Overtime Pay Policy for Non-exempt Personnel - eDisk - Franklin ...

Overtime Pay Policy for Non-exempt Personnel - eDisk - Franklin ...

Overtime Pay Policy for Non-exempt Personnel - eDisk - Franklin ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

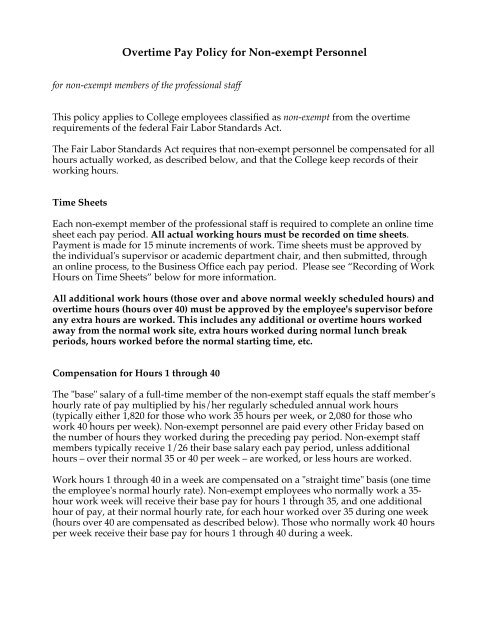

<strong>Overtime</strong> <strong>Pay</strong> <strong>Policy</strong> <strong>for</strong> <strong>Non</strong>-<strong>exempt</strong> <strong>Personnel</strong><strong>for</strong> non-<strong>exempt</strong> members of the professional staffThis policy applies to College employees classified as non-<strong>exempt</strong> from the overtimerequirements of the federal Fair Labor Standards Act.The Fair Labor Standards Act requires that non-<strong>exempt</strong> personnel be compensated <strong>for</strong> allhours actually worked, as described below, and that the College keep records of theirworking hours.Time SheetsEach non-<strong>exempt</strong> member of the professional staff is required to complete an online timesheet each pay period. All actual working hours must be recorded on time sheets.<strong>Pay</strong>ment is made <strong>for</strong> 15 minute increments of work. Time sheets must be approved bythe individual's supervisor or academic department chair, and then submitted, throughan online process, to the Business Office each pay period. Please see “Recording of WorkHours on Time Sheets” below <strong>for</strong> more in<strong>for</strong>mation.All additional work hours (those over and above normal weekly scheduled hours) andovertime hours (hours over 40) must be approved by the employee's supervisor be<strong>for</strong>eany extra hours are worked. This includes any additional or overtime hours workedaway from the normal work site, extra hours worked during normal lunch breakperiods, hours worked be<strong>for</strong>e the normal starting time, etc.Compensation <strong>for</strong> Hours 1 through 40The "base" salary of a full-time member of the non-<strong>exempt</strong> staff equals the staff member’shourly rate of pay multiplied by his/her regularly scheduled annual work hours(typically either 1,820 <strong>for</strong> those who work 35 hours per week, or 2,080 <strong>for</strong> those whowork 40 hours per week). <strong>Non</strong>-<strong>exempt</strong> personnel are paid every other Friday based onthe number of hours they worked during the preceding pay period. <strong>Non</strong>-<strong>exempt</strong> staffmembers typically receive 1/26 their base salary each pay period, unless additionalhours – over their normal 35 or 40 per week – are worked, or less hours are worked.Work hours 1 through 40 in a week are compensated on a "straight time" basis (one timethe employee's normal hourly rate). <strong>Non</strong>-<strong>exempt</strong> employees who normally work a 35-hour work week will receive their base pay <strong>for</strong> hours 1 through 35, and one additionalhour of pay, at their normal hourly rate, <strong>for</strong> each hour worked over 35 during one week(hours over 40 are compensated as described below). Those who normally work 40 hoursper week receive their base pay <strong>for</strong> hours 1 through 40 during a week.

