198/00 Half Tick Trading in the 3-Year Treasury Bond Futures Contract

198/00 Half Tick Trading in the 3-Year Treasury Bond Futures Contract

198/00 Half Tick Trading in the 3-Year Treasury Bond Futures Contract

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

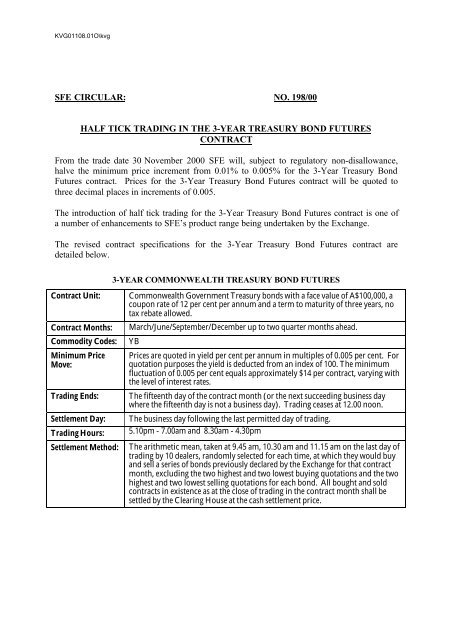

KVG01108.01O\kvgSFE CIRCULAR: NO. <strong>198</strong>/<strong>00</strong>HALF TICK TRADING IN THE 3-YEAR TREASURY BOND FUTURESCONTRACTFrom <strong>the</strong> trade date 30 November 2<strong>00</strong>0 SFE will, subject to regulatory non-disallowance,halve <strong>the</strong> m<strong>in</strong>imum price <strong>in</strong>crement from 0.01% to 0.<strong>00</strong>5% for <strong>the</strong> 3-<strong>Year</strong> <strong>Treasury</strong> <strong>Bond</strong><strong>Futures</strong> contract. Prices for <strong>the</strong> 3-<strong>Year</strong> <strong>Treasury</strong> <strong>Bond</strong> <strong>Futures</strong> contract will be quoted tothree decimal places <strong>in</strong> <strong>in</strong>crements of 0.<strong>00</strong>5.The <strong>in</strong>troduction of half tick trad<strong>in</strong>g for <strong>the</strong> 3-<strong>Year</strong> <strong>Treasury</strong> <strong>Bond</strong> <strong>Futures</strong> contract is one ofa number of enhancements to SFE’s product range be<strong>in</strong>g undertaken by <strong>the</strong> Exchange.The revised contract specifications for <strong>the</strong> 3-<strong>Year</strong> <strong>Treasury</strong> <strong>Bond</strong> <strong>Futures</strong> contract aredetailed below.3-YEAR COMMONWEALTH TREASURY BOND FUTURES<strong>Contract</strong> Unit:<strong>Contract</strong> Months:Commodity Codes:M<strong>in</strong>imum PriceMove:<strong>Trad<strong>in</strong>g</strong> Ends:Settlement Day:<strong>Trad<strong>in</strong>g</strong> Hours:Settlement Method:Commonwealth Government <strong>Treasury</strong> bonds with a face value of A$1<strong>00</strong>,<strong>00</strong>0, acoupon rate of 12 per cent per annum and a term to maturity of three years, notax rebate allowed.March/June/September/December up to two quarter months ahead.YBPrices are quoted <strong>in</strong> yield per cent per annum <strong>in</strong> multiples of 0.<strong>00</strong>5 per cent. Forquotation purposes <strong>the</strong> yield is deducted from an <strong>in</strong>dex of 1<strong>00</strong>. The m<strong>in</strong>imumfluctuation of 0.<strong>00</strong>5 per cent equals approximately $14 per contract, vary<strong>in</strong>g with<strong>the</strong> level of <strong>in</strong>terest rates.The fifteenth day of <strong>the</strong> contract month (or <strong>the</strong> next succeed<strong>in</strong>g bus<strong>in</strong>ess daywhere <strong>the</strong> fifteenth day is not a bus<strong>in</strong>ess day). <strong>Trad<strong>in</strong>g</strong> ceases at 12.<strong>00</strong> noon.The bus<strong>in</strong>ess day follow<strong>in</strong>g <strong>the</strong> last permitted day of trad<strong>in</strong>g.5.10pm - 7.<strong>00</strong>am and 8.30am - 4.30pmThe arithmetic mean, taken at 9.45 am, 10.30 am and 11.15 am on <strong>the</strong> last day oftrad<strong>in</strong>g by 10 dealers, randomly selected for each time, at which <strong>the</strong>y would buyand sell a series of bonds previously declared by <strong>the</strong> Exchange for that contractmonth, exclud<strong>in</strong>g <strong>the</strong> two highest and two lowest buy<strong>in</strong>g quotations and <strong>the</strong> twohighest and two lowest sell<strong>in</strong>g quotations for each bond. All bought and soldcontracts <strong>in</strong> existence as at <strong>the</strong> close of trad<strong>in</strong>g <strong>in</strong> <strong>the</strong> contract month shall besettled by <strong>the</strong> Clear<strong>in</strong>g House at <strong>the</strong> cash settlement price.

2For fur<strong>the</strong>r <strong>in</strong>formation on please contact <strong>the</strong> undersigned on 02 9256 0489 or by email(kvandege@sfe.com.au), or visit <strong>the</strong> SFE website www.sfe.com.au.KRISTYE VAN DE GEERASSISTANT MANAGER, INTEREST RATE PRODUCTSBUSINESS DEVELOPMENT 9 NOVEMBER 2<strong>00</strong>0