26-28 September 2012 Southern Sun Ridgeway, Lusaka, Zambia ...

26-28 September 2012 Southern Sun Ridgeway, Lusaka, Zambia ...

26-28 September 2012 Southern Sun Ridgeway, Lusaka, Zambia ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

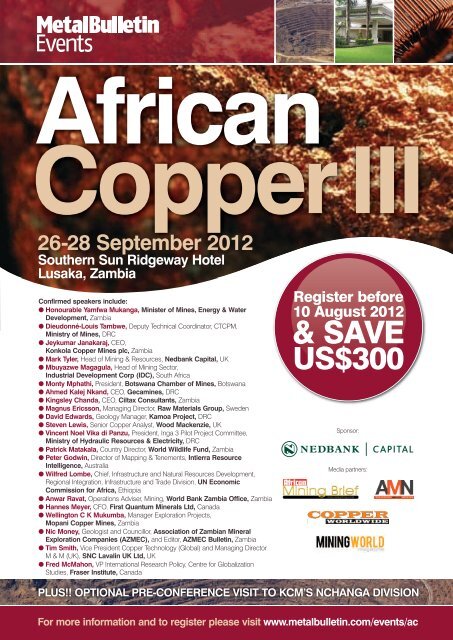

AfricanCopperIII<strong>26</strong>-<strong>28</strong> <strong>September</strong> <strong>2012</strong><strong>Southern</strong> <strong>Sun</strong> <strong>Ridgeway</strong> Hotel<strong>Lusaka</strong>, <strong>Zambia</strong>Confirmed speakers include:l Honourable Yamfwa Mukanga, Minister of Mines, Energy & WaterDevelopment, <strong>Zambia</strong>l Dieudonné-Louis Tambwe, Deputy Technical Coordinator, CTCPM,Ministry of Mines, DRCl Jeykumar Janakaraj, CEO,Konkola Copper Mines plc, <strong>Zambia</strong>l Mark Tyler, Head of Mining & Resources, Nedbank Capital, UKl Mbuyazwe Magagula, Head of Mining Sector,Industrial Development Corp (IDC), South Africal Monty Mphathi, President, Botswana Chamber of Mines, Botswanal Ahmed Kalej Nkand, CEO, Gecamines, DRCl Kingsley Chanda, CEO, Ciltax Consultants, <strong>Zambia</strong>l Magnus Ericsson, Managing Director, Raw Materials Group, Swedenl David Edwards, Geology Manager, Kamoa Project, DRCl Steven Lewis, Senior Copper Analyst, Wood Mackenzie, UKl Vincent Noel Vika di Panzu, President, Inga 3 Pilot Project Committee,Ministry of Hydraulic Resources & Electricity, DRCl Patrick Matakala, Country Director, World Wildlife Fund, <strong>Zambia</strong>l Peter Godwin, Director of Mapping & Tenements, Intierra ResourceIntelligence, Australial Wilfred Lombe, Chief, Infrastructure and Natural Resources Development,Regional Integration, Infrastructure and Trade Division, UN EconomicCommission for Africa, Ethiopial Anwar Ravat, Operations Adviser, Mining, World Bank <strong>Zambia</strong> Office, <strong>Zambia</strong>l Hannes Meyer, CFO, First Quantum Minerals Ltd, Canadal Wellington C K Mukumba, Manager Exploration Projects,Mopani Copper Mines, <strong>Zambia</strong>l Nic Money, Geologist and Councillor, Association of <strong>Zambia</strong>n MineralExploration Companies (AZMEC), and Editor, AZMEC Bulletin, <strong>Zambia</strong>l Tim Smith, Vice President Copper Technology (Global) and Managing DirectorM & M (UK), SNC Lavalin UK Ltd, UKl Fred McMahon, VP International Research Policy, Centre for GlobalizationStudies, Fraser Institute, CanadaRegister before10 August <strong>2012</strong>& SAVEUS$300Sponsor:Media partners:PLUS!! OPTIONAL PRE-CONFERENCE VISIT TO KCM’S NCHANGA DIVISIONFor more information and to register please visit www.metalbulletin.com/events/ac

