Sole Proprietor Agent Agreement - Florida Blue - BCBSF

Sole Proprietor Agent Agreement - Florida Blue - BCBSF

Sole Proprietor Agent Agreement - Florida Blue - BCBSF

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

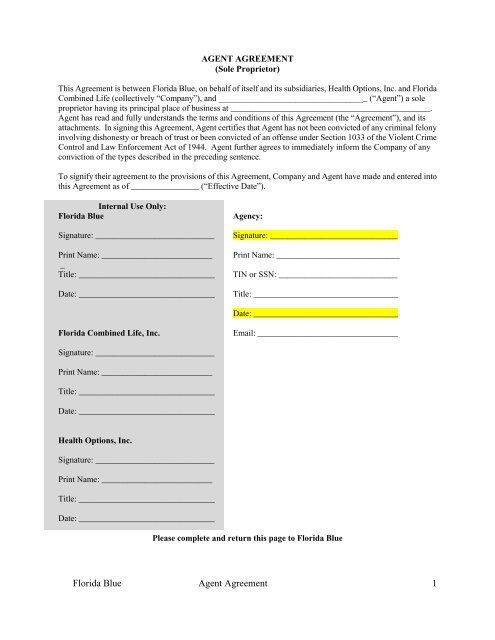

AGENT AGREEMENT(<strong>Sole</strong> <strong>Proprietor</strong>)This <strong>Agreement</strong> is between <strong>Florida</strong> <strong>Blue</strong>, on behalf of itself and its subsidiaries, Health Options, Inc. and <strong>Florida</strong>Combined Life (collectively “Company”), and ___________________________________ (“<strong>Agent</strong>”) a soleproprietor having its principal place of business at _______________________________________________.<strong>Agent</strong> has read and fully understands the terms and conditions of this <strong>Agreement</strong> (the “<strong>Agreement</strong>”), and itsattachments. In signing this <strong>Agreement</strong>, <strong>Agent</strong> certifies that <strong>Agent</strong> has not been convicted of any criminal felonyinvolving dishonesty or breach of trust or been convicted of an offense under Section 1033 of the Violent CrimeControl and Law Enforcement Act of 1944. <strong>Agent</strong> further agrees to immediately inform the Company of anyconviction of the types described in the preceding sentence.To signify their agreement to the provisions of this <strong>Agreement</strong>, Company and <strong>Agent</strong> have made and entered intothis <strong>Agreement</strong> as of ________________ (“Effective Date”).Internal Use Only:<strong>Florida</strong> <strong>Blue</strong>Signature: ____________________________Print Name: ___________________________Title: ________________________________Date: ________________________________Agency:Signature: ______________________________Print Name: _____________________________TIN or SSN: ____________________________Title: __________________________________Date: __________________________________<strong>Florida</strong> Combined Life, Inc.Email: _________________________________Signature: ____________________________Print Name: __________________________Title: ________________________________Date: ________________________________Health Options, Inc.Signature: ____________________________Print Name: __________________________Title: ________________________________Date: ________________________________Please complete and return this page to <strong>Florida</strong> <strong>Blue</strong><strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 1

AGENT AGREEMENT(<strong>Sole</strong> <strong>Proprietor</strong>)This <strong>Agreement</strong> is between <strong>Florida</strong> <strong>Blue</strong>, on behalf of itself and its subsidiaries, Health Options, Inc. and <strong>Florida</strong>Combined Life (collectively “Company”), and ___________________________________ (“<strong>Agent</strong>”) a soleproprietor having its principal place of business at _______________________________________________.<strong>Agent</strong> has read and fully understands the terms and conditions of this <strong>Agreement</strong> (the “<strong>Agreement</strong>”), and itsattachments. In signing this <strong>Agreement</strong>, <strong>Agent</strong> certifies that <strong>Agent</strong> has not been convicted of any criminal felonyinvolving dishonesty or breach of trust or been convicted of an offense under Section 1033 of the Violent CrimeControl and Law Enforcement Act of 1944. <strong>Agent</strong> further agrees to immediately inform the Company of anyconviction of the types described in the preceding sentence.To signify their agreement to the provisions of this <strong>Agreement</strong>, Company and <strong>Agent</strong> have made and entered intothis <strong>Agreement</strong> as of ________________ (“Effective Date”).Internal Use Only:<strong>Florida</strong> <strong>Blue</strong>Signature: ____________________________Print Name: ___________________________Title: ________________________________Date: ________________________________Agency:Signature: ______________________________Print Name: _____________________________TIN or SSN: ____________________________Title: __________________________________Date: __________________________________<strong>Florida</strong> Combined Life, Inc.Email: _________________________________Signature: ____________________________Print Name: __________________________Title: ________________________________Date: ________________________________Health Options, Inc.Signature: ____________________________Print Name: __________________________Title: ________________________________Date: ________________________________Please retain the rest of this contract (including this page) for your files<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 2

prepared and furnished to <strong>Agent</strong> forthat purpose by Company.b) <strong>Agent</strong> shall use best efforts to ensurethat each application for a CompanyProduct is fully and truthfullycompleted by the applicant and thecompleted application fully andaccurately reflects and discloses thecircumstances, including the healthcondition, of persons for whom aCompany Product is sought in theapplication, as applicable. <strong>Agent</strong>further agrees to inform everyapplicant that Company will rely uponsaid representations in theunderwriting process, and that thesubsequent discovery of material factsknown to applicant and either notdisclosed or misrepresented may resultin the rescission of any CompanyProduct. <strong>Agent</strong> will also inform theapplicant that in no event will theapplicant have any coverage unlessand until the application is reviewedand approved by the Company and apolicy is issued.5) <strong>Agent</strong> is not authorized to, and agrees notto, enter into, alter, deliver or terminate anypolicy on behalf of Company, extend thetime of payment of any charges orpremiums, or bind Company in any waywithout the prior written permission ofCompany. <strong>Agent</strong> acknowledges andagrees that Company reserves the right, inaccordance with applicable law, to rejectany and all applications submitted by<strong>Agent</strong>.6) <strong>Agent</strong> is not authorized to receive anyCompany funds except the initialpremiums for Company Products, and<strong>Agent</strong> is not authorized to deductcompensation, commissions, service feesor allowances from any initial premiums<strong>Agent</strong> may collect. Any funds that <strong>Agent</strong>does receive for or on behalf of Companyshall be received and held by <strong>Agent</strong> in afiduciary capacity, shall be separatelyaccounted for, shall not be commingled by<strong>Agent</strong> with personal funds of <strong>Agent</strong> orother business accounts managed or ownedby <strong>Agent</strong>, and shall be remitted toCompany promptly but in no event laterthan five (5) calendar days from the date ofreceipt.7) <strong>Agent</strong> shall not broadcast, publish ordistribute any advertisements or othermaterial relating to Company Products, notoriginated by Company, nor use the name,trademark or logo of Company or any of itssubsidiaries or affiliates in any way ormanner without Company’s prior writtenconsent and then only as specificallyauthorized in writing by Company. Therestrictions on promotional and descriptivematerial included in this Paragraph 7includes, but is not limited to, internetcommunications or any other electronictransmissions representing CompanyProducts, brochures, telephone directoryadvertisements (print or electronic) and<strong>Agent</strong> or agency company listings.8) <strong>Agent</strong> agrees to maintain complete andseparate records for Company for a periodof at least seven (7) years of all transactionspertaining to applications submitted toCompany, and any other documents as maybe required by the <strong>Florida</strong> Office ofInsurance Regulation or othergovernmental agency. Any and all recordsdescribed above or as may otherwise relateto <strong>Agent</strong>’s activities in connection withCompany business shall be accessible andavailable to representatives of Companyand Company’s regulators who may auditthem from time to time while this<strong>Agreement</strong> is in effect or within seven (7)years after termination thereof.9) <strong>Agent</strong> agrees to obtain and maintain Errorsand Omissions Insurance coverage withminimum amounts of $500,000 peroccurrence and $1,000,000 in aggregate, orsuch higher amounts as may be required bylaw or as determined by Company andfrom a carrier satisfactory to Company.<strong>Agent</strong> shall provide to Company uponrequest certificates of insurance evidencing<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 4

