Accrual Accounting and Income Determination - Pearson Learning ...

Accrual Accounting and Income Determination - Pearson Learning ...

Accrual Accounting and Income Determination - Pearson Learning ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

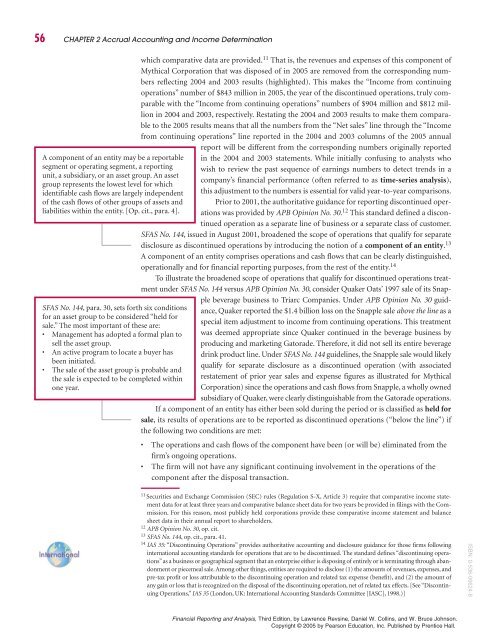

56 CHAPTER 2 <strong>Accrual</strong> <strong>Accounting</strong> <strong>and</strong> <strong>Income</strong> <strong>Determination</strong>which comparative data are provided. 11 That is, the revenues <strong>and</strong> expenses of this component ofMythical Corporation that was disposed of in 2005 are removed from the corresponding numbersreflecting 2004 <strong>and</strong> 2003 results (highlighted). This makes the “<strong>Income</strong> from continuingoperations” number of $843 million in 2005, the year of the discontinued operations, truly comparablewith the “<strong>Income</strong> from continuing operations” numbers of $904 million <strong>and</strong> $812 millionin 2004 <strong>and</strong> 2003, respectively. Restating the 2004 <strong>and</strong> 2003 results to make them comparableto the 2005 results means that all the numbers from the “Net sales” line through the “<strong>Income</strong>from continuing operations” line reported in the 2004 <strong>and</strong> 2003 columns of the 2005 annualreport will be different from the corresponding numbers originally reportedA component of an entity may be a reportable in the 2004 <strong>and</strong> 2003 statements. While initially confusing to analysts whosegment or operating segment, a reporting wish to review the past sequence of earnings numbers to detect trends in aunit, a subsidiary, or an asset group. An assetcompany’s financial performance (often referred to as time-series analysis),group represents the lowest level for whichidentifiable cash flows are largely independent this adjustment to the numbers is essential for valid year-to-year comparisons.of the cash flows of other groups of assets <strong>and</strong> Prior to 2001, the authoritative guidance for reporting discontinued operationswas provided by APB Opinion No. 30. 12 This st<strong>and</strong>ard defined a discon-liabilities within the entity. [Op. cit., para. 4].tinued operation as a separate line of business or a separate class of customer.SFAS No. 144, issued in August 2001, broadened the scope of operations that qualify for separatedisclosure as discontinued operations by introducing the notion of a component of an entity. 13A component of an entity comprises operations <strong>and</strong> cash flows that can be clearly distinguished,operationally <strong>and</strong> for financial reporting purposes, from the rest of the entity. 14To illustrate the broadened scope of operations that qualify for discontinued operations treatmentunder SFAS No. 144 versus APB Opinion No. 30, consider Quaker Oats’ 1997 sale of its Snapplebeverage business to Triarc Companies. Under APB Opinion No. 30 guidance,Quaker reported the $1.4 billion loss on the Snapple sale above the line as aSFAS No. 144, para. 30, sets forth six conditionsfor an asset group to be considered “held forsale.” The most important of these are:special item adjustment to income from continuing operations. This treatment• Management has adopted a formal plan to was deemed appropriate since Quaker continued in the beverage business bysell the asset group.producing <strong>and</strong> marketing Gatorade. Therefore, it did not sell its entire beverage• An active program to locate a buyer has drink product line. Under SFAS No. 144 guidelines, the Snapple sale would likelybeen initiated.qualify for separate disclosure as a discontinued operation (with associated• The sale of the asset group is probable <strong>and</strong>the sale is expected to be completed within restatement of prior year sales <strong>and</strong> expense figures as illustrated for Mythicalone year.Corporation) since the operations <strong>and</strong> cash flows from Snapple, a wholly ownedsubsidiary of Quaker, were clearly distinguishable from the Gatorade operations.If a component of an entity has either been sold during the period or is classified as held forsale, its results of operations are to be reported as discontinued operations (“below the line”) ifthe following two conditions are met:• The operations <strong>and</strong> cash flows of the component have been (or will be) eliminated from thefirm’s ongoing operations.• The firm will not have any significant continuing involvement in the operations of thecomponent after the disposal transaction.11 Securities <strong>and</strong> Exchange Commission (SEC) rules (Regulation S-X, Article 3) require that comparative income statementdata for at least three years <strong>and</strong> comparative balance sheet data for two years be provided in filings with the Commission.For this reason, most publicly held corporations provide these comparative income statement <strong>and</strong> balancesheet data in their annual report to shareholders.12 APB Opinion No. 30, op. cit.13 SFAS No. 144, op. cit., para. 41.14 IAS 35: “Discontinuing Operations” provides authoritative accounting <strong>and</strong> disclosure guidance for those firms followinginternational accounting st<strong>and</strong>ards for operations that are to be discontinued. The st<strong>and</strong>ard defines “discontinuing operations”as a business or geographical segment that an enterprise either is disposing of entirely or is terminating through ab<strong>and</strong>onmentor piecemeal sale. Among other things, entities are required to disclose (1) the amounts of revenues, expenses, <strong>and</strong>pre-tax profit or loss attributable to the discontinuing operation <strong>and</strong> related tax expense (benefit), <strong>and</strong> (2) the amount ofany gain or loss that is recognized on the disposal of the discontinuing operation, net of related tax effects. [See “DiscontinuingOperations,” IAS 35 (London, UK: International <strong>Accounting</strong> St<strong>and</strong>ards Committee [IASC], 1998.)]ISBN: 0-536-06624-8Financial Reporting <strong>and</strong> Analysis, Third Edition, by Lawrence Revsine, Daniel W. Collins, <strong>and</strong> W. Bruce Johnson.Copyright © 2005 by <strong>Pearson</strong> Education, Inc. Published by Prentice Hall.