African Copper III<strong>26</strong>-<strong>28</strong> <strong>September</strong> <strong>2012</strong> <strong>Southern</strong> <strong>Sun</strong> <strong>Ridgeway</strong>, <strong>Lusaka</strong>, <strong>Zambia</strong><strong>Zambia</strong>’s annual copper output is set to reach 1.5mtonnes by 2016 while the DRC is aiming for similarproduction levels within the same time-frame – andtheir largely untapped mineral wealth is drawing theinterest of the global mining community. With thelong-term fundamentals remaining very buoyant forcopper, the search for new and economically viablesources of the red metal is gaining pace, and Africais high on the list of resources to be mined.The continent as a whole offers a great deal in terms ofreward – higher ore grades than in most parts of theworld, exciting and lucrative by-products, and aneconomy that is desperately keen for economicdevelopment and diversification. There are risks too –logistical and operational hurdles, not to mention therecent drive for ensuring the proceeds from mining toremain, to a larger degree, within national boundaries.Given the heightened interest in investing in Africancopper to replenish the global supply pipeline, MetalBulletin Events is holding its third African CopperConference in its natural home – the Central AfricanCopperbelt. Recognising the region’s growingimportance to global copper balances, <strong>Zambia</strong> and thecity of <strong>Lusaka</strong> will play host to this year’s conferencewhich will feature an extended programme and a visit toa local mining operation.Key topics for discussion:l Overcoming logistical, infrastructure and energyhurdles? How much progress is being made?l Will resource nationalism put the brakes onmine development?l Global concentrate supply-demand balances –what can Africa realistically contribute?l Balancing economic pressures withenvironmental and ecological imperativesl Where is the mineralization and how good is it?What about co-products such as cobalt and gold?l Can DRC and <strong>Zambia</strong> spawn new mega-projects?l What do other countries such as Eritrea,Botswana, Nambia, and Gabon have to offer?l Geopolitical stability and country risk; mining lawreform – promises or reality?l Financing options: the banks, the trading houses,the multilateral agenciesWho should attend?l Traders, smelters and users of copper lookingfor new supply sourcesl Junior miners and exploration firms looking toshowcase their projects and secure financel Brokers and bankers looking for newopportunities and wanting to gauge the risksl Logistics and infrastructure providers,equipment makers and consultants seekingnew sales openingsl Anyone with an interest in global copper supply– demand balances and trends

Wednesday <strong>26</strong> <strong>September</strong> <strong>2012</strong>18:00 RegistrationConference welcome receptionDay oneThursday 27 <strong>September</strong> <strong>2012</strong>08:00 Registration desk opens09:00 Opening remarksAnn-Marie Moreno, Metal Bulletin Events, UK09:05 Welcome addressHonourable Yamfwa Mukanga, Minister of Mines,Energy & Water Development, <strong>Zambia</strong>Session I: Copperbelt copperpotential under scrutiny09:30 The role of government in building a sustainablecopper industry• Creating an attractive investment model for mine development• Striking the right balance in fiscal and regulatory reform• Good governance, transparency and political stability as foundationsfor investment• Mining as a driver for social and economic improvement• The government’s role in developing infrastructure and energy• The state-investor-community alliance – optimising benefits forall stakeholders• Valuation of minerals by-products and creating a copper downstreamindustry for a sustainable developmentDieudonné-Louis Tambwe, Deputy TechnicalCoordinator, CTCPM, Ministry of Mines, DRCMagnus Ericsson, Managing Director,Raw Materials Group, Sweden10:20 Gecamines and African copper development – howwill this partnership evolve in the coming years?• How has Gecamines’ role changed in the past 20-30 years and what isits purpose today?• The transition from state mining company to commercial enterprise –what challenges remain? How will it be financed?• What expertise can Gecamines bring to exploration and miningjoint ventures?• Is there scope for investment outside the DRC?Ahmed Kalej Nkand, CEO, Gecamines, DRC11:05 Refreshment breakSession II: African copperresources – how good, howmuch, how needed?11:35 African copper mine production in a globalcontext – and what of the future?• Latin America remains king – but is it losing momentum? What of Asiaand Australasia?• How much is Africa supplying today and what prospects for the next5-10 years?• SX-EW versus concentrate? Contrasting acid supply and smeltercapacity in Latin America and Africa• How do African mining costs compare to other major productioncentres?Steven Lewis, Senior Copper Analyst,Wood Mackenzie, UK11:50 Exploring Sub-Saharan Africa for new copperresources – what more can the region offer?• How well explored is Sub-Saharan Africa today?• Quality, quantity, ore type, depth – how attractive are theknown orebodies?• What new resources are being uncovered – where and what potential?• Who is spearheading the exploration drive? Is moreexpenditure needed?• Using modern exploration techniques and geological mapping tooptimise resultsPeter Godwin, Director of Mapping & Tenements,Intierra Resource Intelligence, Australia12:15 An overview of copper geology and other mineraldistribution in <strong>Zambia</strong>• Where are the country’s copper resources – what form, type, quality?• What else can the country offer in terms of mineral wealth?• How much scope is there for boosting energy mineral output?• Examining the investment potential of <strong>Zambia</strong>n mineralsNic Money, Geologist and Councillor, Association of<strong>Zambia</strong>n Mineral Exploration Companies (AZMEC),and Editor, AZMEC Bulletin, <strong>Zambia</strong>12:40 LunchSession III: New initiatives forCopperbelt copper14:15 Kamoa – a world class copper mine in the making?• Geology, resources reserves• What are the metallurgical, geotechnical, socio-economic andenvironmental considerations in this new area of the Copperbelt?• Does this western extension of the CAC have the potential to hostmore sizeable orebodies? What is exploration indicating?David Edwards, Geology Manager, Kamoa Project, DRC14:40 Building new life into Nkana – a review of theSynclinorium shaft project• Investment costs, feasibility results, financing and time lines• How much more copper will be produced and for how much longer?• What other plans are on the drawing board to extend Mopanimine lifespans?Wellington C K Mukumba, Manager ExplorationProjects, Mopani Copper Mines, <strong>Zambia</strong>15:05 African Copperbelt smelter developments– an update• Copperbelt main centres producers and logistical aspects ofcopper smelting• Existing and proposed copper smelters and their technologies andestimated capacities• Related smelter issues – power, transport and cobaltTim Smith, Vice President Copper Technology (Global)and Managing Director M & M (UK),SNC Lavalin UK Ltd, UKMetal Bulletin Events reserve the right to alter the venue, timings and/or speakers. © Metal Bulletin Events, part of Euromoney Trading Limited

