- Page 1 and 2: OFFICIAL COPT ^ 7 ^ / i ( 7raises t

- Page 3 and 4: During the 2011 ''conference call;

- Page 5 and 6: discussions with Johnson that.prece

- Page 7 and 8: Executives declined to answer quest

- Page 9 and 10: People in the;World" in 2009.After

- Page 11 and 12: Energy CpipM.'26%;.ahc|:vyisconsin.

- Page 13 and 14: Those customers, for the most part,

- Page 15 and 16: Cassell is chief of coal generation

- Page 17 and 18: From: Jim Hyler | Redacted - Person

- Page 19 and 20: From: McKee, Marie | Redacted - Per

- Page 21 and 22: HostCode': 257184NOTICE Morgan[Stan

- Page 23 and 24: Cbrisequently. this lettef .is; bei

- Page 25 and 26: General Electric Co. (GE) is suspen

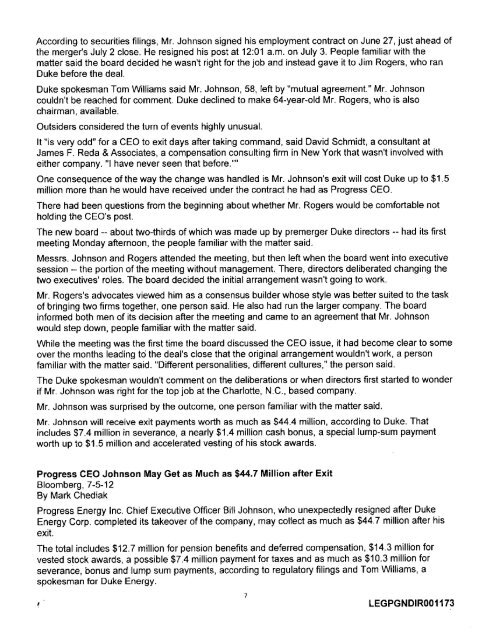

- Page 27 and 28: In addition, he'll receive about $1

- Page 29: Analyst Hugh Wynne at Bernstein Res

- Page 33 and 34: The report, submitted to the Japane

- Page 35 and 36: The two winning companies are to be

- Page 37 and 38: LEGRGNDIR001180, LEGPGN Dt R- REPLA

- Page 39 and 40: From: McKee, Mariel Redacted-Person

- Page 41 and 42: From: Carlos Saladrigas f Redaaed -

- Page 43 and 44: From: McKee, Mariel Redacted-Person

- Page 45 and 46: From:Sent:To:Subject:Attachments:Ne

- Page 47 and 48: Fom 4 (coni:)- Narnc.nnd Address of

- Page 49 and 50: From;Sent:To:Subject:McKee,. Marie

- Page 51 and 52: From: "Jim Hyler | Redacted - Perso

- Page 53 and 54: From:Sent:To:Rogers, Jim [Jim.Roger

- Page 55 and 56: From;Sent:To:Subject:Harrington, Su

- Page 57 and 58: From:Shiel, Tom Jr [Tom.Shiel@duke-

- Page 59 and 60: Wall Street JournalAt Work: When th

- Page 61 and 62: Despite the controversy, corporate

- Page 63 and 64: REGIONAL PRESSLos Angeles TimesCEO-

- Page 65 and 66: TRADE/BUSINESS PUBLICATIONSForbesJo

- Page 67 and 68: JOBLB FRANK, WILKINSON BRIMMER KATC

- Page 69 and 70: DUK: Media Coverage7/6/12 - 3:00PM

- Page 71 and 72: DUK: Media Coverage7/6/12 - 3:00PM

- Page 73 and 74: DUK: Media Coverage7/6/12 - 3:00PM

- Page 75 and 76: DUK: Media Coverage7/6/12 - 3:00PM

- Page 77 and 78: DUK: Media Coverage7/6/12 - 3:00PM

- Page 79 and 80: NEWSWIRESAssociated PressEx-Progres

- Page 81 and 82:

LEGPGNDIR001224

- Page 83 and 84:

