SCHEDULE PLANNING GUIDE - Financial Services Institute

SCHEDULE PLANNING GUIDE - Financial Services Institute

SCHEDULE PLANNING GUIDE - Financial Services Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ED SESSIONS<br />

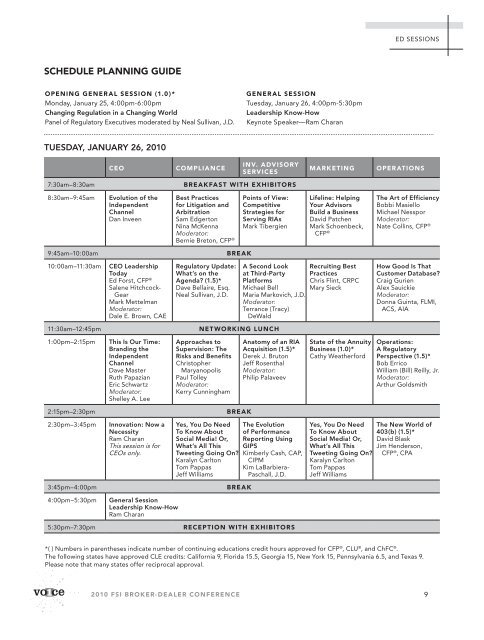

<strong>SCHEDULE</strong> <strong>PLANNING</strong> <strong>GUIDE</strong><br />

OPENING GENER AL SESSION (1.0 ) *<br />

Monday, January 25, 4:00pm-6:00pm<br />

Changing Regulation in a Changing World<br />

Panel of Regulatory Executives moderated by Neal Sullivan, J.D.<br />

GENER AL SESSION<br />

Tuesday, January 26, 4:00pm-5:30pm<br />

Leadership Know-How<br />

Keynote Speaker—Ram Charan<br />

Tuesday, January 26, 2010<br />

CEO<br />

Compliance<br />

Inv. Advisory<br />

<strong>Services</strong><br />

Marketing<br />

Oper ations<br />

7:30am–8:30am<br />

Breakfa st with Exhibitors<br />

8:30am–9:45am<br />

Evolution of the<br />

Independent<br />

Channel<br />

Dan Inveen<br />

Best Practices<br />

for Litigation and<br />

Arbitration<br />

Sam Edgerton<br />

Nina McKenna<br />

Moderator:<br />

Bernie Breton, CFP ®<br />

Points of View:<br />

Competitive<br />

Strategies for<br />

Serving RIAs<br />

Mark Tibergien<br />

Lifeline: Helping<br />

Your Advisors<br />

Build a Business<br />

David Patchen<br />

Mark Schoenbeck,<br />

CFP ®<br />

The Art of Efficiency<br />

Bobbi Masiello<br />

Michael Nesspor<br />

Moderator:<br />

Nate Collins, CFP ®<br />

9:45am–10:00am<br />

Break<br />

10:00am–11:30am<br />

CEO Leadership<br />

Today<br />

Ed Forst, CFP ®<br />

Salene Hitchcock-<br />

Gear<br />

Mark Mettelman<br />

Moderator:<br />

Dale E. Brown, CAE<br />

Regulatory Update:<br />

What’s on the<br />

Agenda (1.5)*<br />

Dave Bellaire, Esq.<br />

Neal Sullivan, J.D.<br />

A Second Look<br />

at Third-Party<br />

Platforms<br />

Michael Bell<br />

Maria Markovich, J.D.<br />

Moderator:<br />

Terrance (Tracy)<br />

DeWald<br />

Recruiting Best<br />

Practices<br />

Chris Flint, CRPC<br />

Mary Sieck<br />

How Good Is That<br />

Customer Database<br />

Craig Gurien<br />

Alex Sauickie<br />

Moderator:<br />

Donna Guinta, FLMI,<br />

ACS, AIA<br />

11:30am–12:45pm<br />

Net working Lunch<br />

1:00pm–2:15pm<br />

This Is Our Time:<br />

Branding the<br />

Independent<br />

Channel<br />

Dave Master<br />

Ruth Papazian<br />

Eric Schwartz<br />

Moderator:<br />

Shelley A. Lee<br />

Approaches to<br />

Supervision: The<br />

Risks and Benefits<br />

Christopher<br />

Maryanopolis<br />

Paul Tolley<br />

Moderator:<br />

Kerry Cunningham<br />

Anatomy of an RIA<br />

Acquisition (1.5)*<br />

Derek J. Bruton<br />

Jeff Rosenthal<br />

Moderator:<br />

Philip Palaveev<br />

State of the Annuity<br />

Business (1.0)*<br />

Cathy Weatherford<br />

Operations:<br />

A Regulatory<br />

Perspective (1.5)*<br />

Bob Errico<br />

William (Bill) Reilly, Jr.<br />

Moderator:<br />

Arthur Goldsmith<br />

2:15pm–2:30pm<br />

Break<br />

2:30pm–3:45pm<br />

Innovation: Now a<br />

Necessity<br />

Ram Charan<br />

This session is for<br />

CEOs only.<br />

Yes, You Do Need<br />

To Know About<br />

Social Media! Or,<br />

What’s All This<br />

Tweeting Going On<br />

Karalyn Carlton<br />

Tom Pappas<br />

Jeff Williams<br />

The Evolution<br />

of Performance<br />

Reporting Using<br />

GIPS<br />

Kimberly Cash, CAP,<br />

CIPM<br />

Kim LaBarbiera-<br />

Paschall, J.D.<br />

Yes, You Do Need<br />

To Know About<br />

Social Media! Or,<br />

What’s All This<br />

Tweeting Going On<br />

Karalyn Carlton<br />

Tom Pappas<br />

Jeff Williams<br />

The New World of<br />

403(b) (1.5)*<br />

David Blask<br />

Jim Henderson,<br />

CFP ® , CPA<br />

3:45pm–4:00pm<br />

break<br />

4:00pm–5:30pm<br />

General Session<br />

Leadership Know-How<br />

Ram Charan<br />

5:30pm–7:30pm<br />

Recep tion with Exhibitors<br />

*( ) Numbers in parentheses indicate number of continuing educations credit hours approved for CFP ® , CLU ® , and ChFC ® .<br />

The following states have approved CLE credits: California 9, Florida 15.5, Georgia 15, New York 15, Pennsylvania 6.5, and Texas 9.<br />

Please note that many states offer reciprocal approval.<br />

2010 FSI Broker- Dealer Conference<br />

9

ED SESSIONS<br />

opening general session<br />

Changing Regulation in a Changing World<br />

Monday, January 25, 4:00pm-6:00pm<br />

This session has been approved for 1.0 hour of continuing education for CFP ® , CLU ® , and ChFC ® .<br />

The opening keynote session at OneVoice will focus on one of the most important<br />

and challenging issues facing independent broker-dealer firms today—regulatory<br />

reform. Neal Sullivan, J.D., partner with Bingham McCutchen and FSI’s<br />

outside policy counsel, will lead a panel discussion with regulatory executives<br />

that we can guarantee will be another can’t-miss keynote session.<br />

Moderator: Neal Sullivan, J.D., Partner, Bingham McCutchen, LLP<br />

Panel of Regulatory Executives: Paul S. Atkins, Co-founder and Managing Director,<br />

Patomak Partners, LLC<br />

Joseph P. Borg, Director, Alabama Securities Commission<br />

David A. DeMuro, Lawyer, O’Melveny & Myers<br />

Neal Sullivan is co-chair of Bingham’s Securities Area, a 120-attorney group within<br />

Bingham McCutchen. He is also practice group leader of the firm’s broker-dealer<br />

group. Neal conducts a comprehensive securities regulatory practice and maintains<br />

a particular focus on broker-dealer and investment adviser matters. He regularly<br />

represents clients before the SEC, FINRA, and other self-regulatory organizations<br />

and state securities agencies, frequently concerning emerging regulatory issues. In<br />

addition, he has extensive experience with private and public investigations and<br />

enforcement proceedings brought by the SEC, FINRA, and its predecessor entities<br />

(NASD and NYSE) and state agencies. Neal serves as outside counsel to the Boston<br />

Options Exchange and to Bourse de Montréal with regard to U.S. registration<br />

issues. He was formerly outside counsel to the Boston Stock Exchange.<br />

Paul S. Atkins is co-founder and managing director of Patomak Partners, LLC, a<br />

regulatory compliance consulting firm based in Washington, DC. Previously, Paul<br />

served as commissioner of the Securities and Exchange Commission from July 2002<br />

to August 2008. During his two terms, he advocated transparency and consistency<br />

in the SEC’s decision-making and operations; smarter regulation that considers<br />

costs and benefits; and improvements to the competitiveness and attractiveness of<br />

the US capital markets. He represented the SEC at various meetings of the US-EU<br />

