II YEAR - ANUCDE

II YEAR - ANUCDE

II YEAR - ANUCDE

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

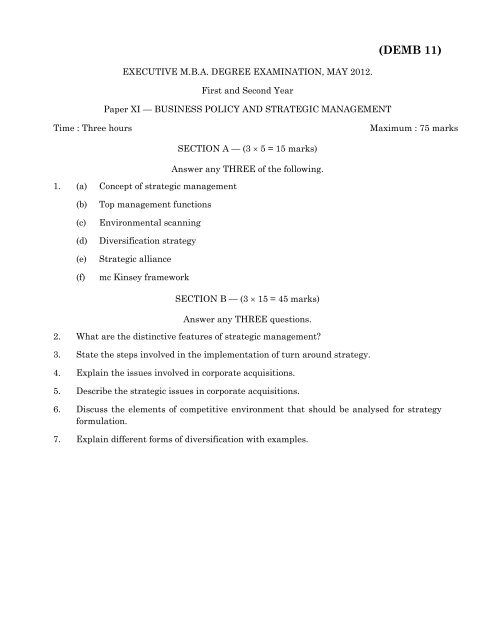

(DEMB 11)EXECUTIVE M.B.A. DEGREE EXAMINATION, MAY 2012.First and Second YearPaper XI — BUSINESS POLICY AND STRATEGIC MANAGEMENTTime : Three hoursMaximum : 75 marks1. (a) Concept of strategic managementSECTION A — (3 × 5 = 15 marks)Answer any THREE of the following.(b)(c)(d)(e)(f)Top management functionsEnvironmental scanningDiversification strategyStrategic alliancemc Kinsey frameworkSECTION B — (3 × 15 = 45 marks)Answer any THREE questions.2. What are the distinctive features of strategic management?3. State the steps involved in the implementation of turn around strategy.4. Explain the issues involved in corporate acquisitions.5. Describe the strategic issues in corporate acquisitions.6. Discuss the elements of competitive environment that should be analysed for strategyformulation.7. Explain different forms of diversification with examples.

SECTION C — (15 marks)(Compulsory)8. “It was the best of times; it was the worst of times”It was the former because Allen Bank’s acquisition of a part of the Bradbury Bank -what the latter termed NEM (Newly Emerging Market) operations - seemed anacquisition scripted in heaven. Both were venerable institutions of British origin. Allenwas the largest international bank in developing markets. Its core businesses? Retailand corporate banking, treasury ops and trade financing. The bank employed over33,000 people across 740 offices in 55 countries Bradbury bank was smaller, but onlymarginally so. It employed 28,000 people and was present in 42 countries. Its corebusinesses were retail and corporate banking and trade financing. However, its NEMbusiness was focussed exclusively on high-networth individuals and large corporates. So,when Bradbury wished to sell its NEM operations – it wanted to exit NEM becausemost’ economies there boasted a low credit rating and it wished to lessen its overallcredit risk; besides, it wished to focus its efforts on the first world - it was only naturalthat Allen, which wished to expand its presence in developing countries, buy them.It was the worst of times because the Cultures of the two banks were as different asblues-grass and Bhangra-pop. Allen was a systems driven bank which boasted of stronginternal controls and placed an emphasis on training and performance. Bradbury was aold-world type, inward-looking firm with weak control Systems and condoned pedestrianperformance. Worse, it did little to spread its customer base and aggressively acquirenew business.It was also the worst of times because the two companies had different organisationalstructures. Allen favoured the matrix with the head of each division or functionreporting directly to the regional head of that division or function, and only informally tothe country head. Bradbury preferred a linear reporting relationship with everyonereporting to the country head. Expectedly, Bradbury employees who became part of therechristened Allen Bradbury Bank (ABB - no relation to the energy giant, although thebank could have learned a thing or two from that company’s integration of Asea andBrown Boveri) felt lost. “There is no symbol of authority I can relate to in myworkplace,” was a commonly heard refrain.

