Specialty: Insights for the specialty insurance and ... - Ernst & Young

Specialty: Insights for the specialty insurance and ... - Ernst & Young

Specialty: Insights for the specialty insurance and ... - Ernst & Young

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

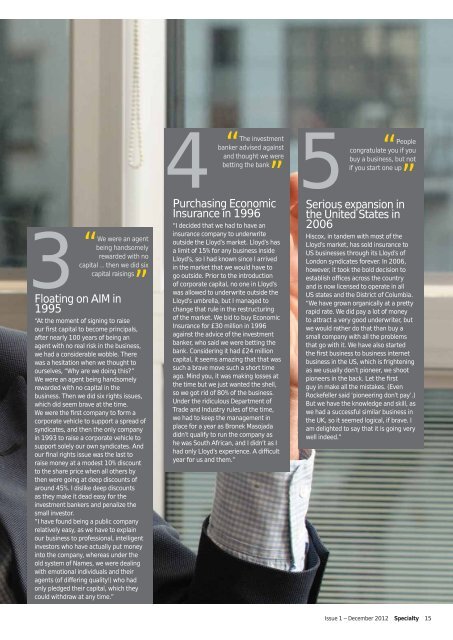

3Floating on AIM in1995“We were an agentbeing h<strong>and</strong>somelyrewarded with nocapital … <strong>the</strong>n we did sixcapital raisings”“At <strong>the</strong> moment of signing to raiseour first capital to become principals,after nearly 100 years of being anagent with no real risk in <strong>the</strong> business,we had a considerable wobble. Therewas a hesitation when we thought toourselves, “Why are we doing this?”We were an agent being h<strong>and</strong>somelyrewarded with no capital in <strong>the</strong>business. Then we did six rights issues,which did seem brave at <strong>the</strong> time.We were <strong>the</strong> first company to <strong>for</strong>m acorporate vehicle to support a spread ofsyndicates, <strong>and</strong> <strong>the</strong>n <strong>the</strong> only companyin 1993 to raise a corporate vehicle tosupport solely our own syndicates. Andour final rights issue was <strong>the</strong> last toraise money at a modest 10% discountto <strong>the</strong> share price when all o<strong>the</strong>rs by<strong>the</strong>n were going at deep discounts ofaround 45%. I dislike deep discountsas <strong>the</strong>y make it dead easy <strong>for</strong> <strong>the</strong>investment bankers <strong>and</strong> penalize <strong>the</strong>small investor.”I have found being a public companyrelatively easy, as we have to explainour business to professional, intelligentinvestors who have actually put moneyinto <strong>the</strong> company, whereas under <strong>the</strong>old system of Names, we were dealingwith emotional individuals <strong>and</strong> <strong>the</strong>iragents (of differing quality!) who hadonly pledged <strong>the</strong>ir capital, which <strong>the</strong>ycould withdraw at any time.”“The investmentbanker advised against<strong>and</strong> thought we werebetting <strong>the</strong> bank”4Purchasing EconomicInsurance in 1996“I decided that we had to have an<strong>insurance</strong> company to underwriteoutside <strong>the</strong> Lloyd’s market. Lloyd’s hasa limit of 15% <strong>for</strong> any business insideLloyd’s, so I had known since I arrivedin <strong>the</strong> market that we would have togo outside. Prior to <strong>the</strong> introductionof corporate capital, no one in Lloyd’swas allowed to underwrite outside <strong>the</strong>Lloyd’s umbrella, but I managed tochange that rule in <strong>the</strong> restructuringof <strong>the</strong> market. We bid to buy EconomicInsurance <strong>for</strong> £30 million in 1996against <strong>the</strong> advice of <strong>the</strong> investmentbanker, who said we were betting <strong>the</strong>bank. Considering it had £24 millioncapital, it seems amazing that that wassuch a brave move such a short timeago. Mind you, it was making losses at<strong>the</strong> time but we just wanted <strong>the</strong> shell,so we got rid of 80% of <strong>the</strong> business.Under <strong>the</strong> ridiculous Department ofTrade <strong>and</strong> Industry rules of <strong>the</strong> time,we had to keep <strong>the</strong> management inplace <strong>for</strong> a year as Bronek Masojadadidn’t qualify to run <strong>the</strong> company ashe was South African, <strong>and</strong> I didn’t as Ihad only Lloyd’s experience. A difficultyear <strong>for</strong> us <strong>and</strong> <strong>the</strong>m.”“Peoplecongratulate you if youbuy a business, but notif you start one up”5Serious expansion in<strong>the</strong> United States in2006Hiscox, in t<strong>and</strong>em with most of <strong>the</strong>Lloyd’s market, has sold <strong>insurance</strong> toUS businesses through its Lloyd’s ofLondon syndicates <strong>for</strong>ever. In 2006,however, it took <strong>the</strong> bold decision toestablish offices across <strong>the</strong> country<strong>and</strong> is now licensed to operate in allUS states <strong>and</strong> <strong>the</strong> District of Columbia.“We have grown organically at a prettyrapid rate. We did pay a lot of moneyto attract a very good underwriter, butwe would ra<strong>the</strong>r do that than buy asmall company with all <strong>the</strong> problemsthat go with it. We have also started<strong>the</strong> first business to business internetbusiness in <strong>the</strong> US, which is frighteningas we usually don’t pioneer, we shootpioneers in <strong>the</strong> back. Let <strong>the</strong> firstguy in make all <strong>the</strong> mistakes. (EvenRockefeller said ‘pioneering don’t pay’.)But we have <strong>the</strong> knowledge <strong>and</strong> skill, aswe had a successful similar business in<strong>the</strong> UK, so it seemed logical, if brave. Iam delighted to say that it is going verywell indeed.”Issue 1 — December 2012 <strong>Specialty</strong> 15