17 - Indiana Association for Community Economic Development

17 - Indiana Association for Community Economic Development

17 - Indiana Association for Community Economic Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

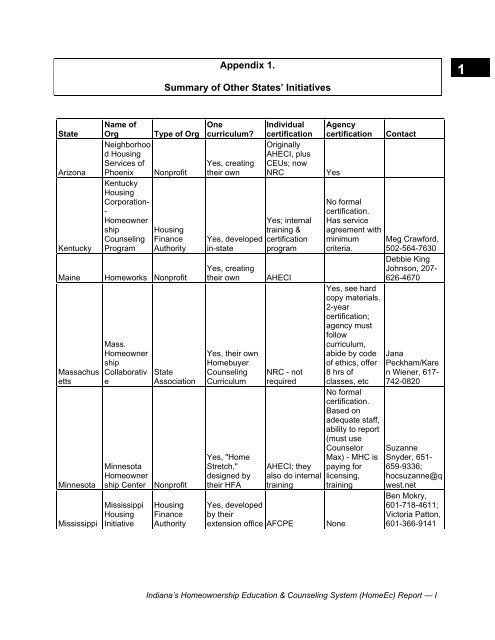

Appendix 1.Summary of Other States’ Initiatives1StateArizonaKentuckyMaineMassachusettsMinnesotaMississippiName ofOrg Type of OrgNeighborhood HousingServices ofPhoenix NonprofitKentuckyHousingCorporation--Homeownership HousingCounseling FinanceProgram AuthorityHomeworks NonprofitMass.HomeownershipCollaborativeMinnesotaHomeownership CenterMississippiHousingInitiativeState<strong>Association</strong>NonprofitHousingFinanceAuthorityOnecurriculum?Yes, creatingtheir ownYes, developedin-stateYes, creatingtheir ownYes, their ownHomebuyerCounselingCurriculumYes, "HomeStretch,"designed bytheir HFAIndividualcertificationOriginallyAHECI, plusCEUs; nowNRCYes; internaltraining &certificationprogramAHECINRC - notrequiredAHECI; theyalso do internaltrainingYes, developedby theirextension office AFCPEAgencycertificationYesNo <strong>for</strong>malcertification.Has serviceagreement withminimumcriteria.Yes, see hardcopy materials.2-yearcertification;agency mustfollowcurriculum,abide by codeof ethics, offer8 hrs ofclasses, etcNo <strong>for</strong>malcertification.Based onadequate staff,ability to report(must useCounselorMax) - MHC ispaying <strong>for</strong>licensing,trainingNoneContactMeg Craw<strong>for</strong>d,502-564-7630Debbie KingJohnson, 207-626-4670JanaPeckham/Karen Wiener, 6<strong>17</strong>-742-0820SuzanneSnyder, 651-659-9336;hocsuzanne@qwest.netBen Mokry,601-718-4611;Victoria Patton,601-366-9141<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — I

OklahomaOregonRhodeIslandSouthDakotaTexasVirginiaOklahomaHomebuyerEducation<strong>Association</strong>State<strong>Association</strong>(<strong>Community</strong>ActionAgencies)HomeownerEducationCollaborative of Oregon NonprofitHomeownershipEducationCenterHomeownershipEducationResourceOrganizationTexasStatewideHomebuyerEducationProgramVirginia<strong>Association</strong>of HousingCounselorsState<strong>Association</strong>IndependentNFP, but isgoverned bythe HFA'sBoard ofCommissionersHousingFinanceAuthorityState<strong>Association</strong>Yes, acombination of9 differentcurricula tomeet alllenders'requirementsYes, "ABCs ofHomebuying",developed instateYes, developedin-house NRCNo requiredcurriculum;each provideruses FannieMaeFoundation orCredit WhenCredit Is Due,or acombinationNRC; also, theycan pick &choose whichsections ofMoneySmartthey want toadd inNRCInternal trainingprogram, plus30 CEUs per 3-year period,OR"Certification byApplication"(test-out option)NRC; notrequired but isofferedNRCVAHC (butrecognized byNRC), plus 12CEUs per 2-year periodNo <strong>for</strong>malcertification.Has serviceagreement withminimumcriteria.NoneNo <strong>for</strong>malcertification.Has serviceagreement withminimumcriteria.No <strong>for</strong>malcertification.Agency mustcommit tomeetingcurriculumstandards.Tricia Auberle,405-524-4124;www.homebuyereducation.infoTerri Duffy,503-284-5569Carrie/BrendaClement, 401-521-1461www.sdhda.org<strong>for</strong> wording, etcGreg & Paul,605-773-2466Agency mustbe considered"qualified"be<strong>for</strong>e theindividual canbe trained -criteria are:nonprofits,CDCs, CHDOs,CBOs, FBOs,Extensionagents, andLUGs, & others JoAnnw/ a community DePenning,building focus 512-475-4779KirstenVroman,kirsten.vroman@vhda.com,804-343-55341<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — II

Appendix 2.Other States’ Funding Strategies For Homeownership Education & CounselingState Name of Organization Type of Organization How HEC Is FundedKentucky Kentucky Housing Corporation-- Housing Finance Authority • Housing Assistance Fund, funded by mortgageHomeownership Counselingrevenue bonds.Program• HUD counseling dollars.MaineMaine State Housing Authority Housing Authority• HUD counseling dollars.• Many organizations instead apply <strong>for</strong> HUD funds viaandCHAPA, or apply <strong>for</strong> HUD dollars directly.• MPP fund – MSHA’s own fundsHomeworksNonprofit• Financial institutions.MassachusettsMassachusetts HomeownershipCollaborative• Neighborhood Reinvestment.State <strong>Association</strong> • Lender contributions.• CHAPA has a HUD intermediary grant.• Some agencies apply directly to HUD.• Some agencies use HOME funds.• FHLB.Minnesota Minnesota Homeownership Center Nonprofit • In 2002, MHC pooled funds from HFA and 2 otherorganizations, so that agencies could apply to one fund.• Raise HUD funds through the Housing PartnershipNetwork.• HFA "appropriated dollars" and their own revenue.• MHC raises private dollars.• Financial institutions deeply involved.Mississippi Mississippi Housing Initiative State <strong>Association</strong> • Financial institutions deeply involved.• Neighborhood Reinvestment Corporation.• General fund allocation <strong>for</strong> community development.• HUD counseling dollars.• HOME funds.• USDA Rural <strong>Development</strong>.• Fannie Mae Foundation.• Congressional Black Caucus Foundation.OklahomaOklahoma Homebuyer Education<strong>Association</strong>State <strong>Association</strong> (<strong>Community</strong>Action Agencies)Local agencies fund themselves directly through:• HUD.• FHLB.• State community action association.• HOME training and TA funds.<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — III2

Appendix 2.Other States’ Funding Strategies For Homeownership Education & CounselingState Name of Organization Type of Organization How HEC Is FundedOregon Homeowner Education Collaborativeof OregonNonprofit • Neighborhood Reinvestment Corporation.• Housing Finance Authority has some state funds.• FSS programs.• Foundations.• Financial institutions.• HUD counseling funds.Rhode Island Homeownership Education Center State <strong>Association</strong> • HUD counseling funds through regional NewEngland network.• Programs apply directly <strong>for</strong> HUD and HOME dollars.• Housing Resource Commission (state agency)applies <strong>for</strong> a collective pot of money from privatefunders, which programs can then access.South DakotaTexasVirginiaHomeownership EducationResource OrganizationTexas Statewide HomebuyerEducation ProgramVirginia Housing <strong>Development</strong>AuthorityandVirginia <strong>Association</strong> of HousingCounselorsIndependent nonprofit, but isgoverned by the HFA's Board ofCommissioners• HERO has a pot of privately raised funds that areavailable throughout the state.• SDHFA applies <strong>for</strong> HUD funds and includes allaffiliates in the application.Housing Finance Authority • HUD grant with subcontracts.• HOME funds (downpayment assistance).• Organizations charge a nominal fee ($25-50) <strong>for</strong>services (often refunded upon purchase).• Foundations.• Financial institutions.Housing Finance AuthorityState <strong>Association</strong>• HUD grant with subcontracts.• Some organizations apply independently <strong>for</strong> HUDcounseling funds.• Virginia’s Department of Housing and <strong>Community</strong><strong>Development</strong> funds individual organizations via ageneral fund appropriation and federal TANF dollars.• HOME funds.• CDBG funds.• Other HUD funds.• Some philanthropic dollars.• Church mission funds.• Some financial institution investment.<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — IV2