Compensation <strong>for</strong> Hours Over 40An "overtime premium" is paid <strong>for</strong> all hours worked in excess of 40 in one work week.Hours over 40 in one work week are compensated at the rate of one and one-half timesthe employee's regular hourly rate of pay <strong>for</strong> the week. For the purposes of computingovertime, the work week begins at 12:01 a.m. Sunday and ends 168 hours later at 12:00a.m. the next Sunday. For example, a non-<strong>exempt</strong> employee who normally works 35hours per week works 44 hours in one work week. This individual will receive hernormal base salary <strong>for</strong> hours 1 through 35, pay at one times her normal hourly rate <strong>for</strong>each hour 36 through 40, and pay at one and one-half times her regular rate <strong>for</strong> hours 41through 44.The following will count as “hours worked” <strong>for</strong> non-<strong>exempt</strong> employees, solely <strong>for</strong> thepurpose of calculating eligibility <strong>for</strong> overtime pay; i.e., calculating the number of “workhours” an employee is credited with in a work week.In addition to the total number of hours an individual actually works, paid absences dueto any of the following will count as up to a maximum of 7 or 8 hours per day (based onthe staff member's regular number of scheduled daily work hours) solely <strong>for</strong> purposes ofdetermining total "work hours” <strong>for</strong> the week:• paid vacation days• paid sick days, bereavement days, and/or family illness days• paid personal days• paid time spent in business-related training or travel• time away from work spent on jury duty• absences during paid College holidays *• absences when the President declares an additional paid College holiday period• absences during a paid utility failure or weather emergency period* Please Note: <strong>Non</strong>-<strong>exempt</strong> staff members who do not work on a College holidaywill receive pay <strong>for</strong> their regularly scheduled number of daily hours (typically 7 or8 hours). They will be paid at one time their normal hourly rate <strong>for</strong> these hours(“holiday pay”). For purposes of determining whether a staff member worked over40 hours during one work week, in order to determine eligibility <strong>for</strong> overtime pay,these “holiday hours” will count as hours worked.<strong>Non</strong>-<strong>exempt</strong> staff who are required by their supervisor to work on a Collegeholiday will receive one hour of pay <strong>for</strong> each hour actually worked, plus oneadditional hour of pay (holiday pay), at their normal hourly rate, <strong>for</strong> each hourworked on the holiday. For purposes of determining whether a non-<strong>exempt</strong> staffmember worked over 40 hours during the work week, in order to determineeligibility <strong>for</strong> overtime pay, only hours actually worked on the College holidaywill count toward total hours worked <strong>for</strong> the week. The additional hours paid <strong>for</strong>the holiday (holiday pay) will not count as hours worked when a non-<strong>exempt</strong> staffmember actually works on the holiday.

"Comp. Time"A schedule re-arrangement may be permitted when a non-<strong>exempt</strong> employee works morethan his/her normal scheduled hours during the week. For example, if an employee whonormally works 7 hours per day works 8 hours on Monday, he may reduce his schedule,with his supervisor's permission, to 6 hours on another day during the week. However, ifa non-<strong>exempt</strong> employee works more than 40 hours during one week, she must record thehours over 40 as overtime on her online time sheet and will receive the applicableovertime premium. The employee may, with her supervisor's permission, take an hourand a half of unpaid time off work at a later date.On-call TimeIf a non-<strong>exempt</strong> employee must be "on-call" on College premises, hours on-call must berecorded on the employee's time sheet. A non-<strong>exempt</strong> employee who is required to beon-call but whose activities are not restricted (i.e., may serve on-call while at home, ispermitted to carry a pager, or is permitted to leave a message where he/she can bereached) should record on time sheets only time actually spent responding to a call.Reporting Errors<strong>Franklin</strong> & Marshall College intends to abide by all applicable wage and hourregulations. A member of the faculty or professional staff who feels he/she has not beenpaid correctly is to promptly notify the Assistant Director or the Director, HumanResources, 291-3995. Routine questions regarding pay, taxes, or standard deductionsmay be directed to the <strong>Pay</strong>roll Coordinator, 291-3928.Student workers are to promptly report errors in pay to the Office of Financial Aid, 291-3991, or to the Student <strong>Pay</strong>roll Clerk, 291-4211.

Recording of Work Hours on Online Time Sheets<strong>for</strong> non-<strong>exempt</strong> members of the professional staff• All work hours must be accurately recorded on online time sheets. “Work time”includes all time spent per<strong>for</strong>ming activities on behalf of <strong>Franklin</strong> & Marshall inconjunction with your employment.• Work time includes time spent attending work-related meetings if you are askedor expected to attend, even if the meeting occurs during a time when younormally do not work.• Time spent per<strong>for</strong>ming College-related work away from campus must be recordedon time sheets (work from home or other location). Such work must be authorizedin advance by your supervisor or academic department chair.• Time worked is to be rounded to the nearest 15 minute increment. For example, ifyou begin working at 7:58 a.m., record 8:00 a.m. on your online time sheet. If youbegin working at 8:18 a.m., record 8:15 a.m. on your online time sheet.• The actual time spent working is to be recorded on your online time sheet,rounded to the nearest 15 minute increment. If you arrive later than scheduled orleave work earlier than normal on a particular day, your actual work hours thatday are to be recorded on the time sheet, rounded to the nearest 15 minuteincrement. Similarly, if you work more hours than normal on a particular day,your total actual hours are to be recorded on your time sheet (additional hoursmust be approved in advance by your supervisor).• Your immediate supervisor or academic department chair must approve youronline time sheet each pay period. Online time sheets must be completed,approved, and submitted no later than by each payroll deadline, if any hours wereworked during the payroll period. Time sheets must not be held and submitted ona monthly basis or intermittently.• Work hours over and above your normal weekly schedule must be approved inadvance by your supervisor. Work hours over 40 during one week arecompensated at 1.5 times your regular hourly rate; any work hours over 40 duringone week must be authorized in advance by your supervisor.• Time spent attending College events on a purely voluntary basis is generally notconsidered work time and should not be recorded on time sheets (with theexception of the DIPNIC, the annual holiday luncheon, and similar authorizedevents held <strong>for</strong> faculty and professional staff).• For full-time personnel, paid sick days, paid vacation days, “Family Illness Days”,paid personal days, and any unpaid time off must be recorded on online timesheets.Please contact the <strong>Pay</strong>roll Coordinator, 291-3928 with questions about completing time sheets.