Fact Sheet - Dimensional Fund Advisors

Fact Sheet - Dimensional Fund Advisors

Fact Sheet - Dimensional Fund Advisors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

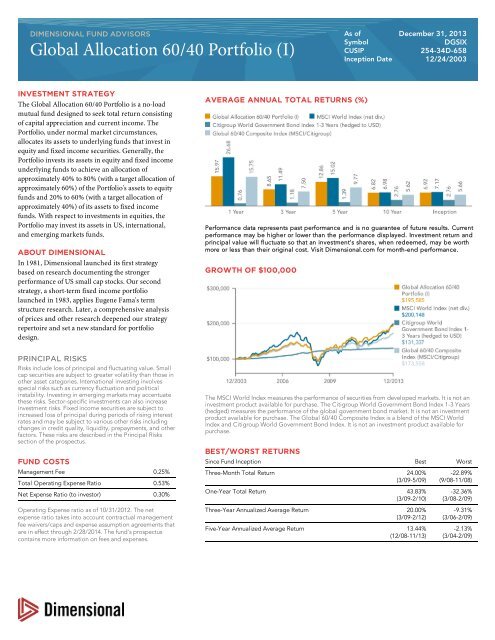

DIMENSIONAL FUND ADVISORSAs of December 31, 2013SymbolDGSIXCUSIP254-34D-658Inception Date 12/24/2003INVESTMENT STRATEGYThe Global Allocation 60/40 Portfolio is a no-loadmutual fund designed to seek total return consistingof capital appreciation and current income. ThePortfolio, under normal market circumstances,allocates its assets to underlying funds that invest inequity and fixed income securities. Generally, thePortfolio invests its assets in equity and fixed incomeunderlying funds to achieve an allocation ofapproximately 40% to 80% (with a target allocation ofapproximately 60%) of the Portfolio's assets to equityfunds and 20% to 60% (with a target allocation ofapproximately 40%) of its assets to fixed incomefunds. With respect to investments in equities, thePortfolio may invest its assets in US, international,and emerging markets funds.ABOUT DIMENSIONALIn 1981, <strong>Dimensional</strong> launched its first strategybased on research documenting the strongerperformance of US small cap stocks. Our secondstrategy, a short-term fixed income portfoliolaunched in 1983, applies Eugene Fama's termstructure research. Later, a comprehensive analysisof prices and other research deepened our strategyrepertoire and set a new standard for portfoliodesign.AVERAGE ANNUAL TOTAL RETURNS (%)Performance data represents past performance and is no guarantee of future results. Currentperformance may be higher or lower than the performance displayed. Investment return andprincipal value will fluctuate so that an investment's shares, when redeemed, may be worthmore or less than their original cost. Visit <strong>Dimensional</strong>.com for month-end performance.GROWTH OF $100,000PRINCIPAL RISKSRisks include loss of principal and fluctuating value. Smallcap securities are subject to greater volatility than those inother asset categories. International investing involvesspecial risks such as currency fluctuation and politicalinstability. Investing in emerging markets may accentuatethese risks. Sector-specific investments can also increaseinvestment risks. Fixed income securities are subject toincreased loss of principal during periods of rising interestrates and may be subject to various other risks includingchanges in credit quality, liquidity, prepayments, and otherfactors. These risks are described in the Principal Riskssection of the prospectus.FUND COSTSManagement Fee 0.25%Total Operating Expense Ratio 0.53%Net Expense Ratio (to investor) 0.30%Operating Expense ratio as of 10/31/2012. The netexpense ratio takes into account contractual managementfee waivers/caps and expense assumption agreements thatare in effect through 2/28/2014. The fund's prospectuscontains more information on fees and expenses.The MSCI World Index measures the performance of securities from developed markets. It is not aninvestment product available for purchase. The Citigroup World Government Bond Index 1-3 Years(hedged) measures the performance of the global government bond market. It is not an investmentproduct available for purchase. The Global 60/40 Composite Index is a blend of the MSCI WorldIndex and Citigroup World Government Bond Index. It is not an investment product available forpurchase.BEST/WORST RETURNSSince <strong>Fund</strong> Inception Best WorstThree-Month Total Return 24.00%(3/09-5/09)One-Year Total Return 43.83%(3/09-2/10)Three-Year Annualized Average Return 20.00%(3/09-2/12)Five-Year Annualized Average Return 13.44%(12/08-11/13)-22.89%(9/08-11/08)-32.36%(3/08-2/09)-9.31%(3/06-2/09)-2.13%(3/04-2/09)

