Understanding Your IRS Form 1099-B - USAA

Understanding Your IRS Form 1099-B - USAA

Understanding Your IRS Form 1099-B - USAA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

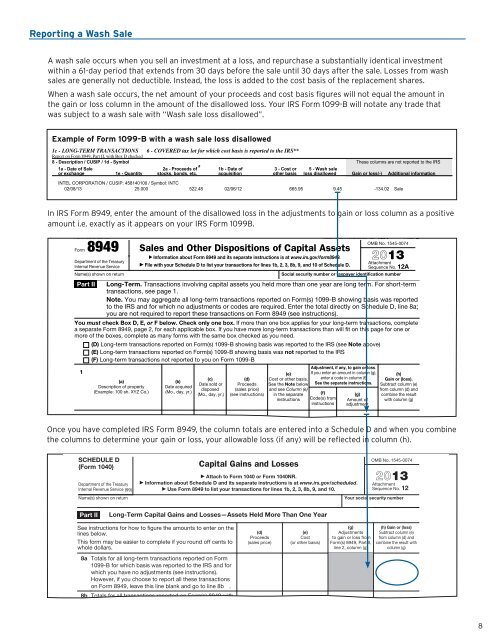

FACEBOOK INC-A / CUSIP: 30303M102 / Symbol: FB4 tax lots for 09/17/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.50.000 2,246.98 08/02/12 1,005.95 0.00 1,241.03 Sale50.000 2,246.99 08/16/12 993.45 0.00 1,253.54 Sale50.000 2,171.98 08/31/12 927.95 0.00 1,244.03 Sale50.000 2,171.99 08/31/12 909.95 0.00 1,262.04 Sale09/17/13 200.000 8,837.94 VARIOUS 3,837.30 0.00 5,000.64 Total of 4 lotsReporting a Wash Sale3 tax lots for 09/20/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.24.000 1,108.05 07/27/12 552.34 0.00 555.71 Sale26.000 1,202.47 07/27/12 598.36 0.00 604.11 SaleA wash sale occurs when you sell an investment at a loss, and repurchase a substantially identical investment50.000 2,308.44 07/31/12 1,143.45 0.00 1,164.99 Salewithin 09/20/13 a 61-day period that 100.000extends from 4,618.96 30 days VARIOUS before the sale until 2,294.1530 days after 0.00 the sale. 2,324.81 Losses Total of 3 from lots washsales are generally not deductible. Instead, the loss is added to the cost basis of the replacement shares.When a wash sale occurs, the net amount of your proceeds and cost basis figures will not equal the amount inthe gain or loss column in the amount of the disallowed loss. <strong>Your</strong> <strong>IRS</strong> <strong>Form</strong> <strong>1099</strong>-B will notate any trade thatwas subject to a wash sale with “Wash sale loss disallowed”.6 tax lots for 09/24/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.25.000 1,223.49 05/18/12 957.20 0.00 266.29 Sale50.000 2,446.98 05/21/12 1,707.95 0.00 739.03 Sale25.000 1,211.24 05/22/12 780.95 0.00 430.29 Sale25.000 1,211.24 05/22/12 804.48 0.00 406.76 Sale25.000 1,223.49 05/22/12 804.47 0.00 419.02 Sale50.000 2,422.48 06/01/12 1,406.95 0.00 1,015.53 SalePage 13 of 62<strong>USAA</strong> 09/24/13 FEDERAL SAVINGS BANK200.000 9,738.92 VARIOUS 6,462.00 0.00 3,276.92 Account Total 10029775 of 6 lots<strong>USAA</strong> INVESTMENT MANAGEMENT CO4 tax lots for 09/26/13.ProceedsTotal proceedsfrom(and costBrokerwhen required)andreportedBartertoExchangethe <strong>IRS</strong>.TransactionsExample 2013 <strong>1099</strong>-B* of <strong>Form</strong> <strong>1099</strong>-B with a wash sale loss disallowed(continued)25.000 1,248.49 05/18/12 955.95 0.00 OMB 292.54No. Sale 1545-07151,248.49 05/18/12 956.95 0.00 291.54 Sale1c - LONG-TERM TRANSACTIONS 25.0006 - COVERED tax 1,248.49 lot for which cost 05/18/12 basis is reported to the <strong>IRS</strong>** 980.95 0.00 267.54 SaleReport on <strong>Form</strong> 8949, Part II, with Box D checked 25.000 1,248.49 05/18/12 1,005.95 0.00 242.54 Sale8 - Description 09/26/13 / CUSIP / 1d - Symbol 100.000 4,993.96 VARIOUS 3,899.80 0.00 These columns 1,094.16are Total not reported of 4 lotsto the <strong>IRS</strong>1a - Date of Sale2a - Proceeds of # 1b - Date of3 - Cost or 5 - Wash saleor exchangeSecurity1e - Quantitytotal:stocks, bonds,28,189.78etc. acquisitionother16,493.25basis loss disallowed0.00Gain or loss(-)11,696.53Additional informationSecurity total: 10,258.59 14,943.17 30.62 -4,653.96INTEL CORPORATION / CUSIP: 458140100 / Symbol: INTC02/08/13 25.000 522.48 02/06/12 665.95 9.45 -134.02 SaleFACEBOOK INC-A / CUSIP: 30303M102 / Symbol: FB4 tax lots for 09/17/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.50.000 2,246.98 08/02/12 1,005.95 0.00 1,241.03 Sale50.000 2,246.99 08/16/12 993.45 0.00 1,253.54 Sale* This is important tax information 50.000 and is being furnished 2,171.98 to the Internal Revenue 08/31/12 Service. If you are required 927.95 to file a return, a negligence penalty 1,244.03 or other sanction Sale may be imposed on youif this income is taxable and the <strong>IRS</strong> 50.000 determines that it has 2,171.99 not been reported. 