such coverage. <strong>Agent</strong> agrees to make bestefforts to provide Company with thirty (30)days prior written notice, and in any eventwill provide notice as soon as reasonablypracticable, of any modification,termination or cancellation of suchcoverage.10) <strong>Agent</strong> is an independent contractor andshall have no claim to compensation exceptas provided in this <strong>Agreement</strong> and <strong>Agent</strong>shall not be entitled to reimbursement fromCompany for any expenses incurred inperforming this <strong>Agreement</strong>. <strong>Agent</strong> furtheragrees that to the extent of anyindebtedness to Company from <strong>Agent</strong>,Company shall have a first lien against anycommissions due <strong>Agent</strong>, and suchindebtedness may be deducted at theCompany’s option from any commissionsdue <strong>Agent</strong>. Moreover, this <strong>Agreement</strong>does not give <strong>Agent</strong> any power of authorityother than as expressly granted herein andno other or greater power shall be impliedfrom the grant or denial of powersspecifically mentioned herein.Company, as well as all machines, parts,equipment, rating tools and other materialsreceived by <strong>Agent</strong> from Company or fromany of its customers, agents or suppliers inconnection with such activities.12) <strong>Agent</strong> shall cooperate fully with Companyin any investigation or proceeding of anyregulatory or governmental body, or courtof competent jurisdiction, including, whererequired by law, making its books andrecords available to such entities forinspection, if it is determined by Companythat the investigation or proceeding affectsmatters covered by, related to, or arisingout of this <strong>Agreement</strong>.13) <strong>Agent</strong> shall defend any act or alleged act of<strong>Agent</strong> at its own expense. <strong>Agent</strong> shallreimburse Company for all costs, expensesor legal fees that Company incurs for thedefense of any administrative action inwhich Company or <strong>Agent</strong> is named andwhich is determined by a court ofcompetent jurisdiction or by an appointedarbitrator to be the consequence of anyunauthorized act of <strong>Agent</strong>.11) <strong>Agent</strong> will treat as trade secrets any and allinformation concerning customers of14) During and after the term of thisCompany or its business, products,<strong>Agreement</strong>, <strong>Agent</strong> shall indemnify, defendtechniques, methods, systems, price-books, and hold Company harmless from andrating tools, plans or policies; and <strong>Agent</strong>against any loss, damage or expense,will not, during the term of this <strong>Agreement</strong> including reasonable attorneys’ fees,or at any time thereafter, disclose suchcaused by or arising from the negligence,information, in whole or in part, to anymisconduct or breach of this <strong>Agreement</strong> byperson, firm or corporation for any reason<strong>Agent</strong>, or from the failure of <strong>Agent</strong> toor purpose whatsoever, or use suchcomply with any federal or state laws, rulesinformation in any way or in any capacityor regulations.other than as a sales agent of Company infurtherance of Company’s interests. Upon15) In the event Company determines thattermination of this <strong>Agreement</strong>, or sooner if<strong>Agent</strong> has failed to (1) perform itsrequested by any Company, <strong>Agent</strong> willresponsibilities and duties in a reasonableimmediately deliver to Company any andand professional manner, or as required byall literature, documents, data, information,this <strong>Agreement</strong> or as otherwiseorder forms, memoranda, correspondence,communicated by Company; or (2) act in acustomer and prospective customer lists,manner consistent with Company’scustomer orders, records, cards or notespolicies and procedures, Company reservesacquired, compiled or coming into <strong>Agent</strong>’sthe right to place <strong>Agent</strong>’s Appointment in aknowledge, possession, custody or controlprobationary status during which timein connection with his/her activities as aCompany may enforce corrective actionsales agent or sales representative ofagainst <strong>Agent</strong> including, for example,refusing to accept new business from<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 5

<strong>Agent</strong>.B. Commission Rules1) For Company Products produced by <strong>Agent</strong>(and as applicable, for any other Companypolicies or contracts <strong>Agent</strong> was authorizedto sell and produced in the past – seeAppendix 1 to Addendum A for a completelist of such policies), Company will pay to<strong>Agent</strong> commissions and renewal fees inaccordance with the rates and schedulesoutlined in Addendum “C,” which ishereby made part of this agreement,provided that <strong>Agent</strong> is in compliance withall items listed (and implied) in said<strong>Agreement</strong>.2) <strong>Agent</strong> shall pay over promptly (within 5business days) to the Company grosspayments and other monies received orcollected on behalf of the Company andshall not deduct or subtract or retaintherefrom commissions or any other feeswhich may be payable hereunder.3) Commissions will only be paid when bothof the following criteria are satisfied:a) Premiums received and retained by theCompany.b) Applications submitted by <strong>Agent</strong> andaccepted by Company.4) Commissions become payable only afterthe due date of the premium payment andthe gross payment due has been received infull and has been processed by theCompany.5) In the event that insured terminatescoverage with Company within the firsttwelve (12) months of plan, Company willdeduct prorated amount from any sums dueor becoming due to <strong>Agent</strong> by Company.or shall be returned in full to the Company,within 5 business days of notification, bythe <strong>Agent</strong> and shall constitute indebtednessto the Company until returned.7) Company reserves the right to periodicallymake changes to the following:a) Company reserves the right to changeCompany’s commission schedules(including renewal fees) at any timeafter providing sixty (60) days priorwritten notice of the commission andrenewal fee change to <strong>Agent</strong>.b) Company shall have the right to developand implement incentive programsrelated to <strong>Agent</strong>s’ sales activities. Anysuch programs shall be subject tochange as provided in Section 7(a)herein.c) In the event <strong>Agent</strong> wishes to contest apayment (i.e., a payment involving aspecific claim or case, as opposed to analleged “programmatic paymenterror”) made under this Section, noticeshall be given to Company within 365calendar days from the date of thedisputed payment. Any such paymentrequest exceeding the 365 calendar dayperiod will not be considered byCompany.8) <strong>Agent</strong>s may assign commissions payablewith respect to policies produced by that<strong>Agent</strong> and issued by the Company toanother licensed <strong>Agent</strong> provided all of thefollowing conditions are satisfied:a) <strong>Agent</strong> must have prior approval fromthe Company.b) The assignment must be in writing andin a form acceptable to the Company,in its sole discretion.6) No commissions will be payable onc) Under the terms of the assignment, theaccount of waived payments or payments<strong>Agent</strong> to whom the commissions arerefunded for any reason. Any commissionsassigned must expressly agree to abidereceived on account of any waived orby the terms of this <strong>Agreement</strong> andrefunded payments shall be deducted fromassume all of the <strong>Agent</strong>’s obligationsfuture commission payments, if available,<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 6

and responsibilities to the Companyand the Insureds under this <strong>Agreement</strong>with respect to the policies for whichcommissions are being assigned.d) Any purported assignment or transferof any interest in <strong>Agent</strong>’s commissionsother than in strict compliance with theterms stated in this <strong>Agreement</strong> shall bevoid to the Company.C. Term and Termination1) This <strong>Agreement</strong> shall be effective for aninitial term of one (1) year from theEffective Date, and thereafter shallautomatically renew for additional terms ofone (1) year each, unless and untilterminated in accordance with theprovisions of this <strong>Agreement</strong>.2) This <strong>Agreement</strong> may be terminatedwithout cause at any time by <strong>Agent</strong> orCompany by either party giving thirty (30)days prior written notice thereof to theother party.3) Company may terminate this <strong>Agreement</strong>immediately upon written notice to <strong>Agent</strong>at any time upon material default orsubstantive breach by <strong>Agent</strong> of one or moreof its obligations under this <strong>Agreement</strong>(including any amendments), or <strong>Agent</strong>’scommission of fraud, dishonesty, breach oftrust, theft, misappropriation of money, orbreach of any fiduciary duty. <strong>Agent</strong>’sfailure to comply with any provision of this<strong>Agreement</strong> shall be material if Companydetermines that such failure affects <strong>Agent</strong>’sability to perform under this <strong>Agreement</strong>.Termination for cause shall not beCompany’s exclusive remedy, but shall becumulative with all other remediesavailable at law or in equity. A failure toterminate this <strong>Agreement</strong> for cause shallnot be a waiver of the right to do so withrespect to any past, current or futuredefault.4) This <strong>Agreement</strong> will automaticallyterminate upon the death of <strong>Agent</strong>.5) Commission Settlement On Terminationa) Commission payments willimmediately cease (and no furthercommissions will become payableafter the termination date) in the eventof the following:i) Dissolution/Termination of the<strong>Agreement</strong> - to include with andwithout cause agreementterminations.ii) <strong>Agent</strong> of Record Change – in suchan event when <strong>Agent</strong> is no longerdesignated as the “<strong>Agent</strong> ofRecord” by an insureds, Companyshall appoint a new <strong>Agent</strong> ofRecord to the insureds.iii) <strong>Agent</strong> induces or attempts toinduce insureds to surrender orterminate policies with Company.iv) <strong>Agent</strong> is no longer servicinginsureds in a manner that issatisfactory to the Company.v) Ninety (90) days after <strong>Agent</strong> is nolonger licensed as an insuranceagent in the state of <strong>Florida</strong> or nolonger appointed with Company,unless commissions during thisninety (90) day period are notpermitted by applicable law.b) In the event of the death of <strong>Agent</strong>:i) <strong>Agent</strong>’s estate shall timely notifyCompany; and,ii) Company shall cease payment ofcommissions upon notification of<strong>Agent</strong>’s death.D. Settlement of DisputesExcept for equitable relief for breaches ofSection E, if any disagreement between the<strong>Agent</strong> and the Company should arise<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 7