None of these, though, worried Surinder Sawhney, the 53-year old CEO of ABB, as muchas the issue of people. Like most CEOs discover during the process of integrationSawhney was discovering that ABB seemed to have two people for every position. Worse,Allen-employees considered their counterparts from Bradbury, who had been taken on,as baggage. “They’re here because that was part of the deal with Bradbury”, confidedone young manager from ABB (he was from the Allen-side). “By themselves, thesepeople would have never been hired by us. “Not surprisingly, the acquisition had alsothrown a spanner into Allen’s well thought out career—progression plans. Sawhney andhis HR head were discovering that they would have to redefine these for a larger groupof employees. At the same time, they had to convince old Allen employees that theyweren’t being short-changed in the process. One senior HR manager had suggested thatthey get senior executives to make short presentations on why they were essential toABB. Sawhney had thought the idea brilliant; his executives hadn’t. Nor had the media.Within days horror stories, mostly apocryphal, about people having to re-interview fortheir jobs were doing the rounds. And all the while, ABB was steadily losing people.Head-hunters and rival banks were making a beeline for some of ABB’s renownedhuman capital. And insecure employees were signing up with lesser companies ratherthan negotiate an uncertain future at the bank.In desperation, Sawhney turned to an old friend, Vinay Sen, a HR professional who’dmade a career for himself as an independent consultant. That hadn’t helped much. True,Sen had shared some interesting thoughts on the issue of synergy. “Apart fromvaluation, the most hyped phrase in an M and A deal is synergy, “he had said. “Peopletalk of dove-tailing strengths and capabilities, bringing complementary skills andexploiting cross-marketing opportunities. To me, synergy simply means one plus one, isnot two, but six, or may be, eight. When a merger merely maintains the existingequilibrium, it does not make for synergy. It is only when there is a geometric leap inthe advantages accruing to a merged entity that synergy makes sense”. All sound stuff;only, it did little to help Sawhney tackle the problem at hand.And this, the beleaguered CEO realised, was only the beginning. Convincing the besttalent to stay put within the bank was the immediate objective. But there were otherlong-term ones. Like realising the benefits of the synergy Sen spoke about and ensuringthat ABB ended up with a larger share of the market than any of its constituententities. Sawhney had read all the right books on getting M and As to work for you, but

this was real. And it was painful. “Heck,” he thought, “we don’t even share a common e-mail system”.Questions:(a)(b)(c)(d)(e)‘Integration is critical to the success of a merger’. Examine the statement keepingthe Allen and Bradbury case in mind.What should Sawhney do to strengthen both banks and develop a concretebusiness plan?What are the areas of compatibility and conflict between Bradbury Bank and AllenBank?What kind of organisational structure should be put in place with a view to ensuresmooth translation of rhetoric into action plans?As a consultant, what steps do you recommend to implement the integration?——————————

(DEMB 12)EXECUTIVE M.B.A. DEGREE EXAMINATION, MAY 2012.First and Second YearsPaper X<strong>II</strong> — INTERNATIONAL BUSINESSTime : Three hoursSECTION A — (3 × 5 = 15 Marks)Answer any THREE of the following.1. (a) Significance of international businessMaximum : 75 marks(b)(c)(d)(e)(f)Ethics in international businessMIS in global businessTrading blocksLogisticsOffensive strategiesSECTION B — (3 × 15 = 45 Marks)Answer any THREE questions.2. State the role of international business in the economic development of a country.3. What do you think are the problems caused by MNCs to host countries?4. How is international strategic management different from domestic strategicmanagement?5. Discuss the strategies employed by a global company to build competitive advantages.6. Bring out the mechanisms employed to control international business.7. How do bilateral and multilateral agreements resolve and prevent conflicts?

SECTION C — (15 Marks)Compulsory8. Super Computers are the fastest computers which are used mainly by scientists, Asupercomputer can cost upward of $30 million. Cray research Inc. is the undisputedleader in this market segment, and it has 67 percent of the world market. Fujitsu Ltd.,in second place, holds 20 percent. The third – place NEC Corp. Has 6 percent.In 1987, the Masachusetts institute of Technology (MIT) planned to buy or rent asupercomputer and solicited bids for the $7.5 million contracts. Among those submittingproposals were Cray Research, IBM. ETA Systems, Amdahi (46 percent owned byFujitsu), and Honeywell – NEC (50 percent owned by NIPPON Electric Corp.).Learning of M.I.T's preference for Japanese - made machines, the U.S. governmentintervened. The acting Secretary of Commerce formally informed M.I.T.'s president that“imported products may be subject to U.S antidumping duty proceedings". Informally,despite a denial of the Commerce Department of the government’s threat, it was madeclear to M.I.T. that of Japan’s barriers preventing U.S. supercomputer firms fromentering the Japanese market, it would not be in the interest of the United States topurchase Japanese units.M.I.T. reacted to the U.S. government’s intervention by cancelling its procurement andannouncing that it planned to apply for federal funds for a research center that woulduse several U.S. made supercomputers.In 1990 supercomputer trade accord has helped Cray Research to increase its marketshare in commercial installations in Japan to 25 percent. How over Cray Research hasbeen unable to further penetrate the public sector, and its market share in this sectorremains at 8 percent. The Public sector includes government funded universities andresearch labs. Although Japanese firms have long been Cray’s Customers, the Japanesegovernment (Japan’s biggest buyer) has never bought from Cray.

