Form 990 - 2011 (2012 YE) - CSUB Foundation

Form 990 - 2011 (2012 YE) - CSUB Foundation

Form 990 - 2011 (2012 YE) - CSUB Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

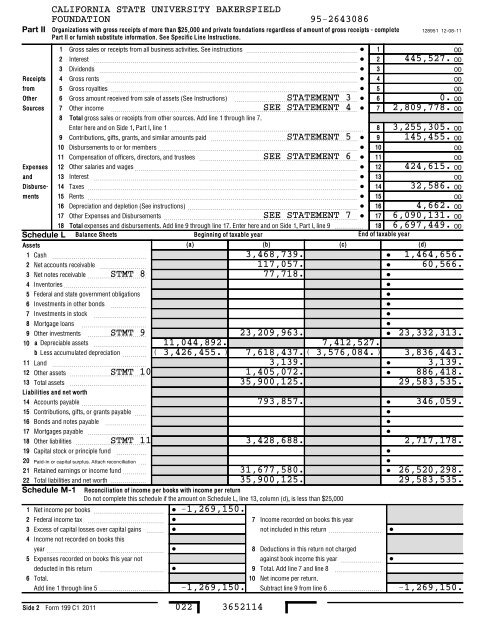

Part IIOrganizations with gross receipts of more than $25,000 and private foundations regardless of amount of gross receipts - completePart II or furnish substitute information. See Specific Line Instructions.128951 12-08-111 Gross sales or receipts from all business activities. See instructions ~~~~~~~~~~~~~~~~~~~ ¥ 1002 Interest ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 2 445,527. 003 Dividends ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 300Receipts 4 Gross rents ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 400from 5 Gross royalties ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 500Other 6 Gross amount received from sale of assets (See Instructions) ~~~~~~~~~~~~~~~~~~~~~STATEMENT 3 ¥ 60. 00Sources 7 Other income ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~SEE STATEMENT 4 ¥ 7 2,809,778. 008 Total gross sales or receipts from other sources. Add line 1 through line 7.Enter here and on Side 1, Part I, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 8 3,255,305. 009 Contributions, gifts, grants, and similar amounts paid ~~~~~~~~~~~~~~~~~~~~~~~~~STATEMENT 5 ¥ 9 145,455. 0010 Disbursements to or for members~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~¥ 100011 Compensation of officers, directors, and trustees ~~~~~~~~~~~~~~~~~~~~~~~~~~~SEE STATEMENT 6 ¥ 1100Expenses 12 Other salaries and wages~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~¥ 12 424,615. 00and 13 Interest ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 1300Disbursements14 Taxes ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 14 32,586. 0015 Rents ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 150016 Depreciation and depletion (See instructions) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ¥ 16 4,662. 0017 Other Expenses and Disbursements ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~SEE STATEMENT 7 ¥ 17 6,090,131. 0018 Total expenses and disbursements. Add line 9 through line 17. Enter here and on Side 1, Part I, line 9 18 6,697,449. 00Schedule L Balance SheetsBeginning of taxable yearEnd of taxable yearAssets(a) (b) (c) (d)1 Cash ~~~~~~~~~~~~~~~~3,468,739. ¥ 1,464,656.2 Net accounts receivable ~~~~~~~~117,057. ¥ 60,566.3 Net notes receivable ~~~~~~~~~~ STMT 877,718.¥45Inventories~~~~~~~~~~~~~~Federal and state government obligations¥¥6 Investments in other bonds ~~~~~~¥7 Investments in stock ~~~~~~~~~¥8 Mortgage loans ~~~~~~~~~~~¥9 Other investments ~~~~~~~~~~ STMT 923,209,963. ¥10 a Depreciable assets ~~~~~~~~~ 11,044,892. 7,412,527.23,332,313.b Less accumulated depreciation ~~~~ ( 3,426,455. ) 7,618,437. ( 3,576,084. ) 3,836,443.11 Land ~~~~~~~~~~~~~~~~3,139. ¥ 3,139.12 Other assets ~~~~~~~~~~~~~ STMT 101,405,072. ¥ 886,418.13 Total assets ~~~~~~~~~~~~~35,900,125. 29,583,535.Liabilities and net worth1415161718CALIFORNIA STATE UNIVERSITY BAKERSFIELDFOUNDATION 95-2643086Accounts payable ~~~~~~~~~~~Contributions, gifts, or grants payable ~~Bonds and notes payable~~~~~~~Mortgages payable ~~~~~~~~~~Other liabilities ~~~~~~~~~~~~ STMT 11793,857. ¥ 346,059.¥3,428,688. 2,717,178.19 Capital stock or principle fund ~~~~~¥20 Paid-in or capital surplus. Attach reconciliation ~¥21 Retained earnings or income fund ~~~~31,677,580. ¥ 26,520,298.22 Total liabilities and net worth 35,900,125. 29,583,535.Schedule M-1 Reconciliation of income per books with income per returnDo not complete this schedule if the amount on Schedule L, line 13, column (d), is less than $25,0001 Net income per books ~~~~~~~~~~~~ ¥ -1,269,150.2 Federal income tax ~~~~~~~~~~~~~ ¥7 Income recorded on books this year3 Excess of capital losses over capital gains ~~~ ¥not included in this return ~~~~~~~~~ ¥4 Income not recorded on books thisyear~~~~~~~~~~~~~~~~~~~~ ¥8 Deductions in this return not charged5 Expenses recorded on books this year notagainst book income this year ~~~~~~~ ¥deducted in this return ~~~~~~~~~~~ ¥9 Total. Add line 7 and line 8 ~~~~~~~~6 Total.10 Net income per return.Add line 1 through line 5 -1,269,150. Subtract line 9 from line 6 -1,269,150.¥¥Side 2<strong>Form</strong> 199 C1 <strong>2011</strong>022 3652114