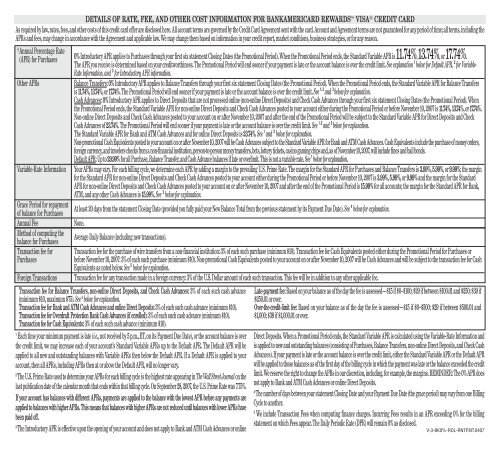

11.74% 13.74% 17.74%

11.74% 13.74% 17.74%

11.74% 13.74% 17.74%

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VdL-RL 16Merkblatt für 2-komponentige organischeBeschichtungen im Trinkwasserbereich„VdL-Richtlinie Epoxidharz im Trinkwasserbereich“Ausgabe Juli 2010Verband der deutschen Lack- und Druckfarbenindustrie e.V.Mainzer Landstraße 55, 60329 Frankfurt am Main

***BANKAMERICARD REWARDS VISA® CARD FEATURESRewards begin at 2,500 points for cash/merchandise and 25,000 points for air. Air rewards subject to maximum dollar value and special air arrangements require payment of additional points and a processing fee. Earn unlimited points. You will earn 1Point per dollar (these are your “base points”) based on new net retail purchases (purchases less credits, returns and adjustments) charged to your BankAmericard Rewards Visa credit card each billing cycle. If you have at least one other open (andcontinuously maintained in good standing) Bank of America deposit, loan, or investment account, and if this BankAmericard Rewards Visa credit card was opened by applying in the banking center with a banking center associate, over the phone, througha Bank of America ATM, with a Group Banking associate, or by completing and mailing this banking center take-one application, then this BankAmericard Rewards Visa credit card account will be an “eligible account” and will earn additional points.Eligible accounts earn an additional .25 Points per dollar based on new net retail purchases (purchases less credits, returns and adjustments) charged to your BankAmericard Rewards Visa credit card each billing cycle. Eligible accounts will also receivean annual bonus match of 25% of your yearly base points that were earned while the account was an eligible account. The annual bonus will be calculated based on points earned from January 1st through December 31st each calendar year. This annualbonus match will appear on your February or March monthly billing statement. This offer is not available through other channels unless explicitly stated otherwise. Point earnings are rounded to the nearest whole point. Balance transfers, cash advances,including purchases of money orders or other cash equivalents, out-of-network payments made through the Bill Pay Choice service, purchases made by or for a business or for a business purpose, fees, finance charges, and unauthorized/fraudulenttransactions do not earn points. Points are valid for 5 years. Points and/or rewards may not be combined with other discount or reward programs, unless specifically authorized by us. Online merchandise catalog has widest selection of rewards; abridgedpamphlet sent upon request. Cash reward check expires 90 days after date of issue. Cash rewards not transferable. Other significant terms apply. Program subject to change. For more information, visit www.bankofamerica.com/worldpoints. Detailsaccompany new account materials. All BankAmericard Rewards Visa cardholders receive WorldPoints program benefits.ConditionsYou are at least 18 years of age or you are at least 21 years of age if a permanent resident of Puerto Rico. You authorize FIA Card Services, N.A. (hereinafter “we” “us” or “our”) to review your credit and employment histories and any other information in orderto approve or decline this request, service your account, and manage our relationship with you. You consent to our sharing of information about you and your account with the organization, if any, endorsing this credit card program. You authorize us to sharewith others, to the extent permitted by law, such information and our credit experience with you. In addition, you may as a Customer later indicate a preference to exempt your account from some of the information-sharing with other companies (“opt-out”).If you accept or use an account, you do so subject to the terms described in this document, the “Details of Rate, Fee, and Other Cost Information,” and the Credit Card Agreement as it may be amended including its arbitration provision; you also agree to payall charges incurred under such terms. You understand that the Annual Percentage Rate you receive will be determined based on your creditworthiness. Any changes you make to the terms of this application will have no effect. You understand that if youapply for an BankAmericard Rewards Visa® card, based on your creditworthiness your application may be approved for a Gold account (Standard Platinum Plus Visa and BankAmericard Rewards Visa accounts only), or a Preferred account. The APRs andbenefits for Gold accounts and Preferred accounts differ from each other and from Platinum Plus accounts. You accept that on a periodic basis your account may be considered for automatic upgrade at our discretion. You consent to and authorize us, any ofour affiliates, or our marketing associates to monitor and/or record any of your phone conversations with any of our representatives.BALANCE TRANSFERS. If the total amount you request exceeds your credit line, we may either send full or partial payment to your creditors in the order you provide them to us or we may send you Cash Advance Checks. Allow at least 2 weeks from accountopening for processing. Continue paying each creditor until the transfer appears as a credit. Balance Transfers incur finance charges from the transaction date. Balance Transfers are subject to transaction fees in the amount of 3% of the transaction (min.$10, max. $75). If you have a dispute with a creditor and pay that balance by transferring it to your new account, you may lose certain dispute rights. Balance Transfers may not be used to pay off or pay down any account issued by FIA Card Services, N.A.BT.0107Overdraft ProtectionOverdraft transfers to your Bank of America checking account from your credit card account will be Cash Advances under your Credit Card Agreement. Transfers will be subject to the terms of both your Credit Card Agreement and the account agreement(s)and disclosures governing your Bank of America checking account. If you link your Bank of America checking account to your credit card for Overdraft Protection, we will automatically transfer funds in multiples of $100 ($25 if you opened your checkingaccount in Washington or Idaho) from your credit card account to cover any overdraft on your checking account, as long as your credit card account has sufficient available credit and you are not in default under your Credit Card Agreement. A fee of 3% ofthe amount transferred ($10 minimum) will apply and the cash advance will accrue interest at the APR stated in your Credit Card Agreement. If the available balance on your credit card account is insufficient to cover the amount required by the overdraft(in the multiple of funds stated above), we may advance the funds even if it causes your credit card account to exceed your credit limit. In that event, an over-the-credit-limit fee will be applied. In certain situations, the fees charged for using OverdraftProtection service linked to your credit card could be higher than the fee for an overdraft or insufficient funds (returned) item that otherwise would have been charged to your checking account. Linking Overdraft Protection from your Bank of Americachecking account to your credit card will end any Overdraft Protection connections to your Bank of America savings account. Please see your Credit Card Agreement for additional details.Automatic Payment TermsYou authorize FIA Card Services, N.A. (hereinafter “we,” “us,” or “our”) and the bank named on the enclosed voided personal check you included with your application (the “Depository Bank”) to deduct the amount selected on the enclosed application (eitherthe Minimum Payment Due or the New Balance shown on each monthly billing statement) from your checking account to pay your credit card account.By requesting AutoPay, you agree that:1. We will process your credit card payment each month on each Payment Due Date for the amount you have chosen on the enclosed application. We will request the Depository Bank to charge your checking account for the amount of each payment. We arenot responsible for errors made by the Depository Bank.2. It can take up to two billing cycles for AutoPay to be set up. Continue to make manual payments until AutoPay is in effect on your account. A letter will be sent to you confirming the AutoPay setup and you will also receive notification on your billing statement.3. The automatic payment will be deducted from your checking account on the payment due date.4. We may credit your credit card account for an automatic payment before the funds are received from the checking account. If we do so, we may reverse the credit if the payment is not received from your checking account.5. We will process each payment as long as the following conditions apply:a. This Agreement remains in effect;b. Sufficient funds are available in your checking account;c. You have not stopped payment on the payment; andd. We continue to offer AutoPay for your account.6. Either you or we may terminate this agreement with respect to future payments by giving the other party at least 10 days’ written notice cancelling AutoPay for your account.