South Carolina, Florida, Indiana, K

- Page 85 and 86:

Charlotte News ObserverBill Johnson

- Page 87 and 88:

Charlotte Business JournalReport: N

- Page 89 and 90:

Johnson will get $12.7 million for

- Page 91 and 92:

Triangle Business JournalJohnson mi

- Page 93 and 94:

potential insurance proceeds are un

- Page 95 and 96:

BLOGSThe Daily BeastDuke CEO Lasts

- Page 97 and 98:

The HillNews bites: Anger follows b

- Page 99 and 100:

Duke won federal approval for the m

- Page 101 and 102:

DUK: Media Coverage 07.06.12Page 2

- Page 103 and 104:

DUK: Media Coverage 07.06.12Page 4

- Page 105 and 106:

DUK: Media Coverage 07.06.12Page 6

- Page 107 and 108:

DUK: Media Coverage 07.06.12Page 8

- Page 109 and 110:

DUK: Media Coverage 07.06.12Page 10

- Page 111 and 112:

DUK: Media Coverage 07.06.12Page 12

- Page 113 and 114:

DUK: Media Coverage 07.06.12Page 14

- Page 115 and 116:

DUK: Media Coverage 07.06.12Page 16

- Page 117 and 118:

DUK: Media Coverage 07.06.12Page 18

- Page 119 and 120:

DUK: Media Coverage 07.06.12Page 20

- Page 121 and 122:

DUK: Media Coverage 07.06.12Page 22

- Page 123 and 124:

From:Sent:To:Subject:Harris DeLoach

- Page 125 and 126:

hope for best and wish you a good4t

- Page 127 and 128:

To: Harris DeLoachSubject: last eve

- Page 129 and 130:

INTENTIONALLY LEFT BLANKLEGPGNDIROO

- Page 131 and 132:

From:Sent:Harrington, :Sue C [Sue.H

- Page 133 and 134:

deceit that I have witnessed during

- Page 135 and 136:

who orchestrated it or why. The big

- Page 137 and 138:

Johnson. The commission says it rec

- Page 139 and 140:

A former board member involved in a

- Page 141 and 142:

"This can only be described as an i

- Page 143 and 144:

The North Carolina Utilities Commis

- Page 145 and 146:

the hook for billions in costs tied

- Page 147 and 148:

Before the market can ultimately de

- Page 149 and 150:

Sent: Tuesday, July 03, 2012 6:53 A

- Page 151 and 152:

From:Sent:To:Subject:Redacted - Per

- Page 153 and 154:

From:Harrington, Sue C [Sue.Harring

- Page 155 and 156:

From:Sent:To:Subject:Harris DeLoach

- Page 157 and 158:

From:Sent:To:Subject:Harris DeLoach

- Page 159 and 160:

From:Sent:To:Shiel, Torn Jr [T6m;Sh

- Page 161 and 162:

"I've certainly, been thinking that

- Page 163 and 164:

"There's riot ari ideritifiedj imme

- Page 165 and 166:

The plan, if Rogers sticks to it, i

- Page 167 and 168:

From:Sent:To:Subject:Harris DeLoach

- Page 169 and 170:

From:Harris DeLoachSent:Sunday, Jul

- Page 171 and 172:

From: William Bamet! Redacted - Per

- Page 173 and 174:

From:Sent:To:Subject:Harris DeLoach

- Page 175 and 176:

From:Harris; DeLoachSent:Sunday, Ju

- Page 177 and 178:

From:Sent:To:Subject:William Bamet

- Page 179 and 180:

From:Sent:To:Subject:Harris DeLoach

- Page 181 and 182:

From:Harris belioachSent:Monday.Jul

- Page 183 and 184:

From: Baker, John D.f Redacted-Pers

- Page 185 and 186:

From:Manly, Marc E.[Marc.Manly@duke

- Page 187 and 188:

POTENTIAL TOPICSiFOR QUESTIONS OF M

- Page 189 and 190:

Today's Top StoriesDuke Energy mav

- Page 191 and 192:

From:Harris. DeLoachSent: Monday.Ju

- Page 193 and 194:

