KING WAN CORPORATION LIMITED ANNuAL REPORT

KING WAN CORPORATION LIMITED ANNuAL REPORT

KING WAN CORPORATION LIMITED ANNuAL REPORT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

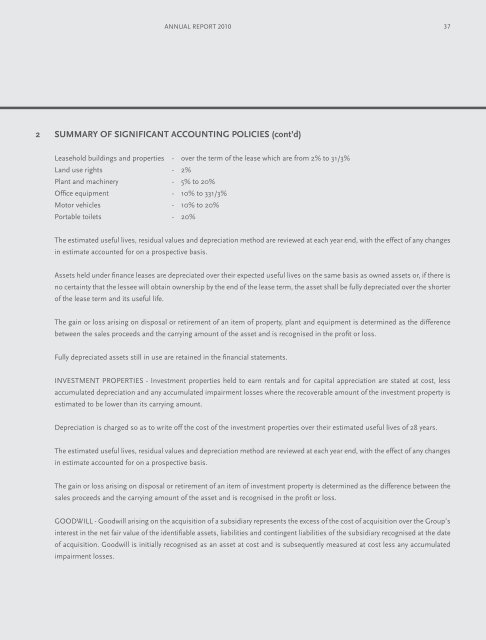

ANNUAL <strong>REPORT</strong> 2010 372 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d)Leasehold buildings and properties - over the term of the lease which are from 2% to 31/3%Land use rights - 2%Plant and machinery - 5% to 20%Office equipment - 10% to 331/3%Motor vehicles - 10% to 20%Portable toilets - 20%The estimated useful lives, residual values and depreciation method are reviewed at each year end, with the effect of any changesin estimate accounted for on a prospective basis.Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned assets or, if there isno certainty that the lessee will obtain ownership by the end of the lease term, the asset shall be fully depreciated over the shorterof the lease term and its useful life.The gain or loss arising on disposal or retirement of an item of property, plant and equipment is determined as the differencebetween the sales proceeds and the carrying amount of the asset and is recognised in the profit or loss.Fully depreciated assets still in use are retained in the financial statements.INVESTMENT PROPERTIES - Investment properties held to earn rentals and for capital appreciation are stated at cost, lessaccumulated depreciation and any accumulated impairment losses where the recoverable amount of the investment property isestimated to be lower than its carrying amount.Depreciation is charged so as to write off the cost of the investment properties over their estimated useful lives of 28 years.The estimated useful lives, residual values and depreciation method are reviewed at each year end, with the effect of any changesin estimate accounted for on a prospective basis.The gain or loss arising on disposal or retirement of an item of investment property is determined as the difference between thesales proceeds and the carrying amount of the asset and is recognised in the profit or loss.GOODWILL - Goodwill arising on the acquisition of a subsidiary represents the excess of the cost of acquisition over the Group’sinterest in the net fair value of the identifiable assets, liabilities and contingent liabilities of the subsidiary recognised at the dateof acquisition. Goodwill is initially recognised as an asset at cost and is subsequently measured at cost less any accumulatedimpairment losses.