as required by Law.c) Information Safeguards and BreachReporting.was the subject of theunauthorized use ordisclosure, and each suchindividual’s contract number;(i) Privacy of Protected HealthInformation. Business Associateshall use appropriate safeguards toprevent use or disclosure ofProtected Health Information andNonpublic Personal FinancialInformation not provided for bySection E.Business Associate shall report inwriting to Company’s CorporateCompliance Office any use ordisclosure of Protected HealthInformation or Nonpublic PersonalFinancial Information notprovided for by Section E as soonas practicable but no later than five(5) days after Business Associatebecomes aware of suchunauthorized use or disclosure.Unless otherwise directed byCompany’s Corporate ComplianceOffice, Business Associate shallinclude in the report the following:(A) the date of the unauthorizeduse or disclosure;(B) the name and (if known)address of the person or entitywhich received ProtectedHealth Information pursuant tothe unauthorized disclosure;(C) a brief description of theProtected Health Informationthat was the subject of theunauthorized use ordisclosure;(D) a brief statement of the natureof the unauthorized use ordisclosure;(E) the name and date of birth ofthe individual(s) whoseProtected Health Information(F) the corrective action thatBusiness Associate has takenor will take to prevent furtherunauthorized use ordisclosures; and(G) the steps Business Associatehas taken or will take tomitigate any known harmfuleffects of the unauthorized useor disclosure.(ii) Security of Electronic ProtectedHealth Information. BusinessAssociate shall implementadministrative, physical andtechnical safeguards thatreasonably and appropriatelyprotect the confidentiality,integrity, and availability ofElectronic Protected HealthInformation.Business Associate shall report inwriting to Company’s CorporateCompliance Office any successfulSecurity Incident as soon aspracticable but no later than five(5) days after Business Associatebecomes aware of such SecurityIncident and shall submitfollow-up documentation pursuantto the direction of Company’sCorporate Compliance Office.Upon Company’s request andpursuant to Company’s direction,Business Associate shall report inwriting any attempted butunsuccessful Security Incident ofwhich Business Associatebecomes aware. BusinessAssociate shall comply with thissection 2(c)(ii) upon the later of (1)April 20, 2005; or (2) the EffectiveDate.d) Mitigation. Business Associate shall<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 9

mitigate to the extent practicable anyharmful effect of which BusinessAssociate is aware that is caused byany use or disclosure of ProtectedHealth Information or NonpublicPersonal Financial information notprovided for by Section E.e) <strong>Agent</strong>s and Subcontractors. BusinessAssociate shall ensure that its agentsand subcontractors to whom itprovides Protected Health Informationagree in writing to the same privacyand security restrictions and conditionsthat apply through Section E toBusiness Associate with respect tosuch information.f) Business Associate Guidance.Business Associate shall comply withany policy, procedure or guidance withrespect to Business Associate’sresponsibilities under Sections E thatCompany may, from time to time,issue and communicate in writing toBusiness Associate.2) Management of Protected HealthInformation.a) Access. Business Associate shall,within seven (7) days followingCompany’s request, make available toCompany for inspection and copyingProtected Health Information about anindividual that is in BusinessAssociate’s custody or control, so thatCompany may meet its accessobligations under the HIPAA-ASPrivacy Rule.b) Amendment. Business Associate shallwithin fourteen (14) days followingCompany’s request, amend or permitCompany to amend any portion ofProtected Health Information that is inBusiness Associate’s custody orcontrol so that Company may meet itsamendment obligations under theHIPAA-AS Privacy Rule.c) Disclosure Accounting. BusinessAssociate shall record the informationspecified below (“disclosureinformation”) for each disclosure ofProtected Health Information thatBusiness Associate makes, excludingdisclosures identified in 45 CFR §164.528(a)(1) including but not limiteddisclosures for Treatment, Payment,and Health Care Operations anddisclosures pursuant to a HIPAA-AScompliant authorization, and shallreport the disclosure information toCompany’s Corporate ComplianceOffice at P.O. Box 44283,Jacksonville, <strong>Florida</strong> 32203-4283 inwriting within five (5) days ofBusiness Associate making theaccountable disclosure.Disclosure information shall include:(i)(ii)the disclosure date;the name and (if known) addressof person or entity to whichBusiness Associate made thedisclosure;(iii) a brief description of theProtected Health Informationdisclosed;(iv)(v)(vi)a brief statement of the purposeof the disclosure;the name and date of birth of theindividual whose ProtectedHealth Information wasdisclosed; andthat individual’s contractnumber.d) Inspection of Internal Practices, Booksand Records. Business Associate shallmake its internal practices, books, andrecords relating to its use anddisclosure of Protected HealthInformation and its protection of theconfidentiality, integrity, andavailability Electronic ProtectedHealth Information available toCompany and the U.S. Department of<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 10

Health and Human Services (“HHS”)as requested or required to determineCompany’s compliance with theHIPAA-AS Privacy Rule and SecurityRule.3) Breach of Privacy and Security Obligationsa) Termination of Addendum.(i) Company and Business Associatespecifically acknowledge andagree that a breach of any term ofthis Section E shall be considered abreach of a material term of the<strong>Agreement</strong> and Company mayterminate the <strong>Agreement</strong> inaccordance with the <strong>Agreement</strong>’stermination provision.b) Obligations on Termination.<strong>Agreement</strong>.(i) Return or Destruction of ProtectedHealth Information. Upontermination of the <strong>Agreement</strong>,Business Associate shall, iffeasible, return to Company ordestroy all Protected HealthInformation in its custody orcontrol in whatever form ormedium, including all copies andall derivative data, compilations,and other works that allowidentification of any individualwho is a subject of the ProtectedHealth Information. BusinessAssociate shall in writing identifyto Company any Protected HealthInformation that cannot feasibly bereturned to Company or destroyedand explain why return ordestruction is infeasible. BusinessAssociate shall limit further use ordisclosure of such ProtectedHealth Information to thosepurposes that make its return orb) Amendment to Section E. Section Edestruction infeasible. Businessshall automatically amend upon theAssociate shall complete thesecompliance date of any final regulationobligations as promptly asor amendment to final regulationpossible, but not later than thirtypromulgated by HHS or a <strong>Florida</strong>(30) days following the effectiveregulatory agency concerning subjectdate of the termination of thematter of Section E such that Business<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 11(ii)Continuing Privacy andSecurity Obligations. BusinessAssociate’s obligation toprotect the privacy andconfidentiality and safeguardthe security of Protected HealthInformation specified in SectionE shall be continuous andsurvive termination of the<strong>Agreement</strong>.4) General Provisions for Section E.a) Definitions. The terms “ElectronicProtected Health Information” and“Protected Health Information” havethe meanings set out in 45 CFR §160.103, except Protected HealthInformation shall be limited to thatinformation created or received byBusiness Associate from or on behalfof Company pursuant to the<strong>Agreement</strong>. The term “Required byLaw” has the meaning set out in 45CFR § 164.103. The term “SecurityIncident” has the meaning set out in 45CFR § 164.304. The terms “HealthCare Operations,” “Payment,” and“Treatment” have the meanings set outin 45 CFR § 164.501. For purposes ofthis Addendum, Protected HealthInformation encompasses Company’sElectronic Protected HealthInformation. The term “NonpublicPersonal Financial Information” hasthe meaning set out in Fla. Admin.Code § 4-128.002 except NonpublicPersonal Financial Information shallbe limited to that information createdor received by Business Associatefrom or on behalf of Companypursuant to this <strong>Agreement</strong>.