Appendix 3.List of Review Panel MembersThe following individuals participated in the HomeEC Review Panel in 2002 and 2003:3NameLisa AbbottMarsha BurseyJanet DitmireJacquie DodykMarcia HubbertTracy HughesTracy HuttonTracy KenneyMark LindenlaubJohn NiedermanAnnette PhillipsRose Marie RobertsErika ScottSheryl SharpeCaroline ShookMelinda WrightAgencyBloomington Department of Housing andNeighborhood <strong>Development</strong>Pathfinder Services (Huntington)Housing Assistance Office (South Bend)Af<strong>for</strong>dable Housing Corp. (Marion)New Hope Services (Jeffersonville)<strong>Indiana</strong>polis Neighborhood Housing PartnershipNew Hope Services (Jeffersonville)HOPE of EvansvilleHousing Partnership Inc (Columbus)Pathfinder Services (Huntington)Rural Opportunities Inc (Muncie)Ohio Valley Opportunities (Madison)IHFAIHFAHousing Opportunities Inc (Valparaiso)Momentive Consumer Credit Counseling(<strong>Indiana</strong>polis)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — V

Appendix 4.Summary Of Participant Responses from Fall 2001 Network MeetingsProgram and Curriculum Standards4What are the key elements or components of a successful homeownershipeducation program?1. Post-purchase counseling (including home maintenance and <strong>for</strong>eclosureavoidance) (10)2. Credit (reading a report, credit repair) (8)3. Budgeting and financial management (8)4. Instruction on the home purchase process (8)5. Mortgages and lending (8)6. Program resources (staffing, funding) (8)7. Accessibility of the program to clients (5)8. Helping clients determine whether home purchase is right <strong>for</strong> them (5)What are the key elements or components of a successful homeownershipcounseling program?1. Post-purchase counseling (including home maintenance and <strong>for</strong>eclosureavoidance) (8)2. Determining af<strong>for</strong>dability of home <strong>for</strong> client (7)3. Budgeting and financial management (5)4. Case management (4)Reviewing the list of key elements identified, which items would you expect/thinkshould be considered a “minimum” requirement?1. Credit (reading a report, credit repair) (8)2. Post-purchase counseling (including home maintenance and <strong>for</strong>eclosureavoidance) (7)3. Determining af<strong>for</strong>dability of home <strong>for</strong> client (6)4. Instruction on the home purchase process (5)5. Budgeting and financial management (4)6. Life skills instruction (4)Can you identify any unique or special circumstances that impact or change yourlist of key elements?1. Language/cultural barriers (6)2. Special needs (disabilities, elderly, etc) (5)3. Geography (rural vs. urban, cost of living) (4)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — VI

What do you see as the biggest barrier or what would make these minimumrequirements difficult <strong>for</strong> your organization to meet?1. Program funding (8)2. Staffing/Organizational capacity (8)3. Language/cultural barriers (4)4. Clients (identifying and getting referrals; lack of commitment; other issues) (4)5. Lack of standards/certification (4)6. Accessibility to locations/facilities (4)4Training and Certification of CounselorsWhat are the key areas of competency and expertise <strong>for</strong> an individual to beknowledgeable in order to deliver services of a homeownership educationprogram?1. Certified/trained (18)2. Interpersonal skills (<strong>17</strong>)3. Experience in home purchase/lending (12)4. Experience in financial literacy (7)5. Experience in credit counseling (6)6. Experience with home purchase process (5)7. Experience in post-purchase issues (4)What are the key areas of competency and expertise <strong>for</strong> an individual to beknowledgeable in order to deliver services of a homeownership counselingprogram?1. Interpersonal skills (9)2. Experience in home purchase/lending (5)3. Experience in credit counseling (5)4. Experience in financial literacy (3)5. Experience with home purchase process (3)Reviewing the list of key elements identified, which items would you expect/thinkshould be considered a “minimum” requirement?1. Knowledge of lending and mortgage products (10)2. Interpersonal skills (9)3. Experience in financial literacy (7)4. Experience in credit counseling (6)5. Experience in post-purchase issues (5)6. Trained/certified (4)7. Experience with home purchase process (4)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — VII

Can you identify any unique or special circumstances that impact or change yourlist of key competencies and expertise?1. Language/cultural barriers (7)2. Special needs (6)3. Sustainability of programming (3)4. Rural vs. urban issues (2)4What do you see as the biggest barrier or what would make these minimumrequirements difficult <strong>for</strong> individuals to meet?1. Training <strong>for</strong> staff (11)2. Funding (9)3. Staffing (7)4. Language barriers (2)<strong>Development</strong> of a Regional SystemAll Participant DiscussionAdvantagesIncreased efficiencyNetworking, in<strong>for</strong>mation-sharing, and communications opportunitiesNot re-inventing the wheelDisadvantagesCompetition <strong>for</strong> resourcesConcerns about accessibility and freedom of choice <strong>for</strong> clientsLarge service area mightTurfismWhat is a region?Overall consensus was that defining the regions is something to be carefully consideredbe<strong>for</strong>e making a decision. Organizations are interested in working together andnetworking, but don’t want to lose their autonomy. It will be important to define who wewant to be served and how the set-up of regions will affect that service.<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — VIII

Appendix 5.Spring 2002 Network Meetings:First Draft Flowchart – Homeownership Education & Counseling Process5InquiryClient expresses interest in homeownershipAssessmentClient's needs indicate either counseling or educationHomeownership CounselingOne-on-one, intensive, financial mgmt/credit repair focusHomeownership EducationGroup/classroom structure, focus on home purchase processKey ElementsKey ElementsProgramCounselorProgramEducatorHomeownership<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — IX

Appendix 6.Spring 2002 Network Meetings:First Draft “Key Elements of Homeownership Education Programs”Homeownership Education Programs:Key ElementsOverview6Homeownership education programs are geared toward those who are comparativelyclose to being ready <strong>for</strong> home purchase, and who do not require in-depth, one-on-onecounseling. Usually set up in a classroom/group <strong>for</strong>mat, the homeownership educationprogram focuses primarily on the processes of selecting a home, qualifying <strong>for</strong> amortgage, closing, and post-purchase issues. While it usually addresses the topics ofmoney management and credit, the homeownership education program is not designed<strong>for</strong> intensive credit counseling or basic life skills training.Homeownership EDUCATOR skill setRequired• Knowledge of and experience with the home purchase process• Knowledge of and experience with lending/mortgage products• Knowledge of and experience with basic home maintenance• Familiarity with other common post-purchase issues• Strong interpersonal skillsDesired• Foreign language skills• Education background• Familiarity with local social service networks<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — X

Basic Programmatic Needs• Homeownership education curriculum which incorporates the “basic elements” inat least the recommended minimum amount of hours• Adequate funding and staffing to provide services• Ability to provide one-on-one counseling as needed, or ability to refer the client toa partnering counseling service• Access to af<strong>for</strong>dable training <strong>for</strong> staff• Accessibilityo Printed materials translated into Spanish and/or other languages spokenin the area; translator available if trainer does not speak the language inquestiono Handicap accessibility of facilitieso Centrally located facility, easy to get to via public transportationo Available transportation <strong>for</strong> circumstances where there is no other optiono Ability to provide food if program takes place during mealtime, or is longerthan two hourso Ability to provide child care6Basic Elements of a Homeownership Education CurriculumIn this scenario, a basic homeownership education curriculum would entail sevenprimary topics, totaling a minimum of ten hours of class time.1. Getting Started (1-2 hours)Goal: Client determines whether homeownership is right <strong>for</strong> them, and what stepsthey will need to take to begin preparing <strong>for</strong> the purchase process.May include:• Advantages & disadvantages of homeownership• The role of long-term budgeting and saving• Possible barriers to approval, especially creditworthiness• How much the client can af<strong>for</strong>d to spend• Programs <strong>for</strong> low- and moderate-income buyers and first-time buyers2. Money Management & Credit Assessment (2-4 hours)Goal: Client gets a sense of where they are financially, what they need to do to bemortgage-ready, and understands basic budgeting.May include:• Setting short- and long-range goals• <strong>Development</strong> of spending and saving plans• Tracking income and expenses• How to read a credit report• In<strong>for</strong>mation on credit reporting agencies• Strategies <strong>for</strong> building or rebuilding credit<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XI

