search servey and seizure

search servey and seizure

search servey and seizure

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

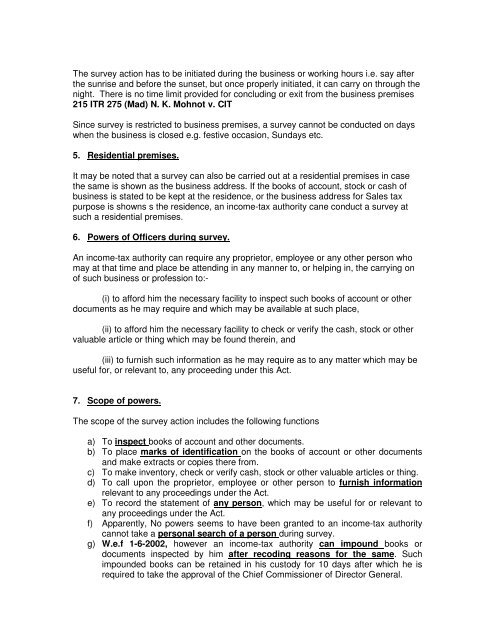

The survey action has to be initiated during the business or working hours i.e. say afterthe sunrise <strong>and</strong> before the sunset, but once properly initiated, it can carry on through thenight. There is no time limit provided for concluding or exit from the business premises215 ITR 275 (Mad) N. K. Mohnot v. CITSince survey is restricted to business premises, a survey cannot be conducted on dayswhen the business is closed e.g. festive occasion, Sundays etc.5. Residential premises.It may be noted that a survey can also be carried out at a residential premises in casethe same is shown as the business address. If the books of account, stock or cash ofbusiness is stated to be kept at the residence, or the business address for Sales taxpurpose is showns s the residence, an income-tax authority cane conduct a survey atsuch a residential premises.6. Powers of Officers during survey.An income-tax authority can require any proprietor, employee or any other person whomay at that time <strong>and</strong> place be attending in any manner to, or helping in, the carrying onof such business or profession to:-(i) to afford him the necessary facility to inspect such books of account or otherdocuments as he may require <strong>and</strong> which may be available at such place,(ii) to afford him the necessary facility to check or verify the cash, stock or othervaluable article or thing which may be found therein, <strong>and</strong>(iii) to furnish such information as he may require as to any matter which may beuseful for, or relevant to, any proceeding under this Act.7. Scope of powers.The scope of the survey action includes the following functionsa) To inspect books of account <strong>and</strong> other documents.b) To place marks of identification on the books of account or other documents<strong>and</strong> make extracts or copies there from.c) To make inventory, check or verify cash, stock or other valuable articles or thing.d) To call upon the proprietor, employee or other person to furnish informationrelevant to any proceedings under the Act.e) To record the statement of any person, which may be useful for or relevant toany proceedings under the Act.f) Apparently, No powers seems to have been granted to an income-tax authoritycannot take a personal <strong>search</strong> of a person during survey.g) W.e.f 1-6-2002, however an income-tax authority can impound books ordocuments inspected by him after recoding reasons for the same. Suchimpounded books can be retained in his custody for 10 days after which he isrequired to take the approval of the Chief Commissioner of Director General.