Associate’s obligations remain incompliance with the final regulation oramendment to final regulation, unlessCompany or Business Associate electsto terminate Section E by giving theother party written notice oftermination at least ninety (90) daysbefore the compliance date of suchfinal regulation.c) No Third Party Beneficiaries. Noparty shall be deemed a third partybeneficiary of Section E.F. General Terms1) Entire <strong>Agreement</strong>. As of the EffectiveDate of this <strong>Agreement</strong>, this <strong>Agreement</strong>(including any attached addendums orschedules) is the complete and solecontract between the parties regarding thedistribution and renewal of CompanyProducts (and as applicable, any otherCompany policies or contracts) by <strong>Agent</strong>and supersedes any and all priorunderstandings or agreements between theparties whether oral or in writing on thissubject matter. For the avoidance ofdoubt, this <strong>Agreement</strong> replaces all SingleCase <strong>Agreement</strong>s between the partiesexecuted prior to the Effective Date,including, without limitation, with respectto commission or other compensationpayable for Company Products (and asapplicable, other Company policies orcontracts) issued prior to or after theEffective Date.2) Construction. In this <strong>Agreement</strong> the words“shall” and “will” are used in themandatory sense. Unless the contextotherwise clearly requires, any one genderincludes all others, the singular includesthe plural, and the plural includes thesingular.3) No Waiver. The fact that Company maynot have insisted upon strict compliancewith this <strong>Agreement</strong> with respect to an actor transaction of <strong>Agent</strong> shall not relieve<strong>Agent</strong> from the obligation to performstrictly in accordance with the terms of this<strong>Agreement</strong>.4) Independent Contractor. <strong>Agent</strong> shall be anindependent contractor of Company, andnothing herein shall be construed ascreating a relationship ofemployer-employee, partner, jointventurer, officer or agent of Company inany manner for any other purpose, otherthan as specifically provided in this<strong>Agreement</strong>.5) Applicable Law. This <strong>Agreement</strong> shall begoverned by the laws of the State of <strong>Florida</strong>without regard to its conflict of lawsprovisions.6) Limitation of Liability. Company’sliability, if any, for damages to <strong>Agent</strong> forany cause whatsoever arising out of orrelated to this <strong>Agreement</strong>, and regardless ofthe form of the action, shall be limited to<strong>Agent</strong>’s actual damages. Company shallnot be liable for any indirect, incidental,punitive, exemplary, special orconsequential damages of any kindwhatsoever sustained as a result of a breachof this <strong>Agreement</strong> or any action, inaction oralleged tortuous conduct or delay byCompany.7) Survival. In addition to those provisionswhich by their terms survive expiration ortermination of this <strong>Agreement</strong>, Paragraphs8 and 10-14 of Section A; and Sections B,D, E and F shall survive expiration ortermination of this <strong>Agreement</strong>, regardlessof the cause giving rise thereto.8) No Third Party Beneficiaries. Nothingexpress or implied in this <strong>Agreement</strong> isintended to confer, nor shall anythingherein confer, upon any person other thanthe parties and the respective successors orpermitted assigns of the parties, any rights,remedies, obligations or liabilitieswhatsoever.9) Amendment. Except as stated in Section C,Company may modify this <strong>Agreement</strong>upon thirty (30) days prior written notice to<strong>Agent</strong> Notwithstanding the foregoing,<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 12

upon the enactment of any law orregulation, or any order or direction of anygovernmental agency affecting this<strong>Agreement</strong> (including, without limitation,Section C of this <strong>Agreement</strong>), Companymay, by written notice to <strong>Agent</strong>, amend the<strong>Agreement</strong> in such manner as Companydetermines necessary to comply with suchlaw or regulation, or any order or directiveof any governmental agency. Companymay provide written notice pursuant to thisParagraph 9 by letter, newsletter, electronicmail or other media.10) Relationship of <strong>Blue</strong> Cross and <strong>Blue</strong> ShieldAssociation - This <strong>Agreement</strong> constitutesan agreement solely between Company and<strong>Agent</strong> and Company is an independentcorporation operating under a license fromthe <strong>Blue</strong> Cross and <strong>Blue</strong> ShieldAssociation, an association of independent<strong>Blue</strong> Cross and <strong>Blue</strong> Shield Plans (the"Association") permitting Company to usethe <strong>Blue</strong> Cross and <strong>Blue</strong> Shield servicemarks in accordance with the <strong>Blue</strong> Crossand <strong>Blue</strong> Shield Association's licensingstandards and that Company is notcontracting as the agent of the Association.<strong>Agent</strong> has not entered into this <strong>Agreement</strong>based upon representations by any personsother than Company and no person, entity,or organization other than Company shallbe held accountable or liable to <strong>Agent</strong> forany of Company's obligations under this<strong>Agreement</strong>.11) Compliance with Law. As applicable tothis <strong>Agreement</strong>, Company and <strong>Agent</strong> shallcomply with all laws and regulationsapplicable to their businesses, theirlicenses and the transactions into whichthey enter.12) Fiduciary Capacity. <strong>Agent</strong> agrees that inperforming under this <strong>Agreement</strong> <strong>Agent</strong> isacting in a fiduciary capacity to Company.<strong>Agent</strong> shall act in the best interest ofCompany. <strong>Agent</strong> shall not permit otherinterests, activities or responsibilities tointerfere with <strong>Agent</strong>’s faithful performanceunder this <strong>Agreement</strong>.13) Assignment. Except as specificallyprovided in Paragraph 8 of Section B,neither this <strong>Agreement</strong> nor the right toreceive money hereunder may be assignedwithout the prior written consent ofCompany, and any assignment madecontrary to this provision shall be void as toCompany; provided, however, Companymay assign, delegate or transfer this<strong>Agreement</strong> in whole or in part to anyaffiliate, now or in the future, or to anyentity which succeeds to the applicableportion of its business through a sale,merger or other transaction, provided tosuch other entity assumes the obligationsof Company hereunder. This <strong>Agreement</strong> ispersonal to <strong>Agent</strong>, and <strong>Agent</strong>’s dutieshereunder shall not be delegated orsubcontracted by <strong>Agent</strong>. <strong>Agent</strong> shall notuse subagents.14) Notice. Any notice required fromCompany under this <strong>Agreement</strong> shall bedeemed given on the day such notice isdeposited in the United States mail withfirst class postage pre-paid and addressedto <strong>Agent</strong> at the address of the <strong>Agent</strong>appearing on the records of Company.Any notice required from <strong>Agent</strong> shall bedeemed given on the date after such noticeis deposited in the United States mail withfirst class postage pre-paid and addressedto Group Vice President, Corporate Sales,<strong>Florida</strong> <strong>Blue</strong>, 4800 Deerwood CampusParkway, Building 305, Jacksonville,<strong>Florida</strong>, 32246.15) Force Majeure. Any delay or failure ofCompany to perform its obligations underthis <strong>Agreement</strong> shall not be deemed to be abreach of this <strong>Agreement</strong> and shallotherwise be excused to the extent that, thedelay or failure is caused by an event oroccurrence beyond the reasonable controlof Company and without its fault ornegligence, including (but not limited to)acts of God, severe weather, wars,revolution, civil commotion, acts of publicenemy or terrorism, embargo, action byany governmental or regulatory authority,natural disasters, sabotage, strikes,<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 13

slowdowns, picketing or boycotts, powerfailures, nuclear hazard, or court injunctionor order (a “Force Majeure Event”). IfCompany claims that a Force MajeureEvent has arisen, Company shall:(i) promptly notify the <strong>Agent</strong> of thesame,(ii) take all commercially reasonablesteps to overcome and remove theeffects of the Force MajeureEvent,(iii)notify the <strong>Agent</strong> on a continuingbasis of its efforts to overcomethe Event of Force MajeureEvent and16) Electronic Notices, Waivers andAmendments. Except as provided inParagraph 9 of Section F, for purposes ofproviding notices required or permitted bythis <strong>Agreement</strong>, waiving any right underthis <strong>Agreement</strong>, or amending any term ofthis <strong>Agreement</strong> and notwithstanding anylaw recognizing electronic signatures orrecords, “a writing signed,” “in writing”and words of similar meaning, shall meanonly a writing in a tangible form bearing anactual “wet” signature in ink manuallyapplied by the person authorized by therespective party, unless the parties agreeotherwise by making a specific reference tothis section.(iv)promptly notify the <strong>Agent</strong> whensaid condition has ceased.<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 14

