Notes to FINANCIAL STATEMENTS August 31, 2008, all dollars and shares are rounded to thousands (000)CUSTODIAN FEES – U.S. Bank serves as the funds’ custodianpursuant to a custodian agreement with FAF. Thecustodian fee charged for each fund is equal to an annualrate of 0.005% of average daily net assets. All fees arecomputed daily and paid monthly.Under the custodian agreement, interest earned onuninvested cash balances is used to reduce a portion ofeach fund’s custodian expenses. These credits, if any, aredisclosed as “Indirect payments from the custodian” in theStatement of Operations. Conversely, the custodiancharges a fee for any cash overdrafts incurred, whichincreases the fund’s custodian expenses.For the fiscal year ended August 31, 2008, custodian feeswere increased as a result of overdrafts and decreased as aresult of interest earned as follows:Fund Increased DecreasedGovernment Obligations Fund $10 $ 4Prime Obligations Fund — 51Tax Free Obligations Fund 1 7Treasury Obligations Fund — 29U.S. Treasury <strong>Money</strong> <strong>Market</strong> Fund 1 2DISTRIBUTION AND SHAREHOLDER SERVICING (12b-1) FEES –Quasar Distributors, LLC (“Quasar”), a subsidiary ofU.S. Bancorp, serves as distributor of the funds pursuantto a distribution agreement with FAF. Under thedistribution agreement, and pursuant to a plan adopted byeach fund under rule 12b-1 of the Investment CompanyAct, each fund pays Quasar a monthly distribution and/orshareholder servicing fee equal to an annual rate of0.25%, 1.00%, 1.00%, 0.15%, and 0.50% of each fund’saverage daily net assets attributable to Class A shares,Class B shares, Class C shares, Class D shares, andReserve Class shares, respectively. No distribution orshareholder servicing fees are paid by Institutional InvestorClass shares, Class Y shares, Class I shares, or Class Zshares. These fees may be used by Quasar to providecompensation for sales support, distribution activities,and/or shareholder servicing activities. In order tomaintain minimum distribution yields for TreasuryObligations Fund at various times during the year, classspecific distribution and/or shareholder servicing fees werevoluntarily reimbursed by FAF Advisors.Under these distribution and shareholder servicingagreements, the following amounts were retained byaffiliates of FAF Advisors for the fiscal year endedAugust 31, 2008:FundAmountGovernment Obligations Fund $ 4,528Prime Obligations Fund 7,349Tax Free Obligations Fund 699Treasury Obligations Fund 20,018U.S. Treasury <strong>Money</strong> <strong>Market</strong> Fund 631agreement with FAF Advisors, under which FAF Advisorshas agreed to provide FAF, or will enter into writtenagreements with other service providers pursuant to whichthe service providers will provide FAF, with nondistribution-relatedservices to shareholders of Class A,Class D, Class I, Class Y shares, Institutional InvestorClass, and Reserve Class shares. Each fund pays FAFAdvisors a monthly shareholder servicing fee equal to anannual rate of 0.25% of the average daily net assetsattributable to Class A, Class D, Class Y, and ReserveClass shares, a fee equal to an annual rate of 0.20% of theaverage daily net assets attributable to Class I shares, anda fee equal to an annual rate of 0.10% of the averagedaily net assets attributable to Institutional Investor Classshares. During the fiscal year ended August 31, 2008, FAFAdvisors waived shareholder servicing fees of 0.03% ofaverage daily net assets of Class I shares and InstitutionalInvestor Class shares of Prime Obligations Fund, and0.01% of average daily net assets of Reserve Class sharesof Treasury Obligations Fund.Under this shareholder servicing plan and agreement, thefollowing amounts were paid to FAF Advisors for thefiscal year ended August 31, 2008:FundAmountGovernment Obligations Fund $20,260Prime Obligations Fund 31,305Tax Free Obligations Fund 4,155Treasury Obligations Fund 39,946U.S. Treasury <strong>Money</strong> <strong>Market</strong> Fund 2,227OTHER EXPENSES – In addition to the investment advisoryfees, administration fees, transfer agent fees, custodianfees, and distribution and shareholder servicing fees, eachfund is responsible for paying most other operatingexpenses, including: legal, auditing, registration fees,postage and printing of shareholder reports, fees