Transatlantic Economic Council, the President’s Working Group on <strong>Financial</strong><br />

Markets, the World Economic Forum, and the Transatlantic Business Dialogue. He<br />

paid official visits to almost two dozen countries on five continents. He had earlier<br />

SEC experience from 1990-1994 when he served on the staffs of SEC Chairmen<br />

Richard C. Breeden and Arthur Levitt, as chief of staff and counselor, respectively.<br />

Prior to his appointment as commissioner, Paul was a partner of<br />

PricewaterhouseCoopers (and its predecessor Coopers & Lybrand.)<br />

10 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Joseph (Joe) Borg has been director of the ASC since 1994. Joe is twice past<br />

president of the North American Securities Administrators Association (NASAA)<br />

and serves as a member of its Board of Directors, ombudsman and chair of the<br />

International Committee. Joe has testified before various committees of the U.S.<br />

Senate and U.S. House of Representatives including recent testimony on such<br />

areas as Microcap fraud, criminal elements in the financial markets, information<br />

sharing among financial regulatory agencies before the House Committee on<br />

Oversight about risks posed to everyday investors from Initial Public Offerings of<br />

private equity and hedge fund firms and the Senate Special Committee on Aging<br />

concerning illegal investment sales practices that victimize senior citizens.<br />

Joe served as a U.S. delegate to an Intergovernmental Expert Group for the<br />

United Nations Commission on International Trade and Law (UNCITRAL).<br />

David A. DeMura is currently a lawyer with O’Melveny & Myers. From 1984<br />

through 2008, he worked at Lehman Brothers as head of Global Compliance and<br />

Regulation. Earlier, he spent ten years with the SEC. He was on the Executive<br />

Committee of SIFMA’s Compliance & Legal Division, serving as president from<br />

2003 to 2004. He is a trustee of the SIFMA/Wharton Securities Industry <strong>Institute</strong>.<br />

David was on the NASD Board of Governors from 2001 through 2005. From<br />

1999 through 2002, he sat on the NASD’s National Adjudicatory Council,<br />

serving as its chairman from 2001 to 2002. He was on the NASD, now FINRA,<br />

Membership Committee; the Licensing and Registration Council; and the<br />

Compliance Advisory Group.<br />

david received his B.A. from the University of Michigan and his J.D. from the<br />

University of Notre Dame Law School.<br />

2010 FSI Broker- Dealer Conference<br />

11

ED SESSIONS<br />

CEO Track<br />

Evolution of the Independent Channel<br />

Tuesday, January 26, 8:30am-9:45am (75 minutes)<br />

The present is not the future—there are stark new realities in the advisor marketplace and the<br />

economy. What you think it means to be “independent” may be different than what advisors think it<br />

means. And, what you think they’re looking for, need, and find acceptable from their broker-dealer<br />

may not match their expectations. This session will tap into decades-long thought leadership to<br />

confirm or debunk our perception of what really matters to your client, the independent financial<br />

advisor. Inveen is the director of research at FA Insight and a former consultant with Moss Adams<br />

LLP and Russell Investment Group. FA Insight produces the FSI Broker-Dealer <strong>Financial</strong> Perfromance<br />

and Compensation Study for FSI.<br />

Speaker:<br />

Dan Inveen, Director of Research, FA Insight<br />

Dan Inveen, an FA Insight founding partner, has assisted businesses with research<br />

and strategy development for over two decades. His expertise in strategic planning,<br />

financial management, staffing, compensation, operations, and client servicing has<br />

helped a broad spectrum of industry executives gain a better understanding of how<br />

to achieve success in the financial advisory marketplace. Prior to forming FA Insight,<br />

Dan’s past positions include serving as senior research manager with the Business<br />

Consulting Group at Moss Adams, manager of marketing research for Russell<br />

Investment Group, and director and chief economist for the U.S. Virgin Islands<br />

Bureau of Economic Research.<br />

Deena Katz is an associate professor in the Personal <strong>Financial</strong> Planning Division at<br />

Texas Tech University, in Lubbock, Texas. She is also a founding partner of Evensky<br />

& Katz, a wealth management firm located in Coral Gables, Fla. She is an internationally<br />

recognized financial advisor and practice management expert and the<br />

author of seven books on financial planning and practice management topics.<br />

Deena was one of the first advisors named to <strong>Financial</strong> Planning Magazine’s list<br />

of “Movers and Shakers” for 2001 and 2008, as well as one of Accounting Today’s<br />

“Top Ten Names to Know in <strong>Financial</strong> Planning” in 2001 and 2002. She has been<br />

on Investment Advisor’s list of “Most Influential People in the Industry” for six of<br />

the past seven years.<br />

deena is on the national board of directors of the <strong>Financial</strong> Planning Association ®<br />

and is an immediate past member of the board of trustees for the Foundation for<br />

<strong>Financial</strong> Planning.<br />

12 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

CEO Leadership Today<br />

Tuesday, January 26, 10:00am-11:30am (90 minutes)<br />

What is your firm doing that demonstrates why the independent channel is best positioned to serve<br />

the advisory community What changes are you considering in response to market disruption and<br />

anticipated regulatory changes Is the traditional broker-dealer model still relevant Hear three top<br />

broker-dealer executives share their views on how they are positioning their firms to handle these<br />

questions and the ever-changing regulatory environment.<br />

Moderator: Dale E. Brown, CAE, President & CEO, FSI<br />

Speakers: Ed Forst, CFP ® , President, Lincoln Investment Planning<br />

Salene Hitchcock-Gear, President & CEO, Ameritas Investment Corp.<br />

Mark Mettelman, President & CEO, Triad Advisors, Inc.<br />

Dale Brown is the founding president and CEO of the <strong>Financial</strong> <strong>Services</strong> <strong>Institute</strong>.<br />

FSI was formed in January 2004 as the association for independent broker-dealers<br />

and the independent financial advisors they serve. Since its launch, FSI has grown<br />

to 117 broker-dealer members who serve more than 138,000 independent financial<br />

advisors. FSI also includes over 11,000 financial advisor members.<br />

Dale brings more than 21 years of association management experience to FSI and<br />

broad leadership in government relations and constituent advocacy. He leads<br />

FSI’s advocacy strategy, interacting frequently with regulators and policymakers in<br />

Washington. Prior to joining FSI at its launch, Dale led the government relations,<br />

corporate, and broker-dealer programs for the <strong>Financial</strong> Planning Association<br />

(FPA) and the International Association for <strong>Financial</strong> Planning (IAFP). Dale led the<br />

successful fight in the mid-1990s against IRS attempts to force broker-dealers to<br />

re-classify independent contractor representatives as statutory employees.<br />

Ed Forst, president and CEO of Lincoln Investment Planning, is responsible for the<br />

activities of 446 licensed representatives, located in 74 branch offices, and more<br />

than 190 full-time operations and support personnel.<br />

Lincoln Investment Planning, Inc. is a full-service broker-dealer and registered<br />

investment adviser serving the diverse financial needs of about 125,000 individual<br />

investors representing over $5.9 billion in assets. For the past 40 years, Lincoln<br />

Investment has focused on providing retirement plans for employees of school<br />

districts, universities, hospitals, and other non-profit and community-based<br />

2010 FSI Broker- Dealer Conference<br />

13

ED SESSIONS<br />

organizations. With over 2,100 payroll deduction retirement plans receiving over<br />

$210 million in retirement contributions annually, Ed has been instrumental in<br />

positioning Lincoln Investment as the broker-dealer of choice for 403(b) professionals<br />

nationwide.<br />

ed is a CERTIFIED FINANCIAL PLANNER (CFP ® ) certificant and has been in the<br />

financial services industry since 1980.<br />

Salene Hitchcock-Gear is president and chief executive officer of Acacia Life<br />

Insurance Company, a UNIFI company headquartered in Bethesda, Md., and<br />

Ameritas Investment Corp. (AIC). An affiliate of UNIFI Companies, AIC is a fullservice<br />

broker-dealer headquartered in Lincoln, Neb., with corporate offices in<br />

Bethesda, Md.; Cincinnati, Ohio; and Omaha, Neb. AIC has nearly 2,000 registered<br />

representatives nationwide and approximately $12 billion in total client<br />

assets under management. The firm has been in the public finance business since<br />

1997 and consistently ranks first among the top 15 managing underwriters doing<br />

business in Nebraska.<br />

salene is also the executive leader of the Wealth Management Group (WMG),<br />

designed to leverage the annuity, retirement plans, and investment businesses for<br />

