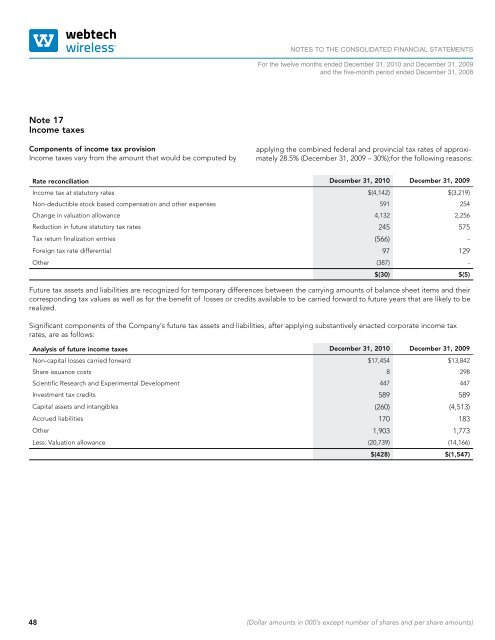

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor the twelve months ended December 31, <strong>2010</strong> and December 31, 2009and the five-month period ended December 31, 2008Note 17Income taxesComponents of income tax provisionIncome taxes vary from the amount that would be computed byapplying the combined federal and provincial tax rates of approximately28.5% (December 31, 2009 – 30%);for the following reasons:Rate reconciliation December 31, <strong>2010</strong> December 31, 2009Income tax at statutory rates $(4,142) $(3,219)Non-deductible stock based compensation and other expenses 591 254Change in valuation allowance 4,132 2,256Reduction in future statutory tax rates 245 575Tax return finalization entries (566) -Foreign tax rate differential 97 129Other (387) -$(30) $(5)Future tax assets and liabilities are recognized for temporary differences between the carrying amounts of balance sheet items and theircorresponding tax values as well as for the benefit of losses or credits available to be carried forward to future years that are likely to berealized.Significant components of the Company’s future tax assets and liabilities, after applying substantively enacted corporate income taxrates, are as follows:Analysis of future income taxes December 31, <strong>2010</strong> December 31, 2009Non-capital losses carried forward $17,454 $13,842Share issuance costs 8 298Scientific Research and Experimental Development 447 447Investment tax credits 589 589Capital assets and intangibles (260) (4,513)Accrued liabilities 170 183Other 1,903 1,773Less: Valuation allowance (20,739) (14,166)$(428) $(1,547)48 (Dollar amounts in 000’s except number of shares and per share amounts)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor the twelve months ended December 31, <strong>2010</strong> and December 31, 2009and the five-month period ended December 31, 2008The Company has recorded a valuation allowance against itsfuture income tax assets as management believes it is not morelikely than not that future income tax assets will be realized withinthe carry-forward period.Canadian investment tax credits of $589 can be carried forwardand applied against future income taxes payable, and will expire in2026 and 2027.Scientific research and experimental development expendituresof $1,582 can be carried forward indefinitely and applied againstfuture income.Canadian non-capital loss carry forwards of $43,917 expiring in2025, 2026, 2027, 2028, 2029 and 2030 can be carried forward andapplied against future taxable income.The Company also has UK operating loss carry forwards of $12,802which can be carried forward indefinitely and applied againstfuture UK taxable income.The Company also has US operating loss carry forwards of $4,763which can be carried forward indefinitely and applied againstfuture US taxable income.Note 18CommitmentsCapital leaseRentAcquisitionliabilities2011 $107 $987 $1,500 $2,5942012 114 904 - 1,0182013 112 840 - 9522014 through 2018 4 3,324 - 3,328Total $337 $6,055 $1,500 $7,892TotalNote 19LitigationIn August 2009 the Company was served notice of a lawsuit filedby HTI Inc./NetworkFleet (“HTI”) in the Eastern District of Texas,alleging patent infringement by the Company. In August <strong>2010</strong>,the Company received notice that its application to have thelawsuit moved from the Texas court to the Southern District ofCalifornia court had been granted. In January <strong>2010</strong>, the Companyreceived notice from the US Patent and Trademark Office that theCompany’s application to have a number of the patents in questionre-examined had also been granted. The Company believesthis suit to be without merit. No damages are specified in the lawsuitand the Company is unable to estimate the dollar value of anysuch claim which may be made by HTI in the future.The Company has filed a number of lawsuits in Brazil against aformer reseller, Crown Telecom (Crown) and its founder. Crown,now bankrupt and in the hands of a receiver, obtained a judgmentagainst the Company for business interference which was subsequentlyappealed and reversed in July 2009 by a higher court. Thematter is now back before the civil court and undergoing pre-trialproceedings, the outcome of which cannot be practicably determined.The Company believes the claim to be without merit andwill vigorously defend the claim.Note 20Related Party TransactionsIncluded within current liabilities are retention bonuses in theamount of $1,500 owed to a current and two former executives ofInterFleet. Refer to note 12 for details.Note 21Contingencies and guaranteesIn the normal course of business, the Company provides suretybonds under standard contractual terms in service agreementswith its government customers, for performance and materialsand wages requirements. At December 31, <strong>2010</strong> the Companyheld three surety bonds totaling $1,470 (2009 - $1,470) in favor oftwo customers. One of the bonds covered materials and wagesrequirements of $700 and the balance of $770 covered performanceunder two bonds. TheCompany also carries letters of guarantee of $333.Note 22Subsequent eventsOn March 1, 2011, the Company closed a private placement to sell15,000,000 common shares at a price of $0.40 per share for grossproceeds of $6,000.(Dollar amounts in 000’s except number of shares and per share amounts)49