Röhlig Annual Report 2012 Rohlig_Annual_Report_2012.pdf

Röhlig Annual Report 2012 Rohlig_Annual_Report_2012.pdf

Röhlig Annual Report 2012 Rohlig_Annual_Report_2012.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

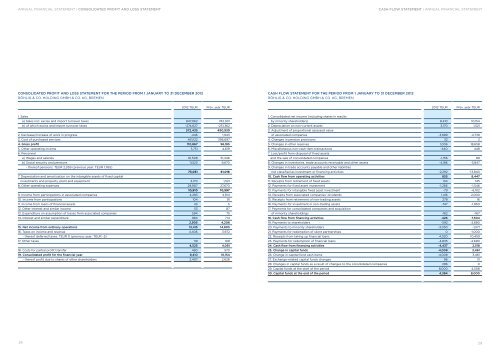

AnnuAl FInAnCIAl StAteMent | CoNSoLIdATed ProFIT ANd LoSS STATeMeNTCASh FLow STATeMeNT | AnnuAl FInAnCIAl StAteMentCoNSoLIdATed ProFIT ANd LoSS STATeMeNT For The PerIod FroM 1 JANUAry To 31 deCeMber <strong>2012</strong>röHlIG & CO. HOlDInG GMBH & CO. KG, BreMenCASh FLow STATeMeNT For The PerIod FroM 1 JANUAry To 31 deCeMber <strong>2012</strong>röHlIG & CO. HOlDInG GMBH & CO. KG, BreMen<strong>2012</strong> teur prev. year teur<strong>2012</strong> teur prev. year teur1. Salesa) Sales incl. excise and import turnover taxes 847,062 742,301b) of which excise and import turnover taxes -274,627 -251,362572,435 490,9392. Decrease/Increase of work in progress -446 1,9433. Cost of purchased services 461,122 396,6974. Gross profit 110,867 96,1855. Other operating income 5,751 4,6196. personnela) Wages and salaries 61,508 51,346b) Social security and pensions 11,523 9,670- thereof pensions: teur 2,059 (previous year: teur 1,765)73,031 61,0167. Depreciation and amortisation on the intangible assets of fixed capitalinvestments and property, plant and equipment 3,170 1,5218. Other operating expenses 29,907 27,67010,510 10,5979. Income from participations in associated companies 4,283 4,81410. Income from participations 104 9111. Income from loans of financial assets 43 512. Other interest and similar income 53 8713. expenditure on assumption of losses from associated companies 594 7514. Interest and similar expenditure 984 7142,905 4,20815. Net income from ordinary operations 13,415 14,80516. taxes on income and revenue 4,406 3,972- thereof deferred taxes: teur 0 (previous year: teur -5)17. Other taxes 119 1094,525 4,08118. Costs for partial profit transfer 480 57019. Consolidated profit for the financial year 8,410 10,154- thereof profit due to shares of other shareholders 2,407 2,6261. Consolidated net income (including shares in resultsby minority shareholders) 8,410 10,1542. Depreciation on non-current assets 3,170 1,5213. Adjustment of proportional assessed valueof associated companies -3,689 -4,7394. Changes in pension provisions 32 35. Changes in other reserves 1,006 18,6586. Miscellaneous non-cash-item transactions -440 4487. loss/profit from disposal of fixed assetsand the sale of consolidated companies -1,156 898. Changes in inventories, trade accounts receivable and other assets -4,186 -3,8479. Changes in trade accounts payable and other liabilitiesnot classified as investment or financing activities -2,292 -13,84010. Cash flow from operating activities 855 8,44711. receipts from retirement of fixed assets 134 14512. payments for fixed asset investment -1,266 -1,54613. payments for intangible fixed asset investment -79 -6,10214. receipts from associated companies’ dividends 1,416 2,00015. receipts from retirement of non-trading assets 278 1616. payments for investment in non-trading assets -747 -1,85017. payments for consolidated companies and acquisitionof minority shareholdings -162 -16718. Cash flow from financing activities -426 -7,50419. payments to shareholders -592 -2,68020. payments to minority shareholders -3,030 -1,57121. payments for redemption of silent partnerships 0 -1,00022. receipts from taking up financial loans 4,020 10,45923. payments for redemption of financial loans -4,835 -2,69024. Cash flow from financing activities -4,437 2,51825. Change in capital funds -4,008 3,46126. Change in capital fund cash items -4,008 3,46127. exchange-related capital funds changes 96 3128. Changes in capital funds as a result of changes to the consolidated companies 296 029. Capital funds at the start of the period 8,000 4,50830. Capital funds at the end of the period 4,384 8,00028 29