BUDGET - BMR Advisors

BUDGET - BMR Advisors

BUDGET - BMR Advisors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

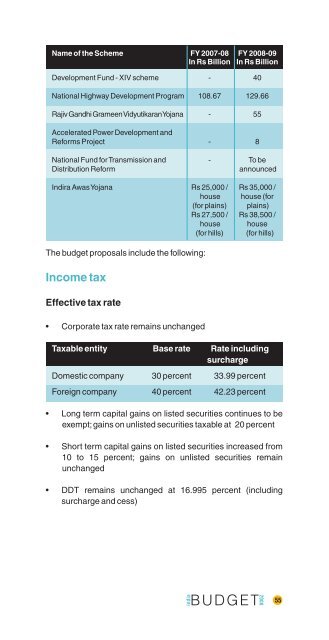

Name of the Scheme FY 2007-08 FY 2008-09In Rs Billion In Rs BillionDevelopment Fund - XIV scheme - 40National Highway Development Program 108.67 129.66Rajiv Gandhi Grameen Vidyutikaran Yojana - 55Accelerated Power Development andReforms Project - 8National Fund for Transmission and - To beDistribution ReformannouncedIndira Awas Yojana Rs 25,000 / Rs 35,000 /house house (for(for plains) plains)Rs 27,500 / Rs 38,500 /house house(for hills) (for hills)The budget proposals include the following:Income taxEffective tax rate• Corporate tax rate remains unchangedTaxable entity Base rate Rate includingsurcharge / cessDomestic company 30 percent 33.99 percentForeign company 40 percent 42.23 percent• Long term capital gains on listed securities continues to beexempt; gains on unlisted securities taxable at 20 percent• Short term capital gains on listed securities increased from10 to 15 percent; gains on unlisted securities remainunchanged• DDT remains unchanged at 16.995 percent (includingsurcharge and cess)india<strong>BUDGET</strong>200855