3. Selecting a Home (2-4 hours)Goal: Client determines what kind of home they need, want, and can af<strong>for</strong>d, andbegins to explore options.May include:• Research and evaluation of neighborhoods they are interested in• Advantages and disadvantages of different types of housing• Creation of “wish lists”• Choosing a realtor• Understanding MLS lists• House-hunting resources• Comparison shopping and record-keeping• In<strong>for</strong>mation about fair housing practices• Negotiating the purchase• Submitting the offerGoal: Client knows what to watch <strong>for</strong> in an inspection.May include:• Checklist of inspection items• Finding an inspector• Environmental issues to investigate64. Financing a Home (2-3 hours)Goal: Client understands what a mortgage is and how it works, what to look <strong>for</strong> in amortgage, why it is important to “shop around”, how to qualify, how much to borrow,and how to identify predatory lending practices.May include:• Types of lenders• Types of products, including programs <strong>for</strong> low- to moderate-income buyers• Prequalification• Loan application process and paperwork• Calculating debt ratios and loan payments• Comparing loan terms and “shopping” <strong>for</strong> financing• Calculating costs related to obtaining a loan, down payment, and closing• Understanding fees• Ensuring a fair appraisal• Fair housing practices and “red flags” <strong>for</strong> predatory lending<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XII

5. Understanding the Closing Process (1-2 hours)Goal: Client knows what to expect at closing, including familiarity with <strong>for</strong>ms anddocumentsMay include:• Moving checklist• Final walk-through• Costs of closing on a loan• Closing documents (HUD-1, Truth in Lending, title insurance, mortgage,mortgage note, deed, homeowners’ insurance, etc)66. Maintaining Your Home (1-2 hours)Goal: Client understands basic home maintenance and repair needs.May include:• Homeowners’ insurance• Basic household tools, supplies, and safety items• Hiring contractors• Seasonal home maintenance• Budgeting <strong>for</strong> maintenance and repairs• Energy efficiency• “Good neighbor” guidelines• Handling emergencies• Keeping records7. Keeping Your Home (1-2 hours)Goal: Client understands how their loan works, steps to maintain financial stability,and how to avoid <strong>for</strong>eclosure.May include:• Understanding the terms of the loan (payment due date, loan amortization,etc)• Where and when to seek help if difficulties arise• Budgeting review• Creating an emergency fund• Refinancing and prepaying mortgages<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XIII

Appendix 7.Spring 2002 Network Meetings:First Draft “Key Elements of Homeownership Counseling Programs”Homeownership Counseling Programs:Key ElementsOverviewHomeownership counseling programs are geared toward those who have significantbarriers toward homeownership and who require intensive, one-on-one assistance inorder to stabilize their situation and become mortgage-ready. This may often entailintensive money management training, credit counseling and repair, and/or referrals toother social service agencies <strong>for</strong> additional support.7While it may briefly address the home purchase process, homeownership counseling isgenerally a precursor to the broader homeownership education program, which occursonce a client is closer to being ready to purchase the home. Homeownershipcounseling is also crucial <strong>for</strong> post-purchase support of homeowners, particularly interms of <strong>for</strong>eclosure avoidance. Clients who complete a homeownership educationcourse may end up returning <strong>for</strong> more intensive, one-on-one counseling after their homepurchase.Homeownership Counselor Skill SetRequired• Experience in providing financial literacy• Experience in providing credit counseling• Certification/training in relevant areas• Familiarity with local social service networks• Strong interpersonal skillsDesired• Foreign language skills• Social work background• Knowledge of and experience with the home purchase process• Knowledge of and experience with lending/mortgage products<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XIV

Programmatic Needs• Adequate funding and staffing to provide services• Access to af<strong>for</strong>dable training <strong>for</strong> staff• Referral agreements with social service agencies• Accessibilityo Printed materials translated into Spanish and/or other languages spokenin the area; translator available if trainer does not speak the language inquestiono Handicap accessibility of facilitieso Centrally located facility, easy to get to via public transportationo Available transportation <strong>for</strong> circumstances where there is no other optiono Ability to provide food if program takes place during mealtime, or is longerthan two hourso Ability to provide child care7Basic Elements of a Homeownership Counseling CurriculumThe time frame <strong>for</strong> homeownership counseling is much more strongly dictated by theindividual needs of the client than in homeownership education. Counseling programstend to be far more personalized to each client, and generally take place over a longerperiod of time than a general pre-purchase training program. There<strong>for</strong>e, the timeranges noted below <strong>for</strong> counseling are minimum estimates, designed to reflect thewidely varying requirements of each client, rather than hard-and-fast rules. For someclients, the minimum recommendations will suffice; <strong>for</strong> others, many more hours in oneor more topic areas will be needed.1. Assessment (minimum 1 hour)Goal: Client is aware of financial and other barriers to homeownership.Goal: Client makes in<strong>for</strong>med decision as to whether to pursue home purchase.May include:• Advantages & disadvantages of homeownership• Possible barriers to approval, especially creditworthiness• How much the client can af<strong>for</strong>d to spend2. Financial Management (minimum 2 hours)Goal: Client has a budget and financial plan and understands the importance ofsaving.May include:• Setting short- and long-term priorities• Tracking income and expenses• How to trim expenses• Basic banking skills• Planning <strong>for</strong> emergencies<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XV

3. Credit and Credit Repair (minimum 1 hour)Goal: Client understands their credit reports and how credit works; has arepayment plan <strong>for</strong> existing debt and a development plan <strong>for</strong> building new credit.May include:• Definition of credit and credit scoring• In<strong>for</strong>mation on procuring credit reports• Review of client’s actual credit report• Communicating with creditors and credit agencies• Developing traditional and alternative credit lines4. Case Management & Life Skills (minimum 2 hours)Goal: Client meets regularly with homeownership counselor to assessprogress and has access to other services (employment training, education,social services) that will increase stability, improve quality of life, and helpthem make in<strong>for</strong>med life choices.May include:• Referrals to other social service providers75. Post-Purchase: Default Intervention (minimum 2 hours)Goal: Homeowners who are in danger of <strong>for</strong>eclosure will retain their homes.May include:• Where and when to seek help if difficulties arise• Budgeting <strong>for</strong> home maintenance and repair• Creating an emergency fund<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XVI

Appendix 8.Summary of Participant Responses from Spring 2002 Network MeetingsSummary of Spring 2002 Network MeetingsThe discussion at the Spring 2002 meetings centered around two main areas: first,developing standards and ensuring uni<strong>for</strong>m quality of homeownership education andcounseling programs throughout <strong>Indiana</strong>, and second, developing a framework toensure accessibility of services throughout the state.QUALITY8In this section, participants were asked to comment on three draft documents: aflowchart delineating the process of homeownership education and counseling services;a listing of key elements of education programs; and a listing of key elements ofcounseling programs.Comments on Service Flowchart:1. Arrows should go both ways between education and counseling (3)2. Counseling may take place in small groups as well as one-on-one (2)3. Add post-purchase as a separate component on flowchart and include it earlier inthe program (should post-purchase counseling be a requirement <strong>for</strong> everyone?)(2)4. Counseling and education may overlap (2)5. Consider phrasing as “long-term” and “short-term”, rather than “counseling” and“education” (2)6. Add an “intake” step <strong>for</strong> data collection between the Inquiry and Assessmentlevels7. Accurate description8. Counseling is an ongoing process9. Allow <strong>for</strong> the option that the client may choose not to become a homeowner10. Would like to see a more specific definition of what assessment is and how it’sdone11. Provide education as early as possible12. Counseling should be required to strengthen the education component.Comments on Components of Homeownership Education Programs:1. Time frames may be too demanding (balance time frames with quality ofservice); minimum hours are too high--it is difficult to get clients to attend multiplesessions (5)2. Expand “Selecting a Home” to include more on realtors, offers, purchaseagreements, and strategies on money management and budgeting (4)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XVII