Addendum A: Company ProductsJANUARY 1 – DECEMBER 31, 2014 CALENDAR YEAR<strong>Florida</strong> <strong>Blue</strong>/Health Options Product Offerings:1) Group Products (4+)a) <strong>Blue</strong>Care (HMO) (offered by Health Options, Inc.)b) <strong>Blue</strong>Choice (PPO) (offered by <strong>Florida</strong> <strong>Blue</strong> (“<strong>BCBSF</strong>”))c) <strong>Blue</strong>Options (PPO) (offered by <strong>BCBSF</strong>)<strong>Florida</strong> Combined Life Product Offerings:1) Group Productsa) Basic Life with Accelerated Living Benefitsb) Basic Life with Hospital Indemnity Riderc) Short Term Disabilityd) Long Term Disabilitye) Long Term Disability with Spousal Disability, Portability, and Minimum Indemnity (AD&D)Optional Ridersf) Employee Choice (Supplemental Long Term Disability)g) Term Accidental Death and Dismembermenth) Supplemental Term Lifei) Dependent Term Lifej) Pre-Paid Dentalk) Indemnity Dentall) PPO Dentali) Traditional PPOii) In-network fixed Co-payment schedule2) Group Payroll Deduction Programsa) Voluntary Life with Accelerated Living Benefitsb) Voluntary Short Term Disabilityc) Voluntary Long Term Disabilityd) Voluntary Term Accidental Death and Dismembermente) Voluntary Group Long Term Care (integrated product for home, community, and nursing homecare)3) Pretax Programsa) Premium Conversion Plansb) Group Long Term Carec) Group Home Health Cared) Flexible Spending Accounts (FSA)e) Health Reimbursement Accounts (HRA)f) Health Savings Accounts (HSA)<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 15

<strong>Blue</strong>Choice Copay Plan612-R1<strong>Blue</strong>Choice Copay Plan 613<strong>Blue</strong>Choice Copay Plan613-R1<strong>Blue</strong>Choice Copay Plan 615<strong>Blue</strong>Choice Copay Plan615-R1<strong>Blue</strong>Choice Copay Plan 702<strong>Blue</strong>Choice Copay Plan702-R1<strong>Blue</strong>Choice Copay Plan 703<strong>Blue</strong>Choice Copay Plan703-R1<strong>Blue</strong>Choice Copay Plan 704<strong>Blue</strong>Choice Copay Plan704-R1<strong>Blue</strong>Choice Copay Plan 706<strong>Blue</strong>Choice Copay Plan706-R1<strong>Blue</strong>Choice Copay Plan 708<strong>Blue</strong>Choice Copay Plan708-R1<strong>Blue</strong>Choice Copay Plan 714<strong>Blue</strong>Choice Copay Plan714-R1<strong>Blue</strong>Choice Copay Plan 716<strong>Blue</strong>Choice Copay Plan716-R1<strong>Blue</strong>Choice Copay Plan 717<strong>Blue</strong>Choice Copay Plan717-R1<strong>Blue</strong>Choice Copay Plan 719<strong>Blue</strong>Choice Copay Plan719-R1<strong>Blue</strong>Choice Copay Plan 720<strong>Blue</strong>Choice Copay Plan720-R1<strong>Blue</strong>Choice Copay Plan 725<strong>Blue</strong>Choice Copay Plan725-R1<strong>Blue</strong>Choice Copay Plan 727<strong>Blue</strong>Choice Copay Plan727-R1<strong>Blue</strong>Choice Copay Plan 730<strong>Blue</strong>Choice Copay Plan730-R1<strong>Blue</strong>Choice Copay Plan 735<strong>Blue</strong>Choice Copay Plan735-R1<strong>Blue</strong>Choice Copay Plan 902<strong>Blue</strong>Choice Copay Plan902-R1<strong>Blue</strong>Choice Copay Plan 903<strong>Blue</strong>Choice Copay Plan903-R1<strong>Blue</strong>Choice Copay Plan 906<strong>Blue</strong>Choice Copay Plan906-R1<strong>Blue</strong>Choice Copay Plan 908<strong>Blue</strong>Choice Copay Plan908-R1<strong>Blue</strong>Choice Copay Plan 916<strong>Blue</strong>Choice Copay Plan916-R1<strong>Blue</strong>Choice Copay Plan 917<strong>Blue</strong>Choice Copay Plan917-R1<strong>Blue</strong>Choice Copay Plan 919<strong>Blue</strong>Choice Copay Plan 920<strong>Blue</strong>Choice Copay Plan 925<strong>Blue</strong>Choice Copay Plan925-R1<strong>Blue</strong>Choice Copay Plan 927<strong>Blue</strong>Choice Copay Plan927-R1<strong>Blue</strong>Choice Copay Plan 930<strong>Blue</strong>Choice Fam Cpy Plan 301<strong>Blue</strong>Choice Fam Cpy Plan 303<strong>Blue</strong>Choice Fam Cpy Plan 306<strong>Blue</strong>Choice Fam Cpy Plan306-R1<strong>Blue</strong>Choice Fam Cpy Plan 308<strong>Blue</strong>Choice Fam Cpy Plan308-R1<strong>Blue</strong>Choice Fam Cpy Plan 314<strong>Blue</strong>Choice Fam Cpy Plan314-R1<strong>Blue</strong>Choice Fam Cpy Plan 317<strong>Blue</strong>Choice Fam Cpy Plan317-R1<strong>Blue</strong>Choice Fam Cpy Plan 321<strong>Blue</strong>Choice Fam Cpy Plan321-R1<strong>Blue</strong>Choice Fam Cpy Plan 324<strong>Blue</strong>Choice Fam Cpy Plan324-R1<strong>Blue</strong>Choice Fam Cpy Plan327-R1<strong>Blue</strong>Choice Fam Cpy Plan328-R1<strong>Blue</strong>Choice Fam Cpy Plan329-R1<strong>Blue</strong>Choice Fam Cpy Plan 401<strong>Blue</strong>Choice Fam Cpy Plan401-R1<strong>Blue</strong>Choice Fam Cpy Plan 402<strong>Blue</strong>Choice Fam Cpy Plan402-R1<strong>Blue</strong>Choice Fam Cpy Plan 403<strong>Blue</strong>Choice Fam Cpy Plan403-R1<strong>Blue</strong>Choice Fam Cpy Plan 404<strong>Blue</strong>Choice Fam Cpy Plan404-R1<strong>Blue</strong>Choice Fam Cpy Plan 406<strong>Blue</strong>Choice Fam Cpy Plan406-R1<strong>Blue</strong>Choice Fam Cpy Plan 407<strong>Blue</strong>Choice Fam Cpy Plan407-R1<strong>Blue</strong>Choice Fam Cpy Plan 408<strong>Blue</strong>Choice Fam Cpy Plan408-R1<strong>Blue</strong>Choice Fam Cpy Plan 410<strong>Blue</strong>Choice Fam Cpy Plan410-R1<strong>Blue</strong>Choice Fam Cpy Plan 413<strong>Blue</strong>Choice Fam Cpy Plan413-R1<strong>Blue</strong>Choice Fam Cpy Plan 414<strong>Blue</strong>Choice Fam Cpy Plan414-R1<strong>Blue</strong>Choice Fam Cpy Plan 415<strong>Blue</strong>Choice Fam Cpy Plan415-R1<strong>Blue</strong>Choice Fam Cpy Plan508-R1<strong>Blue</strong>Choice Fam Cpy Plan 512<strong>Blue</strong>Choice Fam Cpy Plan 514<strong>Blue</strong>Choice Fam Cpy Plan514-R1<strong>Blue</strong>Choice Fam Cpy Plan 517<strong>Blue</strong>Choice Fam Cpy Plan517-R1<strong>Blue</strong>Choice Fam Cpy Plan 521<strong>Blue</strong>Choice Fam Cpy Plan521-R1<strong>Blue</strong>Choice Hlth Plan 101<strong>Blue</strong>Choice Hlth Plan 101-R1<strong>Blue</strong>Choice Hlth Plan 103<strong>Blue</strong>Choice Hlth Plan 103-R1<strong>Blue</strong>Choice Hlth Plan 104<strong>Blue</strong>Choice Hlth Plan 106<strong>Blue</strong>Choice Hlth Plan 107<strong>Blue</strong>Choice Hlth Plan 107-R1<strong>Blue</strong>Choice Hlth Plan 108<strong>Blue</strong>Choice Hlth Plan 113<strong>Blue</strong>Choice Hlth Plan 113-R1<strong>Blue</strong>Choice Hlth Plan 117<strong>Blue</strong>Choice Hlth Plan 117-R1<strong>Blue</strong>Choice Hlth Plan 118<strong>Blue</strong>Choice Hlth Plan 118-R1<strong>Blue</strong>Choice Hlth Plan 120<strong>Blue</strong>Choice Hlth Plan 120-R1<strong>Blue</strong>Choice Hlth Plan 122<strong>Blue</strong>Choice Hlth Plan 122-R1<strong>Blue</strong>Choice Hlth Plan 123<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 17