UNIFI. In March 2000, Salene was elected president and chief executive officer of<br />

The Advisors Group (TAG), a subsidiary of Acacia and a full-service broker-dealer.<br />

Mark C. Mettelman is president and CEO of Triad Advisors, Inc. Prior to<br />

co-founding Triad in 1998, Mark was a senior vice president of Keogler, Morgan<br />

& Co., where he was responsible for overseeing the fixed‐income trading<br />

department, advisory services, and new business development. From 1986-1988,<br />

Mark was an equity and fixed income trader for FSC Securities. Prior to joining<br />

FSC, Mark spent two years at Blunt, Ellis & Loewi, where he was an assistant<br />

portfolio manager in the convertible arbitrage department.<br />

Mark is active with the <strong>Financial</strong> <strong>Services</strong> <strong>Institute</strong> (FSI), is a member of National<br />

<strong>Financial</strong>’s Advisory Council, and is frequently quoted in industry publications.<br />

Mark also served on the Investment Advisor Law and Regulatory Subcommittee for<br />

the State of Georgia. Mark holds the following industry registrations: Registered<br />

General Securities Representative, Registered General Securities Principal,<br />

Registered Municipal Securities Principal, Securities Agent, and Registered<br />

Investment Adviser. He holds a B.S. in management from Auburn University.<br />

14 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

This Is Our Time: Branding the Independent Channel<br />

Tuesday, January 26, 1:00pm-2:15pm (75 minutes)<br />

The independent broker-dealer and advisor channel may be the best-kept secret of the last 40 years.<br />

Now, it’s time to tell our story—and do some strategic thinking on what “Brand IBD” is, how it could<br />

occupy the right space in the consumer’s mind, what the brand’s promise and pledge are, and how<br />

to position the brand for the long term. This panel discussion will be led by an industry communications<br />

consultant and includes executives of two broker-dealers and a business and marketing<br />

strategy consultant. Put on your best “what if” strategic thinking cap for this important session.<br />

Moderator: Shelley A. Lee, Communications Consultant, Ashworth-Lee Communications<br />

Speakers: Dave Master, Managing Director, Carpenter Group<br />

Ruth Papazian, Executive Vice President & Chief Marketing Officer, LPL <strong>Financial</strong><br />

Eric Schwartz, Chairman & CEO, Cambridge Investment Research<br />

Shelley Lee, a communications professional for more than 25 years, is the founder<br />

and president of Ashworth-Lee Communications. Her experience and skills include<br />

consulting, planning, and implementation services for a wide variety of corporate<br />

communications initiatives, including corporate and brand identity, strategic<br />

messaging, marketing communications programs, communications strategy, and<br />

editorial management. Prior to founding her own business in 1989, she was director<br />

of corporate communications for an independent broker-dealer and editorial<br />

services manager for a major non-profit health organization. Shelley also is an extensively<br />

published writer and business journalist who has written for The Wall Street<br />

Journal, Money magazine, Business to Business, and Atlanta magazine, and is a<br />

regular writer for the Journal of <strong>Financial</strong> Planning.<br />

David (Dave) Master runs the consulting practice for Carpenter Group, a business<br />

advisory and marketing firm that works solely with financial services clients in areas<br />

such as wealth management, retirement, and product sales. Prior to joining the<br />

Carpenter Group, Dave was director of strategic initiatives for Prudential Investments<br />

and CMO for JennisonDryden mutual funds and managed accounts. Before joining<br />

Prudential, Dave spent a decade consulting to firms such as American Skandia,<br />

William Blair, Farmer’s Insurance, First Chicago/NBD, Scudder, Charles Schwab, SEI<br />

Investments, and Fleet <strong>Financial</strong> on strategy, product development, and marketing.<br />

dave started consulting after having been a senior manager at the Chase Manhattan<br />

Bank with Vista Mutual Funds and Global Investor <strong>Services</strong>; and at the Bank of New<br />

England, where he was head of account management for the Fiduciary <strong>Services</strong><br />

Group and director of marketing for commercial banking. He studied economics at<br />

Dartmouth College and received his M.B.A. from the Yale School of Management.<br />

2010 FSI Broker- Dealer Conference<br />

15

ED SESSIONS<br />

Ruth Papazian serves as executive vice president and chief marketing officer of<br />

LPL <strong>Financial</strong>, providing strategic direction and oversight of the marketing, advertising,<br />

and marketing communication activities for the firm’s Independent Advisor<br />

<strong>Services</strong> and Institution <strong>Services</strong> businesses. In this role, Ruth is responsible for<br />

firm-wide marketing efforts, as well as for the development of key programs,<br />

campaigns, and events that support the growth and profitability of independent<br />

advisor practices and the financial institution-based investment programs<br />

supported by LPL <strong>Financial</strong>.<br />

Prior to joining LPL <strong>Financial</strong> in 2007, Ruth was managing director and head of global<br />

marketing for Morgan Stanley Investment Management and president and chief<br />

marketing officer for Evergreen Investments. Ruth has over 25 years’ experience in<br />

advertising and marketing in the financial services industry. She is a member of The<br />

Investment Company <strong>Institute</strong>, the Forum for Investment Advice, and the Corporate<br />

Executive Board/VIP Forum. Ruth earned a bachelor’s degree from Stonehill College.<br />

Eric Schwartz is founder, chairman, and CEO of Cambridge Investment Research,<br />

Inc. Since founding Cambridge’s predecessor broker-dealer, Eneric <strong>Financial</strong><br />

<strong>Services</strong>, Inc., in 1981, he has led Cambridge’s phenomenal growth, based in large<br />

part on his fundamental commitment to providing the highest level of flexible,<br />

open-architecture fee and commission platforms to independent financial planners<br />

and investment advisors.<br />

Eric is a member of the founding board of directors of the <strong>Financial</strong> <strong>Services</strong><br />

<strong>Institute</strong> (FSI) and immediate past chairman of that organization.<br />

Innovation: Now a Necessity<br />

Tuesday, January 26, 2:30pm-3:45pm (75 minutes)<br />

This session is for CEOs only.<br />

Surveying the forever-changed financial services landscape, CEOs of independent broker-dealers<br />

acknowledge the status quo will no longer suffice. Shrinking margins, unpredictable regulatory<br />

expansion, changing advisor preferences, and rapidly evolving technology require a renewed effort<br />

to embrace change. This exclusive, CEO-only session will be led by Ram Charan, a highly sought<br />

advisor to CEOs and senior executives in companies ranging from start-ups to members of the<br />

Fortune 500, including GE, DuPont, EDS, and Colgate-Palmolive. He is the author of a number of<br />

best-selling business books, including Execution, Know-How, and Every Business Is a Growth<br />

Business. Ram will conduct an interactive session for CEOs on leading a transformation toward<br />

efficiencies, how to get existing teams to think creatively, leveraging talent, and strategic coaching.<br />

A don’t-miss session for broker-dealer CEOs.<br />

Speaker: Ram Charan<br />

16 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Ram Charan is a highly acclaimed business advisor, speaker, and author. Ram has<br />

coached some of the world’s most successful CEOs. For 35 years, he has worked<br />

behind the scenes at companies like GE, KLM, Bank of America, DuPont, Novartis,<br />

EMC, 3M, and Verizon.<br />

Ram started his business career as a teenager working in the family shoe shop in<br />

India. He went on to earn an engineering degree and then M.B.A. and doctorate<br />

degrees from Harvard Business School. He graduated from Harvard with high<br />

distinction and was a Baker Scholar. He then served on the Harvard Business<br />

School faculty. Ram cuts through the difficult problems and gets you to the right<br />

insights: he makes difficult problems simple with great insights.<br />

ram is a favorite among executive educators. He has taught for 30 consecutive<br />

years at GE’s famous Crotonville <strong>Institute</strong> and is the recipient of their Bell Ringer<br />

award (best teacher).<br />

2010 FSI Broker- Dealer Conference<br />

17

ED SESSIONS<br />

Compliance Track<br />

Best Practices for Litigation and Arbitration<br />

Tuesday, January 26, 8:30am–9:45am (75 minutes)<br />

Market downturns have historically been followed by an increase in customer complaints, arbitrations,<br />

and litigations. This session will cover an overview of the current litigation and arbitration<br />

environment, with a focus on how firms can take steps to improve their handling of these situations.<br />

Our speakers also will cover best practices around the use of e-mail in this age of transparency and<br />

discovery. What should be communicated via e-mail What should not How is the attorney-client<br />

privilege appropriately protected<br />

Moderator: Bernie Breton, CFP ® , Chief Compliance Officer, Multi-<strong>Financial</strong> Securities Corp.<br />

