Fema Forms CA. Anshuman Chaturvedi 23June 12

Fema Forms CA. Anshuman Chaturvedi 23June 12

Fema Forms CA. Anshuman Chaturvedi 23June 12

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

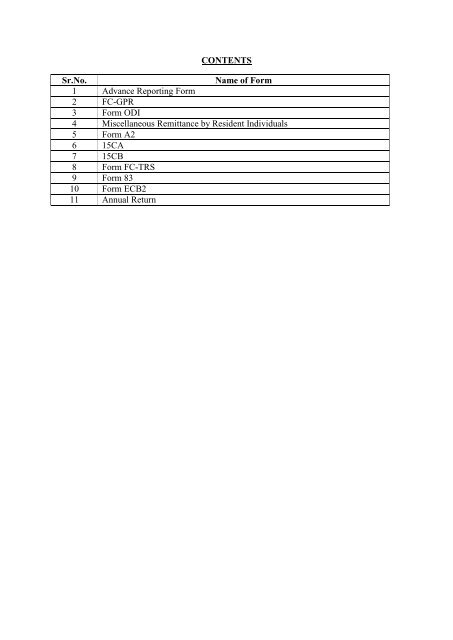

CONTENTSSr.No.Name of Form1 Advance Reporting Form2 FC-GPR3 Form ODI4 Miscellaneous Remittance by Resident Individuals5 Form A26 15<strong>CA</strong>7 15CB8 Form FC-TRS9 Form 8310 Form ECB211 Annual Return

Annex - 6[PART I, Section V, para 1 (i) ]Report by the Indian company receiving amount of consideration for issue ofshares / Convertible debentures under the FDI Scheme( To be filed by the company through its Authorised Dealer Category – I bank, withthe Regional Office of the Reserve Bank under whose jurisdiction the RegisteredOffice of the company making the declaration is situated, not later than 30 daysfrom the date of receipt of the amount of consideration, as specified in para 9 (I) (A)of Schedule I to Notification No. FEMA 20/2000- RB dated May 3, 2000 )Permanent AccountNumber (PAN) of theinvestee company givenby the IT DepartmentNo. Particulars (In Block Letters)1. Name of the Indian companyAddress of the Registered Office2FaxTelephonee-mailDetails of the foreign investor/ collaboratorNameAddressCountry3. Date of receipt of funds4. Amount In foreign currency In Indian Rupees5. Whether investment is underAutomatic Route or Approval RouteAutomatic Route / Approval RouteIf Approval Route, give details (ref.no. of approval and date)Website :www.fema.rbi.org.in72Email : fedcofid@rbi.org.in

6. Name of the AD through whom theremittance is received7. Address of the ADA Copy of the FIRC evidencing the receipt of consideration for issue of shares/convertible debentures as above is enclosed.(Authorised signatory ofthe investee company)(Stamp)(Authorised signatory ofthe AD)(Stamp)FOR USE OF THE RESERVE BANK ONLY:Unique Identification Number for the remittancereceived:Website :www.fema.rbi.org.in73Email : fedcofid@rbi.org.in

Annex - 7[PART I, Section V, para 1 (i) ]Know Your Customer (KYC) Form in respect of the non-resident investorRegistered Name of the Remitter / Investor(Name, if the investor is an Individual)Registration Number (Unique IdentificationNumber* in case remitter is an Individual)Registered Address (Permanent Address ifremitter Individual)Name of the Remitter’s BankRemitter’s Bank Account No.Period of banking relationship with theremitter* Passport No., Social Security No, or any Unique No. certifying the bonafides of theremitteras prevalent in the remitter’s countryWe confirm that all the information furnished above is true and accurate asprovided by the overseas remitting bank of the non-resident investor.(Signature of the Authorised Officialof the AD bank receiving the remittance)Date : Place:Stamp :Website :www.fema.rbi.org.in74Email : fedcofid@rbi.org.in

FC-GPRAnnex - 8[PART I, Section V, para 1 (iii) ]PART - A(To be filed by the company through its Authorised Dealer Category – I bank with the RegionalOffice of the RBI under whose jurisdiction the Registered Office of the company making thedeclaration is situated as and when shares / convertible debentures are issued to the foreigninvestor, along with the documents mentioned in item No. 4 of the undertaking enclosed to thisForm)Permanent Account Number(PAN) of the investee companygiven by the Income TaxDepartmentDate of issue of shares /convertible debenturesNo.1.NameParticulars(In Block Letters)Address of the Registered OfficeStateRegistration No. given by Registrarof CompaniesWhether existing company or newcompany (strike off whichever is notapplicable)Existing company / New companyIf existing company, giveregistration number allotted by RBIfor FDI, if anyTelephoneFaxe-mailWebsite :www.fema.rbi.org.in75Email : fedcofid@rbi.org.in

4 Particulars of Shares / Convertible Debentures Issued(a) Nature and date of issueNature of issue Date of issue Number of shares/convertible debentures01 IPO / FPO02 Preferential allotment /private placement03 Rights04 Bonus05 Conversion of ECB06 Conversion of royalty(including lump sumpayments)07 Conversion against importof capital goods by units inSEZ08 ESOPs09 Share Swap10 Others (please specify)Total(b)Type of security issuedNo. Nature ofsecurityNumber Maturity Facevalue01 Equity02 CompulsorilyConvertibleDebentures03 CompulsorilyConvertiblePreferenceshares04 Others(pleasespecify)TotalPremiumIssuePrice pershareAmount ofinflow*i) In case the issue price is greater than the face value please give break up of the premiumreceived.ii) * In case the issue is against conversion of ECB or royalty or against import of capital goods byunits in SEZ, a Chartered Accountant's Certificate certifying the amount outstanding on the dateof conversion(c) Break up of premium AmountControl PremiumNon competition feeOthers @Total23 SWF means a Government investment vehicle which is funded by foreign exchange assets, and which manages thoseassets separately from the official reserves of the monetary authorities.Website :www.fema.rbi.org.in77Email : fedcofid@rbi.org.in

@ please specify the nature(d)Total inflow (in Rupees) on account ofissue of shares / convertible debentures tonon-residents (including premium, if any)vide(i) Remittance through AD:(ii) Debit to NRE/FCNR A/c withBank_________(iii) Others (please specify)Date of reporting of (i) and (ii) above to RBIunder Para 9 (1) A of Schedule I toNotification No. FEMA 20 /2000-RB datedMay 3, 2000, as amended from time to time.(e) Disclosure of fair value of shares issued**We are a listed company and the marketvalue of a share as on date of the issue is*We are an un-listed company and the fairvalue of a share is*** before issue of shares *(Please indicate as applicable)5. Post issue pattern of shareholdingEquity CompulsorilyconvertiblePreferenceShares/DebenturesInvestor categorya)Non-Resident01 Individuals02 Companies03 FIIs04 FVCIs05 Foreign Trusts06 Private Equity Funds07 Pension/ Provident Funds08 Sovereign Wealth Funds09 Partnership/ ProprietorshipFirms10 Financial Institutions11 NRIs/PIO<strong>12</strong> Others (please specify)b) ResidentTotalSub TotalWebsite :www.fema.rbi.org.in78Email : fedcofid@rbi.org.in

DECLARATION TO BE FILED BY THE AUTHORISED REPRESENTATIVE OF THEINDIAN COMPANY: (Delete whichever is not applicable and authenticate)We hereby declare that:1. We comply with the procedure for issue of shares / convertible debentures as laiddown under the FDI scheme as indicated in Notification No. FEMA 20/2000-RB dated 3 rdMay 2000, as amended from time to time.2. The investment is within the sectoral cap / statutory ceiling permissible under theAutomatic Route of RBI and we fulfill all the conditions laid down for investments underthe Automatic Route namely (strike off whichever is not applicable).a) Foreign entity/entities—(other than individuals), to whom we have issuedshares have existing joint venture or technology transfer or trade markagreement in India in the same field and Conditions stipulated at Para 4.2 ofConsolidated FDI policy Circular of Government of India have been compliedwith.ORForeign entity/entities—(other than individuals), to whom we have issued sharesdo not have any existing joint venture or technology transfer or trade markagreement in India in the same field.For the purpose of the 'same' field, 4 digit NIC 1987 code would be relevant.b) We are not an Industrial Undertaking manufacturing items reserved for smallsector.ORWe are an Industrial Undertaking manufacturing items reserved for small sectorand the investment limit of 24 % of paid-up capital has been observed/ requisiteapprovals have been obtained.c) Shares issued on rights basis to non-residents are in conformity withRegulation 6 of the RBI Notification No FEMA 20/2000-RB dated 3 rd May 2000,as amended from time to time.Shares issued are bonus.ORORShares have been issued under a scheme of merger and amalgamation of two ormore Indian companies or reconstruction by way of de-merger or otherwise of anIndian company, duly approved by a court in India.Website :www.fema.rbi.org.in79Email : fedcofid@rbi.org.in

