Article / Growth: UK economyAutumn 2012Financial servicesITEM club economic<strong>for</strong>ecastThere is welcome news <strong>for</strong> <strong>specialty</strong> insurers keen to optimize opportunities in <strong>the</strong> London markets as <strong>the</strong>latest ITEM <strong>for</strong>ecast <strong>for</strong> financial services sees a return to growth <strong>for</strong> <strong>the</strong> UK economy in <strong>the</strong> second half of2012. GDP is down only 0.2% on <strong>the</strong> year as a whole. Growth <strong>the</strong>n picks up to 1.2% next year <strong>and</strong> to 2.4% in2014 <strong>and</strong> 2015. The <strong>for</strong>ecast includes a mild recovery in consumption, thanks to falling inflation <strong>and</strong> risingemployment. CPI inflation is expected to ease back into line with its target over <strong>the</strong> winter. In this article,we summarize <strong>the</strong> latest findings <strong>and</strong> how <strong>the</strong>y affect general <strong>insurance</strong> (property <strong>and</strong> casualty) companies.After falling 0.9% in 2011, consumer spending is expected to grow by0.6% in 2012 <strong>and</strong> by 0.8% in 2013. Although this is an improvement,it is still weak by historical st<strong>and</strong>ards. The housing market will benefitfrom rising real incomes <strong>and</strong> consumer confidence, as well as <strong>the</strong>easing of funding pressures on <strong>the</strong> mortgage market. We expecthousing transactions to fall to <strong>the</strong>ir lowest levels this autumn be<strong>for</strong>estarting to recover in 2013, with house prices set to follow. Therecovery will be slow, however, with transactions at <strong>the</strong> end of 2016still 39% below <strong>the</strong> levels reached in 2007. The gradual turn in <strong>the</strong>housing market will be assisted by a modest improvement in <strong>the</strong>availability of mortgages. UK banks have reduced <strong>the</strong>ir borrowingfrom overseas banks <strong>and</strong> <strong>the</strong> Bank of Engl<strong>and</strong> <strong>and</strong> can now usegrowing savings deposits to boost lending to <strong>the</strong> private sector. TheFunding <strong>for</strong> Lending Scheme <strong>and</strong> revival of <strong>the</strong> securities market willprovide fur<strong>the</strong>r support.However, <strong>the</strong> improved outlook <strong>for</strong> <strong>the</strong> consumer is offset by aworsening outlook <strong>for</strong> exports. Short-term prospects remain fragile,with <strong>the</strong> Eurozone likely to slip fur<strong>the</strong>r into recession <strong>and</strong> signs of aslowdown in <strong>the</strong> US <strong>and</strong> emerging markets like China <strong>and</strong> India. Butwe are more optimistic about prospects fur<strong>the</strong>r out, given <strong>the</strong> USFederal Reserve’s announcement of additional quantitative easing<strong>and</strong> <strong>the</strong> European Central Bank’s announcement of a new bondbuyingprogram. The willingness of Saudi Arabia to turn on <strong>the</strong>taps, too, should prevent higher oil prices from holding back growth.Providing that <strong>the</strong> Eurozone remains intact <strong>and</strong> <strong>the</strong> US negotiates its“fiscal cliff” successfully, world trade <strong>and</strong> exports should pick up againnext year. Business investment is unlikely to pick up until domestic<strong>and</strong> overseas dem<strong>and</strong> recovers more convincingly, however. Sparecapacity <strong>and</strong> risk aversion are holding back investment, despite verystrong cash flows enjoyed by UK plc. We are <strong>for</strong>ecasting increasesof 2.3% in 2012 <strong>and</strong> 3.9% in 2013– very modest by <strong>the</strong> st<strong>and</strong>ards ofprevious recoveries.The economic environment remains extremely risky. Policy-makersin <strong>the</strong> Eurozone have vowed to do what it takes to hold <strong>the</strong> systemtoge<strong>the</strong>r, but fur<strong>the</strong>r fiscal austerity is still planned <strong>and</strong> progresstoward a banking union is slow. The US fiscal cliff is looming, <strong>and</strong>emerging markets are slowing more than previously expected.Moreover, this summer saw yet ano<strong>the</strong>r example of extreme wea<strong>the</strong>raffecting food <strong>and</strong> o<strong>the</strong>r world markets. Never<strong>the</strong>less, some upsiderisks are now emerging. The world’s largest central banks haveproved adept at dealing with tail risk, <strong>and</strong> <strong>the</strong>ir latest moves are verysupportive. In <strong>the</strong> UK, <strong>the</strong>re is a chance that <strong>the</strong> credit famine mightbe nearing its end, at least in <strong>the</strong> mortgage market, which couldresult in a much stronger bounce in <strong>the</strong> housing market <strong>and</strong> <strong>the</strong> highstreet than we currently envision. Similarly, our <strong>for</strong>ecasts <strong>for</strong> exports<strong>and</strong> investment would need to be revised upward if <strong>the</strong> uncertaintyabout <strong>the</strong> Eurozone was convincingly resolved.Table 1: <strong>for</strong>ecasts of <strong>the</strong>UK economyAnnual percentage changes unless specified2011 2012 2013 2014 2015 2016GDP 0.9 –0.2 1.2 2.4 2.4 2.4Consumer prices 4.5 2.8 2.1 2.0 2.0 2.0Average earnings 2.6 2.0 2.8 3.2 3.9 4.0Unemployment rate (%) 4.7 4.8 4.9 4.5 4.1 3.8Government net borrowing (% of GDP) 8.2 6.7 6.7 5.0 3.5 1.9Three-month interbank rate (%) 0.9 0.9 0.8 1.6 2.5 3.5Effective exchange rate 79.9 83.2 84.2 83.6 81.8 79.4Source: ITEM8 <strong>Specialty</strong> Issue 1 — December 2012

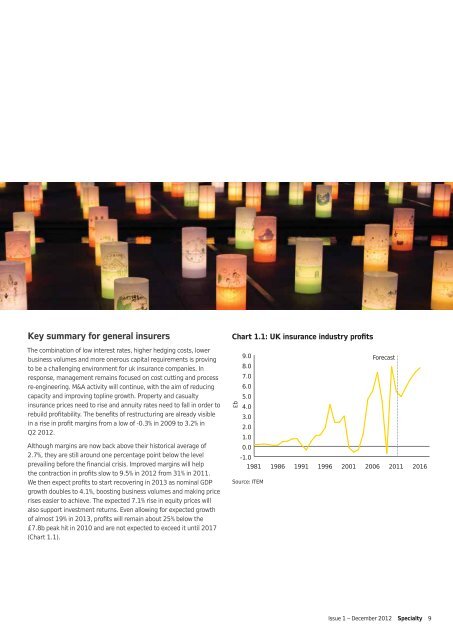

Key summary <strong>for</strong> general insurersChart 1.1: UK <strong>insurance</strong> industry profitsThe combination of low interest rates, higher hedging costs, lowerbusiness volumes <strong>and</strong> more onerous capital requirements is provingto be a challenging environment <strong>for</strong> uk <strong>insurance</strong> companies. Inresponse, management remains focused on cost cutting <strong>and</strong> processre-engineering. M&A activity will continue, with <strong>the</strong> aim of reducingcapacity <strong>and</strong> improving topline growth. Property <strong>and</strong> casualty<strong>insurance</strong> prices need to rise <strong>and</strong> annuity rates need to fall in order torebuild profitability. The benefits of restructuring are already visiblein a rise in profit margins from a low of -0.3% in 2009 to 3.2% inQ2 2012.Although margins are now back above <strong>the</strong>ir historical average of2.7%, <strong>the</strong>y are still around one percentage point below <strong>the</strong> levelprevailing be<strong>for</strong>e <strong>the</strong> financial crisis. Improved margins will help<strong>the</strong> contraction in profits slow to 9.5% in 2012 from 31% in 2011.We <strong>the</strong>n expect profits to start recovering in 2013 as nominal GDPgrowth doubles to 4.1%, boosting business volumes <strong>and</strong> making pricerises easier to achieve. The expected 7.1% rise in equity prices willalso support investment returns. Even allowing <strong>for</strong> expected growthof almost 19% in 2013, profits will remain about 25% below <strong>the</strong>£7.8b peak hit in 2010 <strong>and</strong> are not expected to exceed it until 2017(Chart 1.1).b9.08.07.06.05.04.03.02.01.00.0–1.01981Source: ITEM19861991199620012006Forecast20112016Issue 1 — December 2012 <strong>Specialty</strong> 9