FinCEN Form 109 (03/2007) - Internal Revenue Service

FinCEN Form 109 (03/2007) - Internal Revenue Service

FinCEN Form 109 (03/2007) - Internal Revenue Service

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

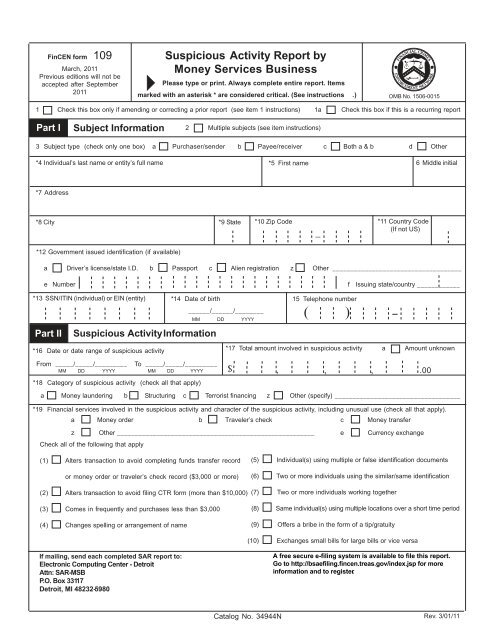

<strong>FinCEN</strong> form <strong>109</strong>March, 2011Previous editions will not beaccepted after September2011Suspicious Activity Report byMoney <strong>Service</strong>s BusinessPlease type or print. Always complete entire report. Itemsmarked with an asterisk * are considered critical. (See instructions .) OMB No. 1506-00151 Check this box only if amending or correcting a prior report (see item 1 instructions) 1a Check this box if this is a recurring reportPart ISubject Information2 Multiple subjects (see item instructions)3 Subject type (check only one box) a Purchaser/sender b Payee/receiver c Both a & b d Other*4 Individual’s last name or entity’s full name *5 First name 6 Middle initial*7 Address*8 City *9 State *10 Zip Code*11 Country Code(If not US)*12 Government issued identification (if available)a Driver’s license/state I.D. b Passport c Alien registration z Other ____________________________________e Number f Issuing state/country ____________*13 SSN/ITIN (individual) or EIN (entity) *14 Date of birth______/______/________MM DD YYYYPart IISuspicious Activity Information*16 Date or date range of suspicious activity_15 Telephone number( )*17 Total amount involved in suspicious activity a Amount unknownFrom _____/_____/_________MM DD YYYYTo _____/_____/_________MM DD YYYY*18 Category of suspicious activity (check all that apply)$ , , ,.00a Money laundering b Structuring c Terrorist financing z Other (specify) ___________________________________*19 Financial services involved in the suspicious activity and character of the suspicious activity, including unusual use (check all that apply).a Money order b Traveler’s check c Money transferz Other _______________________________________________________ e Currency exchangeCheck all of the following that apply(1) Alters transaction to avoid completing funds transfer recordor money order or traveler’s check record ($3,000 or more)(2) Alters transaction to avoid filing CTR form (more than $10,000)(3) Comes in frequently and purchases less than $3,000(4) Changes spelling or arrangement of name(5) Individual(s) using multiple or false identification documents(6) Two or more individuals using the similar/same identification(7) Two or more individuals working together(8) Same individual(s) using multiple locations over a short time period(9) Offers a bribe in the form of a tip/gratuity(10) Exchanges small bills for large bills or vice versaIf mailing, send each completed SAR report to:Electronic Computing Center - DetroitAttn: SAR-MSBP.O. Box 33117Detroit, MI 48232-5980A free secure e-filing system is available to file this report.Go to http://bsaefiling.fincen.treas.gov/index.jsp for moreinformation and to register.Catalog No. 34944NRev. 3/01/11

Suspicious Activity Information - Narrative*Part VI 3Explanation/description of suspicious activity(ies). This section of the report is critical. The care with which it is completed may determine whether ornot the described activity and its possible criminal nature are clearly understood by investigators. Provide a clear, complete and chronological descriptionof the activity, including what is unusual, irregular or suspicious about the transaction(s). Use the checklist below, as a guide, as you prepare yourdescription. The description should cover the material indicated in Parts I, II and III, but the money services