CHARITABLE BINGO OPERATIONS DIVISION - Txbingo.org

CHARITABLE BINGO OPERATIONS DIVISION - Txbingo.org

CHARITABLE BINGO OPERATIONS DIVISION - Txbingo.org

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

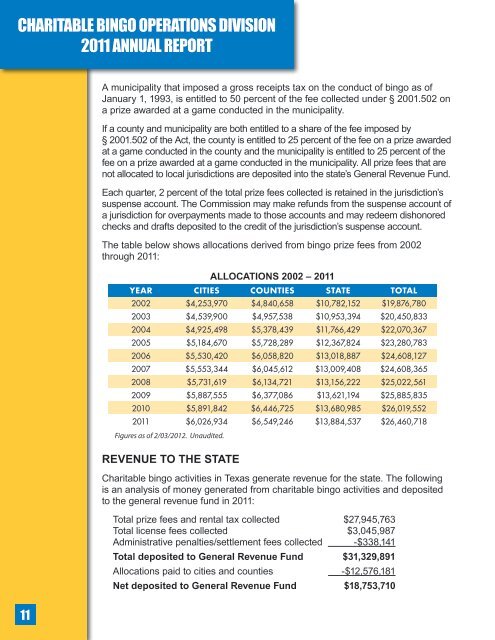

<strong>CHARITABLE</strong> <strong>BINGO</strong> <strong>OPERATIONS</strong> <strong>DIVISION</strong>2011 ANNUAL REPORTA municipality that imposed a gross receipts tax on the conduct of bingo as ofJanuary 1, 1993, is entitled to 50 percent of the fee collected under § 2001.502 ona prize awarded at a game conducted in the municipality.If a county and municipality are both entitled to a share of the fee imposed by§ 2001.502 of the Act, the county is entitled to 25 percent of the fee on a prize awardedat a game conducted in the county and the municipality is entitled to 25 percent of thefee on a prize awarded at a game conducted in the municipality. All prize fees that arenot allocated to local jurisdictions are deposited into the state’s General Revenue Fund.Each quarter, 2 percent of the total prize fees collected is retained in the jurisdiction’ssuspense account. The Commission may make refunds from the suspense account ofa jurisdiction for overpayments made to those accounts and may redeem dishonoredchecks and drafts deposited to the credit of the jurisdiction’s suspense account.The table below shows allocations derived from bingo prize fees from 2002through 2011:ALLOCATIONS 2002 – 2011YEAR CITIES COUNTIES STATE TOTAL2002 $4,253,970 $4,840,658 $10,782,152 $19,876,7802003 $4,539,900 $4,957,538 $10,953,394 $20,450,8332004 $4,925,498 $5,378,439 $11,766,429 $22,070,3672005 $5,184,670 $5,728,289 $12,367,824 $23,280,7832006 $5,530,420 $6,058,820 $13,018,887 $24,608,1272007 $5,553,344 $6,045,612 $13,009,408 $24,608,3652008 $5,731,619 $6,134,721 $13,156,222 $25,022,5612009 $5,887,555 $6,377,086 $13,621,194 $25,885,8352010 $5,891,842 $6,446,725 $13,680,985 $26,019,5522011 $6,026,934 $6,549,246 $13,884,537 $26,460,718Figures as of 2/03/2012. Unaudited.REVENUE TO THE STATECharitable bingo activities in Texas generate revenue for the state. The followingis an analysis of money generated from charitable bingo activities and depositedto the general revenue fund in 2011:Total prize fees and rental tax collected $27,945,763Total license fees collected $3,045,987Administrative penalties/settlement fees collected -$338,141Total deposited to General Revenue Fund $31,329,891Allocations paid to cities and counties -$12,576,181Net deposited to General Revenue Fund $18,753,71011