Preqin Research Report

Preqin Research Report

Preqin Research Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

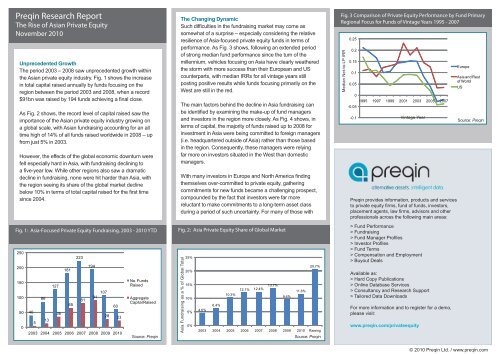

Fig. 4: Split of Asia-Focused Fundraising by Domestic vs ForeignHeadquartered Managers100%90%80%70%60%50%40%30%20%10%0%40.5% 39.8%48.6%67.4% 55.2% 58.4% 61.4%59.5% 60.2%51.4%32.6% 44.8% 41.6% 38.6%2005 2006 2007 2008 2009 2010 RaisingForeignDomesticFig. 5: Split of Funds Currently on the Road by Type10090868073706060504035302721.8 21.5 21.5 20.6202013.51410106.845.33.2 3.10Expansion Buyout Venture Real Estate Infrastructure Fund of Funds Balanced Distressed PE Other/GrowthNo. Funds RaisingAggregate Capital Sought($bn)Within Asia itself there has also been increasing enthusiasmfor private equity, with a growing institutional investor baseseeking out more balanced and sophisticated investmentportfolios. While investors such as the Government ofSingapore Investment Corporation and NLI International, aJapanese insurance company, are long-time supporters ofthe asset class, more recently we have seen new entrantssuch as National Social Security Fund - China and HongKong Monetary Authority Investment Portfolio entering theprivate equity arena for the first time.Fund Managers ReactThe response to the increased enthusiasm from fundmanagers has been significant. In total there are 329 fundson the road focusing on Asia, seeking a total of $117bn inlimited cash available, investments closer to home were theonly ones maintained during 2009.The result has been an increase in the proportion of fundsbeing raised by firms headquartered in Asia, which are morereliant upon gathering commitments from local investorsthan their international counterparts. The proportion ofcapital raised in the region from domestic managers rosefrom less than 40% in 2008 to nearly 60% in 2009. Thistrend looks set to continue in the longer term, with domesticmanagers accounting for 60% of all funds currently on theroad.Institutional Investor Enthusiasm Rising across theWorldWhile the global economic crisis brought about a hiatusin the Asian industry’s growth story, the resilience ofAsian funds and impressive development seen in Asianeconomies has once again attracted the attentions of manyEuropean and American investors in private equity. In arecent survey of institutional investors in private equity, 56%named Asia as an area presenting the best opportunities forinvestment in the current climate.Numerous investors have recently shown increasedattention towards Asia, including Stapi Lifeyrissjodur. TheIcelandic pension fund recently began investing in Asia andanticipates its exposure to the region will increase in thecoming years. Commitments are anticipated to be made topan-Asian funds rather than country-specific funds withinAsia.Another European investor with an interest in Asia is theUK-based London Borough of Islington Pension Fund,which is hoping to gain exposure to Asia through its futurecommitments to funds of funds. Funds of funds representa growth story in their own right, with firms such as BeijingbasedDiligence Capital and Tokyo-based Brightrust PEJapan launching new vehicles in recent times aimed at bothdomestic and international investors alike.Like this report?You can sign up to receive Hedge Fund Investor Spotlight,<strong>Preqin</strong>’s monthly newsletter containing the latest research onhedge fund investors.Visit: www.preqin.com/spotlightEmail: info@preqin.comLondon: +44 (0)20 7645 8888New York: +1 212 808 3008Singapore: +65 6408 0122<strong>Preqin</strong> provides information, products and servicesto private equity fi rms, fund of funds, investors,placement agents, law fi rms, advisors and otherprofessionals across the following main areas:> Fund Performance> Fundraising> Fund Manager Profi les> Investor Profi les> Fund Terms> Compensation and Employment> Buyout DealsAvailable as:> Hard Copy Publications> Online Database Services> Consultancy and <strong>Research</strong> Support> Tailored Data DownloadsFor more information and to register for a demo,please visit:www.preqin.com/privateequity© 2010 <strong>Preqin</strong> Ltd. / www.preqin.com