business (MSB) should describe any otherinformation that it believes is necessary to better enable investigators to understand the suspicious activity being reported.a. Describe conduct that raised suspicion.b. Explain whether the transaction(s) was completed or only attempted.c. Describe supporting documentation and retain such documentationfor your file for five years.d. Indicate a time period, if it was a factor in the suspicious transaction(s).For example, specify the time and whether it occurred during AM orPM. If the activity covers more than one day, identify the time of daywhen such activity occurred most frequently.e. Retain any admission or explanation of the transaction(s) provided bythe subject(s) or other persons. Indicate when and to whom it wasgiven.f. Retain any evidence of cover-up or evidence of an attempt todeceive federal or state examiners, or others.g. Indicate where the possible violation of law(s) took place (e.g.,main office, branch, agent location, etc.).h. Indicate whether the suspicious activity is an isolated incident orrelates to another transaction.i. Indicate for a foreign national any available information on subject’spassport(s), visa(s), and/or identification card(s). Include date, country,city of issue, issuing authority, and nationality.j. Indicate whether any information has been excluded from thisreport; if so, state reasons.k. Indicate whether any U.S. or foreign instrument(s) were involved.If so, provide the amount, name of currency, and country of origin.l. Indicate whether any transfer of money to or from a foreign country,or any exchanges of a foreign currency were involved. If so, identifythe currency, country, and sources and destinations of money.m. Indicate any additional account number(s), and any foreign bank(s)account numbers which may be involved in transfer of money.n. Identify any employee or other individual or entity (e.g., agent)suspected of improper involvement in the transaction(s).o. For issuers, indicate if the endorser of money order(s) and/ortraveler’s check(s) is different than payee. If so, provide the individualor entity name; bank’s name, city, state and country; ABA routingnumber; endorser’s bank account number; foreign non-bank name(if any); correspondent bank name and account number (if any); etc.p. For selling or paying locations, indicate if there is a video recordingmedium or surveillance photograph of the customer.q. For selling or paying locations, if you do not have a record of agovernment issued identification document, describe the type, issuerand number of any alternate identification that is available (e.g., for acredit card specify the name of the customer and credit card number.)r. For selling or paying locations, describe the subject(s) if you do nothave the identifying information in Part I or if multiple individuals usethe same identification. Use descriptors such as male, female, age, etc.s. If amending a prior report, complete the form in its entirety and notethe changes here in Part VI.t. If a law enforcement agency has been contacted, list the name of theagency and the name of any person contacted, their title, theirtelephone number, and when they were contacted.Supporting documentation should not be filed with this report. Maintain the information for your files.Enter the explanation/description narrative in the space below. If necessary, continue the narrative on a duplicate of this page or a blank page.Tips on SAR form preparation and filing are available in the SAR Activity Reviews at w ww.fincen.gov/pub_reports.html.Legal disclaimers will not be included in this narrative.