USA PATRIOT ActTo help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account. What this means for you: Whenyou apply for an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. We may ask you to provide us with other identifying documents.Credit Protection Plus Terms and ConditionsCredit Protection Plus (“the Plan”) is an optional product available on Your Bank of America credit card account. Whether or not You purchase the Plan will not affect Your application for credit or the terms of any existing credit agreement You have with Us.Benefits: In return for a Monthly Program Fee, the Plan can credit up to 18 Monthly Benefit Amounts in the event You incur an approved Hospitalization, Total Disability, Involuntary Unemployment, or Family Medical Leave. You can also receive Three (3)Monthly Benefit Amounts for any approved Life Event. In the event of Your Loss of Life, the Plan can credit a lump sum benefit amount equal to the outstanding balance on the Date of Loss or $25,000, whichever is less.Cost: The Monthly Program Fee is 95¢ per $100 of Your Monthly Outstanding Balance up to $25,000. For Your convenience, the fee is automatically billed to Your credit card account. During months when there is no balance and no activity Your credit cardstatement, there is no charge for the Plan that month.Eligibility Exclusions: There are eligibility requirements, conditions and exclusions that could prevent You from receiving benefits under the Plan. Please refer to the Addendum to the Credit Card Agreement for a full explanation of all requirements,conditions and exclusions.Termination: If, at any time during the first thirty (30) days after the date Your protection begins, You cancel the optional Plan, all Plan fees billed to Your account will be refunded via a credit to the protected card. You have the right to cancel the Plan at anytime by making a telephonic or written request to the Plan Administrator. The Plan will automatically terminate under the following circumstances: You no longer have the Enrolled Account; Your Enrolled Account is closed due to account charge-off; Yousuffer a Loss of Life; Your Enrolled Account becomes 4 payments past due, You enter into a repayment plan for the Enrolled Account, or You conduct or attempt to conduct fraud relating to Plan benefits.The Plan Administrator is CSI Processing, LLC at Credit Protection Plus, P.O. Box 34888, Omaha, NE 68134-0888; (800) 242-6806 Monday – Friday, 7:00 a.m. – 10:00 p.m. Central Time.The Bank of America Privacy Policy is available at bankofamerica.com and accompanies the credit card. This credit card program is issued and administered by FIA Card Services, N.A. Any account opened in response to this application shall be governedby the laws of the State of Delaware.Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. WorldPoints, the WorldPoints design, and Platinum Plus are trademarks of FIA Card Services, N.A. All other trademarks and logos are the propertyof their respective owners.This information was accurate as of 08/31/2007 and may have changed.PRESCREEN & OPT-OUT NOTICE: This “prescreened” offer of credit is based on information in your credit report indicating that you meet certain criteria. This offer is not guaranteed if you do not meet our criteria. If you do not want toreceive prescreened offers of credit from this and other companies, call the consumer reporting agencies toll-free, 1-888-567-8688; or write: Experian Consumer Opt Out, PO Box 919, Allen, TX 75013; Equifax Options, PO Box 740123, Atlanta,GA 30374-0123; or TransUnion Opt Out Request, PO Box 505, Woodlyn, PA 19094-0505.