Notification Report - Revelation

Notification Report - Revelation

Notification Report - Revelation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

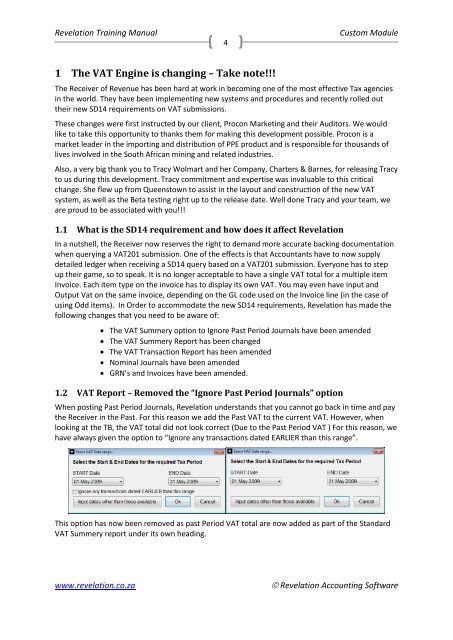

<strong>Revelation</strong> Training Manual4Custom Module1 The VAT Engine is changing – Take note!!!The Receiver of Revenue has been hard at work in becoming one of the most effective Tax agenciesin the world. They have been implementing new systems and procedures and recently rolled outtheir new SD14 requirements on VAT submissions.These changes were first instructed by our client, Procon Marketing and their Auditors. We wouldlike to take this opportunity to thanks them for making this development possible. Procon is amarket leader in the importing and distribution of PPE product and is responsible for thousands oflives involved in the South African mining and related industries.Also, a very big thank you to Tracy Wolmart and her Company, Charters & Barnes, for releasing Tracyto us during this development. Tracy commitment and expertise was invaluable to this criticalchange. She flew up from Queenstown to assist in the layout and construction of the new VATsystem, as well as the Beta testing right up to the release date. Well done Tracy and your team, weare proud to be associated with you!!!1.1 What is the SD14 requirement and how does it affect <strong>Revelation</strong>In a nutshell, the Receiver now reserves the right to demand more accurate backing documentationwhen querying a VAT201 submission. One of the effects is that Accountants have to now supplydetailed ledger when receiving a SD14 query based on a VAT201 submission. Everyone has to stepup their game, so to speak. It is no longer acceptable to have a single VAT total for a multiple itemInvoice. Each item type on the invoice has to display its own VAT. You may even have input andOutput Vat on the same invoice, depending on the GL code used on the Invoice line (in the case ofusing Odd items). In Order to accommodate the new SD14 requirements, <strong>Revelation</strong> has made thefollowing changes that you need to be aware of: The VAT Summery option to Ignore Past Period Journals have been amended The VAT Summery <strong>Report</strong> has been changed The VAT Transaction <strong>Report</strong> has been amended Nominal Journals have been amended GRN’s and Invoices have been amended.1.2 VAT <strong>Report</strong> – Removed the “Ignore Past Period Journals” optionWhen posting Past Period Journals, <strong>Revelation</strong> understands that you cannot go back in time and paythe Receiver in the Past. For this reason we add the Past VAT to the current VAT. However, whenlooking at the TB, the VAT total did not look correct (Due to the Past Period VAT ) For this reason, wehave always given the option to “Ignore any transactions dated EARLIER than this range”.This option has now been removed as past Period VAT total are now added as part of the StandardVAT Summery report under its own heading.www.revelation.co.za <strong>Revelation</strong> Accounting Software