From:Serit:To:Cc:JirriI HylerQMonda

- Page 195 and 196:

A boardroom coup at DukeEriergy

- Page 197 and 198:

Duke. Energy Corp. Chief Executive

- Page 199 and 200:

inging, a, crush of TV cameras arid

- Page 201 and 202:

Whether Progress board"? members we

- Page 203 and 204:

Johnson, 58; sighed a three-year em

- Page 205 and 206:

"The commission reserves the right

- Page 207 and 208:

Indiana, Any fuel'for the Wabash Ri

- Page 209 and 210:

"Whether it's any worse than any ot

- Page 211 and 212:

From:Sent:To:Subject:Harris DeLoach

- Page 213 and 214:

Best regards,MarieACGfNFIDEWTIAL LE

- Page 215 and 216:

From:Sent:To:Subject:Redacted - Per

- Page 217 and 218:

From:Sent:To:Subject:Harris DeLoach

- Page 219 and 220:

From:Sent:To:Subject:Harris DeLoach

- Page 221 and 222:

•• • - •-• 1 ^Most Americ

- Page 223 and 224:

From:Sent:To:Cc:Subject:Baker, John

- Page 225 and 226:

Act. tf you have receivedUhte commu

- Page 227 and 228:

Cqrisequeritl^wrilten .in hopestlia

- Page 229 and 230:

Sent: Thursday, July OS, 2012 02:12

- Page 231 and 232:

Frbm: Baker,. John D. [ Redacted -

- Page 233 and 234:

From: BaKer,.John D.Sent: Friday; J

- Page 235 and 236:

Frbm: Baker, John D. | Redacted-Per

- Page 237 and 238:

From: Baker, John D'. [Sent: Monday

- Page 239 and 240:

From: Harris DeLoachSent: Thursday,

- Page 241 and 242:

From: Harris DeLoach I Redacted - P

- Page 243 and 244:

This e-mail message and;ail documen

- Page 245 and 246:

WilflKn O-JohnwoatviQiM Eawjtivb Di

- Page 247 and 248:

Mitchell-Henderson, Trudie:From:Sen

- Page 249 and 250:

Cuuroc) ari Goipuuto ScccttrVJanuar

- Page 251 and 252:

,Jetm&McAnhiirriaeutfwWe Piwster'C

- Page 253 and 254:

JthnftMcArtfcnr ,Ewnitiva VicePrasi

- Page 255 and 256:

AttendancePROGRESS ENERGY BOARD MEE

- Page 257 and 258:

.VVg^'w i AT. AX&M^A 1 -'^'^iE^es&m

- Page 259 and 260:

PROGRESS ENERG Y BOARD MEETINGMAY i

- Page 261 and 262:

In the newtod, receipts maybe uploa

- Page 263 and 264:

IYou can view other frequently aske

- Page 265 and 266:

Although Progress Energy will riot

- Page 267 and 268:

half from theoriginai 2,900 square

- Page 269 and 270:

Baker, John D.From:Sent:To:Cc:Subje

- Page 271 and 272:

esources (O&M and capital); respond

- Page 273 and 274:

The N.C. Department ofEnvironment a

- Page 275 and 276:

Siefert said..Opening the new, busi

- Page 277 and 278:

In ah editorial published today, th

- Page 279 and 280:

'1i.;':r; ; . :Johp fl.McAithiir ;'

- Page 281 and 282:

, PROGRESS EiNER GYBOARD MEETINGJUL

- Page 283 and 284:

Baker, JohnD.From:VVeriger, Holly,S

- Page 285 and 286:

John tt McArthurH- v -.;~ , August

- Page 287 and 288:

PROGRESS ENERGY SPECIAL S^REHOLDER

- Page 289 and 290:

SCHEDULE OF EVENTSSeptember 2011Boa

- Page 291 and 292:

JohnR.McArtfcirr¥T,\ . •: Novemb

- Page 293 and 294:

PROGRESS ENERGY BOARD mETINGDECEMBE

- Page 295 and 296:

epssWIHomO. Johmon 5'detinBttPtuiit

- Page 297 and 298:

