A Buffer Stocks Model For Stabilizing Price With

A Buffer Stocks Model For Stabilizing Price With

A Buffer Stocks Model For Stabilizing Price With

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

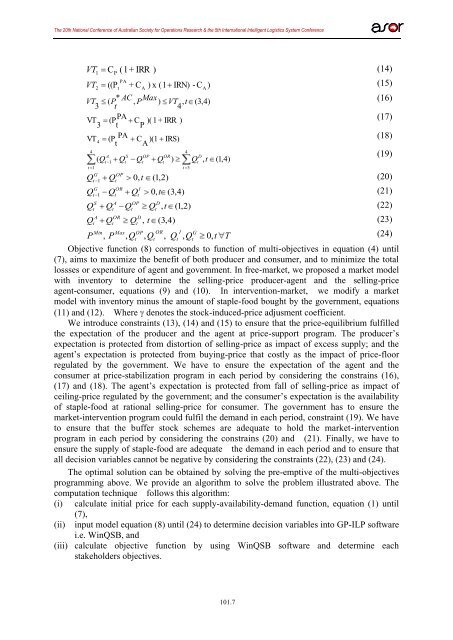

The 20th National Conference of Australian Society for Operations Research & the 5th International Intelligent Logistics System ConferenceVT (1+ IRR )(14)1C PPAVT2((Pt+ CA) x (1 IRN) - CA)(15)VT ( P* AC, PMax) VT , t3 t4(3,4)(16)VT (PPAC )( 1+ IRR )3 t P(17)VT 4(PPAC )(1t AIRS)(18)44A S OP ORD( Q Q Q Q ) Q , (1,4)(19)t 1 t t tttt 1t 3G OPQt1Qt0, t (1,2)G OR IQt1QtQt0, tQQPStAtMinQQAtORtQOPtQDt, tQDt,t(3,4)(3,4)(1,2)(20)(21)(22)(23)Max OP OR I G, P , Q , Q , Q , Q 0, t T(24)ttttObjective function (8) corresponds to function of multi-objectives in equation (4) until(7), aims to maximize the benefit of both producer and consumer, and to minimize the totallossses or expenditure of agent and government. In free-market, we proposed a market modelwith inventory to determine the selling-price producer-agent and the selling-priceagent-consumer, equations (9) and (10). In intervention-market, we modify a marketmodel with inventory minus the amount of staple-food bought by the government, equations(11) and (12). Where denotes the stock-induced-price adjusment coefficient.We introduce constraints (13), (14) and (15) to ensure that the price-equilibrium fulfilledthe expectation of the producer and the agent at price-support program. The producer’sexpectation is protected from distortion of selling-price as impact of excess supply; and theagent’s expectation is protected from buying-price that costly as the impact of price-floorregulated by the government. We have to ensure the expectation of the agent and theconsumer at price-stabilization program in each period by considering the constrains (16),(17) and (18). The agent’s expectation is protected from fall of selling-price as impact ofceiling-price regulated by the government; and the consumer’s expectation is the availabilityof staple-food at rational selling-price for consumer. The government has to ensure themarket-intervention program could fulfil the demand in each period, constraint (19). We haveto ensure that the buffer stock schemes are adequate to hold the market-interventionprogram in each period by considering the constrains (20) and (21). Finally, we have toensure the supply of staple-food are adequate the demand in each period and to ensure thatall decision variables cannot be negative by considering the constraints (22), (23) and (24).The optimal solution can be obtained by solving the pre-emptive of the multi-objectivesprogramming above. We provide an algorithm to solve the problem illustrated above. Thecomputation technique follows this algorithm:(i) calculate initial price for each supply-availability-demand function, equation (1) until(ii)(7),input model equation (8) until (24) to determine decision variables into GP-ILP softwarei.e. WinQSB, and(iii) calculate objective function by using WinQSB software and determine eachstakeholders objectives.101.7