Financial Report 2008 - Leighton Holdings

Financial Report 2008 - Leighton Holdings

Financial Report 2008 - Leighton Holdings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

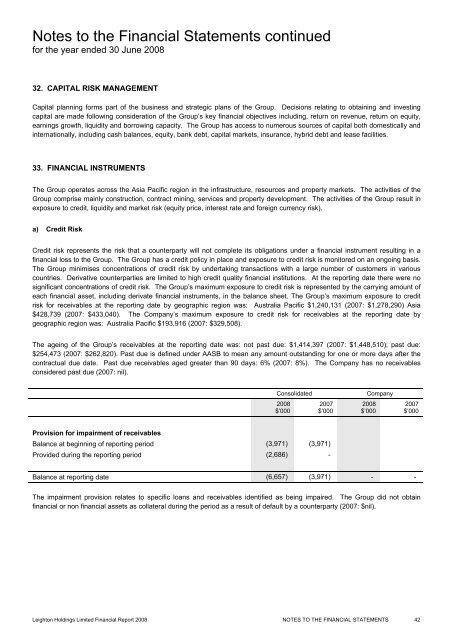

Notes to the <strong>Financial</strong> Statements continuedfor the year ended 30 June <strong>2008</strong>32. CAPITAL RISK MANAGEMENTCapital planning forms part of the business and strategic plans of the Group. Decisions relating to obtaining and investingcapital are made following consideration of the Group’s key financial objectives including, return on revenue, return on equity,earnings growth, liquidity and borrowing capacity. The Group has access to numerous sources of capital both domestically andinternationally, including cash balances, equity, bank debt, capital markets, insurance, hybrid debt and lease facilities.33. FINANCIAL INSTRUMENTSThe Group operates across the Asia Pacific region in the infrastructure, resources and property markets. The activities of theGroup comprise mainly construction, contract mining, services and property development. The activities of the Group result inexposure to credit, liquidity and market risk (equity price, interest rate and foreign currency risk).a) Credit RiskCredit risk represents the risk that a counterparty will not complete its obligations under a financial instrument resulting in afinancial loss to the Group. The Group has a credit policy in place and exposure to credit risk is monitored on an ongoing basis.The Group minimises concentrations of credit risk by undertaking transactions with a large number of customers in variouscountries. Derivative counterparties are limited to high credit quality financial institutions. At the reporting date there were nosignificant concentrations of credit risk. The Group’s maximum exposure to credit risk is represented by the carrying amount ofeach financial asset, including derivate financial instruments, in the balance sheet. The Group’s maximum exposure to creditrisk for receivables at the reporting date by geographic region was: Australia Pacific $1,240,131 (2007: $1,278,290) Asia$428,739 (2007: $433,040). The Company’s maximum exposure to credit risk for receivables at the reporting date bygeographic region was: Australia Pacific $193,916 (2007: $329,508).The ageing of the Group’s receivables at the reporting date was: not past due: $1,414,397 (2007: $1,448,510); past due:$254,473 (2007: $262,820). Past due is defined under AASB to mean any amount outstanding for one or more days after thecontractual due date. Past due receivables aged greater than 90 days: 6% (2007: 8%). The Company has no receivablesconsidered past due (2007: nil).Consolidated<strong>2008</strong>$’000Company<strong>2008</strong>$’0002007$’0002007$’000Provision for impairment of receivablesBalance at beginning of reporting period (3,971) (3,971)Provided during the reporting period (2,686) -Balance at reporting date (6,657) (3,971) - -The impairment provision relates to specific loans and receivables identified as being impaired. The Group did not obtainfinancial or non financial assets as collateral during the period as a result of default by a counterparty (2007: $nil).<strong>Leighton</strong> <strong>Holdings</strong> Limited <strong>Financial</strong> <strong>Report</strong> <strong>2008</strong> NOTES TO THE FINANCIAL STATEMENTS 42