Accrual Accounting and Income Determination - Pearson Learning ...

Accrual Accounting and Income Determination - Pearson Learning ...

Accrual Accounting and Income Determination - Pearson Learning ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

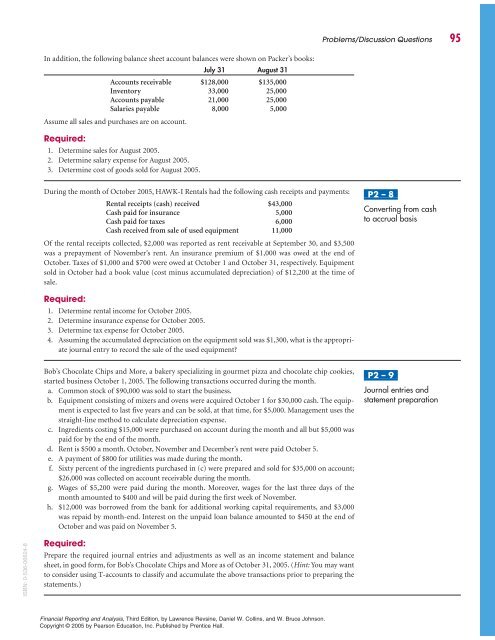

Problems/Discussion Questions 95In addition, the following balance sheet account balances were shown on Packer’s books:July 31 August 31Accounts receivable $128,000 $135,000Inventory 33,000 25,000Accounts payable 21,000 25,000Salaries payable 8,000 5,000Assume all sales <strong>and</strong> purchases are on account.Required:1. Determine sales for August 2005.2. Determine salary expense for August 2005.3. Determine cost of goods sold for August 2005.During the month of October 2005, HAWK-I Rentals had the following cash receipts <strong>and</strong> payments:Rental receipts (cash) received $43,000Cash paid for insurance 5,000Cash paid for taxes 6,000Cash received from sale of used equipment 11,000Of the rental receipts collected, $2,000 was reported as rent receivable at September 30, <strong>and</strong> $3,500was a prepayment of November’s rent. An insurance premium of $1,000 was owed at the end ofOctober. Taxes of $1,000 <strong>and</strong> $700 were owed at October 1 <strong>and</strong> October 31, respectively. Equipmentsold in October had a book value (cost minus accumulated depreciation) of $12,200 at the time ofsale.P2 – 8Converting from cashto accrual basisRequired:1. Determine rental income for October 2005.2. Determine insurance expense for October 2005.3. Determine tax expense for October 2005.4. Assuming the accumulated depreciation on the equipment sold was $1,300, what is the appropriatejournal entry to record the sale of the used equipment?Bob’s Chocolate Chips <strong>and</strong> More, a bakery specializing in gourmet pizza <strong>and</strong> chocolate chip cookies,started business October 1, 2005. The following transactions occurred during the month.a. Common stock of $90,000 was sold to start the business.b. Equipment consisting of mixers <strong>and</strong> ovens were acquired October 1 for $30,000 cash. The equipmentis expected to last five years <strong>and</strong> can be sold, at that time, for $5,000. Management uses thestraight-line method to calculate depreciation expense.c. Ingredients costing $15,000 were purchased on account during the month <strong>and</strong> all but $5,000 waspaid for by the end of the month.d. Rent is $500 a month. October, November <strong>and</strong> December’s rent were paid October 5.e. A payment of $800 for utilities was made during the month.f. Sixty percent of the ingredients purchased in (c) were prepared <strong>and</strong> sold for $35,000 on account;$26,000 was collected on account receivable during the month.g. Wages of $5,200 were paid during the month. Moreover, wages for the last three days of themonth amounted to $400 <strong>and</strong> will be paid during the first week of November.h. $12,000 was borrowed from the bank for additional working capital requirements, <strong>and</strong> $3,000was repaid by month-end. Interest on the unpaid loan balance amounted to $450 at the end ofOctober <strong>and</strong> was paid on November 5.P2 – 9Journal entries <strong>and</strong>statement preparationISBN: 0-536-06624-8Required:Prepare the required journal entries <strong>and</strong> adjustments as well as an income statement <strong>and</strong> balancesheet, in good form, for Bob’s Chocolate Chips <strong>and</strong> More as of October 31, 2005. (Hint: You may wantto consider using T-accounts to classify <strong>and</strong> accumulate the above transactions prior to preparing thestatements.)Financial Reporting <strong>and</strong> Analysis, Third Edition, by Lawrence Revsine, Daniel W. Collins, <strong>and</strong> W. Bruce Johnson.Copyright © 2005 by <strong>Pearson</strong> Education, Inc. Published by Prentice Hall.