2010 ANNUAL REPORT - Webtech Wireless

2010 ANNUAL REPORT - Webtech Wireless

2010 ANNUAL REPORT - Webtech Wireless

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

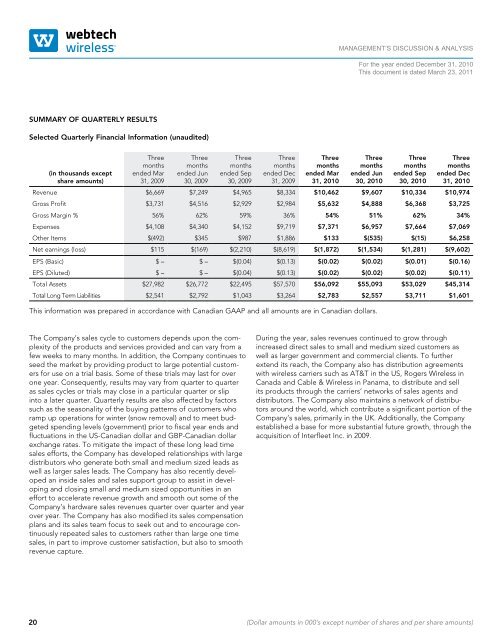

MANAGEMENT’S DISCUSSION & ANALYSISFor the year ended December 31, <strong>2010</strong>This document is dated March 23, 2011SUMMARY OF QUARTERLY RESULTSSelected Quarterly Financial Information (unaudited)(in thousands exceptshare amounts)Threemonthsended Mar31, 2009Threemonthsended Jun30, 2009Threemonthsended Sep30, 2009Threemonthsended Dec31, 2009Threemonthsended Mar31, <strong>2010</strong>Threemonthsended Jun30, <strong>2010</strong>Threemonthsended Sep30, <strong>2010</strong>Threemonthsended Dec31, <strong>2010</strong>Revenue $6,669 $7,249 $4,965 $8,334 $10,462 $9,607 $10,334 $10,974Gross Profit $3,731 $4,516 $2,929 $2,984 $5,632 $4,888 $6,368 $3,725Gross Margin % 56% 62% 59% 36% 54% 51% 62% 34%Expenses $4,108 $4,340 $4,152 $9,719 $7,371 $6,957 $7,664 $7,069Other Items $(492) $345 $987 $1,886 $133 $(535) $(15) $6,258Net earnings (loss) $115 $(169) $(2,210) $(8,619) $(1,872) $(1,534) $(1,281) $(9,602)EPS (Basic) $ – $ – $(0.04) $(0.13) $(0.02) $(0.02) $(0.01) $(0.16)EPS (Diluted) $ – $ – $(0.04) $(0.13) $(0.02) $(0.02) $(0.02) $(0.11)Total Assets $27,982 $26,772 $22,495 $57,570 $56,092 $55,093 $53,029 $45,314Total Long Term Liabilities $2,541 $2,792 $1,043 $3,264 $2,783 $2,557 $3,711 $1,601This information was prepared in accordance with Canadian GAAP and all amounts are in Canadian dollars.The Company’s sales cycle to customers depends upon the complexityof the products and services provided and can vary from afew weeks to many months. In addition, the Company continues toseed the market by providing product to large potential customersfor use on a trial basis. Some of these trials may last for overone year. Consequently, results may vary from quarter to quarteras sales cycles or trials may close in a particular quarter or slipinto a later quarter. Quarterly results are also affected by factorssuch as the seasonality of the buying patterns of customers whoramp up operations for winter (snow removal) and to meet budgetedspending levels (government) prior to fiscal year ends andfluctuations in the US-Canadian dollar and GBP-Canadian dollarexchange rates. To mitigate the impact of these long lead timesales efforts, the Company has developed relationships with largedistributors who generate both small and medium sized leads aswell as larger sales leads. The Company has also recently developedan inside sales and sales support group to assist in developingand closing small and medium sized opportunities in aneffort to accelerate revenue growth and smooth out some of theCompany’s hardware sales revenues quarter over quarter and yearover year. The Company has also modified its sales compensationplans and its sales team focus to seek out and to encourage continuouslyrepeated sales to customers rather than large one timesales, in part to improve customer satisfaction, but also to smoothrevenue capture.During the year, sales revenues continued to grow throughincreased direct sales to small and medium sized customers aswell as larger government and commercial clients. To furtherextend its reach, the Company also has distribution agreementswith wireless carriers such as AT&T in the US, Rogers <strong>Wireless</strong> inCanada and Cable & <strong>Wireless</strong> in Panama, to distribute and sellits products through the carriers’ networks of sales agents anddistributors. The Company also maintains a network of distributorsaround the world, which contribute a significant portion of theCompany’s sales, primarily in the UK. Additionally, the Companyestablished a base for more substantial future growth, through theacquisition of Interfleet Inc. in 2009.20 (Dollar amounts in 000’s except number of shares and per share amounts)