EFTPS - Financial Management Service - Department of the Treasury

EFTPS - Financial Management Service - Department of the Treasury

EFTPS - Financial Management Service - Department of the Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

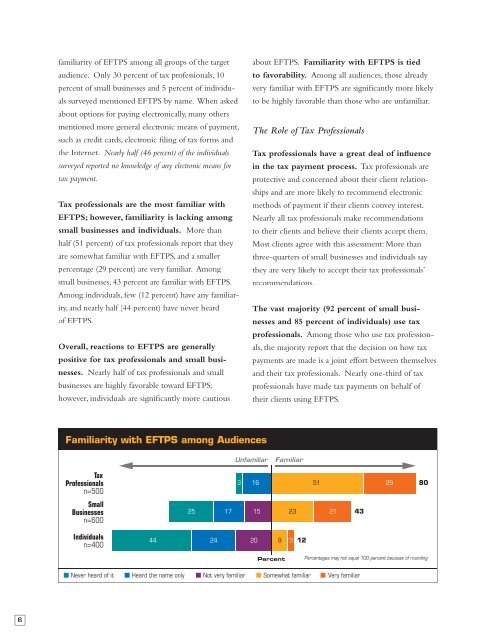

familiarity <strong>of</strong> <strong>EFTPS</strong> among all groups <strong>of</strong> <strong>the</strong> targetaudience. Only 30 percent <strong>of</strong> tax pr<strong>of</strong>essionals, 10percent <strong>of</strong> small businesses and 5 percent <strong>of</strong> individualssurveyed mentioned <strong>EFTPS</strong> by name. When askedabout options for paying electronically, many o<strong>the</strong>rsmentioned more general electronic means <strong>of</strong> payment,such as credit cards, electronic filing <strong>of</strong> tax forms and<strong>the</strong> Internet. Nearly half (46 percent) <strong>of</strong> <strong>the</strong> individualssurveyed reported no knowledge <strong>of</strong> any electronic means fortax payment.Tax pr<strong>of</strong>essionals are <strong>the</strong> most familiar with<strong>EFTPS</strong>; however, familiarity is lacking amongsmall businesses and individuals. More thanhalf (51 percent) <strong>of</strong> tax pr<strong>of</strong>essionals report that <strong>the</strong>yare somewhat familiar with <strong>EFTPS</strong>, and a smallerpercentage (29 percent) are very familiar. Amongsmall businesses, 43 percent are familiar with <strong>EFTPS</strong>.Among individuals, few (12 percent) have any familiarity,and nearly half (44 percent) have never heard<strong>of</strong> <strong>EFTPS</strong>.Overall, reactions to <strong>EFTPS</strong> are generallypositive for tax pr<strong>of</strong>essionals and small businesses.Nearly half <strong>of</strong> tax pr<strong>of</strong>essionals and smallbusinesses are highly favorable toward <strong>EFTPS</strong>;however, individuals are significantly more cautiousabout <strong>EFTPS</strong>. Familiarity with <strong>EFTPS</strong> is tiedto favorability. Among all audiences, those alreadyvery familiar with <strong>EFTPS</strong> are significantly more likelyto be highly favorable than those who are unfamiliar.The Role <strong>of</strong> Tax Pr<strong>of</strong>essionalsTax pr<strong>of</strong>essionals have a great deal <strong>of</strong> influencein <strong>the</strong> tax payment process. Tax pr<strong>of</strong>essionals areprotective and concerned about <strong>the</strong>ir client relationshipsand are more likely to recommend electronicmethods <strong>of</strong> payment if <strong>the</strong>ir clients convey interest.Nearly all tax pr<strong>of</strong>essionals make recommendationsto <strong>the</strong>ir clients and believe <strong>the</strong>ir clients accept <strong>the</strong>m.Most clients agree with this assessment: More thanthree-quarters <strong>of</strong> small businesses and individuals say<strong>the</strong>y are very likely to accept <strong>the</strong>ir tax pr<strong>of</strong>essionals’recommendations.The vast majority (92 percent <strong>of</strong> small businessesand 85 percent <strong>of</strong> individuals) use taxpr<strong>of</strong>essionals. Among those who use tax pr<strong>of</strong>essionals,<strong>the</strong> majority report that <strong>the</strong> decision on how taxpayments are made is a joint effort between <strong>the</strong>mselvesand <strong>the</strong>ir tax pr<strong>of</strong>essionals. Nearly one-third <strong>of</strong> taxpr<strong>of</strong>essionals have made tax payments on behalf <strong>of</strong><strong>the</strong>ir clients using <strong>EFTPS</strong>. 6