<strong>FinCEN</strong> <strong>Form</strong> <strong>109</strong>a Suspicious Activity Report by Money <strong>Service</strong>s Business -- Instructions 1Safe HarborFederal law (31 U.S.C. 5318(g)(3)) providescomplete protection from civil liability for allreports of suspicious transactions made toappropriate authorities, including supportingdocumentation, regardless of whether suchreports are filed pursuant to this report’sinstructions or are filed on a voluntary basis.Specifically, the law provides that a financialinstitution, and its directors, officers, employeesand agents, that make a disclosure of any possibleviolation of law or regulation, including inconnection with the preparation of suspiciousactivity reports, “shall not be liable to any personunder any law or regulation of the United States,any constitution, law, or regulation of any State orpolitical subdivision of any State, or under anycontract or other legally enforceable agreement(including any arbitration agreement), for suchdisclosure or for any failure to provide notice ofsuch disclosure to the person who is the subjectof such disclosure or any other person identifiedin the disclosure”.Notification ProhibitedFederal law (31 U.S.C. 5318(g)(2)) provides thata financial institution, and its directors, officers,employees, and agents, who report suspicioustransactions to the government voluntarily or asrequired by 31 CFR 1022.320, may not notifyany person involved in the transaction that thetransaction has been reported.Notification RequiredIn situations involving suspicious transactionsrequiring immediate attention, such as ongoingmoney laundering schemes, a money transmitter;a currency dealer or exchanger; or an issuer, seller,or redeemer of money orders and/or traveler’schecks shall immediately notify, by telephone,an appropriate law enforcement authority. Inaddition, a timely SAR-MSB form shall be filed,including recording any such notification in PartVI on the form.A. When To File A Report:1. Money transmitters; currency dealers andexchangers; and issuers, sellers and redeemersof money orders and/or traveler’s checks that aresubject to the requirements of the Bank SecrecyAct and its implementing regulations (31 CFRChapter X are required to file a suspiciousactivity report (SAR-MSB) with respect to:a. Any transaction conducted or attemptedby, at, or through a money services businessinvolving or aggregating funds or other assets ofat least $2,000 (except as described in section“b” below) when the money services businessknows, suspects, or has reason to suspect that:i. The transaction involves funds derivedfrom illegal activity or is intended or conductedin order to hide or disguise funds or assets derivedfrom illegal activity (including, without limitation,the nature, source, location, ownership or controlof such funds or assets) as part of a plan to violateor evade any Federal law or regulation or to avoidany transaction reporting requirement underFederal law or regulation;ii. The transaction is designed, whetherthrough structuring or other means, to evade anyregulations promulgated under the Bank SecrecyAct; oriii. The transaction has no business orapparent lawful purpose and the money servicesbusiness knows of no reasonable explanation forthe transaction after examining the available facts,including the background and possible purposeof the transaction.iv. The transaction involves the use of themoney services business to facilitate criminalactivity.b. To the extent that the identification oftransactions required to be reported is derivedfrom a review of clearance records or other similarrecords of money orders or traveler’s checks thathave been sold or processed, an issuer of moneyorders or traveler’s checks shall only be requiredto report a transaction or a pattern of transactionsthat involves or aggregates funds or other assets ofat least $5,000.2. File a SAR-MSB no later than 30 calendardays after the date of initial detection of facts thatconstitute a basis for filing the report.3. The Bank Secrecy Act requires that eachfinancial institution (including a money servicesbusiness) file currency transaction reports (CTRs)in accordance with the Department of the Treasuryimplementing regulations (31 CFR Chapter X).These regulations require a financial institutionto file a CTR (<strong>FinCEN</strong> <strong>Form</strong> 104) whenever acurrency transaction exceeds $10,000. If acurrency transaction exceeds $10,000 and issuspicious, a money transmitter, or issuer, selleror redeemer of money orders and/or traveler’schecks or