ORShares are issued under ESOP and the conditions regarding this issue havebeen satisfied3. Shares have been issued in terms of SIA /FIPB approval No.___________________dated ____________________4. We enclose the following documents in compliance with Paragraph 9 (1) (B) ofSchedule 1 to Notification No. FEMA 20/2000-RB dated May 3, 2000:(i)(ii)A certificate from our Company Secretary certifying that(a) all the requirements of the Companies Act, 1956 have beencomplied with;(b) terms and conditions of the Government approval, if any, havebeen complied with;(c) the company is eligible to issue shares under these Regulations;and(d) the company has all original certificates issued by authoriseddealers in India evidencing receipt of amount of consideration inaccordance with paragraph 8 of Schedule 1 to Notification No.FEMA 20/2000-RB dated May 3, 2000.A certificate from Statutory Auditors / SEBI registered Category IMerchant Banker / Chartered Accountant indicating the manner of arrivingat the price of the shares issued to the persons resident outside India.5. Unique Identification Numbers given for all the remittances received as considerationfor issue of shares/ convertible debentures (details as above), by Reserve Bank.R...R(Signature of the Applicant)* :___________________________________________(Name in Block Letters):___________________________________________(Designation of the signatory) :___________________________________________Place:Date:(* To be signed by Managing Director/Director/Secretary of the Company)Website :www.fema.rbi.org.in80Email : fedcofid@rbi.org.in

CERTIFI<strong>CA</strong>TE TO BE FILED BY THE COMPANY SECRETARY 24 OF THE INDIANCOMPANY ACCEPTING THE INVESTMENT:(As per Para 9 (1) (B) (i) of Schedule 1 to Notification No. FEMA 20/2000-RB datedMay 3, 2000)In respect of the abovementioned details, we certify the following :1. All the requirements of the Companies Act, 1956 have been complied with.2. Terms and conditions of the Government approval, if any, have been complied with.3. The company is eligible to issue shares / convertible debentures under theseRegulations.4. The company has all original certificates issued by AD Category – I banks in India,evidencing receipt of amount of consideration in accordance with paragraph 8 ofSchedule 1 to Notification No. FEMA 20/2000-RB dated May 3, 2000.(Name & Signature of the Company Secretary) (Seal)FOR USE OF THE RESERVE BANK ONLY:Registration Number for the FC-GPR:Unique Identification Number allotted to theCompany at the time of reporting receipt ofremittanceR24 If the company doesn’t have a full time Company Secretary, a certificate from a practicing CompanySecretary may be submitted.Website :www.fema.rbi.org.in81Email : fedcofid@rbi.org.in

Annex - AFORM ODIPART IFor office use onlyDate of Receipt ----------------Inward No. -----------------(I) Investment under (i) Automatic RouteSection A: Details of Indian Party(ii) Approval Route(In case there is more than one Indian party, information may be given on separatesheets for each of the parties)(II) Name of Indian Party(III) Address of Indian PartyCity State Pin(IV) Contact PersonDesignationTel No.Faxe-mail(V) Status of Indian Party: (Please tick appropriate category)(1) Public Ltd. Company (2) Private Limited Company(3) Public Sector Undertaking (4) Registered Partnership(5) Proprietorship (6) Unregistered Partnership(7) Trust (8) Society(9) Others(VI) Activity code of Indian Party**NIC code at 3-digit levelWebsite : www.fema.rbi.org.in36Email : oid@rbi.org.in

[If the Indian Party is engaged in Financial sector or falls under the category ofProprietorship, Unregistered Partnership or Financial sector, please furnish thedetails in Item VII below].(VII) Financial particulars of the Indian Party for the last 3 years(Amt. in Rs. 000s)Particulars Year 131-3-Year 231-3Foreign exchange earnings(excluding equity exports to JV/WOS)Net profitPaid-up CapitalYear 331-3Net worth of (a) Indian Party(b) Group Company@@ In terms of Explanation to Regulation 6 (3) of Notification No. FEMA <strong>12</strong>0/ RB-2004dated July 7, 2004(VIII) Particulars of existing Joint Ventures (JV) and Wholly Owned Subsidiaries (WOS)already in operation or under implementation, of the Indian party and its group concerns:Sr.No.1.2.3.Name of Indian PartyUnique Identification Number allotted byReserve Bank(IX) Whether the proposed investment is (Tick the appropriate box)(a) New Project (Please furnish the details in Section B)(b) Existing Project* (Please furnish the details in Section C)* Acquisition of stake in an already existing JV/WOS overseas promoted by an Indianparty.Website : www.fema.rbi.org.in37Email : oid@rbi.org.in

For Reserve Bank use onlyUnique Identification NumberSection B: Details of Investment in New Project(I) Purpose of investment (Please tick appropriate category)(a) Participation in JV (b) Contribution in WOS(c) Full acquisition of a foreign concern(d) Partial acquisition of a foreign concern(e) Investment in unincorporated entity(f) Others(II) Particulars of JV/WOS(a) Name of JV/WOS(b) Address of JV/WOS(c) Name of the country(d) e-mail(e) Accounting year followed by JV/WOS(III) Activity code of JV/WOS(IV) Whether JV/WOS is SPV (Y/N)? ## If Y, Please furnish the details in Section DProposed Capital Structure[a] Indian Party (ies) % stake [b] Foreign partner(s) % stake(1) (1)(2) (2)(3) (3)Website : www.fema.rbi.org.in38Email : oid@rbi.org.in

Section C: Details of Investment in Existing ProjectIndicate 13 digit Unique Identification Number issued by Reserve Bank(I) Purpose of Supplementary Investment (Please tick appropriate category)(a) Enhancement of Equity in existing JV/WOS overseas(b) Enhancement of Preference Equity/ Convertible Debt(c) Grant/ Enhancement of Loan in existing JV/WOS(d) Extension/ Enhancement of Guarantees(e) Remittances to Unincorporated Entity(e) Others(II) Capital Structure[a] Indian Party (ies) % stake [b] Foreign partner(s) % stake(1) (1)(2) (2)(3) (3)Website : www.fema.rbi.org.in39Email : oid@rbi.org.in

Section D - Funding for JV / WOS(Amount in FCY 000's)I Full Value of the Overseas AcquisitionII Estimated cost of overseas acquisition for the Indian PartyIII Financial commitment * (in applicable FCY): FYCIV Method of Investment by Indian Party(i) Cash Remittance(a) EEFC(b) Market Purchase(ii) Capitalization of(a) Export of plant and machinery(b) Others (please Specify)(iii)ADRs /GDRs [raised overseas](iv) ECB/FCCB(v) Swap of shares(vi) Others (Please specify)Total A [Indian Party]AmountV. Whether JV/WOS is SPV (Y/N)(a) If Y, purpose of SPV:i) Full value of the overseas acquisitionii) Direct / Indirect infusion by SPVii) Funds raised overseas with guarantee/counter guarantee from Indian partyiii) Funds raised overseas without guarantee/counter guarantee from Indian Partyiv) Funds contributed in the form of equity/preference equity/ shareholders loansby foreign investorsv) Securitisationvi) Any other mode (please specify)TotalVI. Guarantees/ Other Non fund based CommitmentsNote * : Financial Commitment as defined in FEMA <strong>12</strong>0/RB-2004 dated July 7, 2004Sec 2(f)- Financial Commitment means amount of Direct Investment by way ofcontribution to equity, loan and 100 per cent of the amount of guarantee issued by IndianParty to or on behalf of its overseas Joint Venture company or Wholly Owned Subsidiary.Website : www.fema.rbi.org.in40Email : oid@rbi.org.in

Section E : Declaration by the Indian PartyI (a) Whether the applicant party (ies), its promoters, directors, etc., are underinvestigations by any investigative/enforcement agency or regulatory body. If yes, thebrief details thereof, including present stage of investigation/ adjudication / manner ofdisposal of the case .______________________________________________________________________________________________________________________________(b) Whether the promoter Indian party(ies) is(are) presently on Exporters' Caution List ofReserve Bank for non-realization of export proceeds or on the list of defaulters to theBanking System circulated by Reserve Bank. If so, status of the Indian party (ies):______________________________________________________________________________________________________________________________(c) Any other information relevant to this proposal, including any special benefits/incentives available in the host country for setting up / acquiring the proposed concern.______________________________________________________________________________________________________________________________I/ We hereby certify that the information furnished above are true and correct.Place: ___________Date : ___________Name:------------------------------Designation-----------------------List of enclosures:1. 4.2. 5.3. 6.___________________________(Signature of authorised official)Stamp/SealWebsite : www.fema.rbi.org.in41Email : oid@rbi.org.in

