<strong>Putnam</strong> Absolute Return Funds<strong>Putnam</strong> <strong>529</strong> <strong>for</strong> <strong>America</strong> is the only <strong>529</strong> account to offer a suite of absolute return funds as an investment option. Thefunds are designed to help you meet your college savings goals with potentially lower volatility than more traditionalmutual fund investments. Your financial advisor can help you choose the fund mix that suits your goal.<strong>Putnam</strong> Absolute Return Fundscan be an ally in helping to navigatetoday’s market volatility.+5%+7%<strong>Putnam</strong> Absolute Return 100 Fund OptionFor investors considering short-term securities.Invests in bonds and cash instruments.<strong>Putnam</strong> Absolute Return 300 Fund OptionFor investors considering a bond fund.Invests in bonds and cash instruments.+3%<strong>Putnam</strong> Absolute Return 500 Fund OptionFor investors considering a balanced fund.Can invest in bonds, stocks, or alternativeasset classes.+1%<strong>Putnam</strong> Absolute Return 700 Fund OptionFor investors considering a stock fund.Can invest in bonds, stocks, or alternativeasset classes.<strong>Putnam</strong>AbsoluteReturn100®<strong>Putnam</strong>AbsoluteReturn300®<strong>Putnam</strong>AbsoluteReturn500®<strong>Putnam</strong>AbsoluteReturn700®The funds seek a positive return that exceeds the rate of inflation, as reflectedby Treasury bills, by 1%, 3%, 5%, or 7% over a period of three years, regardlessof market conditions.Chart does not represent the per<strong>for</strong>mance of <strong>Putnam</strong> AbsoluteReturn Funds. Actual per<strong>for</strong>mance can be found on putnam.com.The funds’ strategies are designed to be largely independent of market direction, and the funds are not intended to outper<strong>for</strong>m stocks and bonds duringstrong market rallies.Consider these risks be<strong>for</strong>e investing: Our allocation of assets among permitted asset categories may hurt per<strong>for</strong>mance. The prices of stocks and bondsin the funds’ portfolio may fall or fail to rise over extended periods of time <strong>for</strong> a variety of reasons, including both general financial market conditions andfactors related to a specific issuer or industry. Our active trading strategy may lose money or not earn a return sufficient to cover associated trading andother costs. Our use of leverage obtained through derivatives increases these risks by increasing investment exposure. Bond investments are subject tointerest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments).Interest-rate risk is greater <strong>for</strong> longer-term bonds, and credit risk is greater <strong>for</strong> below-investment-grade bonds. Unlike bonds, funds that invest in bondshave ongoing fees and expenses. Lower-rated bonds may offer higher yields in return <strong>for</strong> more risk. Funds that invest in government securities are notguaranteed. Mortgage-backed securities are subject to prepayment risk. International investing involves certain risks, such as currency fluctuations,economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility.Our use of derivatives may increase these risks by increasing investment exposure (which may be considered leverage) or, in the case of many over-thecounterinstruments, because of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to theinstrument to meet its obligations. The funds may not achieve their goal, and they are not intended to be a complete investment program. The funds’ef<strong>for</strong>t to produce lower-volatility returns may not be successful and may make it more difficult at times <strong>for</strong> the funds to achieve their targeted return. Inaddition, under certain market conditions, the funds may accept greater volatility than would typically be the case, in order to seek their targeted return.For the 500 Fund and 700 Fund, these risks also apply: REITs involve the risks of real estate investing, including declining property values. Commoditiesinvolve the risks of changes in market, political, regulatory, and natural conditions. Additional risks are listed in the funds’ prospectus. You can lose moneyby investing in the funds.8

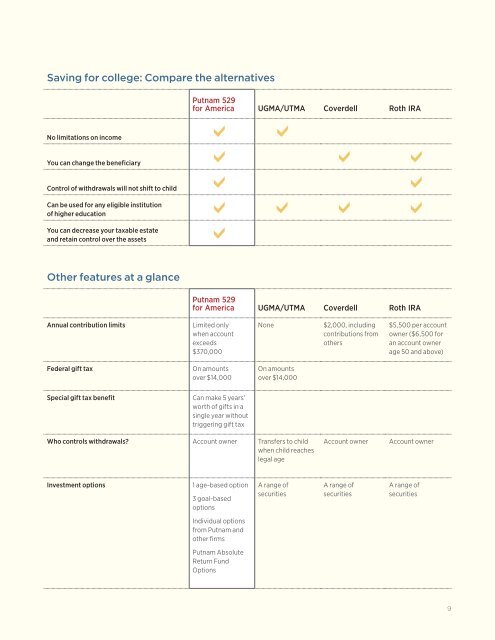

Saving <strong>for</strong> college: Compare the alternatives<strong>Putnam</strong> <strong>529</strong><strong>for</strong> <strong>America</strong> UGMA/UTMA Coverdell Roth IRANo limitations on incomeYou can change the beneficiaryControl of withdrawals will not shift to childCan be used <strong>for</strong> any eligible institutionof higher educationYou can decrease your taxable estateand retain control over the assetsOther features at a glance<strong>Putnam</strong> <strong>529</strong><strong>for</strong> <strong>America</strong> UGMA/UTMA Coverdell Roth IRAAnnual contribution limitsLimited onlywhen accountexceeds$370,000None$2,000, includingcontributions fromothers$5,500 per accountowner ($6,500 <strong>for</strong>an account ownerage 50 and above)Federal gift taxOn amountsover $14,000On amountsover $14,000Special gift tax benefitCan make 5 years’worth of gifts in asingle year withouttriggering gift taxWho controls withdrawals? Account owner Transfers to childwhen child reacheslegal ageAccount ownerAccount ownerInvestment options1 age-based option3 goal-basedoptionsA range ofsecuritiesA range ofsecuritiesA range ofsecuritiesIndividual optionsfrom <strong>Putnam</strong> andother firms<strong>Putnam</strong> AbsoluteReturn FundOptions9