e-IFRSline May 06 - IAS 39: Financial Instruments - Grant Thornton

e-IFRSline May 06 - IAS 39: Financial Instruments - Grant Thornton

e-IFRSline May 06 - IAS 39: Financial Instruments - Grant Thornton

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

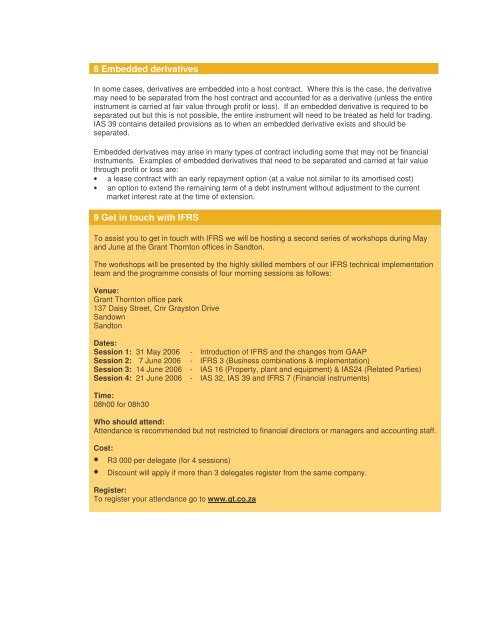

8 Embedded derivativesIn some cases, derivatives are embedded into a host contract. Where this is the case, the derivativemay need to be separated from the host contract and accounted for as a derivative (unless the entireinstrument is carried at fair value through profit or loss). If an embedded derivative is required to beseparated out but this is not possible, the entire instrument will need to be treated as held for trading.<strong>IAS</strong> <strong>39</strong> contains detailed provisions as to when an embedded derivative exists and should beseparated.Embedded derivatives may arise in many types of contract including some that may not be financialinstruments. Examples of embedded derivatives that need to be separated and carried at fair valuethrough profit or loss are:• a lease contract with an early repayment option (at a value not similar to its amortised cost)• an option to extend the remaining term of a debt instrument without adjustment to the currentmarket interest rate at the time of extension.9 Get in touch with IFRSTo assist you to get in touch with IFRS we will be hosting a second series of workshops during <strong>May</strong>and June at the <strong>Grant</strong> <strong>Thornton</strong> offices in Sandton.The workshops will be presented by the highly skilled members of our IFRS technical implementationteam and the programme consists of four morning sessions as follows:Venue:<strong>Grant</strong> <strong>Thornton</strong> office park137 Daisy Street, Cnr Grayston DriveSandownSandtonDates:Session 1: 31 <strong>May</strong> 20<strong>06</strong> - Introduction of IFRS and the changes from GAAPSession 2: 7 June 20<strong>06</strong> - IFRS 3 (Business combinations & implementation)Session 3: 14 June 20<strong>06</strong> - <strong>IAS</strong> 16 (Property, plant and equipment) & <strong>IAS</strong>24 (Related Parties)Session 4: 21 June 20<strong>06</strong> - <strong>IAS</strong> 32, <strong>IAS</strong> <strong>39</strong> and IFRS 7 (<strong>Financial</strong> instruments)Time:08h00 for 08h30Who should attend:Attendance is recommended but not restricted to financial directors or managers and accounting staff.Cost:• R3 000 per delegate (for 4 sessions)• Discount will apply if more than 3 delegates register from the same company.Register:To register your attendance go to www.gt.co.za