15:30 Refreshment breakSession IV: Financing coppermine development in Africa16:00 Financing copper mine development in Africa• Examining political stability and country risk• Finance options for Africa miners – is bank finance available?• What of equity finance – how are investors viewing Africa?• What criteria are the banks looking for? What role are African banksplaying in supporting mine development• Pre-export finance as a quick-start solution especially in difficultareas• Is private equity a route to mine finance?• What role can and are the regional and multinational developmentbanks playing?• What finance is available for plant and equipment procurement?• The role of the IDC in fomenting mineral industry growth in Africa• What assistance can the IDC provide for mining companies?• What are the project, company and country criteria forreceiving funding?• From exploration to mining to metal – at what stage can the IDCbecome involved?• Involving the wider community in mineral growth and its rewardsPanellists:Mark Tyler, Head of Mining & Resources,Nedbank Capital, UKHannes Meyer, CFO,First Quantum Minerals Ltd, CanadaMbuyazwe Magagula, Head of Mining Sector,Industrial Development Corp (IDC), South Africa17:15 Close of day oneDay twoFriday <strong>28</strong> <strong>September</strong> <strong>2012</strong>08:30 Registration desk opens09:00 Opening remarksSession V: How do Africanmining economies fare on apractical level?09:10 Keynote: Operational challenges from a miningcompany viewpoint• Infrastructure issues and their impact on project viability• Manning the new mining sector – is the global skills shortage evenmore acute in Africa?• What of plant, equipment and other inputs? Are water resourcesan issue?Jeykumar Janakaraj, CEO,Konkola Copper Mines plc, <strong>Zambia</strong>09:35 Addressing trade and tax issues in <strong>Southern</strong> Africa• Taxation regimes in the main copper producing countries – whatdoes the investor need to know?• Trade compliance for the importer and exporter – where are themain hurdles?• What incentives and tax breaks are available?• Facilitating customs clearance, duty and VAT rebatesKingsley Chanda, CEO, Ciltax Consultants, <strong>Zambia</strong>10:00 Botswana as a stable and sustainablemining economy• Mining in Botswana in today – who does what and where?• What can the country offer in terms of mineral wealth, security oftenure and political stability?• What mechanisms are in place to ensure the rewards of mining areevenly distributed?• What operational and logistical challenges remain to be overcome?Monty Mphathi, President,Botswana Chamber of Mines, Botswana10:25 What progress is being made to scale up accessto energy in sub-Saharan Africa?• How is economic development impacting on electricity demand?• What initiatives are underway to strengthen resource sharing, createa common market and ensure a sustainable energy industry?• How will the Grand Inga project help power growth in the region?Vincent Noel Vika di Panzu, President, Inga 3 PilotProject Committee, Ministry of HydraulicResources & Electricity, DRC10:50 Refreshment break11:20 Session VI: Sustainability,community and the environmentModerator and introduction:Anwar Ravat, Operations Adviser, Mining,World Bank <strong>Zambia</strong> Office, <strong>Zambia</strong>11:35 Balancing human, wildlife and environmentalneeds with the economic and strategicimperatives of modern-day mining• Managing stakeholder and in particular community expectations• Understanding ecosystem services and contributions to livelihoodsand economies• Integrating the natural resources sector into national developmentframeworks• Water and land resource use and post-mine rehabilitation – whatspecific challenges does Africa hold?• Recommendations for greening the mining sector and whatincentives and market-based mechanisms for sustainableland management?Patrick Matakala, Country Director,World Wildlife Fund, <strong>Zambia</strong>12:00 Integrating the natural resources sector intonational development frameworks• What are the benefits mining can and should bring to all stakeholders?• Collaborating with local stakeholders to minimize and mitigateadverse impacts• Community engagement and consultation as the key to successfultwo-way communications• Devising an impacts checklist for the prefeasibility stage of newprojects and mine expansions• What to do should things go wrong – ensuring channels exist forformal grievance and redressWilfred Lombe, Chief, Infrastructure and NaturalResources Development, Regional Integration,Infrastructure and Trade Division, UN EconomicCommission for Africa, Ethiopia12:25 Investment competitiveness of sub-Saharannations with a focus on <strong>Zambia</strong>Fred McMahon, VP International Research Policy,Centre for Globalization Studies, Fraser Institute,Canada12:50 Discussion period13:10 Lunch and conference close