Redacted - Personal Info.From: Weng

- Page 299 and 300:

Jnfcii A. UcAi^nr ^ .,•Cotuisd ar

- Page 301 and 302:

Mitchell-Henderson, TrudieFrom:Weng

- Page 303 and 304:

WflliMD.JohitSOOChaiman.PirotJert-'

- Page 305 and 306:

JotmB. McArthur-' - ;, ;V" '-,r«ct

- Page 307 and 308:

PROGRESS ENERGY BOARD MEETINGMARCH

- Page 309 and 310:

Mitchell-Henderson, TrudieFrbm:Sent

- Page 311 and 312:

Prior to using the.Password Reset T

- Page 313 and 314:

plant:Developed jointly by Westingh

- Page 315 and 316:

Europe," the Wall Street Journal re

- Page 317 and 318:

will unilaterally or immediately.so

- Page 319 and 320:

JchaH-McAHhii!£icccut;vc,Vici! Prc

- Page 321 and 322:

Mitchell-Henderson, TrudieFrom:Sent

- Page 323 and 324:

User Application::: folders Page 1

- Page 325 and 326:

Board of DirectorsJunel0,2012FERG h

- Page 327 and 328:

Draft Press Release—to be release

- Page 329 and 330:

N.G. regulators pressed'to riile'on

- Page 331 and 332:

Ruling clears road to Duke Energy-P

- Page 333 and 334:

It wiil take about thrce years to b

- Page 335 and 336:

The merger included promises to con

- Page 337 and 338:

for closing the deal to July $; : w

- Page 339 and 340:

Page 1 of 2Entrust r , B %YZli lEnt

- Page 341 and 342:

^ Progress EnergyWilliam D. Johnson

- Page 343 and 344:

Analyst Response Summary(re: FERC's

- Page 345 and 346:

ISI "With FERC Approval The DUK Dea

- Page 347 and 348:

State schedulesDukes Scott of the S

- Page 349 and 350:

The FERC issued a similar type of d

- Page 351 and 352:

For the merger to close out on sche

- Page 353 and 354:

INTENTIONALLY LEFT BLANKLEGPGNDIR00

- Page 355 and 356:

INTENTIONALLY LEFT BLANKLEGPGNDIR00

- Page 357 and 358:

INTENTIONALLY LEFT BLANKLEGPGNDIROO

- Page 359 and 360:

INTENTIONALLY LEFT BLANKHigh LEGPGN

- Page 361 and 362:

INTENTIONALLY LEFT BLANKntial LEGPG

- Page 363 and 364:

INTENTIONALLY LEFT BLANKLEGPGNDIROO

- Page 365 and 366:

Progress EnergyWilliam D. JohnaonCh

- Page 367 and 368:

Scope of bearing narrowThe Progrcss

- Page 369 and 370:

William D. JohnsonCharman, Preiiden

- Page 371 and 372:

Page 1 of 2Standard Folders©Inbox.

- Page 373 and 374:

User Applicatipn •:: FoldersPage

- Page 375 and 376:

User Application:: Folders Page 1 o

- Page 377 and 378:

To help celebrate its 100th birthda

- Page 379 and 380:

egulations; and other factors discu

- Page 381 and 382:

"The economics of cheap gas and red

- Page 383 and 384:

Duke Energy has received requests f

- Page 385 and 386:

derecho, such a storm must cover th

- Page 387 and 388:

"We still have some ofthe employees

- Page 389 and 390:

udget defeat with the help of a han

- Page 391 and 392:

lease.• Requirement that energy c

- Page 393 and 394:

Moeller cast the lone dissenting vo

- Page 395 and 396:

This newsletter was brought to you

- Page 397 and 398:

Utilities'merger of benefit to ATCb

- Page 399 and 400:

- - - €"My goal is to work hard t

- Page 401 and 402:

a"-.The filing does not say what ca

- Page 403 and 404:

%r;-J1'\merger considerably and mig

- Page 405:

"He has been more fonvard-thinking