<strong>Blue</strong>Choice Hlth Plan 123-R1<strong>Blue</strong>Choice Hlth Plan 125<strong>Blue</strong>Choice Hlth Plan 125-R1<strong>Blue</strong>Choice Hlth Plan 126<strong>Blue</strong>Choice Hlth Plan 130-R1<strong>Blue</strong>Choice Hlth Plan 201<strong>Blue</strong>Choice Hlth Plan 201-R1<strong>Blue</strong>Choice Hlth Plan 203<strong>Blue</strong>Choice Hlth Plan 203-R1<strong>Blue</strong>Choice Hlth Plan 204<strong>Blue</strong>Choice Hlth Plan 204-R1<strong>Blue</strong>Choice Hlth Plan 206<strong>Blue</strong>Choice Hlth Plan 206-R1<strong>Blue</strong>Choice Hlth Plan 208<strong>Blue</strong>Choice Hlth Plan 208-R1<strong>Blue</strong>Choice Hlth Plan 210<strong>Blue</strong>Choice Hlth Plan 210-R1<strong>Blue</strong>Choice Hlth Plan 213<strong>Blue</strong>Choice Hlth Plan 213-R1<strong>Blue</strong>Choice Hlth Plan 214<strong>Blue</strong>Choice Hlth Plan 214-R1<strong>Blue</strong>Choice Hlth Plan 216<strong>Blue</strong>Choice Hlth Plan 216-R1<strong>Blue</strong>Choice Hlth Plan 217<strong>Blue</strong>Choice Hlth Plan 217-R1<strong>Blue</strong>Choice Hlth Plan 218<strong>Blue</strong>Choice Hlth Plan 218-R1<strong>Blue</strong>Choice Nasco Plan<strong>Blue</strong>Options Copay Plan 1457<strong>Blue</strong>Options Copay Plan 1461<strong>Blue</strong>Options Copay Plan 1550<strong>Blue</strong>Options Copay Plan 1551<strong>Blue</strong>Options Copay Plan 1552<strong>Blue</strong>Options Copay Plan 1553<strong>Blue</strong>Options Fam Cpy Pl 1257<strong>Blue</strong>Options Fam Cpy Pl 1351<strong>Blue</strong>Options Fam Cpy Pl 1352<strong>Blue</strong>Options Fam Cpy Pl 1353<strong>Blue</strong>Options Fam Cpy Pl 1355<strong>Blue</strong>Options Hlth Plan 1150<strong>Blue</strong>Options Hlth Plan 1151<strong>Blue</strong>Script A Ded Copay Plan 1<strong>Blue</strong>Script C Copay Plan 1<strong>Blue</strong>Script C Copay Plan 2<strong>Blue</strong>Script C Copay Plan 3<strong>Blue</strong>Script C Copay Plan 4<strong>Blue</strong>Script C Copay Plan 5<strong>Blue</strong>Script C Ded Coin Plan 1<strong>Blue</strong>Script C Ded Copay Plan 3<strong>Blue</strong>Script C Ded Copay Plan 4<strong>Blue</strong>Script E Generic Cpy Pl 2<strong>Blue</strong>Script Ii Drug Plan 01<strong>Blue</strong>Script Ii Drug Plan 02<strong>Blue</strong>Script Ii Drug Plan 03<strong>Blue</strong>Script Ii Drug Plan 04<strong>Blue</strong>Script Ii Drug Plan 05<strong>Blue</strong>Script Ii Drug Plan 06<strong>Blue</strong>Script Ii Drug Plan 09<strong>Blue</strong>Script Ii Drug Plan 10<strong>Blue</strong>Script Ii Drug Plan 12<strong>Blue</strong>Script Ii Drug Plan 13<strong>Blue</strong>Script Ii Drug Plan 14<strong>Blue</strong>Script Iii Drug Plan 01<strong>Blue</strong>Script Iii Drug Plan 02<strong>Blue</strong>Script Iii Drug Plan 04<strong>Blue</strong>Script Iii Drug Plan 06<strong>Blue</strong>Script Iii Drug Plan 07<strong>Blue</strong>Script Iii Drug Plan 08<strong>Blue</strong>Script Nasco Drug Plan<strong>Blue</strong>Script V Drug Plan 1<strong>Blue</strong>Script V Drug Plan 2<strong>Blue</strong>Script V Drug Plan 3<strong>Blue</strong>Script V Drug Plan 6<strong>Blue</strong>Script V Drug Plan 7Dap High With OrthoDap High With Ortho-R1Dap High Without OrthoDap Low With OrthoDap Low With Ortho-R1Dap Med With OrthoDap Med With Ortho-R1Dap Med With Ortho-R2Dap Med Without OrthoDap UCR With OrthoDap UCR Without OrthoElect Care Plus Option 100-R2Elect Care Plus Option 105Elect Care Plus Option 109Elect Care Plus Option 200-R2Elect Care Plus Option 206Elect Care Plus Option 300Elect Care Plus Option 300-R2Elect Care Plus Option 300-R3Elect Care Plus Option 500-R2Fl Small Business Option01-R2Fl Small Business Option02-R2Fl Small Business Option03-R2FSA Plan 001FSA Plan 005FSA Plan 006FSA Plan 007FSA Plan 009Group Essential Option 02-R1Group Essential Option 03Group Option 01-R1Group Option 05-R2Group Option 05-R3Group Option 07Group Option 07-R1Group Option 07-R2Group Option 07-R3Group Option 09-R2HMO Drug Option 01HMO Drug Option 01-R1HMO Drug Option 02HMO Drug Option 02-R1HMO Drug Option 03HMO Drug Option 03-R1HMO Drug Option 04HMO Drug Option 04-R1HMO Drug Option 05HMO Drug Option 05-R1HMO Drug Option 06HMO Option 01HMO Option 02HMO Option 02-R1HMO Option 03HMO Option 03-R1HMO Option 04HMO Option 04-R1HMO Option R01HMO Option R01-R1HMO Option R02HMO Option R02-R1HMO Option R03HMO Option R03-R1HMO Option R04HMO Option R04-R1HMO Option/04Hospital Indemnity SubsidyHRA Plan 004HRA Plan 005Major Medical Group Type MMediscript Ii Drug Plan 01Mediscript Ii Drug Plan 1Mediscript Pharmacy ProgramMediscript PharmacyProgram-R1Network Advantage Pl 1750Network Advantage Pl 1751Network Advantage Pl 1752Network Advantage Pl 1753Network Advantage Pl 1754Point Of Service 32-R2Point Of Service NascoPoint Of Service Opt. R20c-R1Point Of Service Opt. R22c-R1Point Of Service Opt. R24c-R1Point Of Service Opt. R26c-R1Point Of Service Opt. R27c-R1Point Of Service Opt. R28c-R1Point Of Service Opt. R30c-R1Point Of Service Opt. R32c-R1Point Of Service Opt. R36c-R1Point Of Service Opt. R37c-R1<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 18