Speakers: Sam Edgerton, Partner, Edgerton & Weaver, LLP<br />

Nina McKenna, Chief Counsel, ING Advisors Network<br />

Bernard (Bernie) Breton is responsible for overseeing the compliance program of<br />

Multi-<strong>Financial</strong> Securities Corp. As the CCO, he also serves as the money laundering<br />

reporting officer (MLRO) and regulatory liaison with FINRA and SEC.<br />

Bernie has over 20 years of experience in the securities compliance area. He previously<br />

served as chief compliance officer for Carillon Investments, Inc., and Union<br />

Central Life Insurance Company’s separate accounts. Prior to that, he held various<br />

compliance positions with MetLife and AXA. He started his compliance career as<br />

an examiner with FINRA’s Atlanta District.<br />

Bernie graduated magna cum laude with a Bachelor of Science degree in<br />

economics and earned an M.B.A. with a major in finance, both from the University<br />

of Tennessee at Chattanooga. He is a CERTIFIED FINANCIAL PLANNER (CFP ® )<br />

certificant and holds various securities registrations. He is also a past FINRA DBCC<br />

Committee member and serves as industry arbitrator for FINRA Arbitration.<br />

Sam Edgerton is the founding partner of Edgerton & Weaver, LLP. Sam is a trial<br />

attorney with civil litigation expertise in state and federal courts, as well as appellate<br />

work, arbitration, and mediation. Sam also has extensive experience in<br />

government enforcement litigation and corporate compliance matters.<br />

From 1982 through 1986, Sam worked in the Office of Enforcement of the U.S.<br />

Securities and Exchange Commission in Los Angeles. From 1984 through 1986, he<br />

also served as a special assistant United States attorney (Criminal Division). Sam<br />

also served as mayor of Hermosa Beach for four terms, having been elected to the<br />

City Council by popular vote in 1991, 1995, 1999, and 2003.<br />

sam is a member of the state bars of California, New York, Massachusetts, and the<br />

District of Columbia. He is also admitted to practice before the Supreme Court of<br />

the United States of America.<br />

18 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Nina Schloesser McKenna is chief counsel with ING US Legal <strong>Services</strong>. Prior to<br />

joining ING, Nina practiced corporate and securities law, as of counsel, with<br />

Sonnenschein, Nath & Rosenthal. Before Nina joined Sonnenschein, Nath &<br />

Rosenthal, she served as a regional chief counsel in the Enforcement Department<br />

of NASD, where for 15 years she provided legal advice in connection with enforcement<br />

matters and broker-dealer regulatory issues.<br />

Session Outline—Best Practices for Litigation and Arbitration<br />

I. Assessing and Handling Customer Claims and Regulatory Matters<br />

II. Handling a Customer Claim<br />

III. Handling a Regulatory Issue<br />

IV. New Topics<br />

V. How Compliance/Supervision Affects Litigation<br />

VI. Dealing With Seniors<br />

VII. Preventing/Defending a Selling Away Case<br />

VIII. Written Supervisory Procedures<br />

IX. Audits<br />

X. Miscellaneous Issues<br />

XI. Q & A from the Audience<br />

Regulatory Update: What’s on the Agenda<br />

Tuesday, January 26, 10:00am–11:30am (90 minutes)<br />

This session has been approved for 1.5 hours of continuing education for CFP ® , CLU ® , and ChFC ® .<br />

Major regulatory developments have occurred during the past year and many more are on the table.<br />

Broker-dealers and investment advisers are greatly impacted and challenged by these changes. This<br />

regulatory and legal panel will provide timely, clear, and concise discussion around these regulatory<br />

changes and their impact on the broker-dealer and advisory compliance community.<br />

Speakers: Dave Bellaire, Esq., General Counsel & Director of Government Affairs, FSI<br />

Neal Sullivan, J.D., Partner, Bingham McCutchen, LLP<br />

David (Dave) Bellaire joined the <strong>Financial</strong> <strong>Services</strong> <strong>Institute</strong>, Inc., as general counsel<br />

and director of government affairs in October 2005. He has extensive experience in<br />

the legal, compliance, and operations departments of independent broker-dealers.<br />

Most recently, Dave worked as vice president of operations and counsel at Securities<br />

Service Network, Inc. (SSN). In 2002, he was recognized as SSN’s Employee of the<br />

2010 FSI Broker- Dealer Conference<br />

19

ED SESSIONS<br />

Year for his outstanding contributions to customer service. Before joining SSN,<br />

Dave served as regional compliance manager and special investigations attorney<br />

with InterSecurities, Inc. (ISI). Prior to his affiliation with ISI, he served as assistant<br />

director of compliance at Commonwealth Equity <strong>Services</strong>, Inc. (now known as<br />

Commonwealth <strong>Financial</strong> Network, Inc.) and as assistant to the executive director of<br />

the <strong>Institute</strong> of Certified <strong>Financial</strong> Planners (now known as the FPA).<br />

dave is licensed to practice law in Massachusetts and Tennessee. Dave also holds<br />

the Series 7, 24, 53, 63, and 65 licenses.<br />

Neal Sullivan is co-chair of Bingham’s Securities Area, a 120-attorney group within<br />

Bingham McCutchen. He is also practice group leader of the firm’s broker-dealer<br />

group. Neal conducts a comprehensive securities regulatory practice and maintains<br />

a particular focus on broker-dealer and investment adviser matters. He regularly<br />

represents clients before the SEC, FINRA, and other self-regulatory organizations<br />

and state securities agencies, frequently concerning emerging regulatory issues. In<br />

addition, he has extensive experience with private and public investigations and<br />

enforcement proceedings brought by the SEC, FINRA, and its predecessor entities<br />

(NASD and NYSE) and state agencies. Neal serves as outside counsel to the Boston<br />

Options Exchange and to Bourse de Montréal with regard to U.S. registration<br />

issues. He was formerly outside counsel to the Boston Stock Exchange.<br />

Neal has appeared before the U.S. Congress to provide testimony on various<br />

SEC proposals and proposed federal oversight of the U.S. capital markets. He is<br />

the former executive director of the North American Securities Administrators<br />

Association and a former vice president, regulation, of the Boston Stock Exchange.<br />

Session Outline—Regulatory Update: What’s On the Agenda<br />

I. Congress<br />

a. Regulatory reform<br />

i. Standard of care<br />

ii. Enhanced regulatory oversight<br />

b. Other issues<br />

II. SEC<br />

a. Strategic plan<br />

i. 12b-1 Fees<br />

ii. Point-of-sale disclosures<br />

iii. Investor education<br />

iv. Municipal securities<br />

b. Other issues<br />

20 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

III. FINRA<br />

a. Rulebook consolidation<br />

i. Expansion of FINRA’s jurisdiction<br />

b. Other issues<br />

IV. NASAA<br />

a. Seeking to expand their jurisdiction<br />

i. RIA supervision<br />

ii. Regulation D, Rule 506 offerings<br />

b. Other issues<br />

Approaches to Supervision: The Risks and Benefits<br />

Tuesday, January 26, 1:00pm–2:15pm (75 minutes)<br />

Centralized or decentralized Does supervision belong in the branch office or the home office<br />

Compliance and supervisory professionals regularly have to determine how to best structure supervisory<br />

responsibilities in order to minimize risk, ensure operational efficiencies, and satisfy regulatory<br />

requirements. This panel will explore the risks and benefits associated with these different models<br />

and help provide information to assist you in developing policies and procedures for the model that<br />

best fits your organization.<br />

Moderator: Kerry Cunningham, Head of Risk Management, ING Advisors Network<br />

Speakers: Christopher Maryanopolis, President, Signator Investors, Inc.<br />

Paul Tolley, Chief Compliance Officer, Commonwealth <strong>Financial</strong> Network<br />

Kerry Cunningham is head of risk management for ING Advisors Network. She<br />

is responsible for overseeing the compliance and operational risk programs of the<br />

Network’s four independent broker-dealers and for other business areas. Prior to<br />

joining ING in 2001, Kerry served as chief counsel in the NASD’s Chicago District<br />

Office. Prior to her work with the NASD, Kerry was an enforcement branch chief in<br />

the Los Angeles office of the Securities and Exchange Commission.<br />

Kerry maintains active memberships in several industry organizations. She is a<br />

past Compliance Council chair and board member of FSI and a past member<br />

of the board of directors for the National Society of Compliance Professionals.<br />

Kerry currently serves as a member of the FINRA District Committee for District<br />