Sponsorship &exhibitionopportunitiesShowcase your company, increase your brandawareness and enhance your networkingopportunities by becoming a sponsor of theAfrican Copper III. Sponsorship opportunitiesdeveloped by Metal Bulletin Events have becomeessential tools for organisations in fulfilling theirmarketing objectives. There are a range ofsponsorship opportunities which will enable yourcompany to raise your brand profile, before and atthe event as well as highlight your company to anaudience of senior executives and key decisionmakers from across the sector.l Welcome reception – network and welcomepotential clients with your branding prominentField tripOptional field trip toKCM’s Nchanga Division25-<strong>26</strong> <strong>September</strong> <strong>2012</strong>The historic Nchanga copper-cobalt mine is situated in the<strong>Zambia</strong>n Copperbelt near the town of Chingola, anddates back to the 1930s. Nchanga’s operating unitscomprise the Nchanga underground mine, fouroperational open-pits, two concentrators, a tailings leachplant, a new direct to blister flash smelter and acid plant.KCM recently invested $100million in the new East Millconcentrator to boost metalrecoveries and cut operatingcosts. There are also plans tospend $200 million on theChingola refractory orestockpile project and $300 million on expanding andextending the lifespan of Nchanga mines. India’s VedantaResources owns an indirect 79.4% stake in KCM, which islisted on the <strong>Lusaka</strong> Stock Exchange. The <strong>Zambia</strong>ngovernment, through ZCCM Investments Holdings, ownsthe remaining KCM stake.Further information about how to sign up for the field tripwill be sent along with your conference registrationacknowledgement.Companies who have attended previousAfrican Copper Conferences include:l Host a delegate lunch – entertain a largenumber of existing and potential clientsl Coffee break sponsor – get your messageacross with high visibility brandingl Delegate bag sponsor – your companylogo on the move for maximum effectl Platinum, Gold & Silver branding –stand out from the rest and ensure your logo is onthe conference stage, all event banners andmarketing material, which is distributed tothousands of professionals in the market placeTo find out more about tailored sponsorship orto reserve your exhibition booth, please contact:Manjit SandhuTel: +44 (0) 20 7779 8188Email: msandhu@metalbulletin.com• Access Freight Africa• Alexander Mining• Alfred H KnightInternational Limited• Anglo American• Antofagasta Minerals• BHP Billiton• Blackthorn Resources Limited• Blenheim Capital Management• Bloomberg News• Cesco Ltda• Clairmont Metals Corporation• Concord Metals Recycling Ltd• DRC Ministry of Mines• Drum Resources Ltd• EMED Tartessus• ENRC Marketing AG• FBN Bank UK Ltd• Financial Times• Freeport McMoRan Copper& Gold Inc• Gecamines• Global Trade InformationServices Inc• Heavymovement• Int’l Copper Study Group• Ivanhoe Mines Ltd• JP Morgan Chase Bank• LN Metals International Ltd• Louis Dreyfus Commodities• Mitsui & Co Europe Plc• Mwana Africa Plc• Nantong Xinwei• Nedbank Capital• Niitco Gmbh• Norges Bank InvestmentManagement• Oando Limited• Outotec Oyj• Pacorini Metals Iberica SAU• Palabora MiningCompany Limited• Ptolemy Resource Capital• Reuters News• Rio Tinto• Rio Tinto (Hong Kong) Ltd• Shalina Resources Limited• Simon Hunt Strategic Services• Societe Generale• Spezia Consultants Metals Ltd• Standard Bank• Sumitomo Mitsui BankingCorporation Europe Limited• Teck Resources Limited• The Beijing Axis• Thomson Reuters• Trafigura Ltd• UTi• VTB Capital• VU Group• Weatherly International• WestLB AG