As an examples of how difficult it is to penetrate Japan’s public sector, the NationalInstitute for Fusion Research chose to lease NEC’S SX -3 system for $625,000 a month.However, according to four pages of benchmark test results, Cray’s C90 systemsurpassed all but one of the Fusion Institute’s speed requirements. Still Japaneseofficials insisted that the extra power available from Cray’s machine was irrelevantsince the fusion scientists did not need it. Furthermore. They pointed out that the bidrequired the machines to work with specialized storage devices. Cray, on the other hand,argued that the requirement in question was bogus since it was included solely to favorNEC’s machine.Washington, while accuring Japan of being unfair, has done exactly the same thing. TheU.S. Government has done its best to discourage sales of Japanese supercomputers inthe United States. U.S. government labs, the biggest supercomputer users in the world,have not yet bought a Japanese machine. Whenever an American University orgovernment agency has expressed and interest in buying a Japanese unit. Cray hasquietly but effectively lobbied to block the move.In 1991, due to political pressure, Fujitsu was prevented from donating a $17 million.Supercomputer to a Colorado consortium of environmental Scientists. Congressionalcritics did not like the idea of a Japanese give away. They did not object, however, whenCray donated in the same year an X-MP system to the Energy Department in Support ofa national high- school Supercomputer program.Questions:(a)(b)(c)Is it appropriate for the U.S government to pressure M.I.T. to reject Japanesesupercomputers inspite of lower prices? Note that the M.I.T research projects thatwould use the Supercomputers were federally funded.Did M.I.T react properly in cancelling its procurement plan?Is appropriate for the United States to try to close of its Supercomputer market toJapan while, at the same time, trying to pressure the Japanese government toPurchases American Supercomputer?———————–––

EXECUTIVE M.B.A. DEGREE EXAMINATION, MAY 2012.(DEMB 13)First and Second YearsPaper X<strong>II</strong>I — MANAGEMENT INFORMATION SYSTEMSTime : Three hoursSECTION A — (3 × 5 = 15 marks)Answer any THREE of the following.Maximum : 75 marks1. (a) Hardware.(b) Machine language.(c) Data filing.(d) Systems analysis.(e) Data diary.(f) Database system.SECTION B — (3 × 15 = 45 marks)Answer any THREE questions.2. What are the conceptual foundations of information system?3. State the phases in system development like cycle.4. Explain the trends in IT.5. Bring out the advantages and disadvantages of database system.6. Discuss the role of mgs in decision - making.7. Describe the types of switching available in networks.

SECTION C — (15 marks)(Compulsory)8. We reach Nock Nock in San Francisco's lower Haight after dark. One inside, our pupilsmadly dilate as we try to catch the dynamics of this small, dark Cenozoic cave trimmedin airplane fuselage and grunge-clad patronage Most don’t take any notice; except aMedus alike young man sporting the stubby remnants of the recently shorn dreadlockswho rises from a floor cushion and extends his hand for a shake. He is Sirdystic, ahacker with whom S I'dhad only E-mail contact until now.“Cool place,” I offer.“Yup.” He gives a wry smile. “Cyber-Flintstones", extends his hand for a shake. He isSirdystic, a hacker with whom I’d had only E-mail contact until now.“Cool place,” I offer.“Yup.” He gives a wry smile. “Cyber-Flintstones.”Soon, seven of us are slugging down room-temperature Guinnesses, which I’m buying.They all belong to the Cult of the Dead Cow, a 13-year-old, in-your-face hacking groupwhose members are young, rebellious, brilliant, and fed up with a mountain of perceivedpersecutions. They’re misunderstood “white hat” good guys. Clueless federal agents aredogging them for no good reason. Privacy. Free speech. You get the picture.But what they really hate is Microsoft Corporation, which, in the past year, has becomethe greatest of hacking targets. “We bring all these huge, gaping holes to their attention,and they don’t listen,” bellows Deth Veggie, a mammoth 24-year-old with rock-starlooks.Microsoft, they say, is more interested in marketing new systems than in securing them.Microsoft is breeding “dumbed-up” systems administrators who are so reliant onfriendly, point-and-click interfaces that they fail to set basic security settings. Microsoft,they say, hasn’t learned from past mistakes made–and patched–in the Unix operatingsystem.“When we find a hole, we share that exploit with the rest of the world—and it takesMicrosoft a long, long time to respond,” says 22-year-old Tweetfish.Hackers have posted the source code and techniques of myriad attacks against Microsoftproducts on World Wide Web sites and bullets in boards. They’ve got the tools to crackpasswords on NT and Windows 95 operating systems, and the techniques to grab thosepasswords from LAN Manager. Hackers know how to drop an ActiveX security levelfrom high to none, essentially helping themselves to anything on the machine and thenetwork it’s connected to.