08/31/12 Remember, taxpayers are ultimately 909.95 responsible for 0.00the accuracy of 1,262.04 their tax return(s). Sale**For NONCOVERED tax lots, values for "Date of acquisition," "Cost or other basis" and "Wash sale loss disallowed" are provided for your reference and are NOT reported to the <strong>IRS</strong>.09/17/13 # Less commissions.200.000 8,837.94 VARIOUS 3,837.30 0.00 5,000.64 Total of 4 lots<strong>Form</strong> 8949 (2013) Attachment Sequence No. 12A Page 23 tax lots for 09/20/13. Total proceeds (and cost when required) reported to the <strong>IRS</strong>.Name(s) shown on return. (Name 24.000 and SSN or taxpayer identification 1,108.05 no. not required 07/27/12 if shown on other side.) 552.34 Social security number 0.00or taxpayer identificationOMB No. 1545-0074555.71 Sale number<strong>Form</strong> 8949 26.000Sales and1,202.47Other Dispositions07/27/12of598.36Capital Assets0.00 604.11 Sale50.000 ▶ Information 2,308.44 about <strong>Form</strong> 8949 and 07/31/12 its separate instructions 1,143.45 is at www.irs.gov/form8949. 0.00 1,164.99 2013 Sale09/20/13Most Department brokers of the issue Treasury their 100.000 own substitute statement 4,618.96 instead of using VARIOUS <strong>Form</strong> <strong>1099</strong>-B. They also 2,294.15 may provide basis information 0.00 (usually 2,324.81 your cost) Total to of you 3 lots on▶ Attachmentthe Internal SCHEDULE statement Revenue ServiceFile with your Schedule D to list your transactions for lines 1b, 3, 8b, 9, and 10 of Schedule D.even D if it is not reported to the <strong>IRS</strong>. Before you check Box D, E, or F below, determine whether you received any statement(s) Sequence OMB No. No. 1545-0074 and, 12A if so,the Name(s) (<strong>Form</strong> transactions shown 1040)for return 6 tax which lots for basis 09/24/13. was reported Total proceeds to the (and <strong>IRS</strong>. Capital cost Brokers when required) are Gains required reported to and report to the Losses<strong>IRS</strong>. basis Social to the security <strong>IRS</strong> for number most or stock taxpayer you bought identification in 2011 number or later.25.000 1,223.49 05/18/12 957.20 266.29 SalePart II Long-Term. 50.000 Transactions 2,446.98 involving Attach capital 05/21/12 to <strong>Form</strong> assets 1040 you or <strong>Form</strong> held more 1040NR. 1,707.95 than one year 0.00are long term. 739.03 For 2013 short-termSaleMost Department brokers of the issue transactions, Treasury their 25.000 own substitute Information see page statement 1. about 1,211.24 instead Schedule of using D and 05/22/12 <strong>Form</strong> its separate <strong>1099</strong>-B. They instructions also may 780.95 is provide at www.irs.gov/scheduled.basis information 0.00 (usually your 430.29 Attachment cost) Sale to you onthe Internal statement Revenue even Service if it (99) is 25.000 not reported to Use the <strong>IRS</strong>. <strong>Form</strong> 1,211.24 Before 8949 you to list check 05/22/12 your Box transactions A, B, or C below, for lines determine 804.48 1b, 2, 3, whether 8b, 9, and you 0.00 10. received any statement(s) 406.76 Sequence Sale and, No. if 12 so,Note. You may aggregate all long-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was reportedthe transactions for which 25.000 basis was reported to 1,223.49 the <strong>IRS</strong>. Brokers 05/22/12 are required to report basis 804.47 to the <strong>IRS</strong> for most 0.00 stock you bought in 419.02 2011 or Sale later.Name(s) shown to on the return <strong>IRS</strong> <strong>Your</strong> social security number50.000and for which no2,422.48adjustments06/01/12or codes are required.1,406.95Enter the total0.00directly on Schedule1,015.53 SaleD, line 8a;09/24/13Part I Short-Term. you are 200.000 not required Transactions to report 9,738.92involving these capital transactions VARIOUSassets on you <strong>Form</strong> held 8949 one6,462.00year (see or instructions). less are0.00short term. For3,276.92long-termTotal of 6 lotstransactions, see page 2.You Part must I check Short-Term Box D, E,4 tax lots for 09/26/13. Capital or F below.Total Gains Checkproceeds only(and Losses—Assets one box. If morecost when required) reported Held thanto the One one box<strong>IRS</strong>. Year applies or Less for your long-term transactions, completea separate <strong>Form</strong> Note. 8949, You page may 2, aggregate for each applicable all short-term box. If transactions you have more reported long-term on transactions <strong>Form</strong>(s) <strong>1099</strong>-B