Models & Technicals - Wholesale Banking - Home

Models & Technicals - Wholesale Banking - Home

Models & Technicals - Wholesale Banking - Home

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

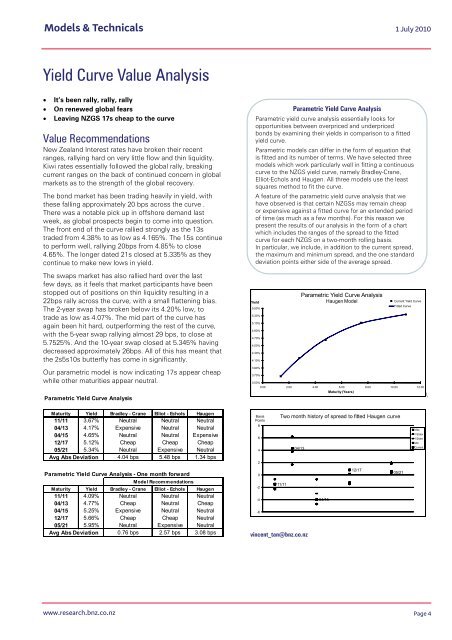

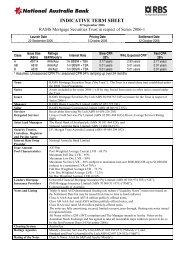

<strong>Models</strong> & <strong>Technicals</strong>1 July 2010Yield Curve Value AnalysisIt’s been rally, rally, rallyOn renewed global fearsLeaving NZGS 17s cheap to the curveValue RecommendationsNew Zealand Interest rates have broken their recentranges, rallying hard on very little flow and thin liquidity.Kiwi rates essentially followed the global rally, breakingcurrent ranges on the back of continued concern in globalmarkets as to the strength of the global recovery.The bond market has been trading heavily in yield, withthese falling approximately 20 bps across the curve .There was a notable pick up in offshore demand lastweek, as global prospects begin to come into question.The front end of the curve rallied strongly as the 13straded from 4.38% to as low as 4.165%. The 15s continueto perform well, rallying 20bps from 4.85% to close4.65%. The longer dated 21s closed at 5.335% as theycontinue to make new lows in yield.The swaps market has also rallied hard over the lastfew days, as it feels that market participants have beenstopped out of positions on thin liquidity resulting in a22bps rally across the curve, with a small flattening bias.The 2-year swap has broken below its 4.20% low, totrade as low as 4.07%. The mid part of the curve hasagain been hit hard, outperforming the rest of the curve,with the 5-year swap rallying almost 29 bps, to close at5.7525%. And the 10-year swap closed at 5.345% havingdecreased approximately 26bps. All of this has meant thatthe 2s5s10s butterfly has come in significantly.Our parametric model is now indicating 17s appear cheapwhile other maturities appear neutral.Parametric Yield Curve AnalysisParametric Yield Curve AnalysisParametric yield curve analysis essentially looks foropportunities between overpriced and underpricedbonds by examining their yields in comparison to a fittedyield curve.Parametric models can differ in the form of equation thatis fitted and its number of terms. We have selected threemodels which work particularly well in fitting a continuouscurve to the NZGS yield curve, namely Bradley-Crane,Elliot-Echols and Haugen. All three models use the leastsquares method to fit the curve.A feature of the parametric yield curve analysis that wehave observed is that certain NZGSs may remain cheapor expensive against a fitted curve for an extended periodof time (as much as a few months). For this reason wepresent the results of our analysis in the form of a chartwhich includes the ranges of the spread to the fittedcurve for each NZGS on a two-month rolling basis.In particular, we include, in addition to the current spread,the maximum and minimum spread, and the one standarddeviation points either side of the average spread.Yield5.50%5.30%5.10%4.90%4.70%4.50%4.30%4.10%3.90%3.70%3.50%Parametric Yield Curve AnalysisHaugen Model0.00 2.00 4.00 6.00 8.00 10.00 12.00Maturity (Years)Current Yield CurveFitted Curve\Maturity Yield Bradley - Crane Elliot - Echols Haugen11/11 3.67% Neutral Neutral Neutral04/13 4.17% Expensive Neutral Neutral04/15 4.65% Neutral Neutral Expensive12/17 5.12% Cheap Cheap Cheap05/21 5.34% Neutral Expensive NeutralAvg Abs Deviation 4.04 bps 5.48 bps 1.34 bpsParametric Yield Curve Analysis - One month forwardModel RecommendationsMaturity Yield Bradley - Crane Elliot - Echols Haugen11/11 4.09% Neutral Neutral Neutral04/13 4.77% Cheap Neutral Cheap04/15 5.25% Expensive Neutral Neutral12/17 5.66% Cheap Cheap Neutral05/21 5.95% Neutral Expensive NeutralAvg Abs Deviation 0.76 bps 2.57 bps 3.08 bpsBasisPoints86420-2-4-6Two month history of spread to fitted Haugen curve11/1104/13vincent_tan@bnz.co.nz04/1512/1705/21Max1 Stdev1 StdevMinCurrentwww.research.bnz.co.nzPage 4