andexpenses of independent directors, insurance, and othermiscellaneous expenses. For the fiscal year endedAugust 31, 2008, legal fees and expenses of $28 were paidto a law firm of which an Assistant Secretary of the fundsis a partner.CONTINGENT DEFERRED SALES CHARGES – A contingentdeferred sales charge (“CDSC”) is imposed onredemptions made in the Class B shares. The CDSC variesdepending on the number of years from time of paymentfor the purchase of Class B shares until the redemption ofsuch shares. Class B shares automatically convert toClass A shares after eight years.SHAREHOLDER SERVICING (NON-12b-1) FEES – FAF has alsoadopted and entered into a shareholder servicing plan and42 FIRST AMERICAN FUNDS 2008 Annual Report

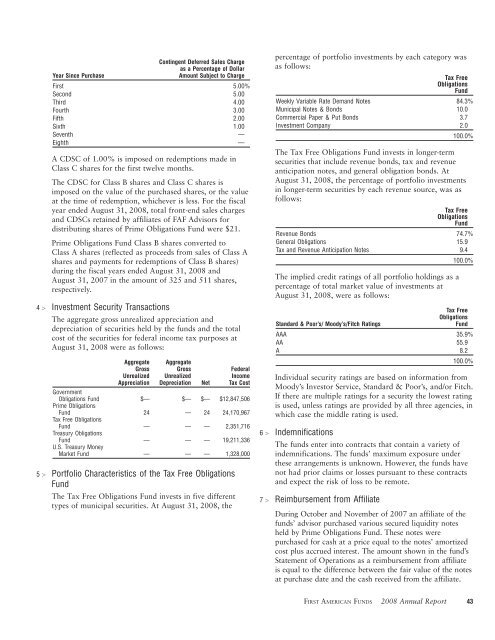

Contingent Deferred Sales Chargeas a Percentage of DollarYear Since PurchaseAmount Subject to ChargeFirst 5.00%Second 5.00Third 4.00Fourth 3.00Fifth 2.00Sixth 1.00Seventh —Eighth —A CDSC of 1.00% is imposed on redemptions made inClass C shares for the first twelve months.The CDSC for Class B shares and Class C shares isimposed on the value of the purchased shares, or the valueat the time of redemption, whichever is less. For the fiscalyear ended August 31, 2008, total front-end sales chargesand CDSCs retained by affiliates of FAF Advisors fordistributing shares of Prime Obligations Fund were $21.Prime Obligations Fund Class B shares converted toClass A shares (reflected as proceeds from sales of Class Ashares and payments for redemptions of Class B shares)during the fiscal years ended August 31, 2008 andAugust 31, 2007 in the amount of 325 and 511 shares,respectively.4 H Investment Security TransactionsThe aggregate gross unrealized appreciation anddepreciation of securities held by the funds and the totalcost of the securities for federal income tax purposes atAugust 31, 2008 were as follows:AggregateGrossUnrealizedAppreciationAggregateGrossUnrealizedDepreciationNetFederalIncomeTax CostGovernmentObligations Fund $— $— $— $12,847,506Prime ObligationsFund 24 — 24 24,170,967Tax Free ObligationsFund — — — 2,351,716Treasury ObligationsFund — — — 19,211,336U.S. Treasury <strong>Money</strong><strong>Market</strong> Fund — — — 1,328,0005 H Portfolio Characteristics of the Tax Free ObligationsFundThe Tax Free Obligations Fund invests in five differenttypes of municipal securities. At August 31, 2008, thepercentage of portfolio investments by each category wasas follows:Tax FreeObligationsFundWeekly Variable Rate Demand Notes 84.3%Municipal Notes & Bonds 10.0Commercial Paper & Put Bonds 3.7Investment Company 2.0100.0%The Tax Free Obligations Fund invests in longer-termsecurities that include revenue bonds, tax and revenueanticipation notes, and general obligation bonds. AtAugust 31, 2008, the percentage of portfolio investmentsin longer-term securities by each revenue source, was asfollows:Tax FreeObligationsFundRevenue Bonds 74.7%General Obligations 15.9Tax and Revenue Anticipation Notes 9.4100.0%The implied credit ratings of all portfolio holdings as apercentage of total market value of investments atAugust 31, 2008, were as follows:Tax FreeObligationsStandard & Poor’s/ Moody’s/Fitch RatingsFundAAA 35.9%AA 55.9A 8.2100.0%Individual security ratings are based on information fromMoody’s Investor Service, Standard & Poor’s, and/or Fitch.If there are multiple ratings for a security the lowest ratingis used, unless ratings are provided by all three agencies, inwhich case the middle rating is used.6 H IndemnificationsThe funds enter into contracts that contain a variety ofindemnifications. The funds’ maximum exposure underthese arrangements is unknown. However, the funds havenot had prior claims or losses pursuant to these contractsand expect the risk of loss to be remote.7 H Reimbursement from AffiliateDuring October and November of 2007 an affiliate of thefunds’ advisor purchased various secured liquidity notesheld by Prime Obligations Fund. These notes werepurchased for cash at a price equal to the notes’ amortizedcost plus accrued interest. The amount shown in the fund’sStatement of Operations as a reimbursement from affiliateis equal to the difference between the fair value of the notesat purchase date and the cash received from the affiliate.FIRST AMERICAN FUNDS 2008 Annual Report 43