Point Of Service Opt. R50c-R1Point Of Service Opt. R52c-R1Point Of Service Opt. R56c-R1Point Of Service Opt. R57c-R1Point Of Service Option 10cPoint Of Service Option10c-R1Point Of Service Option 10-R1Point Of Service Option 10-R2Point Of Service Option11c-R1Point Of Service Option 12cPoint Of Service Option 12-R1Point Of Service Option 12-R2Point Of Service Option 13-R2Point Of Service Option 14cPoint Of Service Option14c-R1Point Of Service Option 14-R1Point Of Service Option 20Point Of Service Option 20cPoint Of Service Option20c-R1Point Of Service Option 20-R1Point Of Service Option 20-R2Point Of Service Option 20-R3Point Of Service Option21c-R1Point Of Service Option 21-R1Point Of Service Option 21-R2Point Of Service Option 22Point Of Service Option 22cPoint Of Service Option22c-R1Point Of Service Option 22-R1Point Of Service Option 22-R2Point Of Service Option 22-R3Point Of Service Option 23Point Of Service Option 23cPoint Of Service Option23c-R1Point Of Service Option 23-R1Point Of Service Option 23-R2Point Of Service Option 23-R3Point Of Service Option 24cPoint Of Service Option24c-R1Point Of Service Option 24-R1Point Of Service Option 24-R2Point Of Service Option 25cPoint Of Service Option 25-R1Point Of Service Option 25-R2Point Of Service Option 25-R3Point Of Service Option 30Point Of Service Option 30cPoint Of Service Option30c-R1Point Of Service Option 30-R1Point Of Service Option 30-R2Point Of Service Option 30-R3Point Of Service Option 31Point Of Service Option 31cPoint Of Service Option31c-R1Point Of Service Option 31-R1Point Of Service Option 31-R2Point Of Service Option 32cPoint Of Service Option32c-R1Point Of Service Option 32-R1Point Of Service Option 32-R2Point Of Service Option 32-R3Point Of Service Option 33Point Of Service Option 33cPoint Of Service Option33c-R1Point Of Service Option 33-R1Point Of Service Option 33-R2Point Of Service Option 34Point Of Service Option 34cPoint Of Service Option34c-R1Point Of Service Option 34-R1Point Of Service Option 34-R2Point Of Service Option 34-R3Point Of Service Option 35cPoint Of Service Option35c-R1Point Of Service Option 35-R1Point Of Service Option 35-R2Point Of Service Option 35-R3Point Of Service Option 50Point Of Service Option 50cPoint Of Service Option50c-R1Point Of Service Option 50-R1Point Of Service Option 50-R2Point Of Service Option 51Point Of Service Option 51cPoint Of Service Option51c-R1Point Of Service Option 51-R1Point Of Service Option 51-R2Point Of Service Option 52Point Of Service Option 52cPoint Of Service Option52c-R1Point Of Service Option 52-R1Point Of Service Option 52-R2Point Of Service Option 53Point Of Service Option 53cPoint Of Service Option53c-R1Point Of Service Option 53-R1Point Of Service Option 53-R2Point Of Service Option 53-R3Point Of Service Option 54Point Of Service Option 54cPoint Of Service Option54c-R1Point Of Service Option 54-R1Point Of Service Option 54-R2Point Of Service Option 54-R3Point Of Service Option 55Point Of Service Option 55/R2Point Of Service Option 55cPoint Of Service Option55c-R1Point Of Service Option 55-R1Point Of Service Option 55-R2Point Of Service Option 55-R3Point Of Service Option 5cPoint Of Service Option 5c-R1Point Of Service Option 5c-R3Point Of Service Option 5c-R4Point Of Service Option 7cPoint Of Service Option 7c/R2Point Of Service Option 7c-R1Point Of Service Option 7c-R2Point Of Service Option 7c-R3Point Of Service Option 7c-R4Point Of Service Option R20Point Of Service Option R20cPoint Of Service OptionR20-R1Point Of Service Option R22Point Of Service Option R22cPoint Of Service OptionR22-R1Point Of Service Option R24Point Of Service Option R24cPoint Of Service OptionR24-R1Point Of Service Option R26Point Of Service Option R26cPoint Of Service OptionR26-R1Point Of Service Option R27Point Of Service Option R27cPoint Of Service OptionR27-R1Point Of Service Option R28Point Of Service Option R28cPoint Of Service OptionR28-R1Point Of Service Option R30Point Of Service Option R30cPoint Of Service Option<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 19

R30-R1Point Of Service Option R32Point Of Service Option R32cPoint Of Service OptionR32-R1Point Of Service Option R36Point Of Service Option R36cPoint Of Service OptionR36-R1Point Of Service Option R37Point Of Service Option R37cPoint Of Service OptionR37-R1Point Of Service Option R39Point Of Service OptionR39-R1Point Of Service Option R50Point Of Service Option R50cPoint Of Service OptionR50-R1Point Of Service Option R52Point Of Service Option R52cPoint Of Service OptionR52-R1Point Of Service Option R56Point Of Service Option R56cPoint Of Service OptionR56-R1Point Of Service Option R57Point Of Service Option R57cPoint Of Service OptionR57-R1Point Of Service Option R59Point Of Service OptionR59-R1Point Of Service Option/R2PPC Care Manager OptRc14-R1PPC Care Manager OptRc14-R2PPC Care Manager Option C1PPC Care Manager Option C12PPC Care Manager Option C14PPC Care Manager Option C2PPC Care Manager Option C4PPC Care Manager Option C5PPC Care Manager Option C6PPC Care Manager Option C7PPC Care Manager Option D3PPC Care Manager Option D5PPC Care Manager Option D6PPC Care Manager Option D8PPC Care Manager Option Rc1PPC Care Manager OptionRc14PPC Care Manager Option Rc4PPC Care Manager OptionRc4-R1PPC Care Manager Option Rc8PPC Care Manager OptionRc8-R1PPC Care Manager OptionRd4-R1PPC Care Manager Option Rd8PPC Care Manager OptionRd8-R1PPC Group Option 01-R1PPC Group Option 01-R2PPC Group Option 02PPC Group Option 02-R1PPC Group Option 03-R1PPC Group Option 04PPC Group Option 04-R1PPC Group Option 04-R3PPC Group Option 05-R1PPC Group Option 06-R1PPC Group Option 07PPC Group Option 07-R1PPC Group Option 07-R2PPC Group Option 08-R1PPC Group Option 09PPC Group Option 09-R1PPC Group Option 09-R2PPC Group Option 10-R1Pref. Care Plus Option 1-R1Prescription Drug Option 01Prescription Drug Option01-R1Prescription Drug Option 02Prescription Drug Option02-R1Prescription Drug Option 03Prescription Drug Option03-R1Prescription Drug Option 05Prescription Drug Option 06Prescription Drug Option06-R1Prescription Drug Option 07Prescription Drug Option 08Prescription Drug Option08-R1Prescription Drug Option 09Prescription Drug Option09-R1Prescription Drug PlanSmall Employer Option 01Small Employer Option 01-R1Small Employer Option 01-R2Small Employer Option 02-R1Small Employer Option 02-R2Standard HMO Plan Option 1Standard HMO Plan Option 2Standard PPO Plan Option 1Standard PPO Plan Option 2Stop LossTable RatedTraditional Plus Option 5a-R1Traditional Plus Option 5a-R2Traditional Plus Option 7aTraditional Plus Option 7a-R1Traditional Plus Option 7a-R2Traditional Plus Option 9a-R1Traditional Plus Option 9a-R2<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 20

Addendum B: <strong>Agent</strong> “Good Standing” & Reappointment RequirementsJANUARY 1 – DECEMBER 31, 2014 CALENDAR YEARIn order for an <strong>Agent</strong> to remain in good standings with the Company and maintain their Appointment as an Appointed<strong>Agent</strong> for Company, an <strong>Agent</strong>:1. Must comply with the terms and conditions of the <strong>Agent</strong> <strong>Agreement</strong>.2. Must comply with all <strong>Florida</strong> <strong>Blue</strong> and its subsidiaries, corporate policies and procedures.3. Must have active inventory of a minimum of five (5) Group Cases or fifty (50) Group Contracts (“cases andcontracts” refers to accounts sized four (4) or greater) which inventory will be evaluated.i. At the end of the initial twelve (12) month period calculated from the date of appointment; andii. At the end of every subsequent twelve (12) month period thereafter.4. If the <strong>Agent</strong> satisfies this minimum inventory standard, Company will pay to renew their Appointment; however,i. If, at any time, the <strong>Agent</strong> does not satisfy the minimum inventory standard, or their appointment is terminatedby the State of <strong>Florida</strong>, the <strong>Agent</strong> may be required to reimburse Company for the Appointment FeesCompany paid on their behalf.ii. In the event <strong>Agent</strong> fails to reimburse Company or submit renewal Appointment Fees, Company shall, withinthirty (30) calendar days, terminate <strong>Agent</strong>’s Appointment and Company shall cease commission payment(s)to the <strong>Agent</strong>.5. Must have a valid <strong>Florida</strong> resident health and life agent license.6. Must have on file with Company a fully executed <strong>Agent</strong> <strong>Agreement</strong>.7. Must provide evidence of Errors and Omissions insurance coverage, minimum acceptable coverage is $500,000per occurrence and $1,000,000 in aggregate, and must maintain such insurances for the duration of theirAppointment with the Company.8. Must provide evidence that all continuing education credits/coursework requirements have been met.9. Must have information systems capabilities to include Internet access to facilitate email communication and otherelectronic tools, such as “e-quotes” and electronic enrollment. Please refer to Addendum “D” for furtherexplanation of the information systems requirements for Appointed <strong>Agent</strong>s.<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 21

