Evaluation of Railway Projects in the European Union

Evaluation of Railway Projects in the European Union

Evaluation of Railway Projects in the European Union

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

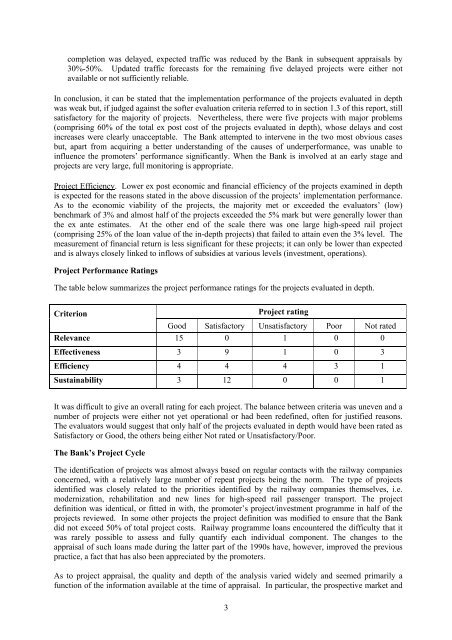

completion was delayed, expected traffic was reduced by <strong>the</strong> Bank <strong>in</strong> subsequent appraisals by30%-50%. Updated traffic forecasts for <strong>the</strong> rema<strong>in</strong><strong>in</strong>g five delayed projects were ei<strong>the</strong>r notavailable or not sufficiently reliable.In conclusion, it can be stated that <strong>the</strong> implementation performance <strong>of</strong> <strong>the</strong> projects evaluated <strong>in</strong> depthwas weak but, if judged aga<strong>in</strong>st <strong>the</strong> s<strong>of</strong>ter evaluation criteria referred to <strong>in</strong> section 1.3 <strong>of</strong> this report, stillsatisfactory for <strong>the</strong> majority <strong>of</strong> projects. Never<strong>the</strong>less, <strong>the</strong>re were five projects with major problems(compris<strong>in</strong>g 60% <strong>of</strong> <strong>the</strong> total ex post cost <strong>of</strong> <strong>the</strong> projects evaluated <strong>in</strong> depth), whose delays and cost<strong>in</strong>creases were clearly unacceptable. The Bank attempted to <strong>in</strong>tervene <strong>in</strong> <strong>the</strong> two most obvious casesbut, apart from acquir<strong>in</strong>g a better understand<strong>in</strong>g <strong>of</strong> <strong>the</strong> causes <strong>of</strong> underperformance, was unable to<strong>in</strong>fluence <strong>the</strong> promoters’ performance significantly. When <strong>the</strong> Bank is <strong>in</strong>volved at an early stage andprojects are very large, full monitor<strong>in</strong>g is appropriate.Project Efficiency. Lower ex post economic and f<strong>in</strong>ancial efficiency <strong>of</strong> <strong>the</strong> projects exam<strong>in</strong>ed <strong>in</strong> depthis expected for <strong>the</strong> reasons stated <strong>in</strong> <strong>the</strong> above discussion <strong>of</strong> <strong>the</strong> projects’ implementation performance.As to <strong>the</strong> economic viability <strong>of</strong> <strong>the</strong> projects, <strong>the</strong> majority met or exceeded <strong>the</strong> evaluators’ (low)benchmark <strong>of</strong> 3% and almost half <strong>of</strong> <strong>the</strong> projects exceeded <strong>the</strong> 5% mark but were generally lower than<strong>the</strong> ex ante estimates. At <strong>the</strong> o<strong>the</strong>r end <strong>of</strong> <strong>the</strong> scale <strong>the</strong>re was one large high-speed rail project(compris<strong>in</strong>g 25% <strong>of</strong> <strong>the</strong> loan value <strong>of</strong> <strong>the</strong> <strong>in</strong>-depth projects) that failed to atta<strong>in</strong> even <strong>the</strong> 3% level. Themeasurement <strong>of</strong> f<strong>in</strong>ancial return is less significant for <strong>the</strong>se projects; it can only be lower than expectedand is always closely l<strong>in</strong>ked to <strong>in</strong>flows <strong>of</strong> subsidies at various levels (<strong>in</strong>vestment, operations).Project Performance Rat<strong>in</strong>gsThe table below summarizes <strong>the</strong> project performance rat<strong>in</strong>gs for <strong>the</strong> projects evaluated <strong>in</strong> depth.CriterionProject rat<strong>in</strong>gGood Satisfactory Unsatisfactory Poor Not ratedRelevance 15 0 1 0 0Effectiveness 3 9 1 0 3Efficiency 4 4 4 3 1Susta<strong>in</strong>ability 3 12 0 0 1It was difficult to give an overall rat<strong>in</strong>g for each project. The balance between criteria was uneven and anumber <strong>of</strong> projects were ei<strong>the</strong>r not yet operational or had been redef<strong>in</strong>ed, <strong>of</strong>ten for justified reasons.The evaluators would suggest that only half <strong>of</strong> <strong>the</strong> projects evaluated <strong>in</strong> depth would have been rated asSatisfactory or Good, <strong>the</strong> o<strong>the</strong>rs be<strong>in</strong>g ei<strong>the</strong>r Not rated or Unsatisfactory/Poor.The Bank’s Project CycleThe identification <strong>of</strong> projects was almost always based on regular contacts with <strong>the</strong> railway companiesconcerned, with a relatively large number <strong>of</strong> repeat projects be<strong>in</strong>g <strong>the</strong> norm. The type <strong>of</strong> projectsidentified was closely related to <strong>the</strong> priorities identified by <strong>the</strong> railway companies <strong>the</strong>mselves, i.e.modernization, rehabilitation and new l<strong>in</strong>es for high-speed rail passenger transport. The projectdef<strong>in</strong>ition was identical, or fitted <strong>in</strong> with, <strong>the</strong> promoter’s project/<strong>in</strong>vestment programme <strong>in</strong> half <strong>of</strong> <strong>the</strong>projects reviewed. In some o<strong>the</strong>r projects <strong>the</strong> project def<strong>in</strong>ition was modified to ensure that <strong>the</strong> Bankdid not exceed 50% <strong>of</strong> total project costs. <strong>Railway</strong> programme loans encountered <strong>the</strong> difficulty that itwas rarely possible to assess and fully quantify each <strong>in</strong>dividual component. The changes to <strong>the</strong>appraisal <strong>of</strong> such loans made dur<strong>in</strong>g <strong>the</strong> latter part <strong>of</strong> <strong>the</strong> 1990s have, however, improved <strong>the</strong> previouspractice, a fact that has also been appreciated by <strong>the</strong> promoters.As to project appraisal, <strong>the</strong> quality and depth <strong>of</strong> <strong>the</strong> analysis varied widely and seemed primarily afunction <strong>of</strong> <strong>the</strong> <strong>in</strong>formation available at <strong>the</strong> time <strong>of</strong> appraisal. In particular, <strong>the</strong> prospective market and3