2009/10 Annual Report - Cruising Yacht Club of Australia

2009/10 Annual Report - Cruising Yacht Club of Australia

2009/10 Annual Report - Cruising Yacht Club of Australia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

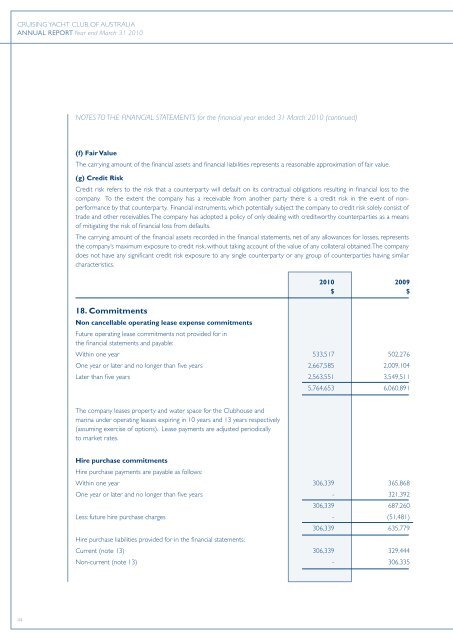

CRUISING YACHT CLUB OF AUSTRALIAANNUAL REPORT Year end March 31 20<strong>10</strong>NOTES TO THE FINANCIAL STATEMENTS for the financial year ended 31 March 20<strong>10</strong> (continued)(f) Fair ValueThe carrying amount <strong>of</strong> the financial assets and financial liabilities represents a reasonable approximation <strong>of</strong> fair value.(g) Credit RiskCredit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss to thecompany. To the extent the company has a receivable from another party there is a credit risk in the event <strong>of</strong> nonperformanceby that counterparty. Financial instruments, which potentially subject the company to credit risk solely consist <strong>of</strong>trade and other receivables. The company has adopted a policy <strong>of</strong> only dealing with creditworthy counterparties as a means<strong>of</strong> mitigating the risk <strong>of</strong> financial loss from defaults.The carrying amount <strong>of</strong> the financial assets recorded in the financial statements, net <strong>of</strong> any allowances for losses, representsthe company’s maximum exposure to credit risk, without taking account <strong>of</strong> the value <strong>of</strong> any collateral obtained. The companydoes not have any significant credit risk exposure to any single counterparty or any group <strong>of</strong> counterparties having similarcharacteristics.20<strong>10</strong> <strong>2009</strong>$ $18. CommitmentsNon cancellable operating lease expense commitmentsFuture operating lease commitments not provided for inthe financial statements and payable:Within one year 533,517 502,276One year or later and no longer than five years 2,667,585 2,009,<strong>10</strong>4Later than five years 2,563,551 3,549,5115,764,653 6,060,891The company leases property and water space for the <strong>Club</strong>house andmarina under operating leases expiring in <strong>10</strong> years and 13 years respectively(assuming exercise <strong>of</strong> options). Lease payments are adjusted periodicallyto market rates.Hire purchase commitmentsHire purchase payments are payable as follows:Within one year 306,339 365,868One year or later and no longer than five years - 321,392306,339 687,260Less: future hire purchase charges - (51,481)306,339 635,779Hire purchase liabilities provided for in the financial statements:Current (note 13) 306,339 329,444Non-current (note 13) - 306,33544