No. 2. Kerry is a graduate of Loyola Law School of Los Angeles and the University<br />

of California at San Diego.<br />

2010 FSI Broker- Dealer Conference<br />

21

ED SESSIONS<br />

Chris Maryanopolis has over 22 years of experience in the financial services industry<br />

and over 8 years of experience as a senior level executive. He has experience in<br />

client services, marketing, and sales within diversified financial firms. He was hired<br />

with John Hancock <strong>Financial</strong> Network in May 2007 and is currently president of<br />

Signator Investors, Inc.<br />

Prior to that, he was president of Equity <strong>Services</strong> and also served as the chief<br />

of broker dealer operations with NYLIFE Securities. In 1990, Chris obtained his<br />

M.B.A. from Fordham and in 1986, his B.A. from the SUNY at Stony Brook.<br />

Paul Tolley has been chief compliance officer at Commonwealth <strong>Financial</strong> Network<br />

since August 2006. As CCO of Commonwealth, Paul is responsible for establishing,<br />

administering, and enforcing Commonwealth’s broker-dealer and investment adviser<br />

supervisory and compliance policies and procedures. He is also responsible for the<br />

general management and leadership of the firm’s compliance and licensing staff.<br />

Paul has more than 19 years of compliance experience and a strong background in<br />

broker-dealer and investment advisory compliance best practices. Prior to joining<br />

Commonwealth, Paul was first vice president and chief compliance officer for<br />

National Planning Holdings of Santa Monica, Calif., where he oversaw compliance<br />

for the four independent broker-dealers within the NPH broker-dealer network. He<br />

has also served in senior compliance positions at Cambridge Investment Research<br />

and LPL.<br />

Paul holds FINRA Series 4, 7, 24, 53, 63, and 65 securities licenses. Paul earned his<br />

B. S. in Business Administration from Northeastern University in Boston.<br />

Session Outline—Approaches to Supervision: The Risks and Benefits<br />

Whether you’re with a large or small firm, deciding what supervisory structure is<br />

best for your firm can be challenging. This interactive panel, which includes representatives<br />

of both supervisory and compliance functions, will discuss the pros<br />

and cons of centralized, decentralized, and hybrid supervision models and the<br />

challenges each model presents for the supervisors, their chain of command, and<br />

compliance professionals.<br />

I. Overview of Supervision vs. Compliance, Types of Supervisory Models, and<br />

Changing Regulatory Views<br />

II. Discussion Areas:<br />

a. The advantages/disadvantages of supervision in the field by OSJ managers<br />

b. The advantages/disadvantages of centralized supervision by employees in<br />

the home office<br />

c. Special issues involving producing managers, geographic locations of<br />

offices, special products, etc.<br />

22 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

d. Reporting structures of supervisors in any model<br />

e. Areas of the business that might be appropriate for home office supervision<br />

even where a decentralized field supervision model is used—the hybrid model<br />

f. If some supervision must be in the Compliance Department, can the<br />

inherent conflicts of interest be handled and, if so, how<br />

III. Questions and Answers<br />

Yes, You Do Need To Know About Social Media!<br />

Or, What’s All This Tweeting Going On<br />

(Joint Session with Marketing)<br />

Tuesday, January 26, 2:30pm–3:45pm (75 minutes)<br />

Facebook, Twitter, LinkedIn, Tumblr—social media has exploded in the last couple of years, encouraging<br />

both firms and their customers to communicate, network, and share information. Who’s using<br />

it (Some of you are—and so are some of your advisors.) How do you participate in it—and how do<br />

you “control” it What are the regulatory views on social media What are the risks If you can’t beat<br />

them, join them. Just know how to do it the right way.<br />

Speakers: Karalyn Carlton, Vice President, Marketing, Pacific West Securities, Inc.<br />

Tom Pappas, Vice President and Director of Advertising Regulation, FINRA<br />

Jeff Williams, Vice President & CCO, Northwestern Mutual Investment <strong>Services</strong><br />

Karalyn Carlton’s focus as vice president of marketing for Pacific West <strong>Financial</strong><br />

Group is to create programs that add value to the firm’s financial professionals’<br />

practices, manage the firm’s marketing efforts, improve communication, and<br />

expand business through field development. Prior to joining Pacific West in 2002,<br />

Karalyn worked in business development for a branding agency, concentrating in<br />

sales and assisting clients with their marketing initiatives. She also has served as<br />

marketing manager for a national craft beverage company and as project manager<br />

for a business interiors firm.<br />

Karalyn holds the 7 and 66 licenses and obtained the Accredited Asset<br />

Management Specialist (AAMS) designation. She is a member of the American<br />

Marketing Association and serves on serves on FSI’s Marketing Council.<br />

2010 FSI Broker- Dealer Conference<br />

23

ED SESSIONS<br />

Thomas Pappas is vice president and director of the FINRA Advertising Regulation<br />

Department, which regulates the advertisements, sales literature, and correspondence<br />

used by FINRA firms. His responsibilities include rule development,<br />

management of the filing and surveillance programs, and related enforcement<br />

activities. He served in the same role at NASD before its 2007 consolidation with<br />

NYSE Member Regulation, which resulted in the formation of FINRA. He joined<br />

NASD in 1984 and was previously with Davenport & Company LLC. He received a<br />

bachelor’s degree from The University of Richmond and an M.B.A. from Virginia<br />

Commonwealth University.<br />

Jeff Williams is the vice president and chief compliance officer for Northwestern<br />

Mutual Investment <strong>Services</strong>, LLC, which is a subsidiary of The Northwestern Mutual<br />

Life Insurance Company, and a registered broker-dealer and investment advisor. In<br />

his capacity as CCO, Jeff is responsible for the compliance program for the firm<br />

and its 7,000+ representatives. Jeff joined The Northwestern Mutual Life Insurance<br />

Company in 1991 as the corporate risk manager and subsequently became vice<br />

president of compliance risk management. Jeff received a B.S. degree in business<br />

administration from the University of Illinois (Champaign) in 1977.<br />

Session Outline—Yes, You Do Need To Know About Social Media! Or,<br />

What’s All This Tweeting Going On<br />

I. Social Media as a Marketing Tool<br />

a. What is social media<br />

b. The current landscape: social media today (LinkedIn, Twitter, etc.)<br />

c. Before you get started<br />

d. Strategies for growing brand awareness and establishing and building<br />

relationships<br />

e. Challenges marketing departments face in these efforts<br />

II. Rules and Regulations Applicable to Social Media<br />

a. How do SEC and FINRA rules apply to social media<br />

• Record keeping—retain, archive, and retrieve<br />

• Internal approval by registered principal<br />

• FINRA filing requirements<br />

• Issues relating to content<br />

• Supervision and procedures<br />

b. Update on recent guidance issued by FINRA<br />

III. A CCO’s Perspective<br />

a. Requests to use social media<br />

• Internal (marketing, communications, recruiting)<br />

• External (brokers, customers)<br />

24 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

b. What are potential social media risks your firm should consider<br />

• Advertising rules—supervision and retention<br />

• Communication threads—supervision and retention<br />

• Access to sites<br />

• Outside business activities<br />

• “Newness” risk<br />

• Image protection<br />

c. How do you manage these risks<br />

• Policies and procedures<br />

• Supervisory controls<br />

• Technology<br />

d. Observations<br />

2010 FSI Broker- Dealer Conference<br />

25

ED SESSIONS<br />

Investment Advisory <strong>Services</strong> track<br />

Points of View: Competitive Strategies for Serving RIAs<br />

Tuesday, January 26, 8:30am–9:45am (75 minutes)<br />

Are you as competitive as you can be for new recruits looking to retain their independent RIAs while<br />

coming on board with your firm This session will present the points of view of BD/RIAs, large RIAs,<br />

and IARs looking to relocate, examining the different options to meet these needs and how each<br />

option will affect the firm’s bottom line. Former noted industry consultant Mark Tibergien, now CEO<br />

of Pershing Advisor Solutions, will lead you through whether to allow independent RIAs to use your<br />

proprietary trade programs, conduct asset management, custody away, and share fees with third<br />

parties such as accountants and lawyers. Mark also will explore current RIA trends, including growth<br />

and retraction.<br />

Speaker: Mark Tibergien, CEO, Pershing Advisor Solutions, LLC<br />

Mark Tibergien is managing director of Pershing LLC. Previously, Mark was a principal<br />

in Moss Adams LLP, where he was chairman of the <strong>Financial</strong> <strong>Services</strong> Industry<br />

Group. He has consulted with hundreds of financial services organizations in the<br />

U.S, Australia, and Canada. For the past eight years, Accounting Today has recognized<br />

