The assessment of Euroclear Bank (ICSD)

The assessment of Euroclear Bank (ICSD)

The assessment of Euroclear Bank (ICSD)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

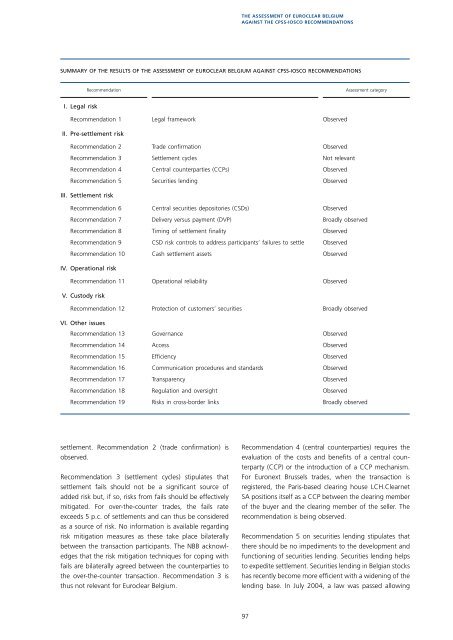

<strong>The</strong> Assessment <strong>of</strong> <strong>Euroclear</strong> Belgiumagainst the CPSS-IOSCO RecommendationsSUMMARY OF THE RESULTS OF THE ASSESSMENT OF EUROCLEAR BELGIUM AGAINST CPSS-IOSCO RECOMMENDATIONSRecommendationAssessment categoryI. Legal riskRecommendation 1 Legal framework ObservedII. Pre-settlement riskRecommendation 2 Trade confirmation ObservedRecommendation 3 Settlement cycles Not relevantRecommendation 4 Central counterparties (CCPs) ObservedRecommendation 5 Securities lending ObservedIII. Settlement riskRecommendation 6 Central securities depositories (CSDs) ObservedRecommendation 7 Delivery versus payment (DVP) Broadly observedRecommendation 8 Timing <strong>of</strong> settlement finality ObservedRecommendation 9 CSD risk controls to address participants’ failures to settle ObservedRecommendation 10 Cash settlement assets ObservedI V. Operational riskRecommendation 11 Operational reliability ObservedV. Custody riskRecommendation 12 Protection <strong>of</strong> customers’ securities Broadly observedVI. Other issuesRecommendation 13 Governance ObservedRecommendation 14 Access ObservedRecommendation 15 Efficiency ObservedRecommendation 16 Communication procedures and standards ObservedRecommendation 17 Transparency ObservedRecommendation 18 Regulation and oversight ObservedRecommendation 19 Risks in cross-border links Broadly observedsettlement. Recommendation 2 (trade confirmation) isobserved.Recommendation 3 (settlement cycles) stipulates thatsettlement fails should not be a significant source <strong>of</strong>added risk but, if so, risks from fails should be effectivelymitigated. For over-the-counter trades, the fails rateexceeds 5 p.c. <strong>of</strong> settlements and can thus be consideredas a source <strong>of</strong> risk. No information is available regardingrisk mitigation measures as these take place bilaterallybetween the transaction participants. <strong>The</strong> NBB acknowledgesthat the risk mitigation techniques for coping withfails are bilaterally agreed between the counterparties tothe over-the-counter transaction. Recommendation 3 isthus not relevant for <strong>Euroclear</strong> Belgium.Recommendation 4 (central counterparties) requires theevaluation <strong>of</strong> the costs and benefits <strong>of</strong> a central counterparty(CCP) or the introduction <strong>of</strong> a CCP mechanism.For Euronext Brussels trades, when the transaction isregistered, the Paris-based clearing house LCH.ClearnetSA positions itself as a CCP between the clearing member<strong>of</strong> the buyer and the clearing member <strong>of</strong> the seller. <strong>The</strong>recommendation is being observed.Recommendation 5 on securities lending stipulates thatthere should be no impediments to the development andfunctioning <strong>of</strong> securities lending. Securities lending helpsto expedite settlement. Securities lending in Belgian stockshas recently become more efficient with a widening <strong>of</strong> thelending base. In July 2004, a law was passed allowing97