And the list goes on.Why Microsoft? \ Why NT? First Microsoft is the biggest dog on the porch. Run, no less,by the richest guy on the planet. That’s irresistible to many hackers. Also, comparedwith Unix, which has been hacked and patched and nausearn, NT makes for an excitingnew playground.In addition, Windows NT is quickly in filtering the enterprise. Microsoft is shippingmore than 100,000 units of NT Version 4.0 every month. According to The Sentry Group,85 percent of businesses and government agencies in the United States will useWindows NT as a desktop platform by next year.In NT 5.0, Microsoft will introduce a three - tiered security architecture. MIT-developedRCF Kerberos authentication will replace the LAN Manager setup that hackers find soinviting. In addition, crypto-key infrastructure will be included to support digitalcertificates that authenticate users who access the system remotely. Moreover, in NT5.0, data encryption will be supported, and administrators will have a central point fromwhich to issue certificates and access controls.Microsoft also maintains an electronic-mail address (secure@microsoft. com) to whichanybody can send information about vulnerabilities. In addition, the company employsabout 300 engineers who work only on security. And they listen to both hackers andcustomers, according to Ed Muth, NT product manager. “We have demanding customerslike banks and defense agencies who are not shy about telling us their security desires,”he says.“That’s a bunch of marketing crock.” Veggie says. “We try to contact Microsoft, and wealways get the brush.”In any event, the bottom line is that the security problems most hackers ferret out aren’thaving a serious effect on Microsoft’s ability to do business. Corporate America doesn’tseem too spooked about Microsoft security, given the speed at which they are deployingWindows NT. And that just keeps the hackers hacking away.Questions :(a)(b)(c)Why are hackers like the Cult of the Dead Cow hacking into Windows NT?What is Microsoft doing about hacking and the security of Windows NT?Is hacking by the Cult of the Dead Cow and other “white hat” hackers ethical?Why or why not?——————

(DEMBB 1)EXECUTIVE M.B.A. DEGREE EXAMINATION, MAY 2012.First and Second YearsGroups B – Financial ManagementPaper I — SECURITY ANALYSIS AND PORTFOLIO MANAGEMENTTime : Three hoursMaximum : 75 marksSECTION A — (3 × 5 = 15 marks)Answer any THREE of the following.1. (a) Risk average.(b)(c)(d)(e)(f)Technical analysis.Optimum portfolio.Stock broker.Company analysis.Portfolio revision.SECTION B — (3 × 15 = 45 marks)Answer any THREE questions.2. Explain the organisation of stock exchanges in India.3. Describe the growth of mutual funds in India.4. Discuss the nature and scope of investment decisions.5. State the approaches used to value shares and bonds.6. Enumerate the factors that may be considered in company analysis.7. Elucidate the considerations in the selection of portfolio.