Fig. 6: Split of Funds Currently on the Road by Fund ManagerHeadquarters60504030201003640445520.7 20.3 232216.0 191511.0 8.3 11 7.3 7.0 5.8 5.3 92.9Hong KongChinaUSIndiaUKUnited Arab EmiratesAustraliaSingaporeJapanSouth KoreaNo. Funds RaisingAggregate Capital Sought($bn)aggregate commitments. This figure accounts for over 20%of all funds being raised worldwide, a record level whichpoints towards a significant future increase in the proportionof global private equity money focusing on Asia.Where Is the Money Going?As Fig. 5 shows, firms raising growth capital funds areseeking to raise the most capital of all fund types currentlyon the road, with 73 growth funds seeking a total of $21.8bn.This is one area of the market which is very characteristic toAsia, with the number and value of growth capital funds inEurope and the US being far lower as a proportion of totalfundraising. The buyout, venture and real estate sectors arealso all seeking over $20bn with new funds currently on theroad.As Fig. 6 reveals, in terms of manager headquarters, HongKong-based firms are leading the field in terms of capitalbeing sought for new funds on the road. Hong Kong isfollowed closely by China, which represents a leadingcentre for new capital being raised for the region, with manyof the funds being raised by managers headquarteredin Hong Kong, Singapore, the US, the UK, the UAE andelsewhere focusing either entirely or to a significant extenton opportunities in the region. India is also a leading regionwithin Asia for private equity investment, while there arealso significant new markets emerging in countries such asVietnam, which has six home-grown funds currently on theroad seeking just over $1bn in aggregate commitments.Long-Term OutlookAs the abundance of new funds on the road shows, growthwithin the private equity industry in Asia is already underway.With increasing numbers of both domestic and inter-regionalinvestors seeking to increase their exposure to Asia, it islikely that many of these new vehicles will be successful inachieving their targets, and will go on to invest billions ofdollars in Asian companies.Unlike with previous periods of industry growth, the recentrise in activity is being driven primarily by an increase inthe number and stature of domestic firms, with many newprivate equity houses starting up, and existing domesticplayers raising larger vehicles.In order to capture all of these important new developments,we are very excited to announce the launch of our firstAsian office, in Singapore. We are confident that this movewill enable us to better capture all the activity in the region,and better serve our clients in Asia and all other regionsworldwide.The <strong>Preqin</strong> BlogWe regularly post unique content and analysis on varioustopics in the alternative assets industry. Subscribe to theRSS feed or bookmark the page to be kept up to date on allthe latest topics and trends.www.preqin.com/blogJoin our group onSearch for <strong>Preqin</strong>Follow us onwww.twitter.com/<strong>Preqin</strong> provides information, products and servicesto private equity fi rms, fund of funds, investors,placement agents, law fi rms, advisors and otherprofessionals across the following main areas:> Fund Performance> Fundraising> Fund Manager Profi les> Investor Profi les> Fund Terms> Compensation and Employment> Buyout DealsAvailable as:> Hard Copy Publications> Online Database Services> Consultancy and <strong>Research</strong> Support> Tailored Data DownloadsFor more information and to register for a demo,please visit:www.preqin.com/privateequityThe 2011 <strong>Preqin</strong> AlternativesInvestment Consultant ReviewOut NowThe 2011 <strong>Preqin</strong> Alternatives Investment ConsultantsReviewFor more information please visitwww.preqin.com/aic© 2010 <strong>Preqin</strong> Ltd. / www.preqin.com