Addendum C: Company Commission ScheduleJanuary 1, 2014 through December 31, 2014The original effective date of this <strong>Agreement</strong> is January 1, 2014. This <strong>Agreement</strong> will solely govern the amount ofall Commissions and/or Renewal Fees payable to the Agency, including for Company Products (or as applicable, anyother Company policies or contracts Agency was previously authorized to sell).FLORIDA BLUE AND HEALTH OPTIONS, INC.COMMISSION SCHEDULEBase Commission:Per Contract Per Month Rate (4-50 Segment; <strong>Blue</strong>Options, <strong>Blue</strong>Select, Miami-Dade <strong>Blue</strong>,<strong>Blue</strong>Care (HMO) and <strong>Blue</strong>Choice (PPO) Products Only)Group<strong>Blue</strong>PartnersLocation ClassificationNew SalesRenewalsSouth <strong>Blue</strong>Diamond / Gold $40 $36<strong>Florida</strong> andTreasureSilver $34 $30CoastRemaining <strong>Blue</strong>Diamond / Gold $34 $30<strong>Florida</strong>Silver $30 $26LocationAll <strong>Florida</strong>Base Commission AssumptionsRenewal enrollment count will be established 90 days prior to the anniversary date. In the event there is achange of 15% or more in the enrollment count at the time of actual renewal, the group would reflect anychange in the commission rate.For group sizes 51+, any change of commission will require the group to be re-rated with the newcommission amount.For group size 51+, <strong>Florida</strong> <strong>Blue</strong>/HOI will continue to pay based on negotiated rates.Commissions calculated on a Per Contract Per Month basis and contract count are based on month endingin-force contracts.All new and existing 1-50 segment groups that become effective or renew with <strong>Florida</strong> <strong>Blue</strong>/HOI will be paidbased on the Per Contract Per Month base commissions program.Commission rates are determined based on group status as of the original anniversary month.Group rating sizes are determined at the renewal date. Any changes to the group rating size will not takeeffect until the next renewal date. If a group is in the rating category of 4-50 or 1-3, that rating category willnot change until renewal. Further, if an agency experiences a classification change during the year, thecommission on existing groups will not change until the renewal of the group.Rating size for 4-50 is defined as having 4 or more enrolled contracts and 4-50 eligible employees. Groupswith 1-3 enrolled contracts are included in the 1-3 rating category, and those with 51+ eligible employees areincluded in the 51+ category.South <strong>Florida</strong> is defined as Palm Beach, Broward and Miami-Dade counties. Treasure Coast is defined asIndian River, Martin and St. Lucie counties. Monroe County is not included in South <strong>Florida</strong> for commissionpurposes.<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 22

Location-specific rates are based on county of group headquarters.Commissions paid in error or overpayments must be repaid to <strong>Florida</strong> <strong>Blue</strong>/HOI. If a group cancels,commissions will be charged back based on the group cancellation date. For groups that reinstate as a whole,commissions will be paid retroactive to reinstatement date based on the contract count at the time ofreinstatement.No adjustments will be paid for any contracts that are added or terminated retroactively for active groups.This commission schedule applies to group business submitted by Appointed <strong>Agent</strong>s.Classification calculations include only 4+ enrolled groups.New Sales include groups that have not enrolled with <strong>Florida</strong> <strong>Blue</strong>/HOI within the 12-month period prior tothe new enrollment effective date.Group Retiree CommissionsGroup Retiree Product* New Sale Rates Renewal RatesMA-PD, PPO, HMO, & PFFSProducts$200 per contract annually $100 per contract annuallyMedicare Part D $50 per contract annually Not ApplicableMedicare Supplement RetireeProduct $150 per contract annually Not Applicable* These products are separate and distinct from Over 65 Medicare Advantage products.Group Retiree Commission AssumptionsGroup Retiree commissions are paid annually at the time of new sale and on a group’s renewal date.No adjustments for contracts added or terminated after the new sale effective month will be paid.No adjustments for contracts added or terminated after the renewal effective month will be paid.<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 23

FLORIDA COMBINED LIFE INSURANCE COMPANY, INC. (FCL) COMMISSIONSCHEDULEThe ancillary products listed here are offered by <strong>Florida</strong> Combined Life Insurance Company, Inc. (FCL). FCL is anaffiliate of <strong>Florida</strong> <strong>Blue</strong> and an Independent Licensee of the <strong>Blue</strong> Cross and <strong>Blue</strong> Shield Association.GROUP DENTALAnnualized PremiumPer Group<strong>Blue</strong> Dental Choice & FreedomGroup & Voluntary (FullyInsured)<strong>Blue</strong> Dental Care PrepaidGroup & VoluntaryUp to $10,000 10.0% 10%Up to the next $10,000 8.0% 10%Up to the next $10,000 6.0% 10%Up to the next $20,000 4.0% 10%Up to the next $200,000 2.5% 10%Up to the next $250,000 2.0% 10%Up to the next $2,000,000 1.5% 10%Over $2,500,000 1.0% 10%Commissions may be adjusted at renewal or off-anniversary due to factors causing changes in total group revenue.Factors may include but not limited to: additions, cancellations or modification of benefits of any product orfluctuation in enrollment or premium volume.GROUP LIFE AND DISABILITYNumber of EnrolledLivesGroup Life &DisabilityVoluntary Life &Disability4 - 50 15.0% 15%51 - 300 12.0% 15%301 – 500 9.0% 15%500+ 7.0% 15%<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 24

Addendum D: Operating & Hardware RequirementsJANUARY 1 – DECEMBER 31, 2014 CALENDAR YEARListed below are the designated operational system requirements for optimal site performance under the Siebelplatform utilized by <strong>Florida</strong> <strong>Blue</strong> and its subsidiaries (“<strong>BCBSF</strong>”). In order for you to take advantage of all of thecapabilities that <strong>BCBSF</strong> has designed and implemented, and in order for you to remain designated as an <strong>Agent</strong> inGood Standing, you must adopt and maintain these Operating and Hardware Requirements.<strong>BCBSF</strong> reserves the right to make modifications or perform upgrades to its computer systems, including its Siebelplatform. Therefore, from time to time, <strong>BCBSF</strong> may issue revised Operating and Hardware Requirements in orderfor Company and <strong>Agent</strong>’s systems to achieve the desired level of performance in light of any such upgrades ormodifications.The operational requirements are:Windows NT 4.0 Windows 2000 Windows XPMemory (MB) 96 (128 recommended) 96 (192 recommended) 160 (256 recommended)CPUOS LevelBrowserJava RuntimeEnvironmentAdobe AcrobatReaderPentium III 500MHz orCeleron 800 MHz classprocessor, 20MB storageNT 4.0 Service Pack 6a oraboveWindows Internet Explorer6.0 or aboveSun Micro Systems JavaRating Engine (JRE)1.4.1_02Pentium III 500MHz orCeleron 800 MHz classprocessor, 20MB storageService Pack 3 or aboveWindows Internet Explorer6.0 or aboveSun Micro Systems JavaRating Engine (JRE)1.4.1_026 6 6Pentium III 500MHz orCeleron 800 MHz classprocessor, 20MB storageService Pack 1 or aboveWindows Internet Explorer6.0 or aboveSun Micro Systems JavaRating Engine (JRE)1.4.1_02<strong>Florida</strong> <strong>Blue</strong> <strong>Agent</strong> <strong>Agreement</strong> 25