Section F: Certificate by the Statutory Auditors of the Indian PartyIt is certified that the terms and conditions contained in Notification No. FEMA <strong>12</strong>0/RB-2004 dated July 7, 2004, as amended from time to time (Foreign Exchange Management(Transfer or Issue of any Foreign Security) Regulations, 2004) have been complied withby the Indian party(Name of the Indian Party) in respect of the investment under report. Inparticular, it is certified that:(i) the investment is not in real estate oriented or banking business, and(ii) the amount of foreign exchange proposed to be purchased for remittance towardsthe investment together with remittances for all overseas investments already madeand exports and other dues capitalized / swap of shares / investment from ECB /FCCB balances for investment abroad under the Automatic Route is within the limitstipulated by the Reserve Bank from time to time. This has been verified withreference to the net worth of the Indian party (Name of the Indian Party) as on thedate of last audited balance sheet, i. e.-------(date)(iii) has complied with the valuation norms prescribed for the investment(iv) has complied with the ECB guidelines #(v) that the Indian party (a) has made net profits during the preceding three years, (b)has fulfilled the prudential norms of capital adequacy as prescribed by the regulatoryauthority concerned; (c) has been registered with the appropriate regulatory authority inIndia and (d) has obtained approval for the investment in financial services sectoractivities from the regulatory authorities concerned in India and abroad *.Note : *Applicable only in cases where the investment is in the financial services sector(e.g. insurance, mutual fund, asset management, etc.).# Applicable where investment is funded through ECB/FCCB balances.(Signature of the Statutory Auditor of the Company)Name of the firm, Stamp and Registration numberWebsite : www.fema.rbi.org.in42Email : oid@rbi.org.in

Annex – 3[Annex to A. P. (DIR Series) Circular No. 90dated March 06, 20<strong>12</strong>]Application cum Declaration for purchase of foreign exchange under theLiberalised Remittance Scheme of USD 200,000 for Resident individuals(To be completed by the applicant)I. Details of the applicanta. Name …………………………..b. Address…………………………c. Account No……………………..d. PAN No………………………….II. Details of the foreign exchange required1. Amount (Specify currency)………………………………2. Purpose ……………………………………………………III. Source of funds: ………………………………………….IV. Nature of instrumentDraft………………………..Direct remittance…………V. Details of the remittance made under the Scheme in the financial year (April-March) 20__ – 20__Date :………………Amount :………….VI. Details of the Beneficiary1. Name ……………………..2. Address ……………………3. Country ……………………4*. Name and address of the bank……………………….5*. Account No……………………………………………..(* Required only when the remittance is to be directly credited to the bank account ofthe beneficiary)This is to authorize you to debit my account and effect the foreign exchangeremittance/ issue a draft as detailed above (strike out whichever is notapplicable).DeclarationI, ………………. …………(Name), hereby declare that the total amount of foreignexchange purchased from or remitted through, all sources in India during thefinancial year as per item No. V of the Application, including utilisation of the said33

limit on account of loan extended or gift made in rupees credited to NRO account ofnon-resident close relative(s), is within the limit of USD 200,000/- (US Dollar Twohundred thousand only), which is the limit prescribed by the Reserve Bank for thepurpose and certify that the source of funds for making the said remittance belongsto me and will not be used for prohibited purposes.Signature of the applicant(Name)Signature of the natural guardian of the applicant @(Name)@ Where the applicant is minor, the application should be countersigned by minor’snatural guardianCertificate by the Authorised DealerThis is to certify that the remittance is not being made by/ to ineligible entities andthat the remittance is in conformity with the instructions issued by the Reserve Bankfrom time to time under the Scheme.Name and designation of the authorised official:Place:Signature:Date:Stamp and Seal34

Annex-2(Para A 2.4 of Master Circular)FORM - A 2Application cum Declaration Form(To be completed by the applicant)Application for drawal of foreign exchangeI. Details of the applicant -a. Name ____________________________b. Address________________________________________c. Account No. _____________________II. Details of the foreign exchange required1. Amount (Specify currency) ___________________2. Purpose __________________________________III. I authorise you to debit my Saving Bank/Current/RFC/EEF<strong>CA</strong>ccount No._________________ together with your charges and* a) Issue a draft : Beneficiary's Name_____________________Address ________________________________* b) Effect the foreign exchange remittance directly -1. Beneficiary's Name _____________________________2. Name and address of the Bank ____________________3. Account No. ____________________* c) Issue travellers cheques for _________________________* d) Issue foreign currency notes for ______________________(Strike out whichever is not applicable)Declaration(Under FEMA 1999)SignatureI, _________________________ declare that -*1) The total amount of foreign exchange purchased from or remittedthrough, all sources in India during this calendar year including thisapplication is within USD _____________ (USD____________________________________________________________________________only), the annual limit prescribed by Reserve Bank of Indiafor the said purpose.* 2) Foreign exchange purchased from you is for the purposeindicated above.(Strike out whichever is not applicable)SignatureDate :(The purpose codes are on the reverse)Name _____________27

Income-Tax DepartmentFORM NO. 15<strong>CA</strong>(See rule 37BB)Information to be furnished under sub-section (6) of Section 195 of theIncome-tax Act, 1961 relating to remittance of payments to a non-resident orto a foreign companyAck. No. -Part AGENERALName of Remitter (Person responsibleFor making payment u/s 195 of IT Act, 1961)Flat/Door/BlockNo.Name of Premises/Building/VillagePAN of RemitterTAN of RemitterRoad/Street/PostOfficeArea/LocalityStatus-Write 1 if company, Write 2 if firm, and write 3 if othersINFORMATION:REMITTERTown/City/District State Pin codeIn case of company-If domestic, write ‘1’ and if other thandomestic, write ‘2’Principal Place ofBusinessEmail Address(STD code)-Phone Number( )Area CodeAOTypeRange CodeAO No[ITR62;15<strong>CA</strong>,2]{2 }Printed from

Name of recipient of RemittancePAN of recipient of RemittanceComplete Address: Country to which remittance is made :INFORMATION :RECIPIENT OFREMITTANCEStatus-Write 1 if company, write 2 if firm, andwrite 3 if othersPrincipal Place ofBusinessIn case of company- If domestic, write ‘1’and if other than domestic, write ‘2’Email Address(ISD code)-Phone Number( )INFORMATION :ACCOUNTANT(a)(b)(c)(d)Name of the Accountant* signing the certificateName of the proprietorship/ firm of the AccountantAddressRegistration no. of the Accountant(e) Date of Certificate : **Certificate No :(DD/MM/YYYY)* Accountant (other than an employee) shall have the same meaning as defined in the Explanation to Section 288 of Income-tax Act, 1961.** Please fill the serial number as mentioned in the certificate of the accountant.For Office Use OnlyFor Office Use OnlyReceipt No.DateSeal and Signature of receivingofficial[ITR62;15<strong>CA</strong>,2]{2 }Printed from

Part BPARTICULARS OFREMITTANCE ANDTDSPARTICULARS OF REMITTANCE AND TDS (as per certificate of the Accountant)1. Country to which remittance is made Country: Currency:2. Amount of remittance In foreign currency In Indian Rs.3. Name of the bank Branch of the bank4. BSR Code of the bank branch (7 digit)5. Proposed date of remittance(DD/MM/YYYY)6. Amount of TDS In foreign currency In Indian Rs.7. Rate of TDS As per Income-tax Act (%) As per DTAA (%)8. Actual amount of remittance after TDS In foreign currency In Indian Rs.9. Date of deduction of tax at source (DD/MM/YYYY)10. Nature of remittance as per agreement/11.documentIn case the remittance is net of taxes, whethertax payable has been grossed up?(Tick) Yes No<strong>12</strong>. If the remittance is for royalties, fee for (Tick) Yes Notechnical services, interest, dividend, etc.,please indicate:-(a) The clause of the relevant DTAA underwhich the remittance is covered along withreasonsClause of DTAA(b) Rate of TDS required to be deducted in As per DTAA (%)terms of such clause of the applicable DTAA(c) In case TDS is made at a lower rate thanthe rate prescribed under DTAA, reasonsthereof[ITR62;15<strong>CA</strong>,2]{2 }Printed from

