Credit Insurance Rate Modification Effective Nov. 1, 2013 - Ohio ...

Credit Insurance Rate Modification Effective Nov. 1, 2013 - Ohio ...

Credit Insurance Rate Modification Effective Nov. 1, 2013 - Ohio ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

John R. Kasich, GovernorMary Taylor, Lt. Governor/Director50 West Town StreetThird Floor – Suite 300Columbus, OH 43215-4186(614) 644-2658www.insurance.ohio.govMEMORANDUMTo:From:All Interested PartiesPete Weber, ASA, MAAARe: <strong>Credit</strong> <strong>Insurance</strong> <strong>Rate</strong>s <strong>Effective</strong> 11/1/<strong>2013</strong>Date: June 13, <strong>2013</strong>According to <strong>Ohio</strong> Administrative Code Rule 3901-1-14, the <strong>Ohio</strong> Department of<strong>Insurance</strong>, (“Department”) is required to review credit life and credit accident and health(“credit disability”) rates on an annual basis. Further, the rule requires any rate changesbe effective <strong>Nov</strong>ember first of every year after the rule’s initial adoption.The Department concluded this year’s review. After reviewing <strong>Ohio</strong> experience,the Department has determined that no change to the current credit life or credit accidentand health prima facie rates is justified for 2014.The credit life prima facie rates will remain at the level set last year of $0.674 per$1000 per month. The single premium rate for 12 months remains $0.44 per $100.The credit disability prima facie rates will also remain at the level set last year of$1.57 per $100 for the 14-day retroactive plan.A copy of the rates by term and plan is attached.Parties with additional questions may contact Pete Weber at (614) 644-3311 orPeter.Weber@insurance.ohio.gov.Accredited by the National Association of <strong>Insurance</strong> Commissioners (NAIC)Consumer Hotline: 1-800-686-1526 Fraud Hotline: 1-800-686-1527 OSHIIP Hotline: 1-800-686-1578TDD Line: (614) 644-3745(Printed in house)

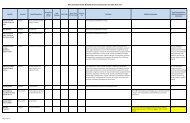

OHIO DEPARTMENT OF INSURANCEEFFECTIVE NOVEMBER 1, <strong>2013</strong><strong>Credit</strong> Disability Premium <strong>Rate</strong>s per $100PlanTerm inMonths14-DayRetroactive14-DayElimination30-DayRetroactive30-DayEliminationTerm inMonths6 $1.22 $0.98 $0.84 $0.48 612 $1.57 $1.37 $1.18 $0.83 1218 $1.80 $1.59 $1.33 $1.05 1824 $1.97 $1.76 $1.44 $1.18 2430 $2.12 $1.92 $1.52 $1.27 3036 $2.25 $2.05 $1.61 $1.36 3642 $2.38 $2.17 $1.67 $1.43 4248 $2.48 $2.29 $1.75 $1.48 4854 $2.60 $2.39 $1.81 $1.55 5460 $2.69 $2.48 $1.87 $1.61 6066 $2.80 $2.59 $1.92 $1.66 6672 $2.90 $2.67 $1.97 $1.72 7278 $2.98 $2.77 $2.03 $1.75 7884 $3.06 $2.84 $2.08 $1.81 8490 $3.15 $2.93 $2.14 $1.87 9096 $3.23 $3.02 $2.17 $1.90 96102 $3.30 $3.09 $2.21 $1.94 102108 $3.38 $3.17 $2.25 $2.00 108114 $3.41 $3.24 $2.30 $2.03 114120 $3.53 $3.30 $2.34 $2.07 120<strong>Credit</strong> Life Premium <strong>Rate</strong>sThe monthly outstanding balance rate is $0.674 per $1000 per month. The joint life rate is 175%of the single life rate or $1.179 per 1000 per month. Single premium rates for gross decreasingcoverage are obtained by the formula given in rule 3901-1-14 (C)(1) and are shown below forterms through 60 months. Net coverage using an appropriate formula and the aboveoutstanding balance rate is required for terms exceeding 60 months per Rule 3901-1-14(C)(1)(j)(ii).Term inMonths Single JointTerm inMonths6 $0.24 $0.41 612 $0.44 $0.77 1218 $0.64 $1.12 1824 $0.84 $1.47 2430 $1.04 $1.83 3036 $1.25 $2.18 3642 $1.45 $2.54 4248 $1.65 $2.89 4854 $1.85 $3.24 5460 $2.06 $3.60 60