Money Market Funds - COUNTRY Financial

Money Market Funds - COUNTRY Financial

Money Market Funds - COUNTRY Financial

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

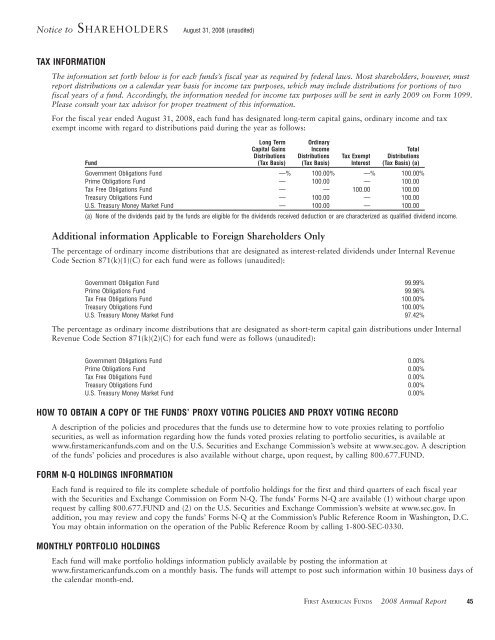

Notice to SHAREHOLDERSAugust 31, 2008 (unaudited)TAX INFORMATIONThe information set forth below is for each funds’s fiscal year as required by federal laws. Most shareholders, however, mustreport distributions on a calendar year basis for income tax purposes, which may include distributions for portions of twofiscal years of a fund. Accordingly, the information needed for income tax purposes will be sent in early 2009 on Form 1099.Please consult your tax advisor for proper treatment of this information.For the fiscal year ended August 31, 2008, each fund has designated long-term capital gains, ordinary income and taxexempt income with regard to distributions paid during the year as follows:FundLong TermCapital GainsDistributions(Tax Basis)OrdinaryIncomeDistributions(Tax Basis)Tax ExemptInterestTotalDistributions(Tax Basis) (a)Government Obligations Fund —% 100.00% —% 100.00%Prime Obligations Fund — 100.00 — 100.00Tax Free Obligations Fund — — 100.00 100.00Treasury Obligations Fund — 100.00 — 100.00U.S. Treasury <strong>Money</strong> <strong>Market</strong> Fund — 100.00 — 100.00(a) None of the dividends paid by the funds are eligible for the dividends received deduction or are characterized as qualified dividend income.Additional information Applicable to Foreign Shareholders OnlyThe percentage of ordinary income distributions that are designated as interest-related dividends under Internal RevenueCode Section 871(k)(1)(C) for each fund were as follows (unaudited):Government Obligation Fund 99.99%Prime Obligations Fund 99.96%Tax Free Obligations Fund 100.00%Treasury Obligations Fund 100.00%U.S. Treasury <strong>Money</strong> <strong>Market</strong> Fund 97.42%The percentage as ordinary income distributions that are designated as short-term capital gain distributions under InternalRevenue Code Section 871(k)(2)(C) for each fund were as follows (unaudited):Government Obligations Fund 0.00%Prime Obligations Fund 0.00%Tax Free Obligations Fund 0.00%Treasury Obligations Fund 0.00%U.S. Treasury <strong>Money</strong> <strong>Market</strong> Fund 0.00%HOW TO OBTAIN A COPY OF THE FUNDS’ PROXY VOTING POLICIES AND PROXY VOTING RECORDA description of the policies and procedures that the funds use to determine how to vote proxies relating to portfoliosecurities, as well as information regarding how the funds voted proxies relating to portfolio securities, is available atwww.firstamericanfunds.com and on the U.S. Securities and Exchange Commission’s website at www.sec.gov. A descriptionof the funds’ policies and procedures is also available without charge, upon request, by calling 800.677.FUND.FORM N-Q HOLDINGS INFORMATIONEach fund is required to file its complete schedule of portfolio holdings for the first and third quarters of each fiscal yearwith the Securities and Exchange Commission on Form N-Q. The funds’ Forms N-Q are available (1) without charge uponrequest by calling 800.677.FUND and (2) on the U.S. Securities and Exchange Commission’s website at www.sec.gov. Inaddition, you may review and copy the funds’ Forms N-Q at the Commission’s Public Reference Room in Washington, D.C.You may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330.MONTHLY PORTFOLIO HOLDINGSEach fund will make portfolio holdings information publicly available by posting the information atwww.firstamericanfunds.com on a monthly basis. The funds will attempt to post such information within 10 business days ofthe calendar month-end.FIRST AMERICAN FUNDS 2008 Annual Report 45