early 1919 that Charles quit J.R. Poole Company and started his ownbusiness. I guess you could say he went into commodities as a broker. The only problemwas he was selling someone else’s commodities. He was served with a warrant forstealing 5,387 pounds of cheese valued at 45 cents a pound. However, Charles’ normalbad luck was changing. The police clerk misspelled his name on the warrant and the casewas dropped due to technical issues as a result of the miscue.After dodging the theft charge, Charles tried to start a foreign trade publication named theTrader's Guide. Not actually having a publication in place was no hurdle for the aspiringPonzi. He mailed offers of the publication to foreign companies over seas. The endeavornever took off as he received no replies… except for one. He received a reply letter froma Spanish entrepreneur asking for a copy of the Trader's Guide. As was professionalcustom at the time, the Spanish inquirer had included an International Reply Coupon ormore commonly known as an IRC, for Charles to respond. 12 Charles now had all threepieces of knowledge to take his shot at making it big: (i) experience on how to play onthe general publics’ distrust of rich bakers to get the small investor to invest, (ii)knowledge of international arbitrage, and (iii) knowledge of a medium (IRC’s) toarbitrage.Charles quickly crunched the numbers. As an example, if he bought the IRC cheap inItaly which at the time could yield 66 IRC’s for just one US dollar, and then redeem the12 In 1906, 63 countries gathered in Rome under one of the first global organizations called the UniversalPostal Union founded in 1874. The goal was to create a method for a person in one country to send a prepostageenvelope to a person in another country so they could reply. As a result, international postalcurrency was created called the IRC or International Reply Coupon. It held a fixed value in all countriesand could be exchanged in any country belonging to the Universal Postal Union for a stamp.

IRC's in the US which were worth $3.30, he would gain a profit of 230% for each dollar!But there were a few problems. First there would be huge expenses in importing largequantities of IRC’s from around the world. Second, how would the IRC's be redeemedfor cash as the US Post Office did not accept IRC’s for cash. Finally, it was illegal underthe Universal Postal Union code to profit from buying and selling IRCs. Charles feltthese were small problems he would overcome later. He had his angle and it was time tomake some money.Charles knew that if he were going to make any significant money from his plan, hewould need private investors. He knew from his experience at Banco Zarossi that largesums of money could be obtained in small amounts from numerous poorer investors if hecould promise them larger profits in short periods of time by utilizing “insideinformation” guarded by the Wall Street fat cats. So, on December 26, 1919, Charlesformed a company for his plan. He named it, The Securities Exchange Company. It wasnever referred to as the SEC, and even though the SEC would not be created for another15 years, the point is amusing.He ordered a stack of printed certificates to issue to investors promising 50% interest onall deposits in just a 90 day period. Charles enlisted the aid of a few sales agents.Utilizing his experiences at Banco Zarossi, Charles soon had 18 investors by January1920. If anyone had stopped to do the math they would have known that it would havetaken an arbitrage of 53,000 IRC’s to repay just the first 18 investors. Charles’ new foundluck continued as no one did the math.The following month, 17 more people invested into The Securities Exchange Company.March totaled 110 new investors. As the original investors showed up for theirinvestment and interest, Charles was ready to pay them. However, seeing the cash in hishands and his willingness to pay, most reinvested their money and it snow balled fromthere. Word spread quickly through the streets of Boston: Charles Ponzi was helping thecommon man get rich. Unfortunately for Mr. Ponzi, it was not just the common man thatwas noticing his new found wealth and fame.Please read PART II of this series to be posted in the next Currents to learn more aboutCharles Ponzi and his infamous scam.Kenneth M. Cherrier, <strong>JD</strong>1 ST BRIDGEHOUSE CONSULTINGPH #: (612) 816-3019EMAIL: kcherrier@1stbridgehouse.com