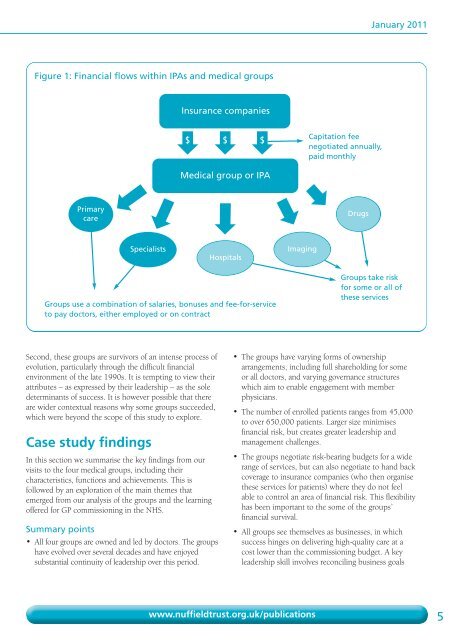

GP commissioning: insights from medical groups in the United States(Casalino, forthcoming). <strong>The</strong> public’s hostility to managedcare has persisted – doctors are wary of being seen to denycare on the grounds of cost.Those medical groups and IPAs that have survivedare generally associated with higher-quality care, asevidenced by greater adherence to clinical guidelines andadoption of electronic medical records (Shortell andCasalino, 2008).Case studiesWe chose our case studies from variants of the two typesof groups described in Box 1. Details of the four groupsselected for study are set out below, in Table 1. We aimedto generate a sample with a variety of size and ownershipmodels. <strong>The</strong> organisations include both profit andnon-profit status.In each organisation, we interviewed senior managers(clinicians and non-clinicians) and doctors who weremembers of the group or IPA. As can be seen fromTable 1, the groups vary in size and form, but whatunites them is that they all manage fixed budgets for anenrolled patient population.<strong>The</strong> groups negotiate annually with the health plans(insurers) for a ‘capitated’ budget, which is paid monthlyto the group (see Figure 1). This budget is calculated as afixed amount per head of population enrolled with thegroup (capitation), adjusted for age and sex and, in thecase of Medicare patients (the over-65 age group fundedby the federal government for their care), on the severityof existing health conditions. A single medical group orIPA will typically hold contracts with several health plans.Budgets are paid monthly to the groups, from which theypay their doctors and a range of other service providers,including hospitals and diagnostic services. It should benoted that the medical groups do not rely solely onbusiness from capitated patients but also provide servicesfor patients with different kinds of insurance products,which have in recent years been growing in popularityrelative to fixed-budget insurance.Limitations of our research<strong>The</strong>re are two main limitations of this research. <strong>The</strong> firstconcerns the US context – these groups are notresponsible for the health of all patients in theirgeographical area in the way that GP consortia will be.In addition, they are not required to involve patients orcommunities in the design and delivery of services, as weassume will be the case with GP consortia in the NHS.Patients are primarily seen as consumers in the UShealthcare system, and are able to exercise choice byswitching health plans or doctor, although in practicechoice is often heavily curtailed by income or type ofhealth plan.Table 1: Characteristics of case studiesNameDateformedTypeCapitatedpatientsNumber of GPsSpecialistsTotal employeddoctorsBristol ParkMedicalGroup1961Group +IPA forspecialists68,00089 employed700 contracted,6 employed95HealthCarePartners1992Group + IPA650,000(3 states)1,400 contracted,480 employed2,600 contracted,120 employed600MonarchHealthCare1994IPA + employeddoctors170,000800 contracted,6 employed1,200 contracted,27 employed33Mills-PeninsulaMedical Group1994IPA + employeddoctors45,000112 contracted,26 employed254 contracted,9 employed354www.nuffieldtrust.org.uk/publications

January 2011Figure 1: Financial flows within IPAs and medical groupsInsurance companies$$ $Capitation feenegotiated annually,paid monthlyMedical group or IPAPrimarycareDrugsSpecialistsHospitalsImagingGroups use a combination of salaries, bonuses and fee-for-serviceto pay doctors, either employed or on contractGroups take riskfor some or all ofthese servicesSecond, these groups are survivors of an intense process ofevolution, particularly through the difficult financialenvironment of the late 1990s. It is tempting to view theirattributes – as expressed by their leadership – as the soledeterminants of success. It is however possible that thereare wider contextual reasons why some groups succeeded,which were beyond the scope of this study to explore.Case study findingsIn this section we summarise the key findings from ourvisits to the four medical groups, including theircharacteristics, functions and achievements. This isfollowed by an exploration of the main themes thatemerged from our analysis of the groups and the learningoffered for GP commissioning in the NHS.Summary points• All four groups are owned and led by doctors. <strong>The</strong> groupshave evolved over several decades and have enjoyedsubstantial continuity of leadership over this period.• <strong>The</strong> groups have varying forms of ownershiparrangements, including full shareholding for someor all doctors, and varying governance structureswhich aim to enable engagement with memberphysicians.• <strong>The</strong> number of enrolled patients ranges from 45,000to over 650,000 patients. Larger size minimisesfinancial risk, but creates greater leadership andmanagement challenges.• <strong>The</strong> groups negotiate risk-bearing budgets for a widerange of services, but can also negotiate to hand backcoverage to insurance companies (who then organisethese services for patients) where they do not feelable to control an area of financial risk. This flexibilityhas been important to the some of the groups’financial survival.• All groups see themselves as businesses, in whichsuccess hinges on delivering high-quality care at acost lower than the commissioning budget. A keyleadership skill involves reconciling business goalswww.nuffieldtrust.org.uk/publications 5