Form 990 - 2011 (2012 YE) - CSUB Foundation

Form 990 - 2011 (2012 YE) - CSUB Foundation

Form 990 - 2011 (2012 YE) - CSUB Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

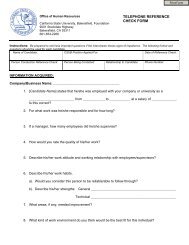

CALIFORNIA STATE UNIVERSITY BAKERSFIELD<strong>Form</strong> <strong>990</strong> (<strong>2011</strong>)FOUNDATION 95-2643086 PagePart IX Statement of Functional ExpensesSection 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A) but are not required tocomplete columns (B), (C), and (D).Check if Schedule O contains a response to any question in this Part IX Do not include amounts reported on lines 6b,(A) (B) (C) (D)Total expenses Program service Management and Fundraising7b, 8b, 9b, and 10b of Part VIII.expenses general expenses expenses1 Grants and other assistance to governments andorganizations in the United States. See Part IV, line 21 145,455. 145,455.234567891011121314151617181920abcdefgGrants and other assistance to individuals inthe United States. See Part IV, line 22 ~~~Grants and other assistance to governments,organizations, and individuals outside theUnited States. See Part IV, lines 15 and 16 ~Benefits paid to or for members ~~~~~~~Compensation of current officers, directors,trustees, and key employees ~~~~~~~~Compensation not included above, to disqualifiedpersons (as defined under section 4958(f)(1)) andpersons described in section 4958(c)(3)(B)Other salaries and wages ~~~~~~~~~~Pension plan accruals and contributions (includesection 401(k) and section 403(b) employer contributions)~~~Other employee benefits ~~~~~~~~~~Payroll taxes ~~~~~~~~~~~~~~~~Fees for services (non-employees):Management ~~~~~~~~~~~~~~~~Legal ~~~~~~~~~~~~~~~~~~~~Accounting ~~~~~~~~~~~~~~~~~Lobbying ~~~~~~~~~~~~~~~~~~Professional fundraising services. See Part IV, line 17Investment management fees ~~~~~~~~Other ~~~~~~~~~~~~~~~~~~~~Advertising and promotionOffice expenses~~~~~~~~~~~~~~~Information technology ~~~~~~~~~~~Royalties ~~~~~~~~~~~~~~~~~~21 Payments to affiliates ~~~~~~~~~~~~22 Depreciation, depletion, and amortization ~~4,662. 4,662.23 Insurance ~~~~~~~~~~~~~~~~~ 25,375. 25,375.24 Other expenses. Itemize expenses not coveredabove. (List miscellaneous expenses in line 24e. If line24e amount exceeds 10% of line 25, column (A)amount, list line 24e expenses on Schedule O.) ~~a ATHLETICS 2,713,296. 2,713,296.b CHILDREN’S CENTER 978,076. 978,076.c CAMPUS PROGRAM 858,656. 858,656.d GRANTS AND CONTRACTS 519,599. 519,599.e All other expenses SEE SCH O 739,470. 673,057. 66,413.25 Total functional expenses. Add lines 1 through 24e 6,697,449. 5,888,139. 607,054. 202,256.26 Joint costs. Complete this line only if the organizationreported in column (B) joint costs from a combinededucational campaign and fundraising solicitation.Check here | if following SOP 98-2 (ASC 958-720)~~~~~~~~~~Occupancy ~~~~~~~~~~~~~~~~~Travel~~~~~~~~~~~~~~~~~~~Payments of travel or entertainment expensesfor any federal, state, or local public officialsConferences, conventions, and meetings ~~Interest~~~~~~~~~~~~~~~~~~424,615. 281,437. 143,178.162,740. 114,650. 48,090.32,586. 21,598. 10,988.50,000. 50,000.22,225. 22,225.13,395. 13,395.5,006. 5,006.2,293. 2,293.132010 01-23-12<strong>Form</strong> <strong>990</strong> (<strong>2011</strong>)1116501109 131596 03040 <strong>2011</strong>.05000 CALIFORNIA STATE UNIVERSITY 03040__110X