Mark as one of the “100 Most Influential” people in the accounting profession,<br />

and for the seventh time, Investment Advisor magazine recognized him as<br />

one of the “25 Most Influential” people in the financial services industry. He<br />

authored two books, Practice Made Perfect and How to Value, Buy or Sell a<br />

<strong>Financial</strong> Advisory Practice.<br />

A Second Look at Third-Party Platforms<br />

Tuesday, January 26, 10:00am–11:30am (90 minutes)<br />

Take a new look at fresh opportunities on the third-party platform and a second look at responsibilities<br />

your current agreements put on your firm that you may not even realize. Learn about the latest<br />

options available to firms interested in offering advisors access to third-party money management<br />

that may save your advisors money and your firm time. Understand when you need to dust off your<br />

solicitation agreements or addendums and get clear on how your responsibilities, opportunities,<br />

and liabilities vary depending on your role as a sponsor, sub-advisor, co-advisor, and solicitor. Join<br />

this panel to learn how to navigate through third-party platforms and explore agreements and relationships<br />

between third-party money managers and IBD/RIAs, revenue sharing, dos and don’ts of<br />

entering into these relationships, and much more.<br />

26 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Moderator: Terrance (Tracy) DeWald, Senior Vice President and General Counsel, Securities<br />

America, Inc.<br />

Speakers: Michael Bell, President and Chief Executive Officer, Curian Capital<br />

Maria Markovich, J.D., Senior Attorney, SEI Advisor Network<br />

Terrance (Tracy) DeWald’s distinguished legal and securities industry career<br />

began in 1987 in Omaha, Nebraska. He spent the first 11 years in private practice,<br />

where he became specialized in securities litigation and arbitration matters. In<br />

1998, Tracy left private practice to accept a position as chief compliance officer<br />

and counsel for The Mutual of Omaha Companies, where he served until 2003,<br />

and from 2003–2007, he served as chief compliance officer for TD Ameritrade.<br />

Currently, Tracy is the senior vice president and general counsel for Securities<br />

America, Inc., and affiliated companies, serving in that position since June of 2007.<br />

tracy is a graduate of Creighton University School of Law, where he is currently an<br />

adjunct professor in the field of arbitration law and procedure. He also remains a<br />

sought-after speaker at many industry and regulatory conferences in the areas of<br />

compliance, privacy/safeguarding, and anti-money laundering issues.<br />

Michael Bell is president and chief executive officer of Curian Capital and Curian<br />

Clearing (“Curian”). As Curian’s CEO, Michael has senior management responsibility<br />

for the strategy and direction of the company. He was named president and<br />

CEO in 2005 after serving as chief legal officer for Curian and Jackson National<br />

Life Distributors LLC, the marketing arm of Curian’s parent, Jackson National Life<br />

Insurance Company ® (Jackson SM ). Michael joined Jackson in 2003 to manage the<br />

legal, regulatory, and compliance activities for Curian, Jackson National Life<br />

Distributors LLC, and National Planning Holdings ® , Inc. Michael was previously a<br />

senior executive at FOLIOfn, Inc., where he served as chief administrative officer<br />

and general counsel and was responsible for the firm’s finance, accounting, legal,<br />

regulatory, compliance, human resources, and administrative functions. Before<br />

joining FOLIOfn, Michael was a corporate finance attorney for Latham & Watkins<br />

and a certified public accountant for KPMG.<br />

Maria Markovich has been a member of SEI’s legal team since 2007, providing<br />

legal services to SEI’s Advisor Network. Prior to joining SEI, Maria was an associate<br />

with the law firms of Drinker Biddle & Reath LLP (Philadelphia), specializing in the<br />

representation of mutual funds and prior to that was with Sullivan & Cromwell LLP<br />

(New York), concentrating in the areas of securities transactions and in the representation<br />

of banks and other financial institutions. Maria is a graduate of the<br />

University of Pennsylvania (B.A. in English), the Pennsylvania Academy of the Fine<br />

Arts (certificate in sculpture), New York University (M.A. in economics) and<br />

Brooklyn Law School (J.D.). Prior to attending law school, Maria was an assistant<br />

bank examiner with the Federal Reserve Bank of New York.<br />

2010 FSI Broker- Dealer Conference<br />

27

ED SESSIONS<br />

Session Outline—A Second Look at Third-Party Platforms<br />

I. Welcome and Introductions<br />

II. Business Models<br />

a. Solicitation model (Top 10 points of interest)<br />

i. Duties and responsibilities of platform and solicitor<br />

ii. Fees of manager and solicitor<br />

iii. Regulatory/compliance issues for manager and solicitor<br />

iv. Miscellaneous topics/issues<br />

b. Sub-advisor model (Top 10 points of Interest)<br />

i. Duties and responsibilities of advisor and sub-advisor<br />

ii. Fees of advisor and sub-advisor<br />

iii. Regulatory/compliance issues for advisor and sub-advisor<br />

iv. Miscellaneous topics/issues<br />

c. Co-advisor model (Top 10 points of Interest)<br />

i. Duties and responsibilities of co-advisors<br />

ii. Fees of co-advisors<br />

iii. Regulatory/compliance issues for co-advisors<br />

iv. Miscellaneous topics/issues<br />

III. Compliance Overview and Approaches from the Platform-user Perspective<br />

a. Reports<br />

b. Other materials<br />

c. Restrictions<br />

d. Communication<br />

Anatomy of an RIA Acquisition<br />

Tuesday, January 26, 1:00pm–2:15pm (75 minutes)<br />

This session has been approved for 1.5 hours of continuing education for CFP ® , CLU ® , and ChFC ® .<br />

Growth is essential—whether by acquiring or aligning with a larger firm—but where do you go<br />

from there Join your colleagues to hear from Philip Palaveev and two broker-dealer executives on<br />

a checklist and timeline for an acquisition’s steps, on examining the process for BD/RIA-BD/RIA,<br />

BD-RIA, or RIA-RIA acquisitions, as well as the regulatory guidelines and common pitfalls to avoid in<br />

a merger/acquisition.<br />

Moderator: Philip Palaveev, President, Fusion Advisor Network<br />

Speakers: Derek J. Bruton, Executive Vice President, National Sales Manager, Independent Advisor<br />

<strong>Services</strong>, LPL <strong>Financial</strong> Corporation<br />

Jeff Rosenthal, Senior Vice President & Chief Marketing Officer, Triad Advisors, Inc.<br />

28 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Philip Palaveev is president of Fusion Advisor Network, a network of some of the<br />

leading independent advisory firms in the country. Fusion provides associated<br />

member firms with business management consulting, marketing, technology optimization,<br />

human resource guidance, benefits, and situational support for equity<br />

transactions.<br />

In his role, Philip leads practice management for the firm and drive its expansion<br />

in the registered investment advisory (RIA) area. In addition, Philip works with new<br />

and existing Fusion members, leveraging his recognized expertise to help them<br />

grow and improve their practices.<br />

Prior to joining Fusion, Philip was a principal with Moss Adams LLP, where he led<br />

the market research for the firm. Specializing in consulting with broker-dealers,<br />

insurance companies, and investment advisers, Philip has participated in over 200<br />

consulting engagements, helping the industry’s largest national firms as well as<br />

the fastest growing RIAs create their pricing and financial management structure.<br />

Derek Bruton is national sales manager for LPL <strong>Financial</strong> Independent Advisor<br />

<strong>Services</strong>. He has responsibility for business consulting for all independent advisors<br />

and is focused on driving advisor satisfaction, supporting the growth of their business,<br />

and serving as a key advocate for their needs.<br />

Derek joined LPL <strong>Financial</strong> in 2007. Prior to joining the firm, he was a managing<br />

director and national sales manager at TD Ameritrade Institutional, presiding<br />

over the institutional sales force. Before TD Ameritrade, Derek worked as director<br />

of money manger services at Merrill Lynch from 2001 through 2005, managing<br />

Merrill’s institutional custody and trading businesses for registered investment<br />

advisers. From 1994 to 2001, Derek served in various sales and sales management<br />

positions with Charles Schwab Institutional. During this period, he managed topperforming<br />

sales teams in both northern California and New York.<br />

derek graduated with a Bachelor of Arts in history and organizational behavior<br />

from Stanford University and is Series 7, 8, 24, and 63 registered.<br />

Jeffrey L. Rosenthal currently serves as chief marketing officer and senior vice<br />

president for Triad Advisors, an independent broker-dealer headquartered in<br />

Atlanta, Georgia. Jeff builds and enhances the relationship and experience Triad’s<br />

affiliated advisors have with the home office. His primary responsibilities include<br />

constructing product distribution, education, and due diligence for Triad’s 450<br />

affiliated advisors across all product lines. With a focus on developing strong relationships,<br />