DIMENSIONAL FUND ADVISORSAS OF DECEMBER 31, 2013WHY CHOOSE A GLOBAL FUND?Even experienced investors can find themselves perplexed by unexpected market events.Choosing a global balanced fund can replace forecasting and guesswork with a disciplined,professional approach incorporating the benefits of investment theory developed over the pastfour decades. It represents a thoughtful and diversified approach for participants and planadministrators alike.ASSETS UNDER MANAGEMENTAll Strategies$337.5 BillionPortfolio Institutional Class$1.9 BillionPORTFOLIO COMPOSITIONPHILOSOPHYAt <strong>Dimensional</strong>, we see markets as an ally, not an adversary. We believe competition quicklydrives stock prices to fair value and that persistent differences in average portfolio returns areexplained by differences in average risk. Rather than trying to take advantage of the ways marketsare mistaken, we take advantage of the ways markets are right—the ways they compensateinvestors. Our mission is to deliver the performance of capital markets and increase returnsthrough state-of-the-art portfolio design and trading.PORTFOLIO COMPOSITIONThe <strong>Dimensional</strong> Global 60/40 Portfolio is intended for investors with a moderate tolerance forrisk. Comprised of 60% equity funds and 40% fixed income funds, the portfolio seeks moderatebut healthy growth of capital over long time horizons. Together, the component funds of theportfolio invest in over 10,000 securities across separate asset classes in forty countries. Theportfolio is systematically rebalanced.Relative to conventional broad-based equity market benchmarks, the portfolio reflects anemphasis on small company stocks and value stocks. Research conducted by Professors EugeneFama and Kenneth French found that small cap stocks and value stocks have higher expectedreturns over long periods. Small stocks and value stocks generally have a high level of risk.Because risk and return are directly related, this higher risk provides small and value stockswith higher expected returns. Such stocks also provide significant diversification benefits whencombined with larger cap and/or growth-oriented stocks.EQUITY CHARACTERISTICSGlobal Allocation 60/40 Portfolio (I)Number of Securities 12,013Weighted Average Market Cap (millions) $53,568Median Market Cap (millions) $714Aggregate Price-to-Book 1.71Component <strong>Fund</strong>s Allocation (%)US EQUITIESCore Equity 1Core Equity 2Real EstateNON-US EQUITIESInternational CoreEMERGING MARKETSEmerging Markets CoreGLOBAL FIXED INCOMEShort-Term Ext. QualityFive-Year GlobalSelectively Hedged GlobalInflation Protected SecuritiesIntermediate-Term Ext. QualityWorld Ex US Government38.89.528.50.816.216.25.15.140.010.05.015.02.55.02.5The portfolio holds equity and fixed income securities. The characteristics shown reflect only theequity holdings.© 2014 <strong>Dimensional</strong> <strong>Fund</strong> <strong>Advisors</strong>. All rights reserved.<strong>Dimensional</strong> <strong>Fund</strong> <strong>Advisors</strong> is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges andexpenses of the <strong>Dimensional</strong> funds carefully before investing. For this and other information about the <strong>Dimensional</strong> funds, please read the prospectus carefully beforeinvesting. Prospectuses are available by calling <strong>Dimensional</strong> <strong>Fund</strong> <strong>Advisors</strong> collect at (512) 306-7400 or at www.dimensional.com. Mutual funds distributed by DFA SecuritiesLLC.