13. In case remittance is for supply of articles or (Tick) Yes Nothings (e.g. plant, machinery, equipment etc.),please indicate,(a) Whether the recipient of remittance has (Tick) Yes Noany permanent establishment (PE) inIndia through which the beneficiary of theremittance is directly or indirectlycarrying on such activity of supply ofarticles or things?(b) Whether such remittance is attributable to (Tick) Yes Noor connected with such permanentestablishment(c) If the reply to Item no. (b) above is ‘yes’,the amount of income comprised in suchremittance which is liable to tax.(d) If not, the reasons in brief thereof.14. In case the remittance is on account of (Tick) Yes Nobusiness income, please indicate:-(a) Whether such income is liable to taxin India(b) If so, the basis of arriving at the rate ofdeduction of tax.(c) If not, the reasons thereof.15. In case any order u/s 195(2)/ 195(3)/ 197 of (Tick) Yes NoIncome-tax Act has been obtained from theAssessing Officer, details thereof:(a) Name and Designation of the Assessing[ITR62;15<strong>CA</strong>,2]{2 }Printed from

Officer who issued the order/ certificate(b) Date of the order/ certificate(DD/MM/YYYY)(c) Specify whether u/s 195(2)/ 195(3)/ 197 ofIT Act16. In case of any other remittance, if tax is notdeducted at source for any reason, detailsthereof.VERIFI<strong>CA</strong>TIONI/We, (full name in block letters), son/ daughter of solemnly declare thatthe information given above is true to the best of my/our knowledge and belief and no relevant information has been concealed. I/We certify that a certificate has been obtainedfrom an accountant, particulars of which are given in this Form, certifying the amount, nature and correctness of deduction of tax at source. In a case where it is found that the taxactually deductible on the amount of remittance has not been deducted or after deduction has not been paid or not paid in full. I/we undertake to pay the amount of tax not deductedor not paid, as the case may be along with interest due. I/We shall also be subject to the provisions of penalty for the said default as per the provisions of the IT Act, 1961. I/Wefurther undertake to submit the requisite documents for enabling the Income-tax Authorities to determine the nature and amount of income of the recipient of the above remittanceas well as documents required for determining my/our liability under the Income-tax Act as a person responsible for deduction of tax at source. I/We further declare that I/weam/are furnishing this information in my/our capacity asand I/we am/are also competent to sign the return of income as perprovisions of section 140 of the Income-tax Act, 1961 and verify it.Place Date Sign here ➔[ITR62;15<strong>CA</strong>,2]{2 }Printed from

FORM NO. 15CB(See rule 37BB)Certificate of an accountant*I have examined the transaction (s) and debit note between M/s. xxxxxx Limited and xxxxxxxxxxxxxxx as well as therelevant documents and books of account required for ascertaining the nature of remittance and for determining the rateof deduction of tax at source as per provisions of sub-section (6) of section 195. We hereby certify the following:—AName and address of the beneficiary of the remittance : xxxxxxcccccccxxxxxxxxxxxxxxxxxxB 1. Country to which remittance is made Country: Uxxx Currency: AED2. Amount of remittanceInv. No. Inv. Date XxxxSZ/UA/DNO/<strong>12</strong>/04/011XxxxxXxxxIn foreign currency :xxxxxx/-3. Name of the bank : Axis Bank Branch of the bank :4. BSR Code of the bank branch (7 digit)5. Proposed date of remittanceIn Indian :Rs.xxxxx6. Amount of TDS In foreign currency In Indian7. Rate of TDS As per Income-tax Act As per DTAA8. Actual amount of remittance after TDS In foreign currency : In Indian:9. Date of deduction of tax at source10. Nature of remittance as per agreement/document11. In case the remittance is net of taxes, whethertax payable has been grossed up? If socomputation thereof may be indicated.(Tick) Yes No

<strong>12</strong>. If the remittance is for royalties, fee fortechnical services, interest, dividend, etc,please indicate:-(a) The clause of the relevant DTAA underwhich the remittance is covered along withreasons(b) Rate of TDS required to be deducted interms of such clause of the applicableDTAA(Tick) Yes NoN.A.As per DTAA (N.A.)(c) In case TDS is made at a lower rate thanthe rate prescribed under DTAA, reasonsthereof13. In case remittance is for supply of articles orthings (e.g. plant, machinery, equipment etc.),please indicate,(a) Whether the recipient of remittance hasany permanent establishment (PE) in Indiathrough which the beneficiary of theremittance is directly or indirectly carryingon such activity of supply of articles orthings?(b) Whether such remittance is attributable toor connected with such permanentestablishment(c) If the reply to Item no. (b) above is ‘yes’,the amount of income comprised in suchremittance which is liable to tax.(d) If not, the reasons in brief thereof.14. In case the remittance is on account ofbusiness income, please indicate:-(a) Whether such income is liable to tax inIndia(b) If so, the basis of arriving at the rate ofdeduction of tax.(c) If not, the reasons thereof.15. In case any order u/s 195(2)/ 195(3)/ 197 ofIncome-tax Act has been obtained from theAssessing Officer, details thereof:(Tick) Yes No(Tick) Yes No(Tick) Yes No(Tick) Yes No(Tick) Yes No(Tick) Yes No

(a) Name and Designation of the Assessingofficer who issued the order/ certificate(b) Date of the order/ certificate(DD/MM/YYYY)(c) Specify whether u/s 195(2)/ 195(3)/ 197 of IT Act16. In case of any other remittance, if tax is notdeducted at source for any reason, detailsthereof..**Certificate No.: UAL/20<strong>12</strong>-13/001For xxxxxxxxxxxx & AssociatesChartered AccountantsFirm Registration No: xxxxxxxxxxxNamexxxxxxxxxxxMembership No:xxxxxxAddress:Place: MumbaiDate:** (To be signed and verified by an accountant (other than an employee) as defined in the Explanation to section 288 ofthe Income-tax Act, 1961).** Certificate number is an internal reference number to be given by the Accountant

Annex – 9-I[PART I, Section V, para 2 ]Form FC-TRSDeclaration regarding transfer of shares / compulsorily and mandatorilyconvertible preference shares (CMCPS) / debentures by way of sale from residentto non resident / non-resident to resident(to be submitted to the designated AD branch in quadruplicate within 60 days fromthe date of receipt of funds)The following documents are enclosedFor sale of shares / compulsorily and mandatorily convertible preference shares /debentures by a person resident in Indiai. Consent Letter duly signed by the seller and buyer or their duly appointedagent and in the latter case the Power of Attorney Document.ii. The shareholding pattern of the investee company after the acquisition ofshares by a person resident outside India.iii. Certificate indicating fair value of shares from a Chartered Accountant.iv. Copy of Broker's note if sale is made on Stock Exchange.v. Declaration from the buyer to the effect that he is eligible to acquire shares /compulsorily and mandatorily convertible preference shares / debenturesunder FDI policy and the existing sectoral limits and Pricing Guidelines havebeen complied with.vi. Declaration from the FII/sub account to the effect that the individual FII / Subaccount ceiling as prescribed has not been breached.Additional documents in respect of sale of shares / compulsorily andmandatorily convertible preference shares / debentures by a person residentoutside Indiavii.viii.If the sellers are NRIs/OCBs, the copies of RBI approvals, if applicable,evidencing the shares held by them on repatriation/non-repatriation basis.No Objection/Tax Clearance Certificate from Income Tax Authority/ CharteredAccount.1Name of the companyAddress (including e-mail ,telephone Number, Fax no)Website :www.fema.rbi.org.in82Email : fedcofid@rbi.org.in

ActivityNIC Code No.2 Whether FDI is allowedunder Automatic routeSectoral Cap under FDIPolicy3 Nature of transactionTransfer from resident to non resident /4(Strike out whichever is notapplicable)Name of the buyerTransfer from non resident to residentConstitution / Nature of theinvesting EntitySpecify whether1. Individual2. Company3. FII4. FVCI5. Foreign Trust6. Private Equity Fund7. Pension/ ProvidentFund8. Sovereign WealthFund (SWF )9. Partnership /Proprietorship firm10. Financial Institution11. NRIs / PIOs<strong>12</strong>. othersDate and Place ofIncorporationAddress of the buyer(including e-mail, telephonenumber. Fax no.)SWF means a Government investment vehicle which is funded by foreign exchange assets, and which manages thoseassets separately from the official reserves of the monetary authorities.Website :www.fema.rbi.org.in83Email : fedcofid@rbi.org.in

