New Zealand Cricket Annual Report 2005 - 2006

New Zealand Cricket Annual Report 2005 - 2006

New Zealand Cricket Annual Report 2005 - 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

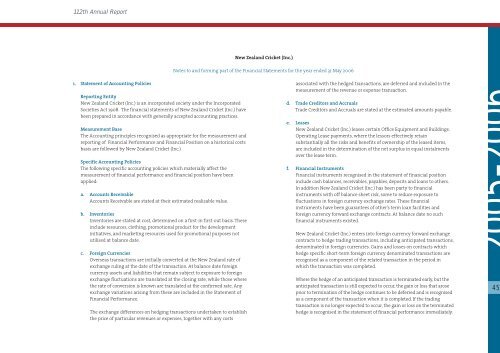

112th <strong>Annual</strong> <strong>Report</strong><strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.)Notes to and forming part of the Financial Statements for the year ended 31 May <strong>2006</strong>1. Statement of Accounting Policies<strong>Report</strong>ing Entity<strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.) is an incorporated society under the IncorporatedSocieties Act 1908. The financial statements of <strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.) havebeen prepared in accordance with generally accepted accounting practices.Measurement BaseThe Accounting principles recognised as appropriate for the measurement andreporting of Financial Performance and Financial Position on a historical costsbasis are followed by <strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.)Specific Accounting PoliciesThe following specific accounting policies which materially affect themeasurement of financial performance and financial position have beenapplied:a. Accounts ReceivableAccounts Receivable are stated at their estimated realisable value.b. InventoriesInventories are stated at cost, determined on a first-in first-out basis. Theseinclude resources, clothing, promotional product for the developmentinitiatives, and marketing resources used for promotional purposes notutilised at balance date.c. Foreign CurrenciesOverseas transactions are initially converted at the <strong>New</strong> <strong>Zealand</strong> rate ofexchange ruling at the date of the transaction. At balance date foreigncurrency assets and liabilities that remain subject to exposure to foreignexchange fluctuations are translated at the closing rate, while those wherethe rate of conversion is known are translated at the confirmed rate. Anyexchange variations arising from these are included in the Statement ofFinancial Performance.The exchange differences on hedging transactions undertaken to establishthe price of particular revenues or expenses, together with any costsassociated with the hedged transactions, are deferred and included in themeasurement of the revenue or expense transaction.d. Trade Creditors and AccrualsTrade Creditors and Accruals are stated at the estimated amounts payable.e. Leases<strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.) leases certain Office Equipment and Buildings.Operating Lease payments, where the lessors effectively retainsubstantially all the risks and benefits of ownership of the leased items,are included in the determination of the net surplus in equal instalmentsover the lease term.f. Financial InstrumentsFinancial instruments recognised in the statement of financial positioninclude cash balances, receivables, payables, deposits and loans to others.In addition <strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.) has been party to financialinstruments with off balance sheet risk, some to reduce exposure tofluctuations in foreign currency exchange rates. These financialinstruments have been guarantees of other’s term loan facilities andforeign currency forward exchange contracts. At balance date no suchfinancial instruments existed.<strong>New</strong> <strong>Zealand</strong> <strong>Cricket</strong> (Inc.) enters into foreign currency forward exchangecontracts to hedge trading transactions, including anticipated transactions,denominated in foreign currencies. Gains and losses on contracts whichhedge specific short-term foreign currency denominated transactions arerecognised as a component of the related transaction in the period inwhich the transaction was completed.Where the hedge of an anticipated transaction is terminated early, but theanticipated transaction is still expected to occur, the gain or loss that aroseprior to termination of the hedge continues to be deferred and is recognisedas a component of the transaction when it is completed. If the tradingtransaction is no longer expected to occur, the gain or loss on the terminatedhedge is recognised in the statement of financial performance immediately.45