Jeff is instrumental in assisting advisors grow their practices in a rapidly<br />

changing marketplace.<br />

2010 FSI Broker- Dealer Conference<br />

29

ED SESSIONS<br />

Prior to joining Triad in 2003, Jeff served as an estate planning specialist with<br />

Hartford Life helping successful advisors create and implement estate planning<br />

solutions for their clients. Before Hartford Life, Jeff was an independent financial<br />

advisor working with emerging‐affluent and affluent business owners in and<br />

around Atlanta from 1993 to 2003. He is currently registered with his Series 6, 7,<br />

63, and 24 and is fully licensed for all life, health and sickness products.<br />

The Evolution of Performance Reporting Using GIPS ®<br />

Tuesday, January 26, 2:30pm–3:45pm (75 minutes)<br />

Compliance-recruiting competition has become increasingly challenging, and 2010 will not likely be<br />

much different. Learn how to differentiate your firm by offering a system that can support performance<br />

reporting and GIPS standards to your IARS and potential recruits. This session will offer firms<br />

an invaluable look into key requirements to stay ahead of the changes and challenges of offering<br />

performance reporting support to your representatives and will discuss best practices on applying<br />

GIPS as well as a review of the crucial issues and latest evolution in performance measurement.<br />

Speakers: Kimberly Cash, CAP, CIPM, Ashland Partners & Company, LLP<br />

Kim LaBarbiera-Paschall, J.D., Associate Vice President, Advisory Compliance,<br />

Ameritas Investment<br />

Kimberly Cash, CPA, CIPM, is a partner with Ashland Partners & Co. LLP. She<br />

speaks internationally on GIPS, sharing 15 years of practical experience in the<br />

detailed analysis of composite construction, performance compilations, and the<br />

intricacies of the full and fair disclosures that are the ethical foundation of the<br />

performance standards. She participated on the AICPA committee that wrote the<br />

SOP establishing national guidance for CPAs conducting verifications.<br />

As an expert in the field, she’s working directly with clients and training a professional<br />

staff of 95 strong with her knowledge of the standards and the industry,<br />

coupled with her ability to match practical applications of the standards to each<br />

client’s unique compliance concerns.<br />

as the partner in charge of verification services at Ashland, she continues to<br />

emphasize ethics and client service as the cornerstone of the firm’s success, while<br />

continually updating and improving service and overseeing client communication<br />

through The Verifier newsletter.<br />

30 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Kim LaBarbiera-Paschall has 20 years of experience in the financial services<br />

industry. She has worked in legal and risk management for banking, investment,<br />

and insurance companies including Prudential, HSBC, Ameriprise, and ING/Multi-<br />

<strong>Financial</strong>. Currently, Kim is the advisory associate vice president and CO of<br />

Ameritas Investment Corp., Bethesda, Md. She has her Series 6, 7, 9/10, 24, 63,<br />

and 66 licenses. She also passed the New York and Virginia state insurance exams.<br />

A member of the New York and New Jersey bars, Kim is pursuing her L.L.M. in<br />

corporate securities law at Georgetown University and is a graduate of Seton Hall<br />

Law School and Boston College. As an active member of the financial services<br />

industry, Kim is a frequent speaker on investment advisory, legal, and compliance<br />

topics. On a more personal note, Kim is a member of the U.S. Sailing Association<br />

and tries to get out sailing as frequently as she can in the Alexandria, Va. area,<br />

where she lives.<br />

Session Outline—The Evolution of Performance Reporting Using GIPS<br />

I. Why comply with the GIPS standards<br />

II. How can I prepare for a GIPS compliance project<br />

III. What should I expect when getting into compliance<br />

IV. What goes into a GIPS compliant presentation<br />

V. Should the firm be verified<br />

VI. What’s new with GIPS in 2010<br />

2010 FSI Broker- Dealer Conference<br />

31

ED SESSIONS<br />

Marketing Track<br />

Lifeline: Helping Your Advisors Build a Business<br />

Tuesday, January 26, 8:30am–9:45am (75 minutes)<br />

A practice management offering can be the ultimate relationship builder for broker-dealers and<br />

their advisors. Developing a program presents a number of challenges but potentially can enhance<br />

recruiting results, drive financial advisor success, aid advisor retention, and even improve partner<br />

firm relationships.<br />

Our speakers, Dave Patchen, regional director, Raymond James <strong>Financial</strong> <strong>Services</strong>, and Mark<br />

Schoenbeck, CFP ® , chief marketing officer and director of practice management, Genworth <strong>Financial</strong><br />

Wealth Management, will focus on this critical business-building technique and why and how to<br />

provide the proper support for your advisors. Other discussion items will include content creation<br />

and delivery, leveraging your partner relationships, and obtaining buy-in.<br />

Speakers: David Patchen, Regional Director, Raymond James <strong>Financial</strong> <strong>Services</strong><br />

Mark Schoenbeck, CFP ® , Chief Marketing Officer & Director of Practice Management,<br />

Genworth <strong>Financial</strong> Wealth Management<br />

David (Dave) Patchen began as a wirehouse producer before moving on to<br />

become an independent contractor branch owner and producer. Prior to coming<br />

to RJFS, Dave was COO of a nationwide independent contractor broker-dealer<br />

that cleared through Raymond James and was founder of Jefferson Capital<br />

Management, a fee-only investment management RIA firm.<br />

He earned his B.S. degree in marketing from Indiana University of Pennsylvania,<br />

and an M.B.A. from the University of Florida. In 2005, he completed the<br />

Registered Corporate Coach (RCC) Program and is now a member of the<br />

Worldwide Association of Business Coaches (WABC). He currently coaches<br />

40 RJFS offices, including Mark Smith in Denver, Colo. Dave has been Series<br />

7 licensed since 1988. He holds FINRA Series 3, 7, 24, 63 and 65 licenses.<br />

Mark Schoenbeck, CFP ® , is chief marketing officer and director of practice<br />

management for Genworth <strong>Financial</strong> Wealth Management. He is responsible for<br />

the development and execution of the firm’s marketing strategies, public relations,<br />

corporate events, and practice management offerings. Mark started his career in<br />

the financial services industry as a financial advisor before moving into leadership<br />

roles within a large independent broker-dealer and money management firm.<br />

He has been widely published in industry publications and is a frequent industry<br />

speaker. Mark earned a bachelor’s degree from California Lutheran University and<br />

holds FINRA licenses 7, 63, 65 and 24. Mark lives in California with his wife Victoria<br />

and his two children, Finley and Daxs.<br />

32 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Session Outline—Lifeline: Helping Your Advisors Build a Business<br />

I. Dedicating Resources to Practice Management<br />

II. The Challenges<br />

III. Tips and Takeaways<br />

IV. Questions and Answers<br />

Recruiting Best Practices<br />

Tuesday, January 26, 10:00am–11:30am (90 minutes)<br />

As the financial services industry undergoes the most significant reform it’s experienced in the last<br />

75 years, it’s clear no facet of our business will go untouched. This change will create great opportunities<br />

and challenges. While the recruiting initiatives of many organizations will benefit from the tailwinds<br />

of financial services reform and the impending industry consolidation, the growth opportunity<br />

will be met with some headwinds. The rapid change will effect how broker-dealers position themselves<br />

in the marketplace, as well as how they attract, onboard, and retain the industry’s best talent.<br />

This session will explore industry trends, highlights opportunities to differentiate your company, and<br />

provides practical concepts and tools you can employ immediately to drive sustainable growth.<br />

Speakers: Chris Flint, CRPC, Vice President, Head of Advisor & Acquisition Strategy,<br />

Lincoln <strong>Financial</strong> Network<br />

Mary Sieck, President, <strong>Financial</strong> <strong>Services</strong> Group, Management Advisors International<br />

Christopher Flint is head of advisor recruitment for the retail distribution network<br />

of Lincoln <strong>Financial</strong> Group. Chris assumed the role in April 2006. Prior to that, he<br />

served as a senior vice president of branch office development for Securities<br />

America, Inc., and managing principal for Securities America Wealth Management<br />

Group in Omaha, Neb.<br />

Chris has a Master of Business Administration degree and a Master of Information<br />

Systems degree from Creighton University. He holds Series 4, 7, 24, 53, 63, and<br />

66 licenses and most recently achieved his CRPC designation.<br />

chris and his wife, Amber, have been married for 14 years and are the proud<br />

parents of two children, Alexandria and Greyson.<br />

2010 FSI Broker- Dealer Conference<br />

33

ED SESSIONS<br />

Mary Sieck, president of the <strong>Financial</strong> Service Group for Management Advisors<br />

