Informing the Financing of Universal Energy Access: An Assessment ...

Informing the Financing of Universal Energy Access: An Assessment ...

Informing the Financing of Universal Energy Access: An Assessment ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

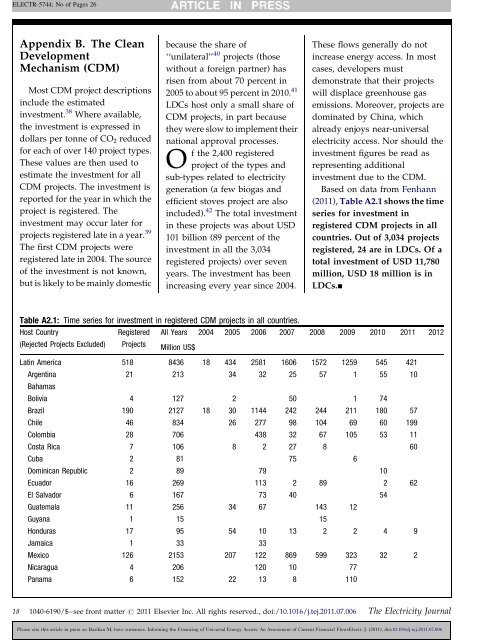

ELECTR-5744; No <strong>of</strong> Pages 26Appendix B. The CleanDevelopmentMechanism (CDM)Most CDM project descriptionsinclude <strong>the</strong> estimatedinvestment. 38 Where available,<strong>the</strong> investment is expressed indollars per tonne <strong>of</strong> CO 2 reducedfor each <strong>of</strong> over 140 project types.These values are <strong>the</strong>n used toestimate <strong>the</strong> investment for allCDM projects. The investment isreported for <strong>the</strong> year in which <strong>the</strong>project is registered. Theinvestment may occur later forprojects registered late in a year. 39The first CDM projects wereregistered late in 2004. The source<strong>of</strong> <strong>the</strong> investment is not known,but is likely to be mainly domesticbecause <strong>the</strong> share <strong>of</strong>‘‘unilateral’’ 40 projects (thosewithout a foreign partner) hasrisen from about 70 percent in2005 to about 95 percent in 2010. 41LDCs host only a small share <strong>of</strong>CDM projects, in part because<strong>the</strong>y were slow to implement <strong>the</strong>irnational approval processes.O f <strong>the</strong> 2,400 registeredproject <strong>of</strong> <strong>the</strong> types andsub-types related to electricitygeneration (a few biogas andefficient stoves project are alsoincluded). 42 The total investmentin <strong>the</strong>se projects was about USD101 billion (89 percent <strong>of</strong> <strong>the</strong>investment in all <strong>the</strong> 3,034registered projects) over sevenyears. The investment has beenincreasing every year since 2004.These flows generally do notincrease energy access. In mostcases, developers mustdemonstrate that <strong>the</strong>ir projectswill displace greenhouse gasemissions. Moreover, projects aredominated by China, whichalready enjoys near-universalelectricity access. Nor should <strong>the</strong>investment figures be read asrepresenting additionalinvestment due to <strong>the</strong> CDM.Based on data from Fenhann(2011), Table A2.1 shows <strong>the</strong> timeseries for investment inregistered CDM projects in allcountries. Out <strong>of</strong> 3,034 projectsregistered, 24 are in LDCs. Of atotal investment <strong>of</strong> USD 11,780million, USD 18 million is inLDCs.&Table A2.1: Time series for investment in registered CDM projects in all countries.Host CountryRegistered All Years 2004 2005 2006 2007 2008 2009 2010 2011 2012(Rejected Projects Excluded) Projects Million US$Latin America 518 8436 18 434 2581 1606 1572 1259 545 421Argentina 21 213 34 32 25 57 1 55 10BahamasBolivia 4 127 2 50 1 74Brazil 190 2127 18 30 1144 242 244 211 180 57Chile 46 834 26 277 98 104 69 60 199Colombia 28 706 438 32 67 105 53 11Costa Rica 7 106 8 2 27 8 60Cuba 2 81 75 6Dominican Republic 2 89 79 10Ecuador 16 269 113 2 89 2 62El Salvador 6 167 73 40 54Guatemala 11 256 34 67 143 12Guyana 1 15 15Honduras 17 95 54 10 13 2 2 4 9Jamaica 1 33 33Mexico 126 2153 207 122 869 599 323 32 2Nicaragua 4 206 120 10 77Panama 6 152 22 13 8 11018 1040-6190/$–see front matter # 2011 Elsevier Inc. All rights reserved., doi:/10.1016/j.tej.2011.07.006 The Electricity JournalPlease cite this article in press as: Bazilian M, have surnames. <strong>Informing</strong> <strong>the</strong> <strong>Financing</strong> <strong>of</strong> <strong>Universal</strong> <strong>Energy</strong> <strong>Access</strong>: <strong>An</strong> <strong>Assessment</strong> <strong>of</strong> Current Financial FlowsElectr. J. (2011), doi:10.1016/j.tej.2011.07.006