Models & Technicals - Wholesale Banking - Home

Models & Technicals - Wholesale Banking - Home

Models & Technicals - Wholesale Banking - Home

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

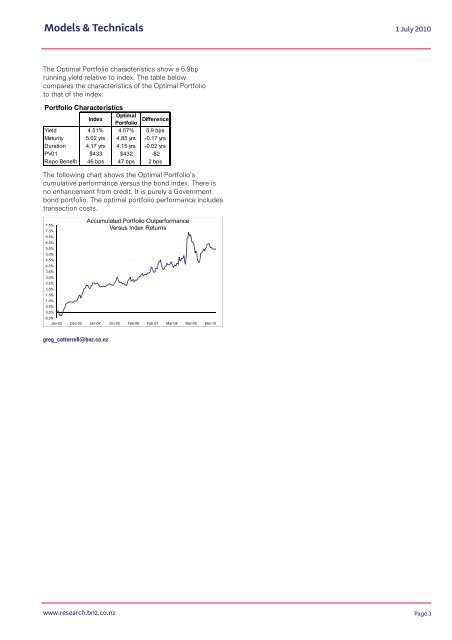

<strong>Models</strong> & <strong>Technicals</strong>1 July 2010The Optimal Portfolio characteristics show a 5.9bprunning yield relative to index. The table belowcompares the characteristics of the Optimal Portfolioto that of the index.Portfolio CharacteristicsIndexOptimalPortfolioDifferenceYield 4.51% 4.57% 5.9 bpsMaturity 5.02 yrs 4.85 yrs -0.17 yrsDuration 4.17 yrs 4.15 yrs -0.02 yrsPV01 $433 $432 -$2Repo Benefit 46 bps 47 bps 2 bpsThe following chart shows the Optimal Portfolio’scumulative performance versus the bond index. There isno enhancement from credit. It is purely a Governmentbond portfolio. The optimal portfolio performance includestransaction costs.Accumulated Portfolio OutperformanceVersus Index Returns7.5%7.0%6.5%6.0%5.5%5.0%4.5%`4.0%3.5%3.0%2.5%2.0%1.5%1.0%0.5%0.0%-0.5%Jan-02 Dec-02 Jan-04 Jan-05 Feb-06 Feb-07 Mar-08 Mar-09 Mar-10greg_cotterrell@bnz.co.nzwww.research.bnz.co.nzPage 3