5 Name of the sellerConstitution / Nature of thedisinvesting entitySpecify whether1. Individual2. Company3. FII4. FVCI5. Foreign Trust6. Private Equity Fund7. Pension/ ProvidentFund8. Sovereign WealthFund (SWF )9. Partnership/Proprietorship firm10. Financial Institution11. NRIs/PIOs<strong>12</strong>. othersDate and Place ofIncorporationAddress of the seller(including e-mail, telephoneNumber Fax no)6 Particulars of earlierReserve Bank / FIPBapprovals7 Details regarding shares / compulsorily and mandatorily convertiblepreference shares (CMCPS) / debentures to be transferredDate of the transactionNumber ofsharesCMCPS /debenturesFacevaluein Rs.NegotiatedPrice forthetransfer**inRs.Amount ofconsiderationin Rs.SWF means a Government investment vehicle which is funded by foreign exchange assets, and which manages thoseassets separately from the official reserves of the monetary authorities.Website :www.fema.rbi.org.in84Email : fedcofid@rbi.org.in

98 Foreign Investments in thecompanyWhere the shares / CMCPS/ debentures are listed onStock ExchangeName of the Stock exchangePrice Quoted on the StockexchangeWhere the shares / CMCPS/ debentures are UnlistedPrice as per Valuationguidelines*Before thetransferAfter thetransferPrice as per CharteredAccountants* / ** Valuation report (<strong>CA</strong>Certificate to be attached)Declaration by the transferor / transfereeI / We hereby declare that :No. of sharesPercentagei. The particulars given above are true and correct to the best of my/our knowledgeand belief.ii.iii.iv.I/ We, was/were holding the shares compulsorily and mandatorily convertiblepreference shares / debentures as per FDI Policy under FERA/ FEMA Regulationson repatriation/non repatriation basis.I/ We, am/are eligible to acquire the shares compulsorily and mandatorilyconvertible preference shares / debentures of the company in terms of the FDIPolicy. It is not a transfer relating to shares compulsorily and mandatorilyconvertible preference shares / debentures of a company engaged in financialservices sector or a sector where general permission is not available.The Sectoral limit under the FDI Policy and the pricing guidelines have beenadhered to.Signature of the Declarant orhis duly authorised agentDate:Website :www.fema.rbi.org.in85Email : fedcofid@rbi.org.in

Note:In respect of the transfer of shares / compulsorily and mandatorily convertible preferenceshares / compulsorily and mandatorily convertible debentures from resident to nonresident the declaration has to be signed by the non resident buyer, and in respect of thetransfer of shares / compulsorily and mandatorily convertible preference shares /compulsorily and mandatorily convertible debentures from non-resident to resident thedeclaration has to be signed by the non-resident seller.Certificate by the AD BranchIt is certified that the application is complete in all respects.The receipt /payment for the transaction are in accordance with FEMA Regulations /Reserve Bank guidelines.SignatureDate: Name of the AD BranchName and Designation of the OfficerAD Branch CodeAD Branch CodeWebsite :www.fema.rbi.org.in86Email : fedcofid@rbi.org.in

Annex IIForm 83Reporting of loan agreement details under Foreign Exchange Management Act, 1999(for all categories and any amount of ECB)Instructions:1. The borrower is required to submit completed Form 83, in duplicate, certified by theCompany Secretary (CS) or Chartered Accountant (<strong>CA</strong>) to the designated AuthorisedDealer (AD). One copy is to be forwarded by the designated AD to the Director,Balance of Payments Statistics Division, Department of Statistics and InformationManagement (DSIM), Reserve Bank of India, Bandra-Kurla Complex, Mumbai 400051 within 7 days from the date of signing loan agreement between borrower andlender for allotment of loan registration number.2. Do not leave any column blank. Furnish complete particulars against each item. Whereany particular item is not applicable write N.A. against it.3. All dates should be in format YYYY/MM/DD, such as 2004/01/21 for January 21, 2004.4. Before forwarding Form 83 to the Reserve Bank, the Authorised Dealer must scrutiniseall the related original documents and ensure that the form is complete in all respectsand in order.5. If space is not sufficient for giving full information/particulars against any item, aseparate sheet may be attached to the form and serially numbered as Annex.6. Firms/companies obtaining sub-loans through DFIs/FIs/banks/NBFCs etc. should notcomplete this form but approach the concerned financial institution directly for reporting.FOR RBI (DESACS) Use onlyLoan_key:CS-DRMS Team Received on Action Taken on LoanClassificationAgreement Details (To be filled by borrowers of External Commercial Borrowings)Part A: Basic DetailsECB Title / ProjectRegistration NumberNo. and Date of RBI approval (if applicable)Loan Key Number (allotted by RBI/ Govt.)Agreement Date (YYYY/MM/DD) / /Currency NameAmount (in FC)GuaranteeStatusGuarantor (Name,Address, contactnumber etc. )Currency Code(SWIFT)(For RBI Use)38

(Use code as per Box1)Multi Currency TypeName and address of the Borrower (BlockLetters)Contact Person's Name:Designation:Phone No. :Fax no. :E-mail ID :(For RBI DESACS use)Name and address of lender / foreign supplier /lesser (Block Letters)Country:E-mail ID :(For RBI DESACS use)Borrowers Category (Tick in appropriate box)Public Sector Unit Private SectorUnitDetailed category (tick below)BankNBFC Reg.No.Financial Institution (Other than NBFC)CorporateNGOs engaged in micro finance activityOther (Specify)Details of foreign equity holding of the lender inborrower company:(a)Share in paid-up equity of the borrower (%)Specify Authorised Dealers Name, and bank codeBank Code Part I:Fax :E-mail ID:Part II:Part B: Other DetailsECB approval Scheme (Tick in appropriate Box)Automatic RouteApproval RouteApproved by Govt.Lender's CategoryMulti-lateral Financial InstitutionForeign Government (Bilateral Agency)Export Credit AgencyIndian Commercial Bank branch abroadOther Commercial BankSupplier of EquipmentLeasing CompanyForeign Collaborator / Foreign Equity Holder(Please provide details of foreign equityholding in the borrower company below)International Capital MarketOther (Specify)(b) Amount of paid-upequityLender's Reference / IBRD No. (if it is a IBRD loan)Maturity DetailsEffective Date of the LoanLast Date of DisbursementMaturity Date (Last paymentdate)Grace Period (Year/Month) Y Y M M39

Economic Sector /Industry Code (See Box3)Purpose of Borrowings Code (Seebox2)If Import, specify the Country of Import (if more than one country, attach details):Type of ECBBuyers CreditSuppliers CreditLine of CreditExport Credit from Bilateral SourcesCommercial loan / Syndicated Loan Securitised instruments - Bonds, CP, FRN etc.(attach sheet for percentage distributionamong lenders)Financial LeaseOthers (Specify)Refinancing of old ECBs: Reg No. of the oldECBApproval No. Date: Amount refinanced: Reason:Hedging risks usingInterest rateswapCurrencyswapOthers (specify)Part C: Schedule of transactionsInterest Payment Schedule:First PaymentDateFixed Rate .Floating Rate:BaseSchedule of Draw DownTranche DateNo (YYYY/MM/DD)(Please see notebelow)/ / Number of Payments in a YearMargin Cap Rate: Floor Rate:CurrencyAmountIf more than one equal installmentsTotal Number of No.of drawals in adrawalscalendar yearNote: 1. In the case of import of goods or services, date of import may be furnished against date of drawdown.2.In the case of financial lease date of acquisition (import) of the goods is to be mentioned as dateof draw down.3. In the case of securitised instruments, date of issue may be shown as date of draw down4. In case more than equal draw down transactions are shown in a row above, date of firsttransaction to be mentioned.Principal Repayment ScheduleDate (YYYY/MM/DD) Currency(First repaymentdate)Amount in FC ineachtransactionIf more than one equalinstallmentsNumber of No. ofinstallments payments in acalendar yearAnnuityRate(if annuitypayment)40

Please tick in appropriate Boxes ifthoseoptions are there in the loanagreement :Can be executed afterdate (s)CallOption :Percent ofDebtPutOptionPercent ofDebt/ / / /Note: In the case of annuity payments, please indicate each equal installment of principal and interestamount with rate.In the case of principal repayment using a percentage profile, percentages may also be indicated.Penal Interest for late payment Fixed % per annum or Base : Margin:Commitment Charges % per annum of : % of UndrawnAmountOther ChargesNature of Charge(Specify)ExpectedDate ofPaymentCurrencyAmountIn case of many equalpaymentsNo. ofpayments in ayearTotalnumber ofpaymentsPART D : ECB availed in the current & previous three financial years-(not applicable for the firsttime borrower)Year Registration No. Currency Loan Amount Amount disbursed Amount outstanding** net of repayments, if any, on the date of application.We hereby certify that the particulars given above are true and correct to the best of ourknowledge and belief. No material information has been withheld and / or misrepresented.Place : _________Date : __________StampStamp____________________________________________(Signature of the Authorised Official of the Company)Name : _______________ Designation : _______________________________________________________(Signature of Company Secretary / CharteredAccountant)Name : ______________________________________[For use of Authorised Dealer]We certify that the borrower is our customer and the particulars given in this formare true and correct to the best of our knowledge and belief. Furthermore, the ECB is incompliance with ECB guidelines.Place : __________Date : __________Stamp___________________________________(Signature of Authorised Official)Name : ______________ Designation: ___________Designation :Name of the bank/branch _______________Bank Code :41