currency dealer or exchanger mustfile two forms, a CTR to report the currencytransaction and a SAR-MSB to report thesuspicious aspects of the transaction. If thesuspicious activity involves a currencytransaction that is $10,000 or less, the institutionis only required to file a SAR-MSB. Appropriaterecords must be maintained in each case. See31 CFR Chapter X.B. Abbreviations and Definitions1. EIN -- Employer Identification Number2. IRS -- <strong>Internal</strong> <strong>Revenue</strong> <strong>Service</strong>3. ITIN -- Individual Taxpayer IdentificationNumberCatalog No. 35084Y4. SSN -- Social Security Number5. Instruments -- includes Money order(s)and/or Traveler’s Check(s)6. Redeemer --A business that acceptsinstruments in exchange for currency or otherinstruments for which it is not the issuer is aredeemer. The MSB definition in 31 CFR1010.100(ff)(4) extends to “redeemers” ofmoney orders and traveler’s checks only insofaras theinstruments involved are redeemed for monetaryvalue — that is, for currency or monetary or othernegotiable or other instruments. The taking of theinstruments in exchange for goods or general servicesis not redemption under BSA regulations.C. General Instructions1. This form should be e-filed through theBank Secrecy Act E-filing System. Go tohttp://bsaefiling.fincen.treas.gov/index.jspto register. This form is also available for downloadon the Financial Crimes EnforcementNetwork’s Web site at www.fincen.gov, or maybe ordered by calling the IRS <strong>Form</strong>s DistributionCenter at (800) 829-3676.2. If not filed electronically or through magneticmedia, send each completed suspicious activityreport to:Electronic Computing Center-DetroitATTN: SAR-MSBP.O. Box 33117Detroit, MI 48232-598<strong>03</strong>. While all items should be completed fullyand accurately, items marked with an asterisk (*)must be completed according to the provisions ofparagraph 4 below.4. If the information for a item marked with aasterisk (*) is not known or not applicable, enterspecial response “XX” to complete the item. Toindicate “Total amount” as unknown, check thebox provided. Non-asterisk fields should be leftblank if the information is unknown or notapplicable.5. Complete each suspicious activity report byproviding as much information as possible on initialand amended or corrected reports.6. Do not include supporting documents whenfiling the suspicious activity report . Retain a copyof the suspicious activity report and all supportingdocumentation or business record equivalent inyour files for five (5) years from the date of thereport. All supporting documentation (such ascopies of instruments; receipts; sale, transactionor clearing records; photographs, surveillanceaudio and/or video recording medium) must bemade available to appropriate authorities uponrequest.Rev. 3/1/11

7. Type or complete the report using blockwritten letters.8. If more than one subject is being reported,use as many copies of the Part I SubjectInformation page as necessary to record theadditional subjects. Attach the additional page(s)behind page 1. If more than one transactionlocation is being reported, use as many copies ofthe Part III Transaction Location Information pageas necessary to record the additional locations.Attach the additional page(s) behind page 2. Ifmore space is needed for the Part VI Narrative,add as many blank continuation pages asnecessary to complete the narrative. Attach theadditional pages behind page 3.If more space is needed to complete any otheritem, identify that item in Part VI by “itemnumber” and provide the additional information.9. Enter all dates in MM/DD/YYYY formatwhere MM = month, DD = day, and YYYY =year. Precede any single number with a zero,i.e., 01, 02, etc.10. Enter all telephone numbers with (areacode) first and then the seven numbers, usingthe format (XXX) XXX-XXXX. List fax andinternational telephone numbers in Part VI.11. Always enter an individual’s name byentering the last name, first name, and middleinitial (if known). If a legal entity is listed, enterits legal name in the last name item and tradename in the first name item.12. Enter all identifying numbers (alienregistration, driver’s license/state ID, EIN, ITIN,Foreign National ID, passport, SSN, vehiclelicense number, etc.) starting from left to right.Do not include spaces or other punctuation.13. Enter all ZIP Codes with at least the firstfive numbers (ZIP+4, if known).14. Enter all monetary amounts in U.S.Dollars. Use whole dollar amounts rounded upwhen necessary. Use this format: $000,000,000.If foreign