than will showing fit on this basis page was for one or25.000 1,248.49 05/18/12 955.95 0.00 292.54 SalemoreSee instructionsof the boxes, reportedforcomplete to the <strong>IRS</strong>how 25.000to figureas many andthe amountsforms which1,248.49 withtothe no adjustmentsentersameon 05/18/12 thebox checked or codes as you are need. required. Enter the total directly on956.95 0.00 (g) 291.54(h) Gain Saleor (loss)lines below. (D) Long-termSchedule 25.000 transactionsD, line 1a;reportedyou are 1,248.49 onnot<strong>Form</strong>(s)required<strong>1099</strong>-B 05/18/12 to reportshowingthese (d) basistransactionswas 980.95 reportedon (e) to<strong>Form</strong>the <strong>IRS</strong> 0.00 8949(see Adjustments (seeNoteinstructions).above) 267.54 Subtract Salecolumn (e)25.000 1,248.49 05/18/12 Proceeds 1,005.95 Cost 0.00 to gain loss from 242.54 from Sale column (d) andYou This must form (E) Long-term check may be Box easier transactions A, B, to or complete C below. reported if you Check on round <strong>Form</strong>(s) only off one cents <strong>1099</strong>-B box. to showing If more than(sales basis oneprice) was box not applies(or reported for yourother basis) to the short-term<strong>Form</strong>(s) <strong>IRS</strong> transactions,8949, Part I, combine the result with09/26/13complete 100.000 4,993.96 VARIOUS 3,899.80 0.00 1,094.16 Total of 4 lotswhole dollars. a separate <strong>Form</strong> 8949, page 1, for each applicable box. If you have more short-term transactions line 2, than column will (g) fit on this column page (g)(F) Long-term transactions not reported to you on <strong>Form</strong> <strong>1099</strong>-Bfor one or more Security of total: the boxes, complete as 28,189.78 many forms with the same box checked 16,493.25 as you need. 0.00 11,696.531a Totals for all short-term transactions reported on <strong>Form</strong>Adjustment, if any, to gain or loss.1 (A) Short-term transactions reported on <strong>Form</strong>(s) <strong>1099</strong>-B showing basis was reportedINTEL CORPORATION <strong>1099</strong>-B / CUSIP: for 458140100 which basis / Symbol: was INTC reported to the <strong>IRS</strong> and for(e) to If the you enter <strong>IRS</strong> an (see amount Note in column above) (g), (h)02/08/13 (B) Short-termwhich you have (a) 25.000 transactions reportedno adjustments (see (b) 522.48 on <strong>Form</strong>(s) (c) <strong>1099</strong>-Binstructions). 02/06/12showing (d) basis Cost was or665.95 not other reported basis. to enter the a code in column (f).9.45<strong>IRS</strong>-134.02GainSaleor (loss).Date sold or Proceeds See the Note below See the separate instructions. Subtract column (e)Description of property Date acquiredHowever,(C) Short-term(Example: 100 if youtransactionssh. XYZ choose Co.) to reportnot reported(Mo., all day, thesetoyr.) transactionsdisposed you on <strong>Form</strong> (sales <strong>1099</strong>-B price) and see Column (e)from column (d) and(Mo., day, yr.) (see instructions) in the separate (f)(g) combine the resulton <strong>Form</strong> 8949, leave this line blank and go to line 1b .Adjustment, if any, to gain or loss.1instructions Code(s) from(e) If you enter an amount Amount in column of (g), with (h) column (g)instructions adjustment1b Totals for all transactions reported on <strong>Form</strong>(s) (c) 8949 with (d) Cost or other basis. enter a code in column (f). Gain or (loss).* This is important tax information (a) and is being furnished (b) to the Internal Date Revenue sold or Service. Proceeds If you are required See the Note to file below a return, See a negligence the separate penalty instructions. or other Subtract sanction column may be (e) imposed on youif this income is taxable Box Description A and checked the <strong>IRS</strong> of property determines . . . that . it Date has . acquired . not . been . reported. . . . Remember, . . taxpayers are ultimately responsible for the accuracy of their tax return(s).disposed (sales price) and see Column (e)from column (d) and**For NONCOVERED (Example: tax lots, values 100 sh. for XYZ "Date Co.) of acquisition," (Mo., day, "Cost yr.) or other basis" and "Wash sale loss disallowed" are provided for your reference and are NOT reported to the <strong>IRS</strong>.