BOX 1: Guarantee Status CodeSr.No.CodeDescriptionBOX 2: Purpose of Borrowings CodeSr.No.CodeDescription1 GG Govt. of India guarantee. 1 IC Import of capital goodsCG Public Sector guarantee 2 RL Local sourcing of capital goods(Rupee expenditure)2 PB Public Sector Bank Guarantee. 3 SL On-lending or sub- lending3 FI Financial InstitutionGuarantee.45RPNPRepayment of earlier ECBNew project4 MB Multilateral /Bilateral InstitutionGuarantee.6 ME Modernisation/Expansion of existingunits5 PG Private Bank Guarantee 7 PW Power6 PS Private Sector Guarantee 8 TL Telecommunication7 MS Mortgage of Assets / Security 9 RW Railways8 OG Other Guarantee 10 RD Roads9 NN Not Guaranteed 11 PT Ports<strong>12</strong> IS Industrial parks13 UI Urban infrastructure14 OI Overseas investment in JV/WOS15 DI PSU Disinvestment16 TS Textile/Steel Restructuring Package17 MF Micro finance activity18 OT Others (Pl. specify)BOX 3 : Industry codes to be usedIndustry Group Name Industry Description CodePLANTATIONS TEA 111COFFEE 1<strong>12</strong>RUBBER 113OTHERS 119MINING COAL 211METAL 2<strong>12</strong>OTHERS 219PETROLEUM & PERTOLEUM PRODUCTS 300MANUFACTURINGAGRICULTURAL PRODUCTS (400) FOOD 411BEVERAGES 4<strong>12</strong>SUGAR 413CIGARETTES & TOBACCO 414BREWERIES & DISTILLERIES 415OTHERS 419TEXTILE PRODUCTS (420) COTTON TEXTILE 421JUTE & COIR GOODS 422SILK & RAYON 423OTHER TEXTILE 429TRANSPORT EQUIPMENT (430) AUTOMOBILES 431AUTO ACCESSORIES & PARTS 432SHIP BUILDING EQUIPMENTS & STORES 433RAILWAY EQUIPMENT & STORES 434OTHERS 43942

MACHINERY & TOOLS (440) TEXTILE MACHINERY 441AGRICULTURAL MACHINERY 442MACHINE TOOLS 443OTHERS 449METAL & METAL PRODUCTS (450) FERROUS (IRON & STEEL) 451NON-FERROUS 452SPECIAL ALLOYS 453OTHERS 459ELECTRI<strong>CA</strong>L, ELECTRONIC GOODS &MACHINERY (460) ELECTRI<strong>CA</strong>L GOODS 461<strong>CA</strong>BLES 462COMPUTER HARDWARE & COMPUTERBASED SYSTEMS 463ELECTRONIC VALVES, TUBES & OTHERS 464OTHERS 469CHEMI<strong>CA</strong>LS & ALLIED PRODUCTS (470) FERTILIZERS 471DYES & DYES STUFF 472MEDICINES & PHARMACEUTI<strong>CA</strong>LS 473PAINTS & WARNISHING 474SOAPS, DETERGENTS, SHAMPOOS,SHAVING PRODUCT 475OTHERS 479OTHERS of Manufacturing (480) CEMENT 481OTHER BUILDING MATERIALS 482LEATHER & LEATHER PRODUCTS 483WOOD PRODUCTS 484RUBBER GOODS 485PAPER & PAPER PRODUCTS 486TYPEWRITERS & OTHER OFFICEEQUIPMENT 487PRINTING & PUBLISHING 488MISCELLANEOUS 489TRADING 500CONSTRUCTION & TURN KEYPROJECTS 600TRANSPORT 700UTILITIES (800)POWER GENERATION, TRANSMISSION &DISTRIBUTION 811OTHERS 8<strong>12</strong>BANKING SECTOR 888SERVICES 900TELECOMMUNI<strong>CA</strong>TION SERVICES 911SOFTWARE DEVELOPMENT SERVICES 9<strong>12</strong>TECHNI<strong>CA</strong>L ENGINEERING &CONSULTANCY SERVICES 913TOURS & TRAVEL SERVICES 914COLD STORAGE, <strong>CA</strong>NNING &WAREHOUSING SERVICES 915MEDIA ADVERTISING & ENTERTAINMENTSERVICES 916FINANCIAL SERVICES 917TRANSPORT SERVICES 919OTHERS (NOT CLASSIFIEDELSEWHERE) 99943

Annex-IIIECB - 2Reporting of actual transactions of External Commercial Borrowings (ECB)under Foreign Exchange Management Act, 1999(for all categories and any amount of loan)Return for the Month of .1. This return should be filled in for all categories of ECB. It should be submitted within 7working days from the close of the month through the designated Authorised Dealer tothe Director, Department of Statistics and Information Management (DSIM), Balance ofPayments Statistics Division, Reserve Bank of India, C-8/9, Bandra-Kurla Complex,Bandra (East), Mumbai-400 051. If there is no transaction during a particular period, aNil return should be submitted.2. Please do not leave any column blank. Furnish complete particulars against each item.Where any particular item is not applicable write N.A. against it.3. All dates should be in format YYYY/MM/DD, such as 2004/01/21 for January 21, 2004.4. Borrowers obtaining sub-loans through DFIs/Banks/NBFCs etc. should not completethis form as the concerned financial institution would directly submit ECB-2.5. Before forwarding the return to Reserve Bank (DSIM), the Company Secretary /Chartered Accountant must scrutinise related original documents and ensure that thereturn is complete and in order as per ECB guidelines issued by Government/RBI.6. The unique Loan Identification Number (LIN)/RBI Registration Number (in case of loanapproved prior to February 01, 2004) must be specified as allotted by RBI. Similarly,the Loan Registration Number (since February 01, 2004) has to be specified.7. If space is not sufficient for giving full information against any item, a separate sheetmay be attached to the return and serially numbered as Annex.8. For purpose of utilization of drawdowns, following codes may be used.BOX 1: Purpose of Utilisation CodeNo.CodDescriptionNoCodeDescription1 IC Import of capital goods <strong>12</strong> TL Telecommunication2 IN Import of non-capital 13 RW Railwaysgoods3 RL Local sourcing of capital 14 RD Roadsgoods (Rupee expenditure)4 RC Working capital15 PT Ports(Rupee expenditure)5 SL On-lending or sub-lending 16 IS Industrial parks6 RP Repayment of earlier ECB 17 UI Urban infrastructure7 IP Interest payments 18 OI Overseas investment inJV/WOS8 HA Amount held abroad 19 IT Development of IntegratedTownship9 NP New project 20 DI PSU Disinvestment44

10 ME Modernisation /expansion ofexisting units21 TS Textile/steel RestructuringPackage11 PW Power 22 MF Micro finance activity23 OT Others (Pl. specify)9. For source of funds for remittances, following codes are to be used.No.BOX 2: Source of Funds for remittanceCodeDescription1 A Remittance from India2 B Account held abroad3 CExports proceeds held abroad4 DConversion of equity capital5 E Others (Specify)FOR RBI (DESACS) Use onlyLoan_keyCS-DRMS Team Received on Action Taken on LoanClassificationPart A: Loan Identification ParticularsLoan Registration Number (LRN)Loan AmountBorrower ParticularsAs perAgreementCurrencyAmountName and address of the Borrower (BlockLetters)RevisedContact Person's Name:Designation:Phone No. :Fax no. :E-mail ID :45

Part B: Actual Transaction Details1. Draw-down during the month :TrancheNo.Date(YYYY/MM/DD)(Please see notebelow)CurrencyAmountAmount of loan committed but notyet drawn at the end of the month(in loan currency)Currency AmountNote: 1. In the case of import of goods or services, date of import may be furnished against date ofdraw-down.2.In the case of financial lease date of acquisition of the goods is to be mentioned as date of drawdown.3. In the case of securitised instruments, date of issue may be shown as date of draw-down2. Schedule of balance amount of loan to be drawn in future:Tranche NoExpectedDate(YYYY/MM/DD)of drawdownCurrencyAmountIf more than one equalinstallmentTotal number No. ofof drawals drawals in acalendaryear3. Details of utilisation of draw-downs during the month:TrancheNo.Date(YYYY/MM/DD)Purposecodes(See BOX 1 )Country Currency Amount FreshDisbursement/From A/c heldabroad4. Amount parked abroad outstanding as on beginning of the month _____:Date(YYYY/MM/DD)Name of bank andbranchAccount No. Currency Amount5. Utilisation of amount parked abroad.Date(YYYY/MM/DD)Name of bankand branchAccountNo.Currency Amount Purpose46