currency is involved, record thecurrency amount in U.S. Dollars, name, andcountry of origin in the Part VI narrative.15. Addresses, general. Enter the permanentstreet address, city, two letter state/territoryabbreviation used by the U.S. Postal <strong>Service</strong>, andZIP code (ZIP+4, if known) of the individual orentity. A post office box number should not beused for an individual, unless no other address isavailable. For an individual also enter anyapartment number or suite number and road orroute number. If a P.O. Box is used for an entity,enter the street name, suite number, and road orroute number. If the address is in a foreigncountry, enter the city, province or state if Canadaor Mexico, and the name of the country.Complete any part of the address that is known,even if the entire address is not known. If thestreet address, city, or ZIP Code is unknown,enter “NA” in the item. If a state or country isunknown, enter “XX” in the item.D. Item Preparation InstructionsItem 1. Check the box if this report amends(adds missing data) or corrects errors in the priorreport. (See Part V, item “s”).Item 1a-- Check this box if this is a recurringreport filed on continuing activity.Part I Subject InformationItem 2 Multiple subjects. Check this box ifmultiple subjects are involved. Attach Part ISubject continuation pages behind page 1 toaccount for all additional subjects involved in thesuspicious activity.Item 3 Subject type. Check box “a” if thesubject purchased a money order(s) or traveler’scheck(s) or sent a money transfer(s). Check box“b” if the subject cashed a money order(s) ortraveler’s check(s) or received payment of a moneytransfer(s). Check box “c” if both “a” and “b”apply. If the transaction is a currency exchangecheck box “c.” Check box “d” Other and describein Part VI if the subject is an individual other thana customer. Examples are MSB employees andagents.Items 4, 5, and 6 *Name of subject. SeeGeneral Instruction 11. Enter the name of thesubject individual in Items 4 through 6. If theMSB knows that the individual has an “also knownas” (AKA) or “doing business as” (DBA) name, enterthat name in Part VI. If the subject is an entity,enter the legal name in Item 4 and the trade orDBA name in item 5. If the legal name is notknown, enter the DBA name in Item 4. If there ismore than one subject, use as many Part I SubjectInformation continuation pages as necessary toprovide the information about each subject.Attach the additional copies behind page 1. Whenthere is more than one purchaser and/or payee(e.g., two or more transactions), indicate in Part VIwhether each subject is a purchaser or payee andidentify the instrument or money transferinformation associated with each subject. If partof an individual’s name is unknown, enter “XX” inthe appropriate name item. If the subject is anentity, enter “XX” in Item 5 (if the trade or legalname is not known) and in Item 6.Items 7 - 11 *Permanent address. SeeGeneral Instructions 13 and 15. Enter “XX” if thestreet address, city, and ZIP Code items areunknown or not applicable. Enter “XX” if thestate or country is not known.Item 12 *Government issued identification (ifavailable). See General Instruction 12. Checkthe box showing the type of document used toverify subject identity. If you check box“z Other”, be sure to specify the type ofdocument used. In box “e” list the number of theidentifying document. In box “f” list the issuingstate or country. If more space is required, enterthe additional information in Part VI. If the subjectis an entity or an individual’s identification wasnot available, check box “z” and enter “XX” in“Other.”Item 13 *SSN/ITIN (individual) or EIN(entity). See General Instruction 12 anddefinitions. If the subject named in Items 4through 6 is a U.S. Citizen or an alien with a SSN,enter his or her SSN in Item 13. If that person isan alien who has an ITIN, enter that number. Foran entity, enter the EIN. If the SSN, ITIN, or EINwas unknown or not applicable, enter “XX” in thisitem.Item 14 *Date of birth. See GeneralInstruction 9. If the subject is an individual, enterthe date of birth. If the month and/or day is notavailable or unknown, fill in with zeros (e.g., “01/00/1969” indicates an unknown date in January,1969).Item 15 Telephone number. See GeneralInstruction 10. Enter the U.S. home or businessnumber for individual or entity. List foreigntelephone numbers and any additional U.S.numbers (e.g., hotel, etc.) in Part VI.Part II Suspicious Activity InformationItem 16 *Date or date rangeof suspiciousactivity. See General Instruction 9. Enter