SECTION C — (15 marks)(Compulsory)8. Anup wants to purchase the stock of company A and B. He estimates the return andprobabilities of returns by analysing the past records with the given details, find act ofthe expected return.ReturnA B Probability86% –2% 0.1510% 6% 0.2012% 10% 0.3013% 15% 0.214% 20% 0.15–––––––––––

(DEMBB 2)EXECUTIVE M.B.A. DEGREE EXAMINATION, MAY 2012.First and Second YearsGroup B — Financial ManagementPaper <strong>II</strong> — FINANCIAL MARKETS AND DERIVATIVESTime : Three hoursSECTION A — (3 × 5 = 15 marks)Answer any THREE of the following.Maximum : 75 marks1. (a) Limitations of forward contract.(b)(c)(d)(e)(f)Concept of financial derivative.Currency swap.Call money.Depository system.Origination.SECTION B — (3 × 15 = 45 marks)Answer any THREE questions.2. What are the constituents of Indian money market?3. Describe the trend of growth in the government securities market.4. State the powers and functions of SEBI.5. Elucidate the factors that affect option pricing.6. Enumerate the motivations under lying swap contract.7. Critically examine the Black-Scholes model of option pricing.

SECTION C — (15 marks)(Case Study)8. An investor has obtained the following details regarding Ogre Corporation call option.The current price of the stock is Rs. 45. And the strike price is Rs. 40 for a three monthoption. The standard deviation is .52, the risk less rate of interest is assumed to be 10per cent.(a)(b)Determine the value of call option.If the current price of a call on Orge's Corporation Stock is Rs. 7. What should aninvestor do to make money?———————–

EXECUTIVE M.B.A. DEGREE EXAMINATION, MAY 2012.First and Second YearsGROUP B – Financial Management(DEMBB 3)Paper <strong>II</strong>I — INTERNATIONAL FINANCIAL MANAGEMENTTime : Three hoursMaximum : 75 marksSECTION A — (3 × 5 = 15 marks)1. (a) Multiple exchange rate.(b)(c)(d)(e)(f)Spot market.Current account.Accounting exposure.Risk in foreign exchange.International portfolio theory.Answer any THREE of the following.SECTION B — (3 × 15 = 45 marks)Answer any THREE questions.2. Explain the ways and means of financing foreign trade.3. State the factors that may be considered while assessing country side.4. Elucidate the finance function in a MNC.5. How is exchange rate determined?6. Bring out the offensive and defensive strategies in international investment.7. How is the inventory management of a MNC different from that a domestic firm.SECTION C — (15 marks)(Compulsory)8. Company A wishes to borrow 10 million at a fixed rate for 5 years and has been offeredeither 11% fixed or six month LIBRO + 1%. Company B wishes to borrow 10 million at afloating rate for 5 years and has been offered either 10% fixed or 6 months LIBOR +0.5%.(a)(b)How do they enter into a swap arrangement in which each benefit equally?What risks did this arrangement generate?———————

(DEMBB 4)EXECUTIVE M.B.A. EGREE EXAMINATION, MAY 2012First and Second YearsGroup B — Financial ManagementPaper IV — MANAGEMENT OF FINANCIAL SERVICESTime : Three hoursSECTION A — (3 × 5 = 15 marks)Answer any THREE of the following.Maximum : 75 marks1. (a) Share transfer agent(b) Discounting of bills(c) Pension fund(d) Balanced fund(e) Stock broking(f) Credit card.SECTION B — (3 × 15 = 45 marks)Answer any THREE of the following.2. Describe the process of venture capital funds.3. Discuss the financial services rendered by banks.4. Explain the tax implications of learning.5. What are the sources of financing industrial projects?6. Elucidate the nature and scope of financial services.7. Trace out the organisation of stock exchanges.

SECTION C — (15 marks)(Compulsory)8. Beta Limited is considering the acquisition of a personal computer costing Rs. 50,000.The effective life of the computer is expected to be five years. The company plans toacquire the same either by borrowing Rs. 50,000 from its bankers at 15% interest perannum or by lease. The company wishes to know the lease rentals to be paid annuallywhich will match the loan option. The following further information is provided to you —(a)(b)(c)The principal amount of the loan will be paid in five annual equal instatmentsInterest, lease rentals, principal repayment are to be paid on the last day of eachyear.The full cost of the computer will be written off over the effective life of computeron a straight—line basis and the same will be allowed for tax purposes.(d) The company’s effective tax rate is 40% and the after tax cost of capital is 9%(e)The computer will be sold for Rs. 1,700 at the end of the 5th year. The commissionon such sales is 9% on the sale value and the same will be paid. Consider tax at40% on the net realisation.You are requiredTo compute the annual lease rentals payable by Beta Limited which will result inindifference to the loan option.The relevant discount factors are as follows :Year 1 2 3 4 5Discount factor 0.92 0.84 0.77 0.71 0.65Annuity discount factor at 9% for 5 years is 3.89.———————