Actuarial Review of the Social Insurance Fund 2005 - Department of ...

Actuarial Review of the Social Insurance Fund 2005 - Department of ...

Actuarial Review of the Social Insurance Fund 2005 - Department of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

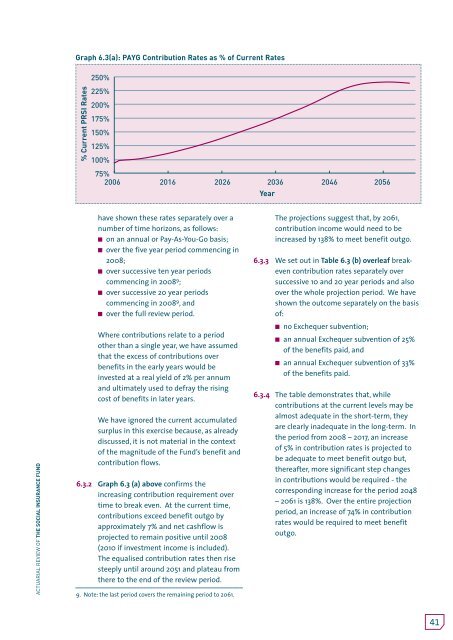

Graph 6.3(a): PAYG Contribution Rates as % <strong>of</strong> Current Rates250%% Current PRSI Rates225%200%175%150%125%100%75%2006 2016 2026 2036 2046 2056Year<strong>Actuarial</strong> <strong>Review</strong> <strong>of</strong> <strong>the</strong> <strong>Social</strong> <strong>Insurance</strong> <strong>Fund</strong>have shown <strong>the</strong>se rates separately over anumber <strong>of</strong> time horizons, as follows:n on an annual or Pay-As-You-Go basis;n over <strong>the</strong> five year period commencing in2008;n over successive ten year periodscommencing in 2008 9 ;n over successive 20 year periodscommencing in 2008 9 , andn over <strong>the</strong> full review period.Where contributions relate to a periodo<strong>the</strong>r than a single year, we have assumedthat <strong>the</strong> excess <strong>of</strong> contributions overbenefits in <strong>the</strong> early years would beinvested at a real yield <strong>of</strong> 2% per annumand ultimately used to defray <strong>the</strong> risingcost <strong>of</strong> benefits in later years.We have ignored <strong>the</strong> current accumulatedsurplus in this exercise because, as alreadydiscussed, it is not material in <strong>the</strong> context<strong>of</strong> <strong>the</strong> magnitude <strong>of</strong> <strong>the</strong> <strong>Fund</strong>’s benefit andcontribution flows.6.3.2 Graph 6.3 (a) above confirms <strong>the</strong>increasing contribution requirement overtime to break even. At <strong>the</strong> current time,contributions exceed benefit outgo byapproximately 7% and net cashflow isprojected to remain positive until 2008(2010 if investment income is included).The equalised contribution rates <strong>the</strong>n risesteeply until around 2051 and plateau from<strong>the</strong>re to <strong>the</strong> end <strong>of</strong> <strong>the</strong> review period.9. Note: <strong>the</strong> last period covers <strong>the</strong> remaining period to 2061.The projections suggest that, by 2061,contribution income would need to beincreased by 138% to meet benefit outgo.6.3.3 We set out in Table 6.3 (b) overleaf breakevencontribution rates separately oversuccessive 10 and 20 year periods and alsoover <strong>the</strong> whole projection period. We haveshown <strong>the</strong> outcome separately on <strong>the</strong> basis<strong>of</strong>:n no Exchequer subvention;n an annual Exchequer subvention <strong>of</strong> 25%<strong>of</strong> <strong>the</strong> benefits paid, andn an annual Exchequer subvention <strong>of</strong> 33%<strong>of</strong> <strong>the</strong> benefits paid.6.3.4 The table demonstrates that, whilecontributions at <strong>the</strong> current levels may bealmost adequate in <strong>the</strong> short-term, <strong>the</strong>yare clearly inadequate in <strong>the</strong> long-term. In<strong>the</strong> period from 2008 – 2017, an increase<strong>of</strong> 5% in contribution rates is projected tobe adequate to meet benefit outgo but,<strong>the</strong>reafter, more significant step changesin contributions would be required - <strong>the</strong>corresponding increase for <strong>the</strong> period 2048– 2061 is 138%. Over <strong>the</strong> entire projectionperiod, an increase <strong>of</strong> 74% in contributionrates would be required to meet benefitoutgo.41