thedate of the reported suspicious activity in the“From” field. If more than one day is involved,indicate the duration of the activity by enteringthe first date in the “From” field and the last datein the “To” field.Item 17 *Total dollar amount. See GeneralInstruction 14. If unknown, check box 17a.If thesuspicious activity only involved purchases, orredemptions, or currency exchanges, enter thetotal U.S. Dollar value involved in the reportedactivity. For instance, if multiple money ordersfrom more than one issuer were redeemed, enterthe total of all money orders redeemed. Ifmultiple activities are involved, such as aredemption of money orders combined withpurchase of a money transfer, enter the largestactivity amount in Item 17. For instance, if thetransaction involved redeeming $5,000 in moneyorders and purchase of a $3,500 money transfer ,the Item 17 amount would be $5,000.Item 18 *Category of suspicious activity.Check the box(es) which best identifies thesuspicious activity. Check box “b Structuring”when it appears that a person (acting alone, inconjunction with, or on behalf of other persons)conducts or attempts to conduct activity designedto evade any record keeping or reportingrequirement of the Bank Secrecy Act. If box “d”is checked, specify the type of suspicious activitywhich occurred. Describe the character of suchactivity in Part VI. Box “z” should only be used if62

no other type of suspicious activity boxadequately categorizes the transaction.Item 19 *Financial services involved.Check any of boxes “a” through “e” that apply toidentify the services involved in the suspiciousactivity. If box “z” is checked, briefly explain theservice on the following line. If “unusual use” isinvolved, check the appropriate service box(s)and box “z” and note “unusual use” and explainin Part VI. Check all of boxes “1” through “10”that apply to describe the character of thesuspicious activity.Item 20 *Purchases and redemptions(See definition 6 on page 1 of the instructions).Enter information about purchases orredemptions of money orders, traveler’s checks,or money transfers. Check the appropriate boxin column “P” or “R” to identify the entry as apurchase or redemption. Enter the name of theissuers, the total number of instrumentspurchased or redeemed, and the total amount ofthe instruments. You can enter up to threeissuers in each instrument category. If more thanthree issuers are involved, enter the informationon the additional issuers in Part VI.Item 21 *Currency Exchanges. Record upto two currency exchanges made by the subject(s).Check the box “If bulk small currency” if a largenumber of small bills was used to pay for thecurrency exchange. Enter the name of thecurrency or type of monetary instrument used topay for the exchange, and the two-digit code forthe country that issued the currency. An exampleof this would be “Pesos” for the name of thecurrency and “MX” representing Mexico as issuerof the currency. Enter the name of the currencyreceived in exchange and the two-digit code forthe country that issued the currency. Enter thevalue of the exchange in U.S. Dollars. If therewere more than two currency exchanges, enterthe information about the additional exchangesin Part VI.Part III Transaction Location InformationItem 22 Multiple selling and/or payingbusiness locations. Check the box if the reportedactivity occurred at multiple selling and/or payingbusiness locations. Fill out as many Part IIITransaction Location Information sections asnecessary to record all locations. Attach theadditional sections behind page 2 of the SAR-MSB.Item 23 Type of business location(s). Checkbox “a” if this is the selling location where thecustomer purchases a money order(s) or traveler’scheck(s), or initiated a money transfer(s), orexchanged currency. Check box “b” if this is thepaying location where the customer cashed amoney order(s) or traveler’s check(s) or receivedpayment of a money transfer(s). Check box “c” ifmultiple transactions are reported and the businesswas both a selling and paying location for one ormore transactions.Item 24 *Legal name of business. Enterthe legal name of the business where thetransactions took place.Item 25 Doing business as. Enter the tradename by which the business is commonly known.Items 26-29, 32 *T ransaction locationaddress. Enter the transaction location addressby following General Instructions 13 and 15.Item 30 *EIN (entity) or SSN/ITIN(individual). See General Instruction 12 anddefinitions. If the business identified in Item 24has an EIN, enter that number in Item 30. If