TrancheNo.6. Debt Servicing during the month -Purpose Date ofRemittanceCurrency Amount Source ofremittance(See Box2)Prepaymentof Principal(Y/N) *PrincipalInterest @ rateOthers (Specify)* In case of prepayment please provide details: Automatic Route / Approval No. Date:Amount:7. Derivative transactions (Interest rate, Currency swap) during the month (if any) -Type of Swap Swap DealerCounter partyImplementationName Country Name Country DateInterest RateswapCurrency swapOthers (specify)TrancheNo.New CurrencyInterest Rate on theNew CurrencyNew Interest Rateon the Loan CurrencyMaturity Dateof the swap deal8. Revised Principal Repayment Schedule (if revised / entered into Interest rate swap)Date (YYYY/MM/DD)(First repaymentdate)CurrencyAmount inForeignCurrency ineachtransactionsIf more than one equalinstallmentsTotal No. of paymentsNumber of in a calendarinstallments year(1, 2, 3, 4, 6, <strong>12</strong>)AnnuityRate(if annuitypayment)9. Amount of outstanding loan at the end of the month :Currency Amount:(For RBI Use)We hereby certify that the particulars given above are true and correct to the best of ourknowledge and belief. No material information has been withheld and / or misrepresented.Place : __________Date : __________Stamp___________________________________(Signature of Authorised Official)Name : ______________________________Designation : _________________________(For Borrowers use)47

Certificate from Company Secretary / Chartered AccountantWe hereby certify that the ECB availed in terms of approval granted by Governmentor RBI or under approval route / automatic route is duly accounted in the books ofaccounts. Further, ECB proceeds have been utilised by the borrower for thepurpose of ______________________________________________. We haveverified all the related documents and records connected with the utilisation of ECBproceeds and found these to be in order and in accordance with the terms andconditions of the loan agreement and with the approval granted by GoI (MoF) orRBI or under approval route / automatic route and is in conformity with the ECBGuidelines issued by the Government.Place :Date :Authorised SignatoryName & AddressRegistration No.Certificate by an Authorised Dealer[Stamp]We hereby certify that the information furnished above with regard to debt servicing,outstandings and repayment schedule is true and correct as per our record. Thedrawal, utilisation and repayment of the ECB have been scrutinised and it iscertified that such drawal, utilisation and repayments of ECB are in compliance withECB guidelines.__________________________________[Stamp]Signature of Authorised DealerPlace : ______________Name:________________________________________Date : ______________Designation :_____________________________________Name & Address ofAuthorised DealerUniform Code No.__________________________48

4RESERVE BANK OF INDIAAnnual Return on Foreign Liabilities and Assets(Return to be filled under A.P. (DIR Series) Circular No.45 dated March 15, 2011to the Department of Statistics and Information Management, RBI, Mumbai)Please read the guidelines/definitions carefully before filling-in the ReturnSection I: Identification ParticularsFor RBI’s use1. Name and Address of the Indian CompanyCOMPANY CODECity:Pin:State:_______________________________________________2. Income-Tax allotted PAN Number of Company:3. Registration No given by the Registrar of Companies:4. Name of the CONTACT PERSON : _____________________________DESIGNATION:____________________Tel.No. (with STD code): _______________________Fax:_______________e-mail:________________________3. Account closing date: (dd/mm/yy) Web-site (if any):___________________________4. In case of change in Company Name and\or activity, specify the old and new Company Name and activity:Old Company Name :________________________________New Company Name _________________________Effective Date ______________________________Old Activity:________________________________ New Activity _________________________5. Nature of Business: Please tick ( ) the appropriate group of activity to which your principal line of businesspertains and also mention, if possible, the NIC code in the bracket.Industry1. Power( )5.Telecom( )9. Transportation( )13. Software andITES/BPO( )Revenue(%)Industry2. Electrical &Electronics( )6. Hotels &Tourism( )10. Petroleum &Natural Gas( )14. Pharmaceutical( )Revenue(%)Industry3. Non - financialservices( )7. MetallurgicalIndustry &Mining( )11. Chemicals(other thanfertilizers)( )15. Other( )Revenue(%)Industry4. Financial Services( )8. Food ProcessingIndustry( )<strong>12</strong>. Construction( )Revenue(%)For RBI’s use (Industry Code)

57. Whether your company is listed in India [please tick ( )]?YesNo8. Whether your company has any Foreign Collaboration? Yes NoIf yes, please indicate whether it is (please tick the appropriate one)(a) Technical collaboration(b) Financial collaboration(foreign equity participation)(c) BothBlock 1A : Total Paid up Capital of Indian CompanyItem1.0 Total Paid-up Capital [(i)+(ii)](i) Ordinary/Equity Share(ii) Preference Share [(a)+(b)](a) Participating(b) Non-participating2.0 Non-resident Equity Holdings1 Individuals2 Companies3 FIIs4 FVCIs5 Foreign Trusts6 Private Equity Funds7 Pension/ Provident Funds8 Sovereign Wealth Fund (SWF) §9 Partnership/ Proprietorship firms10 Financial Institutions11 NRIs/PIO<strong>12</strong> Others (please specify)Note: FY: Financial YearEnd-March of previous FYNumber of SharesAmount in `lakhEnd-March current FYNumber of SharesAmount in `lakhBlock 1B : Free Reserves & Surplus and Retained ProfitItem3.1 Free Reserves & Surplus as at the end of3.2 Profit (+) / Loss (-) after tax3.3 Dividend Declared (excluding tax ondividend)3.4 Retained Profit / loss ( 3.4 = 3.2 -3.3)Amount in ` lakh as at the end – March ofPrevious FYCurrent FYAmount in ` lakhDuring Previous FYDuring Current FY

6Section IIFOREIGN LIABILITIES2. Investments made under Foreign Direct Investment (FDI) scheme in India:In case of listed companies, equity should be valued using share price on closing date of reference period,while in case of unlisted companies, Own Fund of Book Value (OFBV) Method should be used(see the attached guidelines for details)Block 2A: Foreign Direct Investment in India (10% or more Equity Participation)[Please furnish here the outstanding investments made under the FDI Scheme in India by Non-resident Direct investors,who were individually holding 10 per cent or more ordinary/equity shares of your company on the reporting date]If this block is Non-NIL, then please give the Name & Addresses of your subsidiary in India, if any, in BLOCK 9.Name of thenon-residentCompany/IndividualType of CapitalCountry ofnon-residentinvestorEquityholding(%) MarchPrevious FYAmount in ` lakh as at the end ofDecemberCurrent FYMarchCurrent FY1.0 Equity Capital (1.0 = 1.2-1.1)1.1 Claims on Direct Investor1.2 Liabilities to Direct Investor2.0 Other Capital(2.0 = 2.2-2.1)2.1 Claims on Direct Investor2.2 Liabilities to Direct Investor3.0 Disinvestments in India during the yearNote: (i) if investor is a company, then country is the country of incorporation;(ii) Please use different sheet using same format to report different non-resident company/individual.Block 2B: Foreign Direct Investment in India (Less than 10% Equity Holding)[Please furnish here the outstanding investments made under the FDI Scheme in India by Non-resident Direct investors,who were individually holding less than 10 per cent ordinary/ equity shares of your company on the reporting date]Name of thenon-residentCompany/IndividualType of CapitalCountry ofnon-residentinvestorEquityholding(%) MarchPrevious FYAmount in ` lakh as at the end ofDecemberCurrent FYMarchCurrent FY1.0 Equity Capital (1.0 = 1.2-1.1)1.1 Claims on Direct Investor1.2 Liabilities to Direct Investor2.0 Other Capital(2.0 = 2.2-2.1)2.1 Claims on Direct Investor2.2 Liabilities to Direct Investor3.0 Disinvestments in India during the yearNote: (i) if investor is a company, then country is the country of incorporation;(ii) Please use different sheet using same format to report different non-resident company/individual.