3. Include a component on understanding the home inspection report and otherclosing documents (have section on closing needs last so it will stay fresh inclients’ minds) and create procedures to catch problems after loan is closed (4)4. Educators and counselors alike should have background/skills (possiblycertification) in training, especially in the areas of facilitation and culturalsensitivity (4)5. Clients should have opportunity to evaluate the program and educator (3)6. Include in<strong>for</strong>mation on predatory lending products, rent-to-own, “buy here payhere”, and other predatory scenarios (3)7. Include component on tax benefits and tax abatement strategies ofhomeownership (3)8. There is a need <strong>for</strong> marketing support (3)9. Include mortgage insurance (“credit life”, not PMI), reverse mortgage counseling,and homeowners’ insurance as topics (3)10. Need flexibility when offering classes, such as weekends and evenings (2)11. Consider creating a code of ethics <strong>for</strong> avoiding conflict of interest/crasscommercialism (2)12. Concern about funding and accessibility of elements such as child care, food,language, transportation, etc. (2)13. Give client a sense of time frame and “flow” of counseling and education process(2)14. Create a separate module <strong>for</strong> post-purchase counseling—it should be availableto everyone (2)15. Emphasize difference between appraisals and inspections and underscore need<strong>for</strong> inspections16. Limit class sizes to promote relationship-building. Relationships are key—programs should be willing/able to maintain long-term relationship (2)<strong>17</strong>. Include outside professionals/experts <strong>for</strong> various components of training18. Consider “express” classes19. Acknowledge that not everyone is ready <strong>for</strong> homeownership20. Rely on volunteers to talk about specific topics – be sure that these experts donot sell their products – neutrality — code of ethics idea21. Develop relationships between agencies and financial institutions22. The need is <strong>for</strong> interpreters, not translators; interpreters should receive trainingin the terminology and vocabulary of home purchase process23. Consider including pre- and post-tests24. Education can begin very early—even 2-3 years be<strong>for</strong>e purchase; length/depthof education may vary according to client (this should ideally be taught beginningin high school)25. Include in<strong>for</strong>mation on redlining26. Merge “Introduction/Getting Started” and “Assessment” components andconsider combining “Financing a Home” and “Keeping Your Home”27. Ability to refer to other organizations is important <strong>for</strong> both education andcounseling28. Environmental disclosures (e.g. lead) should be included in the “fair housing”section (Right to disclosure—RESPA)8<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XVIII

29. Include “how-to” section with basic home maintenance30. Define what mortgage brokers do31. Include how to differentiate between needs vs. wants when choosing a homeComments on Components of Homeownership Counseling Programs:1. Include post-purchase counseling in pre-purchase classes especially in regardsto predatory lending (Consider what incentives might bring clients back <strong>for</strong> postpurchasecounseling once they are in their homes) (6)2. Programs should be able to provide at least the minimum recommended hours ofcounseling (8 hours is optimistic; probably is not enough time <strong>for</strong> mostcounselees. Use “benchmark” or “average” in place of “minimum” when referringto time frames <strong>for</strong> various components) (5)3. Offer materials and services in alternative <strong>for</strong>mats (<strong>for</strong>eign languages, Braille,tapes, availability of interpreters <strong>for</strong> the deaf) (3)4. Referrals are important (CCCS, others) (2)5. Clarify what non-traditional/alternative lines of credit are6. Necessity <strong>for</strong> flexibility of times/days/locations of services7. How are clients motivated to “stick with it”? Counselors should be skilled inmotivating8. Explain that too much credit can be as much of a problem as too little9. Some components from the Education section would also fit in Counseling10. Counseling may take place in both individual and group settings11. Promote understanding of consumers’ rights—buyer’s need and ability to takecontrol of the home purchase12. Look at pre-approval and pre-qualification process, so that clients can get asense of af<strong>for</strong>dability13. Teach financial problem-solving and add debt reorganization and repaymentplanning under Financial Management section14. Emphasize default prevention over default intervention15. Consider breaking down into “long-term” and “short-term” programs16. Evaluation criteria—how to determine success?<strong>17</strong>. Change “significant barriers” to simply “barriers”18. Link case management activities with other resources19. Educate clients as to EITC and other income opportunities early in process20. Provide access to legal in<strong>for</strong>mation early on, especially with regard to creditissues21. Counselors should remain compassionate and sensitive to clients’ needs --Sensitivity to needs of those who cannot use public transportation, and buildingaccessibility issues (Include a checklist of disability accessibility requirements)22. Require action plan <strong>for</strong> client and promote an approach that fosters selfsufficiency/empowerment23. Assessment should be ongoing and minimum requirements <strong>for</strong> counselingshould be based on the assessment8<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XIX

Ideas <strong>for</strong> what to include in an assessment:• Is client willing to make the time commitment to the counseling/education, or wills/he self-select out?• Evaluate spending patterns and priorities; budget overview• Look at debt to income ratio• Self-assessment• Ensure neutrality of values from the program—program is not <strong>for</strong>cing its valuesonto the client• Have participation agreements setting up what both participants andorganizations will do• Provide description of what being a homeowner is like• Pull credit report ASAP• Provide “red flags” <strong>for</strong> predatory lending scenarios8Overall: There was consensus from the group that the proposed Quality Componentswere acceptable. (7)ACCESSIBILITYIn this section, participants were asked to brainstorm about the opportunities andchallenges of developing a network to promote accessibility of homeownershipeducation and counseling services throughout the state. They were also asked toconsider how a regional network system might be best structured to achieve this goal.Opportunities and Ideas:1. <strong>Development</strong> of a strong marketing plan—radio, TV, other media (4)2. Sharing resources and in<strong>for</strong>mation with other organizations (Organizations couldchoose/be assigned certain responsibilities so coordination would improve) (4)3. Look at census tracts with high populations of low- and moderate-income peoplein order to determine where funds should be spent; plot CDCs statewide as ameans of seeing where gaps in service are located. (3)4. Possibly a satellite/circuit rider approach could be used (2)5. Many successful public-private partnerships are already in place (2)6. Develop relationships with real estate professionals and lenders (2)7. Develop web-based training and counseling (2)8. Build strong referral networks with social service agencies (2)9. Services need to be in close proximity to clients (2)10. Ensure quality and autonomy within regions (2)11. Put ongoing certification process in place (2)12. Regions differ; there<strong>for</strong>e a regional system would be beneficial (2)13. Develop a statewide resource/reference tool <strong>for</strong> building networks <strong>for</strong> approvedproviders (2)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XX

14. Show what the economic benefit of participating in a network would be15. Set up a toll-free number—“Hoosier Healthwise” model16. Promote concept of “coalition” vs. “network”—coalition suggests commonality ofgoals and mission<strong>17</strong>. Use IACED membership base as a conduit to promote accessibility18. Per<strong>for</strong>mance-based system would be important19. “Franchise” model20. Use organizations that already exist21. Flexible training schedule (times, locations)22. Solid structure <strong>for</strong> communications23. Plot CDCs statewide as a means of seeing where gaps in service are located8Challenges and Needs:1. Concern about allocation of funds and inequity (5)2. Need <strong>for</strong> funding and other resources (4)3. Transportation; distance that clients will travel (4)4. Trainers must be sensitive to the region’s needs; balance urban vs. rural needs—different pressures, in<strong>for</strong>mational requirements, proximity to services (3)5. Not every county is currently covered by services6. Avoid “jargon” when working with clients—use vocabulary that they willunderstand7. Language and disability barriers8. More staff, more trainers needed9. Minimize bureaucracy10. Have seen other networks that have not worked effectively11. Ensure all voices are heard in development of framework12. Make sure boundaries of individual organizations still reflect mission13. Timeliness14. Ensuring quality of services15. Clearly define purpose of network; be sure that a regional network is neededbe<strong>for</strong>e implementing such a structureIdeas <strong>for</strong> Regional Structure:1. Smaller regions would be better (4)2. Bringing service to clients is preferable to a centrally located setup; portableclasses, “satellites”, and circuit riders could promote partnership and resourcesharingwith other organizations (4)3. Ensure regions encompass major cities and surrounding counties; investigatefurther where and why underserved areas exist; more in<strong>for</strong>mation is neededbe<strong>for</strong>e a final structure is decided upon (2)4. Smaller regions might break up the state so much as to defeat the purpose ofregions; consider 3-5 regions, similar to Department of Commerce model—butonly if a satellite office/circuit rider structure is also in place.<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXI

5. Work<strong>for</strong>ce Investment Planning regions could work well in both urban and ruralareas6. Perhaps simply using current CHDO system would suffice7. Consider Infolink model, the SBA model, or the Continuum of Care model—alsoa way to reach lower-income clients8. Develop/<strong>for</strong>malize partnerships with local organizations to extend “reach” ofservices9. Some kind of statewide coordination of ef<strong>for</strong>ts; set up a program in each county10. Need to reach efficiency of scale somehow, because funding is drying up11. Funding will drive the structure8Overall:1. There was support <strong>for</strong> regional networks. Most said that their organizationswould probably participate in a regional network system. (4)2. There was mixed support <strong>for</strong> regional networks. Some said that theirorganizations would probably participate if certain conditions were met; otherssaid that their organizations would probably choose not to participate. (3)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXII

Appendix 9.Fall 2002 Network Meetings:Second Draft Flowchart – Homeownership Education & Counseling ProcessHomeownership Education & Counseling ProcessInquiryClient expresses interest in homeownership9IntakeBasic in<strong>for</strong>mation gathered about the client's situation and needsAssessmentClient's needs indicate counseling or education,or, alternatively, client chooses not to pursue homeownership at this timeClient needs significant pre-purchase assistanceClient is relatively close to being ready to purchaseHomeownership CounselingMore intensive financial mgmt/credit repair focusOften (though not always) one-on-oneAlso known as "long-term counseling"• Client may move between counselingand education as needed• Some elements of counseling & educationmay overlapHomeownership EducationPrimary focus is home purchase processOften held in a group/classroom structureAlso known as "short-term counseling"Homeowner may return <strong>for</strong> additionalcounselingHomeownershipClient moves from educationto homeownershipPost-Purchase CounselingMay be included in the education program,added as a separate component, or both<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXIII

Appendix 10.Fall 2002 Network Meetings:Second Draft “Key Elements of Homeownership Education Programs”Homeownership Education Programs:Key ElementsHomeownership education programs are geared toward those who are comparativelyclose to being ready <strong>for</strong> home purchase, and who do not require in-depth, one-on-onecounseling. Often set up in a classroom/group <strong>for</strong>mat, the homeownership educationprogram focuses primarily on the processes of selecting a home, qualifying <strong>for</strong> amortgage, closing, and post-purchase issues. While it usually addresses the topics ofmoney management and credit, the homeownership education program is not designed<strong>for</strong> intensive credit counseling or basic life skills training.10Programmatic Requirements• Homeownership education curriculum which incorporates the “basic elements” inat least the recommended minimum amount of hours• Adequate funding and staffing to provide services• Ability to provide one-on-one counseling as needed, or ability to refer the client toa partnering counseling service• Access to af<strong>for</strong>dable training <strong>for</strong> staff• Accessibilityo Flexible scheduling <strong>for</strong> classes, such as weekends and eveningso Printed materials translated into Spanish and/or other languages spokenin the area; interpreter available if trainer does not speak the language inquestiono Physical accessibility of facilities and other accessibility elements (Braillematerials, audio tapes, interpreters <strong>for</strong> the deaf, etc) <strong>for</strong> people withdisabilitieso Centrally located facility, easy to get to via public transportationo Available transportation <strong>for</strong> circumstances where there is no other optiono Ability to provide food if program takes place during mealtime, or is longerthan two hourso Ability to provide child careo Accommodations <strong>for</strong> clients with low reading skills• Clients should have the opportunity to evaluate the program and educator• Code of ethics or other safeguards <strong>for</strong> outside speakers (real estateprofessionals, lenders, etc) to ensure that no one company’s products or servicesare being promoted<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXIV

Homeownership Educator Skill SetRequired• Knowledge of and experience with the home purchaseprocess• Knowledge of and experience with lending/mortgageproducts• Knowledge of and experience with basic homemaintenance• Familiarity with other common post-purchase issues• Background in training, facilitation and/or culturalsensitivity• Strong interpersonal skills10Desired• Foreign language skills• Education background• Familiarity with local social service networksBasic Elements of a Homeownership Education CurriculumIn this scenario, a basic homeownership education curriculum would entail 5 primarytopics, totaling a minimum of 7.5 hours of class time.1. Getting Started & Financial Assessment (1.5 - 3 hours)Goal: Client determines whether homeownership is right <strong>for</strong> them, and what stepsthey will need to take to begin preparing <strong>for</strong> the purchase process.May include:• Advantages & disadvantages of homeownership• The role of long-term budgeting and saving• Possible barriers to approval, especially creditworthiness• How much the client can af<strong>for</strong>d to spend• Programs <strong>for</strong> low- and moderate-income buyers and first-time buyers• Homeownership is not always the right choice <strong>for</strong> everyoneGoal: Client gets a sense of where they are financially, what they need to do to bemortgage-ready, and understands basic budgeting.<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXV

May include:• Setting short- and long-range goals• <strong>Development</strong> of spending and saving plans• Tracking income and expenses• How to read a credit report• In<strong>for</strong>mation on credit reporting agencies• Strategies <strong>for</strong> building or rebuilding credit2. Selecting a Home (1.5 - 3 hours)Goal: Client decides what kind of home they need, want, and can af<strong>for</strong>d, and beginsto explore options.May include:• Research and evaluation of neighborhoods they are interested in• Advantages and disadvantages of different types of housing• Creation of “wish lists”—needs vs. wants• Choosing a realtor• Understanding MLS lists• House-hunting resources• Comparison shopping and record-keeping• In<strong>for</strong>mation about fair housing practices• Universal design and accessibility options• Environmental disclosures• Negotiating the purchase• Submitting the offer10Goal: Client knows what to watch <strong>for</strong> in an inspection.May include:• Different types of inspections• Difference between inspection and appraisal• Why an inspection is important• Finding an inspector• Checklist of inspection items• Understanding the home inspection report• Environmental issues to investigate<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXVI

3. Financing a Home (2.5 - 4 hours)Goal: Client understands what a mortgage is and how it works, what to look <strong>for</strong> in amortgage, why it is important to “shop around”, how to qualify, and how much toborrow.May include:• Types of lenders (banks, mortgage brokers, etc)• Types of products, including land contracts and programs <strong>for</strong> low- to moderateincomebuyers• Pre-qualification• Loan application process and paperwork• Calculating debt ratios and loan payments• Comparing loan terms and “shopping” <strong>for</strong> financing• Calculating costs related to obtaining a loan, down payment, and closing• Understanding fees• How escrow works10Goal: Client has an understanding of predatory lending and other abusive practices.May include:• Ensuring a fair appraisal• Fair housing practices• “Red flags” <strong>for</strong> predatory lending• Rent-to-own and “buy here pay here” vs. conventional mortgages• Ensuring that fees are legitimate• Common post-purchase predatory lending practicesGoal: Client understands how their loan works, steps to maintain financial stability,and how to avoid <strong>for</strong>eclosure.May include:• Understanding the terms of the loan (payment due date, loan amortization, etc)• Where and when to seek help if difficulties arise• Budgeting review• Creating an emergency fund• Refinancing and prepaying mortgages• The role of reverse mortgages4. Preparing <strong>for</strong> the Closing Process (1 – 2 hours)Goal: Client knows what to expect at closing, including familiarity with <strong>for</strong>ms anddocumentsMay include:• Moving checklist• Final walk-through• Costs of closing on a loan• Closing documents (HUD-1, Truth in Lending, title insurance, mortgage,mortgage note, deed, homeowners’ insurance, etc)<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXVII

Goal: Client understands their home insurance needs.May include:• Homeowners’ insurance• Flood insurance• Personal life insurance• Redlining• Credit life insurance5. Life As a Homeowner (1 - 2 hours)Goal: Client understands basic home maintenance and repair needs.May include:• Property taxes• What homeowners’ insurance will cover• Basic household tools, supplies, and safety items• How-to of basic maintenance and repairs• Seasonal home maintenance• Budgeting <strong>for</strong> maintenance and repairs• Hiring contractors• Energy efficiency• “Good neighbor” guidelines• Handling emergencies• Keeping records10Review (may be open to public)• Financial management• Common post-purchase predatory lending practices• Where and when to seek help if difficulties arise<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXVIII

Appendix 11.Fall 2002 Regional Meetings:Second Draft “Key Elements of Homeownership Counseling Programs”Homeownership Counseling Programs:Key ElementsHomeownership counseling programs are geared toward those who have barrierstoward homeownership and who require more intensive assistance in order to stabilizetheir situation and become mortgage-ready. This may often entail intensive moneymanagement training, credit counseling and repair, and/or referrals to other socialservice agencies <strong>for</strong> additional support. Counseling often, but not always, takes placein a one-on-one setting.11While it may briefly address the home purchase process, homeownership counseling(a.k.a. “long-term”) is generally a precursor to the broader homeownership educationprogram (a.k.a. “short-term”), which occurs once a client is closer to being ready topurchase the home. Homeownership counseling is also crucial <strong>for</strong> post-purchasesupport of homeowners, particularly in terms of <strong>for</strong>eclosure avoidance. Clients whocomplete a homeownership education course may end up returning <strong>for</strong> more intensivecounseling after their home purchase.Programmatic Requirements• Programs should be prepared to offer at least the benchmark/average hours ofcounseling to every client, while recognizing that some clients will not require thatmuch counseling in every area, while others will need far more in some or allareas.• Adequate funding and staffing to provide services• Access to af<strong>for</strong>dable training <strong>for</strong> staff• Referral agreements with social service agencies• Accessibility of services <strong>for</strong> clients:o Flexible scheduling <strong>for</strong> classes, such as weekends and eveningso Printed materials translated into Spanish and/or other languages spokenin the area; interpreter available if trainer does not speak the language inquestiono Physical accessibility of facilities and other accessibility elements (Braillematerials, audio tapes, interpreters <strong>for</strong> the deaf, etc) <strong>for</strong> people withdisabilitieso Counseling facility:• Centrally located• Easy to get to via public transportation• Reasonable distance from clients served<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXIX

o Available transportation <strong>for</strong> circumstances where there is no other optiono Ability to provide food if program takes place during mealtime, or is longerthan two hourso Ability to provide child careo Emphasis on “plain-English” vocabulary, and avoidance of overly technicalterminology or jargono Accommodations <strong>for</strong> clients with low reading skillsHomeownership Counselor Skill SetRequired• Experience in providing financial literacy• Experience in providing credit counseling• Certification/training in relevant areas• Familiarity with local social service networks• Strong interpersonal skills, especially the ability tomotivate others toward a goal11Desired• Foreign language skills• Social work background• Knowledge of and experience with the homepurchase process• Knowledge of and experience with lending/mortgageproducts<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXX

Basic Elements of a Homeownership Counseling CurriculumThe time frame <strong>for</strong> homeownership counseling is much more strongly dictated by theindividual needs of the client than in homeownership education. Counseling programstend to be far more personalized to each client, and generally take place over a longerperiod of time than a general pre-purchase training program. There<strong>for</strong>e, the timeranges noted below <strong>for</strong> counseling are average estimates or benchmarks, designed toreflect the widely varying requirements of each client, rather than hard-and-fast rules.For some clients, a minimum of time will suffice; <strong>for</strong> others, many more hours in one ormore topic areas will be needed.1. Assessment (average 2 hours)Goal: Counselor and client gain a clear sense of the client’s situation and needsMay include:• Referrals to other agencies <strong>for</strong> additional services• Participation agreements describing what clients and counseling agencieswill each commit to• Explanation of housing counseling process• <strong>Development</strong> and ongoing evaluation of action plan <strong>for</strong> client11Goal: Client is aware of his/her financial and other barriers to homeownership.Goal: Client makes in<strong>for</strong>med decision as to whether to pursue home purchase.May include:• Advantages & disadvantages of homeownership• Possible barriers to approval, especially creditworthiness• Get a sense of how much the client can af<strong>for</strong>d to spend (debt-to-incomeratio)• Discuss pre-approval and pre-qualification processes2. Financial Management (average 2 hours)Goal: Client has a budget and financial plan and understands the importance ofsaving.May include:• Setting short- and long-term priorities• Tracking income and expenses• How to trim expenses• Basic banking skills• Financial problem-solving and planning <strong>for</strong> emergencies• Debt reorganization & repayment planning• Discuss income-generating strategies: EITC, etc<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXI

3. Credit and Credit Repair (average 1 hour)Goal: Client understands their credit reports and how credit works; has a repaymentplan <strong>for</strong> existing debt and a development plan <strong>for</strong> building new credit.May include:• Definition of credit and credit scoring• In<strong>for</strong>mation on procuring credit reports• Review of client’s actual credit report• Communicating with creditors and credit agencies• Developing traditional and alternative credit lines• In<strong>for</strong>mation on sources of legal assistance4. Case Management & Life Skills (time varies; occurs multiple times duringcounseling process)Goal: Client meets regularly with homeownership counselor to assessprogress and has access to other services (employment training, education,social services) that will increase stability, improve quality of life, and helpthem make in<strong>for</strong>med life choices.May include:• Referrals to other agencies <strong>for</strong> additional services• <strong>Development</strong> and ongoing evaluation of action plan <strong>for</strong> client115. Post-Purchase (average 2 hours)Goal: Homeowners who are at risk <strong>for</strong> <strong>for</strong>eclosure will retain their homes.May include:• Where and when to seek help if difficulties arise• “Red flags” <strong>for</strong> predatory lending• Budgeting <strong>for</strong> home maintenance and repair• Creating an emergency fund<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXII

Appendix 12.Summary of Participant Responses from Fall 2002 Network MeetingsSummary of Fall 2002 Network MeetingsThe discussion at the Fall 2002 meetings centered around two main areas: first,developing standards and ensuring uni<strong>for</strong>m quality of homeownership education andcounseling programs throughout <strong>Indiana</strong>, and second, developing a framework toensure accessibility of services throughout the state.Note: The numbers in parentheses after some items denote the number of times thatthe idea was suggested over the course of the seven regional meetings.ENSURING QUALITY PROGRAMMING12In this section, participants were asked to comment on three draft documents: aflowchart delineating the process of homeownership education and counseling services;a listing of key elements of education programs; and a listing of key elements ofcounseling programs.Comments on Components of Homeownership Education Programs:• Buy-in from lenders & realtors—show how counseling and education create addedvalue• Consider increasing minimum hours of education• Counselor skill set:o Continuing education is important, since housing programs are alwayschangingo Counselor needs ability to counsel without biaso Counselors will need an understanding of funding sourceso Financial/real estate background would be useful in counselor skill seto Ideally, counselor would be a homeowner him/herselfo “Tough love” approach is helpful• Ensure clients get sufficient service given constraints of time/lender requirements• Ensure clients understand that “long-term” counseling is only a precursor tohomeownership• Fine line between “plain-English” vs. jargon• Funding challenge of being “not rural” and yet not a participating jurisdiction• Items to cover in curriculum:o Address land contracts and other types of purchase productso Address property taxes/exemptionso Clear explanation of escrowo Cover predatory lending<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXIII

o Differentiate between multiple types of inspections, difference betweenappraisal & inspectiono Discuss “life cycle” of homeownershipo Discuss insurance of all typeso Include in<strong>for</strong>mation on flood insuranceo Include in<strong>for</strong>mation on personal life insuranceo Include in<strong>for</strong>mation on wills/powers of attorneyo Include section on budgeting/planning <strong>for</strong> maintenance costs, tools, etco Include section on how to find trustworthy inspectors, appraisers, andrealtors, and the role of each (3)o Include section on ID thefto Include section on mortgage exemptiono Make “life as homeowner” section more in-depth, especially the homemaintenance sectiono Tax implications of homeownership• Minimum hours of instruction may need to vary depending on the size of the groupand individuals’ prior knowledge• Need <strong>for</strong> “teeth” in housing programs—ability to get clients back <strong>for</strong> post-purchasecounseling• Need <strong>for</strong> adequate technology• Need <strong>for</strong> listing of available resources• Pre-qualification should take place early in process• Public transportation to services is a challenge in rural areas• Track outcomes (5)o Include outcomes beyond home purchase itselfo Need <strong>for</strong> data collection tools (2)o Pre-tests and post-tests should be administered <strong>for</strong> measurable results (2)• Varying perceptions of CCCS’ programming—often depends on the individual lender• What happens to those whose needs may not be entirely met by counseling?o Client self-assessment is keyo Assessment process should include referrals <strong>for</strong> those who need it12Comments on Components of Homeownership Counseling Programs:• Basic banking skills should be part of assessment• Begin with financial literacy <strong>for</strong> those who require extensive assistance• Clarify difference between referrals to other agencies and coordination of serviceswith those agencies• Communication with lenders is helpful, but not always easy to do• Consider the pros and cons of clients’ using Debt Management Program or similarcredit counseling programs (2)• Dedicate time <strong>for</strong> one-on-one counseling• Ensure client is working actively toward their goalo Accountabilityo Deadlines<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXIV

o Empowerment• Ensure that client is aware that more money may be required <strong>for</strong> closing – loanqualification is often different from reality• Give clients an explicit explanation of how counseling differs from education, and atimeline <strong>for</strong> how long it will take to go through the process (4)• Need <strong>for</strong> self-esteem training (Pathfinders is willing to share their curriculum)• Need long-term follow-up capability• Promote housing authority participationo Outreacho Section 8 <strong>for</strong> Homeownership• Provide outside referrals <strong>for</strong> other services if needed• Provide potential life scenarios• Require post-purchase counseling <strong>for</strong> some time period• Set a published, regular schedule of classesENSURING ACCESSIBILITY OF PROGRAMMING12In this section, participants were asked to brainstorm about the opportunities andchallenges of developing a network to promote accessibility of homeownershipeducation and counseling services throughout the state. Using the questions below,they were also asked to consider how a regional network system might be beststructured to achieve this goal.If a regional system <strong>for</strong> delivery of homeownership education and counselingservices were to be implemented…What would be the best way to “roll out” this system throughout <strong>Indiana</strong>?• A single pilot may not be sufficient because of the differences between regions• Buy-in from other entitieso Churches, financial institutions, local units of government, realtors, socialservice agencies• Define who services are <strong>for</strong>• Gradual statewide launch that is multi-step and functionally organized• Marketing tools would be key• Pilot program in a single region, then go statewide• Pilot program – selected urban and rural groups would test the program. Then asimultaneous launch of the remainder of the state could occur.• Pilot program in multiple areas – or some kind of statewide “study group”• Pilot program with a minimum of a 6-month time frame to work out kinks• Pilot project, including both urban and rural areas, and both new and seasonedplayerso Add new communities gradually, at intervalso “Pilot” may not be ideal wording; we might try using “trial run” or “start-up”<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXV

• Possibility of simultaneous pilots• Rather than a regional network, the first step should be a bona fide connection ofservices among providers in an area – incentivized via points on IHFA application.• Simultaneous statewide launch (5)• Time is of the essence• Unity/uni<strong>for</strong>mityHow would you organize a regional structure <strong>for</strong> homeownership education andcounseling services?• Consider turf concerns – “will someone steal our clients?”• Create a standalone, regional training center with no conflict of interesto Independent, central staff persono Technology – especially web-basedo Data collection point• Create a clean break between administration and services• Create a regional committee made up of all providers of homeownership educationand counseling, which would drive/monitor regional activity (6)o Ability to make funding decisions within the regiono Administering staff should be employed by regional consortium versus asingle agency or standaloneo Collaborative umbrella organization that would act as a representative <strong>for</strong>all organizationso Create a collaborative system, but keep funding structure as iso Create a system similar to the traveling nurses setup, with designatedtravelers <strong>for</strong> specific areaso Designate a lead agency on council to coordinate services (not tocoordinate funding)o Identify three administrative agencies (north, central, and south) that arejust administrative and do not provide services, but rather contract withlocal organizationso Memorandum of agreement to encourage collaborationo Regional fiscal agent, and county-by-county representation on a regionalboardo Regional network to meet quarterly to discuss funding, curriculum andareas of activityo Regional oversight and administration, but organizations would applydirectly to IHFA <strong>for</strong> fundingo Should consortium be created as a new organization? This has its ownchallenges• Create incentives <strong>for</strong> participation (credit <strong>for</strong> clients served)• Designate one lead non-profit in region to coordinate funding, training, and servicedelivery (6)o Consider CCCS model with central location and branch officeso Non-profits to “contract out” services in regionso Funding to be directly negotiated between providers and state• Do a needs assessment in communities to determine funding priorities12<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXVI

• Don’t make regions too big• Get more clarity on IHFA’s goals <strong>for</strong> the initiative• Have a paid regional coordinator• IHFA to ensure equity of funding among regions• Include a per<strong>for</strong>mance-based funding component• Individual organizations would have to subordinate goals to the region• No geographic restrictions <strong>for</strong> clients – within and between regions• One challenge is how to divide state into regions• Organizations would have stipend/other financial support to participate• Primary concern is cost to establish such a center• Provide <strong>for</strong> flexibility• Region would be responsible <strong>for</strong> ensuring all cities are served with quality service,etc.• Satellite structure – offsite services, provided in each local area• Use the continuum of care model seen in other housing networks12What are the absolute minimum tools and/or resources that you would need toget a regional system started?• Ability to track responses to marketing• Allocation versus competitive-based funding• An accountable entity• Approved curriculum – tailor to area/region (3)• “Bookmobile” – center on wheels• Branding (recognizable logo, etc) (2)• Buy-in from business community (3)• Certification/training opportunities (3)• Clarity on benefits of participation (2)• Consistent scheduling• Create regional marketing plan• Distance learning capabilities (2)• Ease of entry/exit into the market• Ensure that there is at least 1 provider per county• Funding <strong>for</strong> administration, increasing capacity, marketing, equipment, training (4)• Funding needs to be available statewide, and include participating jurisdictions• Good understanding of how homeownership affects community economicdevelopment• Grant writing assistance• Interpreters – sign language, other languages (3)• Intervention/education as early as high school• Local resources• Make coverage of area an incentive <strong>for</strong> funding – provide bonuses <strong>for</strong> un-servedareas<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXVII

• Marketing – a single identity, which could be either regional or statewide (6)o Lender & realtor marketing (2)o Local or toll-free numbers (2)o Printed materials (3)o Relationships with churches and other agencieso Statewide Internet resource <strong>for</strong> marketingo TV, radio, print ads• Meeting/office space, especially if staffed at regional level• Networking opportunities (4)o Ability to connect with local serviceso Identification of key players/who’s who of community-based organizations(2)o Shared list of all organizations providing homeownership services• Outcome-based funding relative to size, production• Partnerships with economic development organizations, banking/lending institutions(2)• Preference would be to bring services to clients, rather than the other way around(2)• Regional planning grant• Resolution on turf issues• Small, county-sized regions• Streamlined reporting system (2)• Technology: computers, PowerPoint, projector, technical assistance (2)• Transportation <strong>for</strong> clients and/or educators12<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXVIII

Appendix 13.Summer 2003 Network Meetings: Draft RecommendationsFindings & Recommendations1. Implement statewide standards <strong>for</strong> content and delivery of homeownershipeducation and counseling.A. Implement curriculum standards <strong>for</strong> homeownership education andcounseling. Programs around the state are using a variety of curricula to deliverin<strong>for</strong>mation to prospective homebuyers. While there is strong agreement fromthe field that a set of standards <strong>for</strong> content and delivery of homeownershipeducation and counseling services would be appropriate and useful, we feel thatimposing a single mandatory curriculum on all providers would limit their capacityto tailor their programming to meet the specific needs of their clients and theirregions. Rather, we recommend that all curricula meet at least a minimumthreshold in terms of scope and scale of in<strong>for</strong>mation. To this end, significantinput has been gathered from industry respondents as to the key curriculumcomponents that should be included in a comprehensive homeownershipeducation and counseling program. These components have been exhaustivelydiscussed, and have enjoyed substantial consensus, throughout the HomeECInitiative.131. Require a minimum number of hours of instruction. One significantelement of the implementation of these new standards would be therequirement that programs provide a minimum number of hours of instruction(about 8 hours). For some programs, this will represent a significant increasein the number of hours of instruction, and there<strong>for</strong>e, substantially increasedcosts. This may include staff time and overhead, and also the potential <strong>for</strong>additional costs to ensure accessibility <strong>for</strong> participants (child care,transportation, etc).B. Implement certification standards <strong>for</strong> homeownership counselors andagencies. Homebuyer educators and counselors should be required to achieveand maintain some <strong>for</strong>m of generally recognized individual certification in theirfield. Additionally, agencies should be required to demonstrate organizationalcapacity to adequately deliver services. Such certification should be renewed ona periodic basis and should require continuing education <strong>for</strong> renewal.2. Understand the value of alternative outcomes. Funders should take into accountthat agencies spend considerable time and money providing education andcounseling services to individuals who ultimately choose not to purchase homes.While homeownership is widely viewed as a key element of the “American dream,”the simple fact is that homeownership is not right <strong>for</strong> everyone at every time. Given<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XXXIX

<strong>Indiana</strong>’s mounting rate of <strong>for</strong>eclosure, it seems more critical now than ever thateach prospective homebuyer makes the right choice <strong>for</strong> themselves and theirfamilies. For some households, homeownership may not be the most sensible orfeasible option. Funders who are interested in outcome-based results should have aclear understanding that an individual who makes an in<strong>for</strong>med decision not to buy ahome can represent as much of a success as one who does achievehomeownership. The financial education and other counseling services that theseindividuals receive from homebuyer education agencies is itself a valuable service,and one that should continue to be funded at an appropriate level.3. Open the door to post-purchase counseling. While pre-purchase counseling is avaluable tool to help homebuyers make wise decisions throughout the purchaseprocess, practitioners have indicated that post-purchase counseling is perhaps evenmore critical to helping families not only attain homeownership, but maintainhomeownership over the long term. The challenge, however, lies in 1) covering thecost of post-purchase counseling and 2) getting clients to return after their homepurchase <strong>for</strong> additional counseling sessions. Funders could assist in this process by:A. Requiring post-purchase counseling in order <strong>for</strong> prospective homebuyers toqualify <strong>for</strong> low-rate loan products, downpayment assistance programs, and otherspecialized services.13B. Facilitating and/or incentivizing improved communications betweenlenders and homeownership education providers, so that educators canintervene with clients as soon as a problem occurs, rather than waiting until theclient approaches them (often, this does not occur until the client has receivednotice of <strong>for</strong>eclosure, when it may be too late to avoid the <strong>for</strong>eclosure process).Organizations who actually hold the loan <strong>for</strong> their clients have had substantialsuccess in averting potential default/<strong>for</strong>eclosure situations, simply because theyare aware early on if the client begins to experience difficulty making payments.4. Develop mechanisms to support and sustain interaction, communication, andcooperation among homeownership education and counseling providers andother stakeholders. The concept of a regional network system, which wasdiscussed at length throughout the HomeEC Initiative, sparked strong reactions, withsupporters on both sides of the issue. Generally speaking, from region to region, theresponse varied greatly; within regions, however, there was relative consensus. Thediversity of opinions among regions indicates that any changes to <strong>Indiana</strong>’shomebuyer education system should allow the opportunity <strong>for</strong> a similar diversity ofsolutions to the regional-network question.A. Incentivize networks, rather than mandating them. Rather than a mandatory,highly <strong>for</strong>malized regional network system, we recommend first implementing anoptional, bona fide connection of services among providers, in a regional area tobe determined by the providers, by an oversight body, or both. Regionalcommittees made up of homebuyer education providers would drive and/or<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XL

monitor regional activity. Each committee would fall somewhere on the spectrumbetween a loose coalition and a governing body, depending on the setup thateach region chooses. The goal is to create, at least at some minimum level, aconnection between service providers.1. General guidance and technical assistance could be provided to agencieswishing to start up a network in their area.2. This connection of services could be incentivized on the IHFA HOMEInvestment Partnerships grant application, providing points to those providerswho are participating in the network in their area. Participants in a networkcould also receive access to additional services, such as marketing materials,communications tools, etc.3. In order <strong>for</strong> this strategy to be successful, however, these networks mustrepresent a bona fide relationship between providers, not merely a superficialor “on-paper” connection. Networks and their individual participants shouldbe required to demonstrate the breadth and depth of their cooperation inorder to receive incentives or other compensation.134. In addition, this network could include a <strong>for</strong>um <strong>for</strong> connections betweenservice providers and other stakeholders, such as real estate and lendingprofessionals, government officials, etc.5. Promote access to services by incentivizing coverage of underserved areas.Organizations or regional collaboratives willing to extend their services into unservedor underserved areas could be awarded additional points on funding applications.6. Remove physical, linguistic, operational, and logistical barriers to providingservice.A. Centralize some services in order to increase efficiency and helppractitioners avoid reinventing the wheel. Some possibilities might include:1. Marketing materials—A statewide marketing campaign with readilyidentifiable logos and design <strong>for</strong> signage, brochures, and other materials thatwould allow a participating organization to identify itself as part of theHomeEC system and could be personalized <strong>for</strong> each service provider. The<strong>Indiana</strong> Department of Commerce has produced similar materials <strong>for</strong> thestate’s IDA program. These materials could be produced in quantity anddistributed centrally.<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XLI

2. Communications tools, including:(a) A statewide 800 number that consumers could call to be connected to acertified homebuyer education provider in their area(b) Public service announcements <strong>for</strong> radio and TV to publicize the 800number and services(c) A statewide Web site containing both consumer and practitionerin<strong>for</strong>mation3. Technology—A viable distance-learning system could be replicated andutilized by practitioners and homebuyers across the state, especially in ruralareas.4. Resources <strong>for</strong> working with people with disabilities—Meeting the specialneeds of people with disabilities may require access to resources that manyprograms may have difficulty locating. For instance, most homeownershipeducation curricula are not available in alternative <strong>for</strong>mats (such as Braille oraudio). Homebuyer education providers may not have readily availableaccess to sign language interpretation, or know where to find it. Counselorsmay not have specific experience in working with specialized loan programsand other services <strong>for</strong> people with disabilities. A centralized database ofresources, training opportunities, and the like, well-marketed tohomeownership education and counseling providers, would be a valuablein<strong>for</strong>mation tool to help agencies build their capacity to serve people withdisabilities more efficiently.13B. Make available the appropriate level of resources to allow homeownershipeducation and counseling providers to do their job adequately.1. Many programs simply do not have the necessary funding to provide the fullrange of services necessary <strong>for</strong> high-quality, fully accessible homeownershipeducation programming. The simple fact is that homeownership educationand counseling is not inexpensive.Neighborhood Reinvestment Corporation estimates that it costs, on average,$75,000 to $100,000 per year to run a quality homeownership education andcounseling program. This includes staff time, materials, and overhead. Italso includes the critical accessibility components that may on the surfaceappear trivial, but which can make the crucial difference between whether aclient is able to access the in<strong>for</strong>mation or not. These components includechild care <strong>for</strong> class sessions, refreshments <strong>for</strong> class sessions, transportation(whether <strong>for</strong> instructors or <strong>for</strong> clients) and so on.A statewide commitment to the increased standards of quality andaccessibility will likely mean that many programs will require additionalfunding. To expect programs to implement substantial new policies,<strong>Indiana</strong>’s Homeownership Education & Counseling System (HomeEc) Report — XLII