Fig. 7: Top 10 Asia Private Equity Funds Closed to Date (Excludes PERE Funds)Fund Vintage Manager Type Final Size (mn)ManagerCountryTPG Asia V 2008 TPG Buyout 4,250 USD USCVC Capital Partners Asia Pacific III 2008 CVC Capital Partners Buyout 4,119 USD UKKKR Asia Fund 2007 Kohlberg Kravis Roberts Buyout 4,000 USD USCitigroup International Growth Partnership II 2007 Citi Venture Capital International Expansion 4,000 USD UKAvenue Asia Special Situations Fund IV 2006 Avenue Capital Group Distressed Debt 3,000 USD USActis Emerging Markets 3 2007 Actis Buyout 2,900 USD UKAffi nity Asia Pacifi c Fund III 2007 Affi nity Equity Partners Buyout 2,800 USD Hong KongBohai Industrial Investment Fund 2006 BOCI Private Equity Buyout 20,000 CNY Hong KongCarlyle Asia Partners III 2008 Carlyle Group Buyout 2,550 USD USFig. 8: Top 10 Asia Private Equity Funds Currently on the RoadFund Manager Type Target Size (mn) Manager CountryIf you are an investor, fund manager or other private equityprofessional operating in Asia and would like to ensure thatinformation we hold on your firm is correct, please contactStuart Taylor at our Singapore office on +65 6408 0122.If you would like to discover how <strong>Preqin</strong>’s industry-leadingdata and intelligence can help you to leverage your researchresources and maintain accurate and comprehensiveinformation on all active players in the industry, please get intouch with Ben Cluny on +65 6408 0122You can register for demo access atwww.preqin.com/demoAVIC Fund of China CCB International Asset Management Expansion 20,000 CNY Hong KongChina Cultural Industry Investment Fund BOCI Private Equity Buyout 20,000 CNY Hong KongGP CapitalChina International Capital Corporation PrivateEquityBuyout 20,000 CNY Hong KongShanghai Financial Development InvestmentFundJinpu Industrial Investment Fund Management Venture (General) 20,000 CNY ChinaSuzhou Venture Capital Fund China Development Bank Venture (General) 15,000 CNY ChinaMacquarie State Bank of India InfrastructureFundMacquarie Infrastructure and Real Assets Infrastructure 2,000 USD AustraliaBaring Asia Private Equity Fund V Baring Private Equity Asia Balanced 1,750 USD Hong KongHuarong Yufu Fund China Huarong Asset Management Corp Venture (General) 10,000 CNY ChinaChina Mining United Fund I China Mining United Fund Natural Resources 10,000 CNY ChinaGuosheng CLSA (Shanghai) IndustrialInvestment Management Co.CLSA Capital Partners Venture (General) 10,000 CNY Hong KongFig. 9: Examples of Investors in Recently Closed Asia FundsInvestor Name Investor Type Country Sample of Recent Asia-Focused Fund InvestmentsAsian Development Bank Bank PhilippinesCalifornia PublicEmployees' RetirementSystem (CalPERS)CDC GroupInternational FinanceCorporation (IFC)National <strong>Research</strong>FoundationPublic PensionFundGovernmentAgencyGovernmentAgencyGovernmentAgencyUSUKUSSingaporeAmWater Asia Water Fund, Asia Clean Energy Fund, China Clean Energy Capital, GEF South AsiaClean Energy Fund, Islamic Infrastructure Fund, MEACP Clean Energy Fund, Mekong BrahmaputraClean Development Fund, South-Asia Clean Energy FundAetos Capital Asia III, Carlyle Asia Growth Partners IV, Carlyle Asia Partners III, India Value Fund IV,New Horizon Capital Fund III, SAIF Partners IVAscent India Fund III, Avigo SME Fund III, CDH China Fund IV, India Financial Inclusion Fund,Kaizen Education Fund I, LC Fund IV, Lok II, Multiples I, Renewable Energy Asia Fund, VenturEastLife Fund IIIAmbit Pragma Ventures, AmWater Asia Water Fund, Aquarius India Fund, Avigo SME Fund III,BioVeda China Fund II, CDH China Fund IV, China-ASEAN Investment Cooperation Fund, CleanResources Asia Growth Fund, India Agri Business Fund, Lok II, Quvat Capital Partners II, SEAFBangladesh Ventures, VenturEast Life Fund III, Vietnam Investments Fund I, Vietnam Pioneer FundExtream Venture Fund I, Nanostart Singapore Early Stage Venture Fund I, Raffles Venture Partners,Seed Ventures IV<strong>Preqin</strong> provides information, products and servicesto private equity fi rms, fund of funds, investors,placement agents, law fi rms, advisors and otherprofessionals across the following main areas:> Fund Performance> Fundraising> Fund Manager Profi les> Investor Profi les> Fund Terms> Compensation and Employment> Buyout DealsAvailable as:> Hard Copy Publications> Online Database Services> Consultancy and <strong>Research</strong> Support> Tailored Data DownloadsFor more information and to register for a demo,please visit:www.preqin.com/privateequity© 2010 <strong>Preqin</strong> Ltd. / www.preqin.com