73. Portfolio and Other Liabilities to Non-residents (i.e. position with unrelated parties)Block 3A: Portfolio InvestmentPlease furnish here the outstanding investments by non-resident investors made under the PortfolioInvestment Scheme in India. In case of listed companies, equity should be valued using share price onclosing date of reference period, while in case of unlisted companies, Own Fund of Book Value (OFBV)Method should be used. (see the attached guidelines for details)Portfolio Investment1.0 Equity Securities2.0 Debt Securities(2.0 = 2.1+2.2)2.1 Bonds and Notes (original maturity more than 1year)2.2 Money Market Instruments (original maturity upto1year)3.0 Disinvestments in India during the yearCountry of nonresidentinvestor March Previous FY March CurrentAmount in ` lakh as at the end ofFYNote: Data pertaining to each type of investment are to be reported consolidating the information country wise. If morecountries are involved to report the data for the particular type(s) of investment, it should be reported in the same formatusing additional sheets separately for each country.Block 3B: Financial Derivatives (with non-resident entities only)Please furnish here the outstanding foreign liabilities on account of financial derivatives contractentered into with non-residents.Financial Derivatives(i) Notional Value(ii) Mark to market valueCountry of non-residentAmount in ` lakh as at the end ofinvestor March Previous FY March Current FYNote: If more countries are involved to report the data for the particular type(s) of investment, it should be reported in thesame format using additional sheets separately for each country.Block 3C: Other Investments:This is a residual category that includes all financial outstanding not considered as direct investment orportfolio investment (outstanding liabilities with Unrelated Parties)Other Investment4.0 Trade Credit (4.0 = 4.1+4.2)4.1 Short Term (4.1= 4.1.1+4.1.2)4.1.1. Up to 6 Months4.1.2. 6 Months to 1 Year4.2. Long Term5.0 Loans (5.0 = 5.1+5.2)5.1 Short Term5.2 Long Term6.0 Other Liabilities (6.0 = 6.1+6.2)6.1 Short Term (Up to 1 yr.)6.2 Long TermCountry of non-resident Amount in ` lakh as at the end oflender March Previous FY March Current FYNote: (i) Data pertaining to each type of investment are to be reported consolidating the information country wise. If morecountries are involved to report the data for the particular type(s) of investment, it should be reported in the same formatusing additional sheets separately for each country.(ii) At item 5.0, loan should include the ECB loan other than those taken from non-resident parent company. ECB loantaken from parent company abroad should be shown under Other Capital of Block 2A.

8Section –IIIFOREIGN ASSETS1. Please use the exchange rate as at end-March/end-December (as applicable) of reporting year whilereporting the foreign assets in ` lakh.2. In case, the overseas company is listed, equity should be valued using share price on closing date ofreference period, while in case of unlisted company, use Own Fund of Book Value (OFBV) method forvaluation of equity (see the attached guidelines for details)Block 4: Direct Investment Abroad under Overseas Direct Investment SchemeBlock 4A: Direct Investment Abroad (10 % or more Equity holding)[Please furnish here your outstanding investments in Non-resident enterprises [Direct Investment Enterprises (DIE)],made under the Overseas Direct Investment Scheme, in each of which your company hold 10 per cent or moreEquity shares on the reporting date]. If this block is Non-NIL, then please furnish the information in BLOCK 6.Name of thenon-residentDirectInvestmentEnterprise(DIE)Type of Capital1.0 Equity Capital (1.0 = 1.1-1.2)Country ofnon-residentDIEEquityholding(%) MarchPreviousFYAmount in ` lakh as at the end ofDecemberCurrentFYMarchCurrentFY1.1 Claims on Direct Investment Enterprise1.2 Liabilities to Direct Investment Enterprise2.0 Other Capital(2.0 = 2.1-2.2)2.1 Claims on Direct Investment Enterprise2.2 Liabilities to Direct Investment Enterprise3.0 Disinvestments made abroad during theyearNote: Please use separate sheets in the above format to report for separate DIEsBlock 4B: Foreign Direct Investment Abroad (Less than 10 % Equity holding)[Please furnish here your outstanding investments in non-resident enterprises (Direct Investment Enterprises DIE), madeunder the Overseas Direct Investment Scheme, in each of which your company holds less than 10 per cent Equityshares on the reporting date].Name of the nonresidententerprisesType of Capital1.0 Equity Capital (1.0 = 1.1-1.2)Country of nonresidententerprisesAmount in ` lakh as at the end ofMarchPreviousFYDecemberCurrent FYMarchCurrentFY1.1 Claims on non-resident Enterprise abroad1.2 Liabilities to non-resident Enterprise abroad2.0 Other Capital (2.0 = 2.1-2.2)2.1 Claims on non-resident Enterprise abroad2.2 Liabilities to non-resident Enterprise abroad3.0 Disinvestments made abroad during theyearNote: Please use separate sheets in the above format to report different non-resident fellow enterprises.

9Portfolio and Other Assets Abroad (i.e., position with unrelated parties)Block 5A: Portfolio Investment Abroad1. Please furnish here the outstanding investments in non-resident enterprises, other than those madeunder Overseas Direct Investment Scheme in India (i.e., other than those reported in Block 4A & 4B).2. In case overseas companies are listed, equity should be valued using share price on closing date ofreference period, while in case of unlisted companies, use Own Fund of Book Value Method (OFBV) (seethe attached guidelines for details)Portfolio Investment1.0 Equity Securities2.0 Debt Securities (2.0=2.1+2.2)2.1 Bonds and Notes (original maturity more than1year)2.2 Money Market Instruments (original maturity up to1year)3.0 Disinvestments Abroad during the yearCountry ofnon-residententerpriseMarch PreviousFYAmount in ` lakh as at the end ofDecemberCurrent FYNote: Data pertaining to each type of investment are to be reported consolidating the information country wise.If particular type(s) of investment spreads over more than one country, it should be reported in the aboveformat using separate additional sheet for each country.Block 5B: Financial Derivatives (with non-resident entities only)Please furnish here the outstanding claims on non-residents on account of financial derivatives contractentered into with Non-residents.Financial Derivatives(i) Notional Value(ii) Mark to market valueMarchCurrent FYCountry of non-residentAmount in ` lakh as at the end ofenterprise March Previous FY March Current FYNote: If particular type(s) of investment spreads over more than one country, it should be reported in the above format usingseparate additional sheet for each country.Block 5C: Other Investment (Outstanding claims on Unrelated Parties):This is a residual category that includes all financial outstanding claims not considered as directinvestment or portfolio investment.Country ofOther Investmentnon-residentMarch Previous FYenterprise4.0 Trade Credit (4.0=4.1+4.2)4.1 Short Term (4.1=4.1.1+4.1.2)4.1.1. Up to 6 Months4.1.2. 6 Months to 1 Year4.2 Long Term5.0 Loans (5.0=5.1+5.2)5.1 Short Term (Up to 1 year)5.2 Long Term6.0 Other Assets (6.0=6.1+6.2)6.1 Currency & DepositsAmount in ` lakh as at the end ofMarch Current FY6.2 OthersNote: (i) Data pertaining to each type of investment are to be reported consolidating the information country wise.If particular type(s) of investment spreads over more than one country, it should be reported in the above formatusing separate additional sheet for each country.

10Block 6: Equity Capital, Free Reserves & Surplus of Direct Investment Enterprise Abroad[Please report here the total equity, the equity held by your company and the total free reserves & surplus of those nonresidententerprises in each of which your company held 10 per cent or more shares on the reporting date].If this block is Non-NIL then please make sure that you have provided the relevant information in BLOCK 4A.Name of the DIE Item Currency March PreviousFYAmount in Foreign Currencyas at the end of (in actual)March CurrentFY(1) (2) (3) (4) (5)1. Total Equity of DIE2. Equity of DIE held by you3. Free Reserves & Surplus of DIE4. Dividend Received by you during the year5. Amount of your Profit retained by DIEduring the yearNote: If your company is a Direct Investor in more than one DIE, the data should be provided in the same format in respectof each such DIE using additional sheets.Block 7: Contingent Foreign Liabilities[Please report here the relevant details about the contingent foreign liabilities of your company]Description of Contingent Liability Country Currency # Amount in Foreign Currency asat the end of (in actual)March Previous March CurrentFYFY(1) (2) (3) (4) (5)Note: # Currency of denomination of the contingent foreign liability should be mentioned in Col. 3. Refer to the detailson Contingent liabilities given in Annex.Block 8: Employee Information of reporting Indian companyNo. of Employees on PayrollPrevious FYAs at the end-March ofCurrent FYBLOCK9:

11Name(s) & Address (es) of your subsidiary in IndiaSr.Nos.Name of Subsidiary in India*YourEquityholding insubsidiary%AddressRetained profit/ lossof your subsidiaryin India during thecurrent FY(Amount in ` lakh )CertificateWe hereby certify that all the facts and figures furnished in this schedule reflect the accurate position of the company andreported after understanding all the items of all the blocks of the schedule.Place :Date :Signature and Name of the Authorised personSeal/Stamp of the Company