Karuna Trust, Karnataka - ZEF

Karuna Trust, Karnataka - ZEF

Karuna Trust, Karnataka - ZEF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

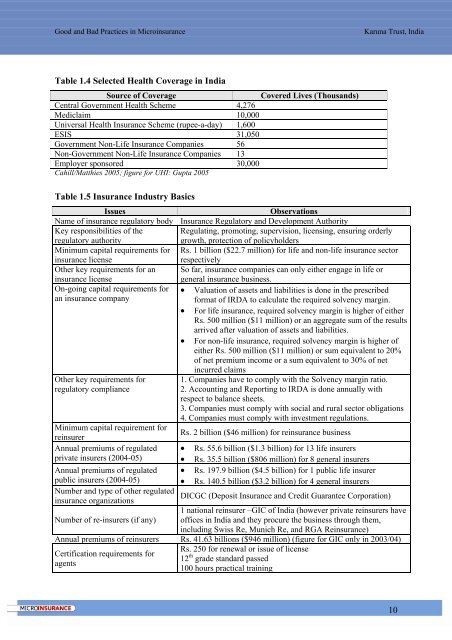

Good and Bad Practices in Microinsurance<strong>Karuna</strong> <strong>Trust</strong>, IndiaTable 1.4 Selected Health Coverage in IndiaSource of CoverageCovered Lives (Thousands)Central Government Health Scheme 4,276Mediclaim 10,000Universal Health Insurance Scheme (rupee-a-day) 1,600ESIS 31,050Government Non-Life Insurance Companies 56Non-Government Non-Life Insurance Companies 13Employer sponsored 30,000Cahill/Matthies 2005; figure for UHI: Gupta 2005Table 1.5 Insurance Industry BasicsIssuesObservationsName of insurance regulatory body Insurance Regulatory and Development AuthorityKey responsibilities of the Regulating, promoting, supervision, licensing, ensuring orderlyregulatory authoritygrowth, protection of policyholdersMinimum capital requirements for Rs. 1 billion ($22.7 million) for life and non-life insurance sectorinsurance licenserespectivelyOther key requirements for an So far, insurance companies can only either engage in life orinsurance licensegeneral insurance business.On-going capital requirements for • Valuation of assets and liabilities is done in the prescribedan insurance companyformat of IRDA to calculate the required solvency margin.• For life insurance, required solvency margin is higher of eitherRs. 500 million ($11 million) or an aggregate sum of the resultsarrived after valuation of assets and liabilities.• For non-life insurance, required solvency margin is higher ofeither Rs. 500 million ($11 million) or sum equivalent to 20%of net premium income or a sum equivalent to 30% of netOther key requirements forregulatory complianceMinimum capital requirement forreinsurerAnnual premiums of regulatedprivate insurers (2004-05)Annual premiums of regulatedpublic insurers (2004-05)Number and type of other regulatedinsurance organizationsincurred claims1. Companies have to comply with the Solvency margin ratio.2. Accounting and Reporting to IRDA is done annually withrespect to balance sheets.3. Companies must comply with social and rural sector obligations4. Companies must comply with investment regulations.Rs. 2 billion ($46 million) for reinsurance business• Rs. 55.6 billion ($1.3 billion) for 13 life insurers• Rs. 35.5 billion ($806 million) for 8 general insurers• Rs. 197.9 billion ($4.5 billion) for 1 public life insurer• Rs. 140.5 billion ($3.2 billion) for 4 general insurersDICGC (Deposit Insurance and Credit Guarantee Corporation)1 national reinsurer –GIC of India (however private reinsurers haveNumber of re-insurers (if any) offices in India and they procure the business through them,including Swiss Re, Munich Re, and RGA Reinsurance)Annual premiums of reinsurers Rs. 41.63 billions ($946 million) (figure for GIC only in 2003/04)Certification requirements foragentsRs. 250 for renewal or issue of license12 th grade standard passed100 hours practical training10