# Less commissions. 2 Totals for all transactions reported on <strong>Form</strong>(s) (Mo., day, 8949 yr.) with (see instructions) in the separate (f)(g) combine the resultinstructions Code(s) fromBox B checked . . . . . . . . . . . . .Amount of with column (g)instructions adjustment3 Totals for all transactions reported on <strong>Form</strong>(s) 8949 withBox C checked . . . . . . . . . . . . .In <strong>IRS</strong> <strong>Form</strong> 8949, enter the amount of the disallowed loss in the adjustments to gain or loss column as a positiveamount i.e. exactly as it appears on your <strong>IRS</strong> <strong>Form</strong> <strong>1099</strong>B.Once you have completed <strong>IRS</strong> <strong>Form</strong> 8949, the column totals are entered into a Schedule D and when you combinethe columns to determine your gain or loss, your allowable loss (if any) will be reflected in column (h).SCHEDULE 4 Short-term D gain from <strong>Form</strong> 6252 and short-term gain or (loss) from <strong>Form</strong>s 4684, 6781, and 8824 . 4 OMB No. 1545-0074(<strong>Form</strong> 5 Net 1040) short-term gain or (loss) from partnerships, Capital Gains S corporations, and Losses estates, and trusts fromSchedule(s) K-1 . . . . . . . . .. . . . . . . . . . . . . . . . . . . 5Attach to <strong>Form</strong> 1040 or <strong>Form</strong> 1040NR.20136 Short-term capital loss Department of the Treasury Information carryover. about Enter Schedule the amount, D and if its any, separate from line instructions 8 of your is Capital at www.irs.gov/scheduled.Loss Carryover AttachmentInternal Worksheet Revenue Service in (99) the instructions Use . <strong>Form</strong> . . 8949 . to . list . your . . transactions . . . . for . lines . . 1b, . 2, . 3, 8b, . 9, . and . . 10. . . 6 Sequence ( No. 12 )Name(s) 7 Net shown short-term on return capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any longtermcapital gains or losses, go to Part II below. Otherwise, go to Part III on the back . . . . . 7<strong>Your</strong> social security numberPart Part IIILong-Term Short-Term Capital Capital Gains Gains and and Losses—Assets Held Held More One Year Than or One Less YearSee instructions for how to figure the amounts to enter on the(g)See instructions for how to figure the amounts to enter on the(g)lines below.(d)(e)Adjustmentslines below.(d)(e)AdjustmentsProceedsCostto gain or loss fromProceedsCostto gain or loss fromThis This form form may may be be easier easier to to complete complete if if you you round round off off cents cents to to (sales price) (or other basis)(sales price) (or other basis)<strong>Form</strong>(s)<strong>Form</strong>(s)8949,8949,PartPartII,I,whole dollars.line 2, column (g)whole dollars.line 2, column (g)8a 1a Totals Totals for for all all long-term short-term transactions transactions reported reported on on <strong>Form</strong> <strong>Form</strong><strong>1099</strong>-B <strong>1099</strong>-B for for which which basis basis was was reported to to the the <strong>IRS</strong> <strong>IRS</strong> and and for forwhich which you you have have no no adjustments (see (see instructions).However, if if you you choose to to report all all these transactionson on <strong>Form</strong> <strong>Form</strong> 8949, 8949, leave leave this this line line blank and and go go to to line line 8b 1b .8b 1b Totals for for all all transactions reported on on <strong>Form</strong>(s) 8949 withBox Box D A checked . . . . . . . . . . . . .92 Totals for for all all transactions reported on on <strong>Form</strong>(s) 8949 withBox Box E B checked . . . . . . . . . . . . .103 Totals for for all all transactions reported on on <strong>Form</strong>(s) 8949 with2 Totals. Box Add F C checked. the amounts in . columns . . .(d), .(e), .(g), . and . (h) . (subtract. . . .11 negative Gain amounts). from <strong>Form</strong> Enter 4797, each total Part here I; long-term and include gain on your from <strong>Form</strong>s 2439 and 6252; and long-term gain or (loss)(h) Gain or (loss)(h) Gain or (loss)Subtract column (e)Subtract column (e)from column (d) andfrom column (d) andcombine the result withcombine the result withcolumncolumn (g)(g)8