Case Study: Deqingyuan - IFC

Case Study: Deqingyuan - IFC

Case Study: Deqingyuan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

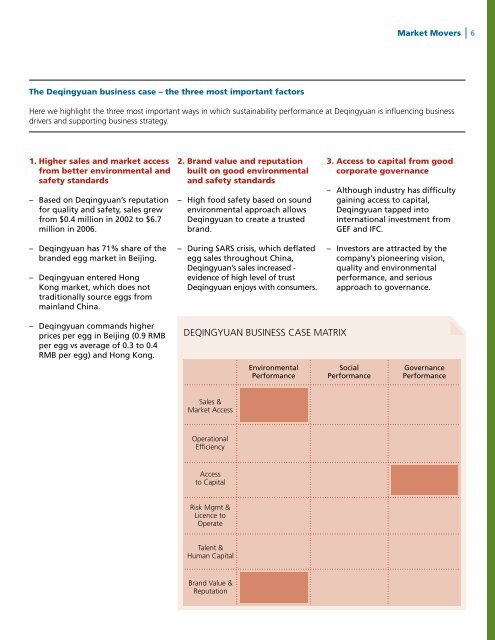

Market Movers 6The <strong>Deqingyuan</strong> business case – the three most important factorsHere we highlight the three most important ways in which sustainability performance at <strong>Deqingyuan</strong> is influencing businessdrivers and supporting business strategy.1. Higher sales and market accessfrom better environmental andsafety standards– Based on <strong>Deqingyuan</strong>’s reputationfor quality and safety, sales grewfrom $0.4 million in 2002 to $6.7million in 2006.– <strong>Deqingyuan</strong> has 71% share of thebranded egg market in Beijing.– <strong>Deqingyuan</strong> entered HongKong market, which does nottraditionally source eggs frommainland China.2. Brand value and reputationbuilt on good environmentaland safety standards– High food safety based on soundenvironmental approach allows<strong>Deqingyuan</strong> to create a trustedbrand.– During SARS crisis, which deflatedegg sales throughout China,<strong>Deqingyuan</strong>’s sales increased -evidence of high level of trust<strong>Deqingyuan</strong> enjoys with consumers.3. Access to capital from goodcorporate governance– Although industry has difficultygaining access to capital,<strong>Deqingyuan</strong> tapped intointernational investment fromGEF and <strong>IFC</strong>.– Investors are attracted by thecompany’s pioneering vision,quality and environmentalperformance, and seriousapproach to governance.– <strong>Deqingyuan</strong> commands higherprices per egg in Beijing (0.9 RMBper egg vs average of 0.3 to 0.4RMB per egg) and Hong Kong.<strong>Deqingyuan</strong> business case matrixEnvironmentalPerformanceSocialPerformanceGovernancePerformanceSales &Market AccessOperationalEfficiencyAccessto CapitalRisk Mgmt &Licence toOperateTalent &Human CapitalBrand Value &Reputation

![Print a two-page fact sheet on this project [PDF] - IFC](https://img.yumpu.com/43449799/1/190x245/print-a-two-page-fact-sheet-on-this-project-pdf-ifc.jpg?quality=85)