not,enter individual owner’s SSN or ITIN.Item 31 *Business telephone number. SeeGeneral Instruction 10. Enter the telephonenumber of the business listed in Item 24.Item 32 Country code. Enter the 2-digitcountry code if not US.Item 33 <strong>Internal</strong> control/file number (Ifavailable). Enter any internal file or report numberassigned by the reporting institution to track thisreport. This information will act as an identificationaid if contact is required.Part IV Reporting Business InformationItem 34 Check this box and go to Part V if thereporting business is the same as the Part IIITransaction Location. If the reporting business isdifferent, complete Part IV.Item 35 *Legal name of business. Enter thelegal name of the reporting business.Item 36 Doing business as. Enter the tradename by which the reporting business is commonlyknown (if other than the legal name).Items 37-40, 43 *Reporting businessaddress. Enter the reporting business address byfollowing General Instructions 13 and 15.Item 40 *EIN (entity) or SSN/ITIN(individual). See General Instruction 12 anddefinitions. If the business identified in Item 35has an EIN, enter that number in Item 41. If not,enter individual owner’s SSN or ITIN.Item 42 *Business phone number. Enter thetelephone number of the reporting business. Ifthe reporting business telephone number is aforeign telephone number, leave Item 44 blankand enter the number in the Part VI Narrative.See General Instruction 10.Item 43 Country code. Enter the 2-digit countrycode if not US.Item 44 <strong>Internal</strong> control/file number (Ifavailable). Enter any internal file or report numberassigned by the reporting institution to track thisreport. This information will act as an identificationaid if contact is required.Part V Contact for AssistanceItem *45-- Designated contact office. Enterthe name of the office that the financial institutionhas designated to receive request for assistancewith this report. This office must have an individualknowledgeable of this report available duringregular business hours.Item * 46--Phone number. See GeneralInstruction B10. Enter the work telephone numberof the contact office.Item *47--Date filed. See General InstructionB9. Enter the date this report was filed. Forelectronic filing, it is the date that the report wase-filed using BSA Direct. For magnetic mediafiling, it is the date the magnetic media wasforwarded to DCC. For all other filers, it is thedate the financial institution completed the finalreview and mailed/submitted the report to DCC.Item 48--Agency. If this report is filed by anagency other than an MSB, such as a federal or stateexaminer, enter the name of the reporting agency inItem 48.Part VI Suspicious Activity Information --Narrative*Enter a narrative describing all aspects of thesuspicious activity not covered by form data items.See page 3 of the form for instructions oncompleting the narrative. If the initial Part VInarrative page is not sufficient, use as many PartVI Narrative continuation pages as necessary tocomplete the narrative. Attach the continuationpages behind the initial narrative page. Legaldisclaimers will not be included in this narrative.Paperwork Reduction Act NoticeThe purpose of this form is to provide an effectivemeans for a money services business (MSB) to notifyappropriate law enforcement agencies of suspicioustransactions and activities that occur by, through, or at anMSB. This report is authorized by law, pursuant toauthority contained in 31 U.S.C. 5318(g). Informationcollected on this report is confidential (31 U.S.C. 5318(g)).Federal regulatory agencies, State law enforcementagencies, the U.S. Departments of Justice and Treasury,and other authorized authorities may use and share thisinformation. Public reporting and record keeping burdenfor this form is estimated to average 60 minutes perresponse, and includes time to gather and maintaininformation for the required report, review the instructions,and complete the information collection. Send commentsregarding this burden estimate, including suggestions forreducing the burden, to the Office of Management and theBudget, Paperwork Reduction Project, Washington, DC205<strong>03</strong> and to the Financial Crimes Enforcement Network,Attn.: Paperwork Reduction Act. P.O. Box 39, ViennaVA 22183-0<strong>03</strong>9. The agency may not conduct or sponsor,and an organization (or a person) is not required to respondto, a collection of information unless it displays a currentlyvalid OMB control number.3

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)