International, an executive search firm, is based out of Charlotte, NC. She has<br />

completed several retained searches for senior level executives in the securities,<br />

broker-dealer, investment advisor, insurance, and mutual fund industries nationwide.<br />

In addition to retained executive searches, she had partnered with client companies,<br />

also on a contingency basis, helping to build sales supervision and compliance<br />

audit teams, financial analysts, and modelers, throughout the United States.<br />

Mary’s division places all levels of candidates in these industries and provides<br />

consultants and contractors for projects or merger/acquisition initiatives to allow<br />

clients to have the best temporary talent available in the industry.<br />

Session Outline—Recruiting Best Practices<br />

I. Industry Highlights—<strong>Financial</strong> Reform & its Impact on Recruiting<br />

II. Positioning for Growth—How to Differentiate in a Commoditized Marketplace<br />

III. Strategies to Attract Your Target Profile—Marketing & Recruiting<br />

IV. On-boarding Best Practices—Transition & Retention<br />

V. Open Forum for Group Discussion & Questions<br />

State of the Annuity Business<br />

Tuesday, January 26, 1:00pm–2:15pm (75 minutes)<br />

This session has been approved for 1.0 hour of continuing education for CFP ® , CLU ® , and ChFC®.<br />

Given the market declines of the last two years, what was the impact on variable annuities and their<br />

riders What does the future hold, and how should advisors be marketing these products And,<br />

looking ahead to 2011 when equity indexed annuities may be treated as securities, what do firms<br />

need to be concerned about when looking at their product lists Cathy Weatherford, president and<br />

CEO of the Insured Retirement <strong>Institute</strong> (formerly NAVA), will present and examine the changing<br />

regulatory climate for annuities.<br />

Speaker: Cathy Weatherford, President & CEO, Insured Retirement <strong>Institute</strong><br />

34 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

Catherine (Cathy) Weatherford is the president and CEO of IRI, the organization<br />

that supports the importance of retirement planning, including the growth, acceptance,<br />

and understanding of annuity and variable life products. Prior to joining IRI,<br />

Cathy served for 12 years as the EVP and CEO for the National Association of<br />

Insurance Commissioners. Cathy was also the first woman to serve as Oklahoma’s<br />

insurance commissioner, a position she held from 1991–1995 after serving as a<br />

senior policy advisor to Oklahoma Governor David Walters. She began her career<br />

serving in several capacities in her 13-year tenure at the Oklahoma Insurance<br />

Department.<br />

Yes, You Do Need To Know About Social Media!<br />

Or, What’s All This Tweeting Going On<br />

(Joint Session with Compliance)<br />

Tuesday, January 26, 2:30pm–3:45pm (75 minutes)<br />

Facebook, Twitter, LinkedIn, Tumblr—social media has exploded in the last couple of years, encouraging<br />

both firms and their customers to communicate, network, and share information. Who’s using<br />

it (Some of you are—and so are some of your advisors.) How do you participate in it—and how do<br />

you “control” it What are the regulatory views on social media What are the risks If you can’t beat<br />

them, join them. Just know how to do it the right way.<br />

Speakers: Karalyn Carlton, Vice President, Marketing, Pacific West Securities, Inc.<br />

Tom Pappas, Vice President and Director of Advertising Regulation, FINRA<br />

Jeff Williams, Vice President & CCO, Northwestern Mutual Investment <strong>Services</strong><br />

Karalyn Carlton’s focus as vice president of marketing for Pacific West <strong>Financial</strong><br />

Group is to create programs that add value to the firm’s financial professionals’<br />

practices, manage the firm’s marketing efforts, improve communication, and<br />

expand business through field development. Prior to joining Pacific West in 2002,<br />

Karalyn worked in business development for a branding agency, concentrating in<br />

sales and assisting clients with their marketing initiatives. She also has served as<br />

marketing manager for a national craft beverage company and as project manager<br />

for a business interiors firm.<br />

Karalyn holds the 7 and 66 licenses and obtained the Accredited Asset<br />

Management Specialist (AAMS) designation. She is a member of the American<br />

Marketing Association and serves on FSI’s Marketing Council.<br />

2010 FSI Broker- Dealer Conference<br />

35

ED SESSIONS<br />

Thomas Pappas is vice president and director of the FINRA Advertising Regulation<br />

Department, which regulates the advertisements, sales literature, and correspondence<br />

used by FINRA firms. His responsibilities include rule development,<br />

management of the filing and surveillance programs, and related enforcement<br />

activities. He served in the same role at NASD before its 2007 consolidation with<br />

NYSE Member Regulation, which resulted in the formation of FINRA. He joined<br />

NASD in 1984 and was previously with Davenport & Company LLC. He received a<br />

bachelor’s degree from The University of Richmond and an M.B.A. from Virginia<br />

Commonwealth University.<br />

Jeff Williams is the vice president and chief compliance officer for Northwestern<br />

Mutual Investment <strong>Services</strong>, LLC, which is a subsidiary of The Northwestern Mutual<br />

Life Insurance Company, and a registered broker-dealer and investment advisor. In<br />

his capacity as the CCO, Jeff is responsible for the compliance program for the firm<br />

and its 7,000+ representatives. Jeff joined The Northwestern Mutual Life Insurance<br />

Company in 1991 as the corporate risk manager and subsequently became the vice<br />

president of compliance risk management. Jeff received a B.S. degree in business<br />

administration from the University of Illinois (Champaign) in 1977.<br />

Session Outline—Yes, You Do Need To Know About Social Media!<br />

Or, What’s All This Tweeting Going On<br />

I. Social Media as a Marketing Tool<br />

a. What is social media<br />

b. The current landscape: social media today (LinkedIn, Twitter, etc.)<br />

c. Before you get started<br />

d. Strategies for growing brand awareness and establishing and building<br />

relationships<br />

e. Challenges marketing departments face in these efforts<br />

II. Rules and Regulations Applicable to Social Media<br />

a. How do SEC and FINRA rules apply to social media<br />

• Record Keeping—retain, archive, and retrieve<br />

• Internal approval by registered principal<br />

• FINRA filing requirements<br />

• Issues relating to content<br />

• Supervision and procedures<br />

b. Update on recent guidance issued by FINRA<br />

III. A CCO’s Perspective<br />

a. Requests to use social media<br />

• Internal (marketing, communications, recruiting)<br />

• External (brokers, customers)<br />

36 2010 FSI Broker- Dealer Conference

ED SESSIONS<br />

b. What are potential social media risks your firm should consider<br />

• Advertising rules—supervision and retention<br />

• Communication threads—supervision and retention<br />

• Access to sites<br />

• Outside business activities<br />

• “Newness” risk<br />

• Image protection<br />

c. How do you manage these risks<br />

• Policies and procedures<br />

• Supervisory controls<br />

• Technology<br />

d. Observations<br />

2010 FSI Broker- Dealer Conference<br />

37

ED SESSIONS<br />

Operations Track<br />

The Art of Efficiency<br />

Tuesday, January 26, 8:30am–9:45am (75 minutes)<br />

Stay competitive, stay in business. If only it were that simple. Efficiency is critical—and challenging.<br />

Learn about how operationally efficient broker-dealers are able to support more investment<br />

professionals, achieve higher levels of productivity, and generate more revenue per employee.<br />

Given increasing competitive pressures, new regulatory requirements, and challenging market<br />

conditions, broker-dealers must enhance their operational infrastructure and processes to achieve<br />

long-term growth.<br />

Moderator: Nate Collins, CFP ® , Managing Director of Operations, ProEquities, Inc.<br />

Speakers: Bobbi Masiello, Senior Vice President, New Business Development, National <strong>Financial</strong>,<br />

a Fidelity Investments company<br />

Michael Nesspor, Managing Director, Pershing, a BNY Mellon company and iNautix, an<br />

affiliate of Pershing<br />

Nate Collins is managing director of operations at ProEquities, Inc., the securities<br />

broker-dealer of Protective Life. Nate has daily responsibility for the firm’s operations,<br />

equity trading, and product due diligence. Prior to joining ProEquities, Nate<br />

served 12 years as the chief financial officer and operations manager of Regions<br />

Investment Company, Inc., which at the time was the securities broker-dealer of<br />

Regions <strong>Financial</strong> Corporation. A CERTIFIED FINANCIAL PLANNER (CFP ® )<br />

certificant, Nate holds the FINRA Series 4, 7, 24, 27, and 63 licenses.<br />

Nate holds a Bachelor of Science degree in accounting from the University<br />

of Alabama.<br />